'I think you would see a 25% reduction in the standard of living in this country if the dollar were no longer the world's reserve currency,' said real estate mogul, Sam Zell.

Featured Trades: (WHY OIL WILL PEAK ON FRIDAY)

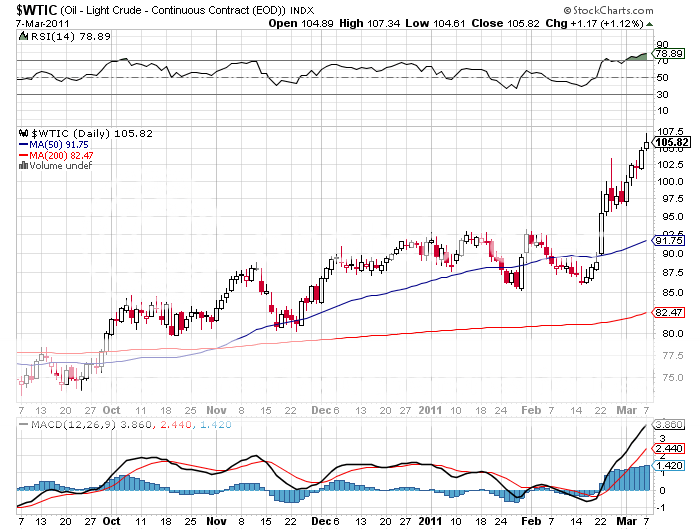

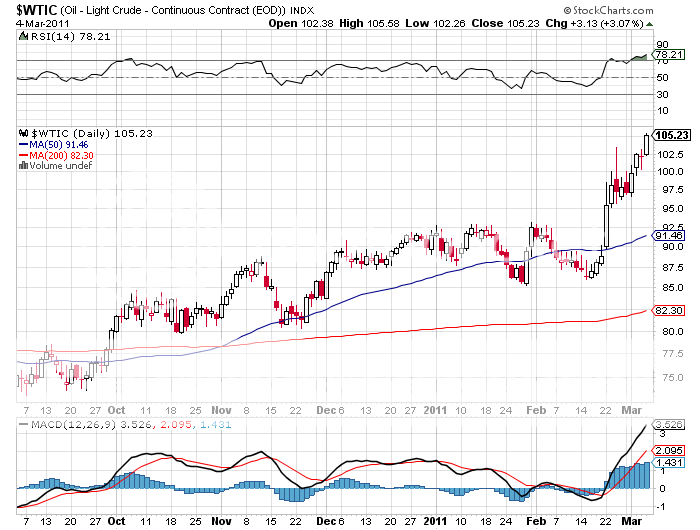

1) Why Oil Will Peak on Friday.? Texas tea has undergone the perfect storm over the past month, with the Middle Eastern dominoes falling one by one. It was the worst case scenario times five, and all of a sudden my once outrageous claim that crude would hit $100/barrel by the end of first quarter seemed positively conservative. On Friday, we face a 'Day of Rage' that threatens to topple the Saudi regime, a 12 million barrel a day exporter.

Don't kid yourself. The real price of crude oil now is $120/barrel. That is where both Brent and Louisiana sweet are trading when you adjust for the term structures in the futures market. The $107 you see trading on your screen on NYMEX is for delivery in Cushing, Oklahoma, where prices have been driven artificially low by a glut of crude coming down from Canada and North Dakota being dumped in a market where there is no storage. According to the CFTC, the net long of 268,000 oil futures contracts in the market would fill all the storage in Cushing six times over.

But Saudi Arabia is not Tunisia, Algeria, Egypt, or Libya. The latter countries had shaky regimes that were established during the postwar era that were built on sand. Saudi Arabia has been around a lot longer. It is based on a series of inter-tribal marriages between tribes that took place during the early 1920's that remain rock solid today. Being the wealthiest country in the region, the Saudi's had a lot more money to spread around to keep everyone loyal. This is why Al Qaida has made absolutely no inroads there for the past 20 years.

This is all a long way of saying that Friday's event in Saudi Arabia will amount to a big nothing. In fact, I don't think we are going to get much more out of the entire Middle Eastern crisis. The Libyan civil war seems to have quickly stalemated. The military there is actually quite small, as Khadafi sought to minimize the threat to his own regime by a coup'?d etat. After all, that's how the young colonel gained power himself in 1968. And no one on either side has any experience fighting, or organizing a military campaign of any kind.

There are other factors to consider. Even a token release of oil from the strategic petroleum reserve, which the administration seems to be considering, could be a real price killer. This is how the last two great price oil price spikes ended. Ben Bernanke's QE2 ends on June 30, which has poured hundreds of billions of dollars into gold, silver, agricultural commodities, and yes, oil. The end of this program could cool the hugely inflationary pressures on all 'hard' assets.

So I think that oil is peaking here for the time being. All of the $23, or 27% increase in the price of oil in the last four weeks has been about fear. Only 1 million barrels a day, or 1.2% of daily global consumption has actually been disrupted, and that can easily be made up by boosting Saudi production, which they have already generously offered to do. Anyone in the oil industry will tell you that, considering only the true supply and demand for oil, the price should be about $70/barrel.

Mind you, I am still a card carrying 'peak oiler.' I think it is just a matter of time before we hit $150/barrel, and then $200. But we have covered an awful lot of ground on the upside in a very short time, so it is time for a rest. I think we are going to see $90/barrel before we see $150.

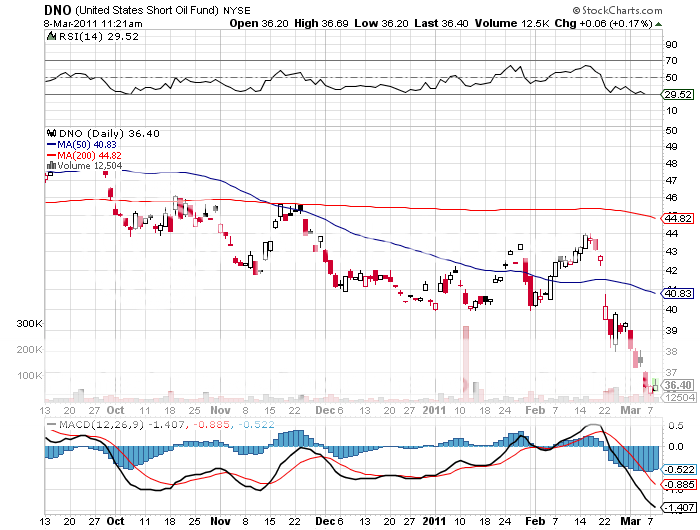

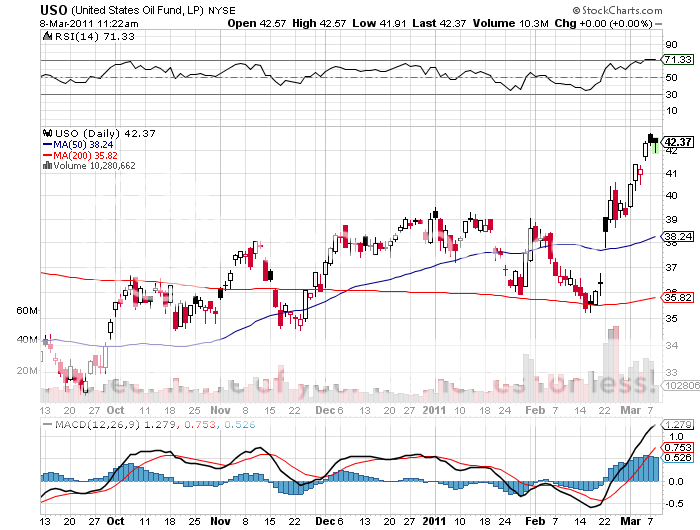

There may be a trade here for the nimble. You can look at the inverse oil ETF (DNO). You can buy out of the money puts on the oil futures. I think $100 out three months would be a nice cheap strike. My favorite would be to buy puts on the Oil ETF (USO). Here the ETF with the world's worst tracking error will work to your advantage to the downside.

-

-

-

Featured Trades: (NEXT STOP $50 FOR SILVER), (CDE), (SLV), (AGQ), (SLW)

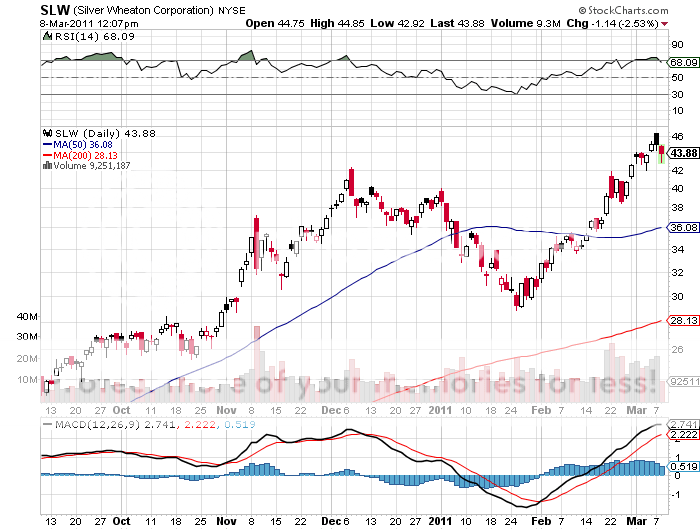

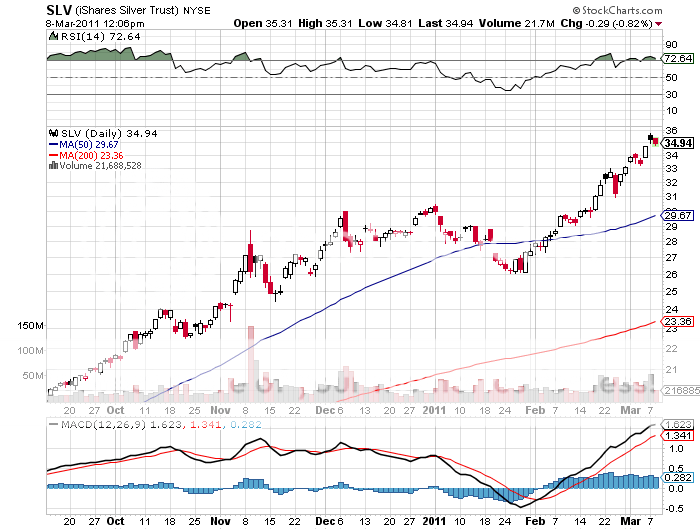

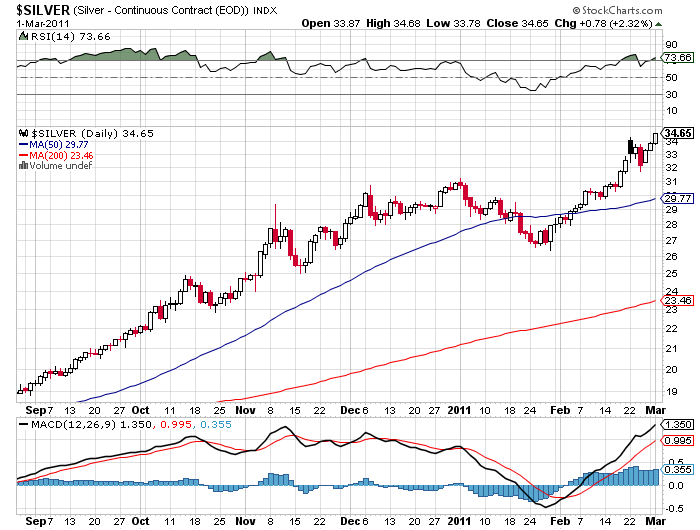

2) Next Stop $50 for Silver. Last week, I saw silver rise $1 in one day. I remember when the white metal's total cost was $1! When I urged readers three years ago to load up on silver at $10 because it was headed to $50, peopled insisted that I was insane. Now that we are ticking at $36, it doesn't look so crazy after all.

Investment demand is overwhelming industrial demand by a large margin. The world produces about 1 billion ounces of silver a year to meet 1 billion ounces a demand for jewelry and industrial process. But over the past year, an additional 300 million ounces of investment demand has piled on top of that, creating the parabolic moves in prices that we have seen this year. The total demand for silver today is the same as it was in 1980, when a corning operation by the Hunt brothers drove it to $50/ounce.

Geologically, silver is 17 times more common than the yellow metal. All of the gold ever mined is still around, from King Solomon's mine, to Nazi gold bars in Swiss bank vaults, and would fill two and a half Olympic sized swimming pools. But most of the silver mined has been consumed in various industrial processes, and is sitting at the bottom of toxic waste dumps.

Silver did take a multiyear hit when the world shifted from silver based films to digital photography during the nineties. Now rising standards of living in emerging countries are increasing the demand for silver, especially in areas where there is a strong cultural preference for the jewelry, as in Latin America. That means we are setting up for a classic supply demand squeeze.

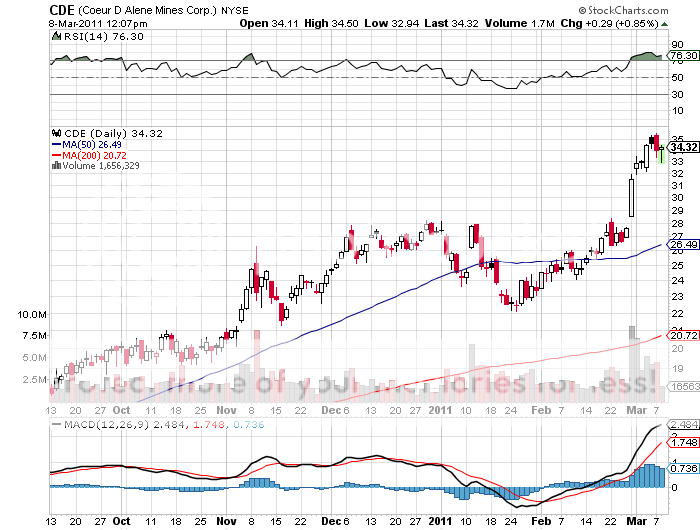

Whatever you do, don't buy silver right here. Wait for a more substantial dip. When you do decide to take the plunge, take a look at top producers Silver Wheaton (SLW) and Coeur D Alene Mines (CDE), the ETF (SLV), and the leveraged ETF (AGQ). The big question is now, should I let target creep take hold and raise my long term forecast to $100? That might be really insane!

-

-

-

-

Buy Silver at $10? You must be Crazy!

Featured Trades: (BETTING ON A MIDDLE EAST WAR)

3) The Bookie's View on War in the Middle East. I have written in the past about the online betting site, Intrade (click here for their site), which will take wagers on anything under the sun, including a range of economic and political probabilities (click here for 'Here's the Winner of the November Election').

The current betting is that there is a 76.5% chance that Muammar Khadafi will be gone by the end of the year. There is only a 6.2% chance that the US will launch an air strike against Iran this year. But there is a 32.4% chance that a weapon of mass destruction will be used somewhere in the world by the end of 2013.

Of greater foreboding for stock traders is that the likelihood of the US going into recession in 2012 has risen from 15.1% to 19.9% just in the last two weeks.

After watching this site with some amusement for years, I should caution potential traders that these prices are subject to huge swings, are often wrong, and come with hefty dealing spreads. Expectation often meets a tragic end at the hands of reality. They can also be very contradictory. While predicting a Democratic slaughter in the last election, they also anticipate that Obama has a 61.1% chance of winning the 2012 presidential election.

The Bookies Give it 5 to 1 Odds

'A girl in the convertible is worth five in the phone book,' said 'Oracle of Omaha', Warren Buffet, CEO and the largest shareholder in Berkshire Hathaway.

Featured Trades: (MY ALL ELECTRIC BOOBY PRIZE), (NSANY), (TM), (BYDDF)

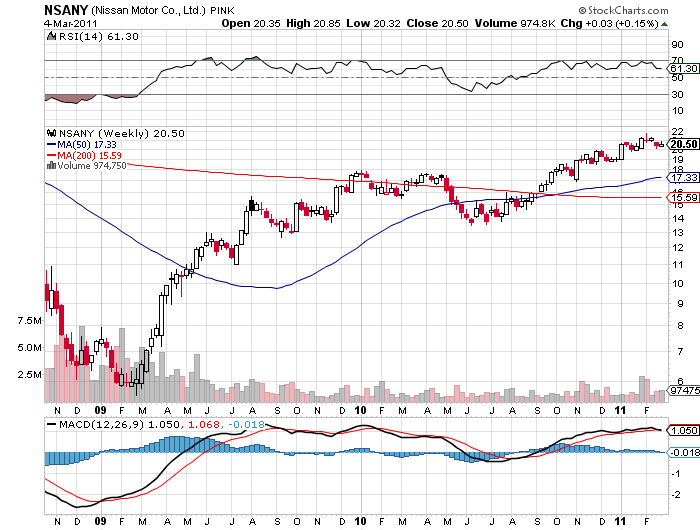

2) China's BYD Promises to Take Over the US Car Market. For years now, I have been chronicling in exacting detail my quest to buy an all-electric Nissan Leaf automobile as the ultimate hedge against rising oil prices (click here for 'Getting Something for Nothing'). The crude price spike arrived right on schedule, with gasoline prices topping $4/gallon in San Francisco last week. My local Nissan dealer assures me that the car I ordered a year ago, along with my substantial $75 deposit, will be delivered in May.

Then I received a scratchy, badly echoing telephone call from the Southern Chinese manufacturing mega city of Shensen.? My friend had just driven BYD's (Build Your Dreams) (BYDDF) new E6 all-electric sedan, and he could not sing its praises loudly enough (click here for their website). The car has a 200 mile range, versus the 100 miles for the Leaf. That is made possible by a 60 KwH battery, compared to the 24 KwH battery in the Leaf. Yet the E6 will be offered in the US for $40,000, close to the non-subsidized price for Nissan's new vehicle.

The great barrier to competitiveness for electric cars has always been the cost of the batteries, which now run at $1,000/KwH. So $24,000 of the cost of the $38,000 fully loaded Nissan Leaf is just to cover the 600 pound lithium ion battery. However, by executing a globally integrated manufacturing model, BYD has been able to lower its costs to $500/KwH. This involves making its own chips, directly owning lithium mines, and operating in low wage countries like China and Eastern Europe. I guess this is what happens when a battery company builds a new car from the ground up, instead of a traditional car manufacturer.

BYD plans to launch mass marketing of the roomy, five passenger E6 in the US by the end of 2012. Safety specifications have already been satisfactorily upgraded to meet rigorous American standards. BYD is quietly setting up its own US dealer network. The cars will initially be offered to fleet users, and then the consumer market. It also will roll out a range of all-electric buses, which no one is currently producing here. The company's goals are anything but modest. It plans to become the largest car maker in China by 2015, and the largest in the world by 2020, surpassing the behemoth Toyota Motors (TM).

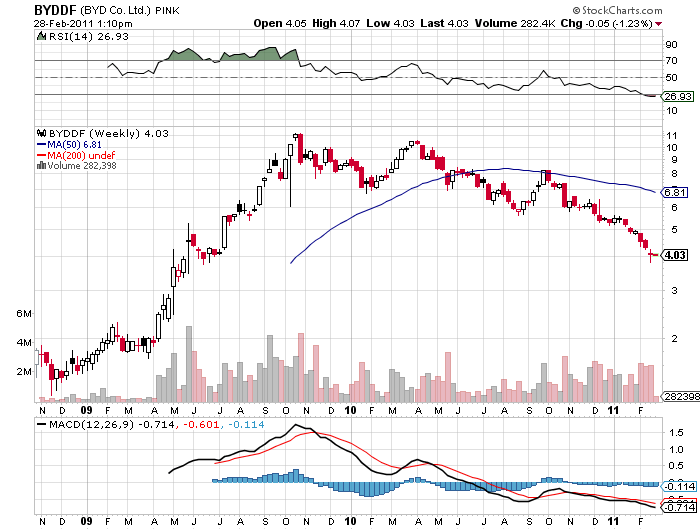

I rode Warren Buffett's coattails into this stock in 2008, taking a position after he bought 10% of the company for $230 million (click here for the piece). Buffett's partner, Charlie Munger, describes CEO Wang Chuan-Fu as a combination of General Electric's (GE) legendary manager, Jack Welch, and inventor Thomas Edison. After that, the stock rose tenfold.

It has since given up half the gains. The stock has suffered from the general malaise towards Chinese stocks since the government began its war against inflation a year ago, raising interest rates and tightening bank reserve requirements no less than eight times. Investors are also concerned that BYD's rumored secondary share issue, needed to finance its massive expansion plans, could weigh heavily on the stock.

Shares with such enormous earnings potential at this price look like a bargain to me. If I had to name one company that could appreciate 1,000% in the future, this is it. But I don't know when. So this would make it a candidate for burying it in a long term portfolio, rather than a short term trading vehicle.

And what of my Nissan Leaf? What happens to its value if BYD delivers on the E6? How about knocking it down by more than half? I'm starting to wonder if instead of getting the lead on cutting edge technology of the century, I got the booby prize.

-

-

Will BYD's E6 Beat Nissan's Leaf Before the Race Has Started?

-

'You know you're no longer CEO when you get into the back of your car and it doesn't move,' ' said 'Oracle of Omaha', Warren Buffet, CEO and the largest shareholder in Berkshire Hathaway.

Featured Trades: (THOUGHTS ON OIL AND THE ECONOMY)

1) Thoughts on Oil and the Economy. If at the beginning of the year I had told you that oil would go well above $100/barrel within two months, there would be a civil war in Libya, and the stock market would hit a new three year high, you would have immediately canceled your subscription to this newsletter and initiated proceedings to have me committed to an insane asylum. Except in Texas, where I would have been taken out and summarily shot, and rightfully so. Not in a vindictive way, but in a humanitarian attempt to put me out of my misery, like a thoroughbred race horse with a broken leg.

Yet, here we are. Go figure. The transportation index, that prodigious user of all types of fuel, is getting slaughtered. Both sides in the Libyan civil war are threatening to attack the other's oil supplies. The rebels say they have sold a supertanker worth of crude. To whom? How did they accept payment? Where is the contract? Who would you contract with? If true, why doesn't Khadafi sink it? It's not like it is a small target. While all western companies have eased oil shipments from Libya, Chinese and Indian companies are picking up the slack on the spot market.

In the meantime, US naval ships are steaming through the Suez Canal in a show of force, and we are days away from Saudi Arabia's 'Day of Rage.' If you think this is just talk, see what the Arab cable news network, Aljazeera, has to say about it by clicking here . I can easily see a carrier group sitting in the Gulf of Sidra, declaring a 'No Fly Zone', and then shooting down any plane that leaves the ground. Remember, our air-to-air missiles have a 100 mile range, and we know that the Libyans don't know how to use theirs. Hey, if you can't win two Middle Eastern wars, maybe the third time is the charm? It couldn't happen to a nicer guy.

If oil stays at the current triple digit altitude, some $70 billion gets lifted out of consumers' pockets, knocking 0.5% off of US GDP this year. Keep in mind that there is absolutely no dearth of oil in the US. Private storage facilities at the Cushing, Oklahoma hub are bulging, and the government's strategic petroleum reserve is chock full. It is fear and speculative buying by hedge funds that is driving prices up, not physical shortages.

Former Chairman of the Federal Reserve, Alan Greenspan, made some interesting comments this morning as to why dear oil wasn't having a bigger impact on the financial markets. Energy conservation has become far more pervasive than any of us realize. All of those subsidized solar panels and hybrid cars are starting to have a major impact on our energy consumption.

Also, thanks to the Great Recession, companies held back investment in productivity increases and cost cutting that have only recently been unleashed. What is one of the biggest of these investments? Spending on energy conservation measures across a vast array of industries.

Remember that busted home heater that I told you about yesterday? I had the engineer take apart both the outgoing and incoming units, and I couldn't believe what I saw. The 20 year old one was a simple gas fired affair. The new one included a built in radiator that sucked every bit of heat out of the apparatus, greatly improving its efficiency. These tiny, incremental sorts of savings are going on in a million imperceptible ways around the world every day, all adding up into something really big.

-

Khadafi's New Negotiating Strategy?

Featured Trades: (UPDATE WITH TECHNICAL ANALYST CHARLES NENNER)

2) An Update with Technical Analyst to the Stars, Charles Nenner. If you have not made your year by now, you are dead meat. Many of 2011's big moves have occurred, and there aren't going to be many fireworks for the rest of the year. Many asset classes are about to settle down into boring, predictable trading ranges.

That was the gist of my conversation with my old friend, Charles Nenner, who flew over from Europe to spend a weekend jamming with fellow musicians in the Big Apple. The wily Dutchman is looking forward to a week of media appearances and consulting with his major hedge fund clients.

Charles is not yet ready to short the US stock market. While the rally is definitely showing advanced signs of age, the upside momentum is impressive, so he would rather stand aside. His extreme, best case target for the S&P 500 is 1356.

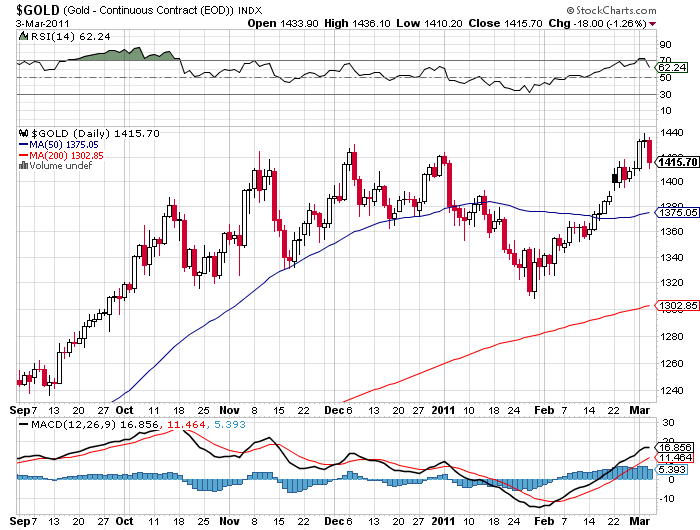

Nenner caught a short play in gold earlier in the year, on which I was able to ride the coattails. Now that we are back up to all times highly he is looking for a repeat. Ditto for silver. I'll let you know when he pulls the trigger.

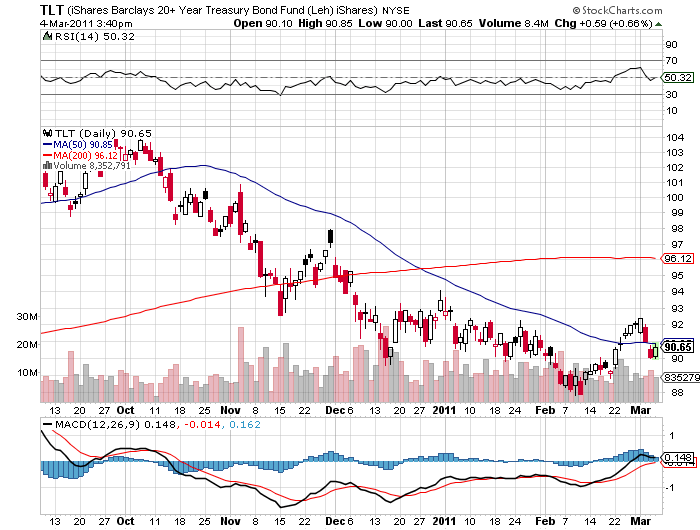

Charles is looking for further weakness in bonds, but doesn't see a crash. His preferred play is a short volatility one whereby he shorts puts on both the 10 year and 30 year September bond futures contract at the 110 level. That equates to a yield of 4.2% on the 10 year and 5.2% for the 30 year. If yields don't get that high, he keeps the entire premium from the short put trade. If he goes in the money, he is quite happy owning bonds at these levels, which he can then sell on the next rally.

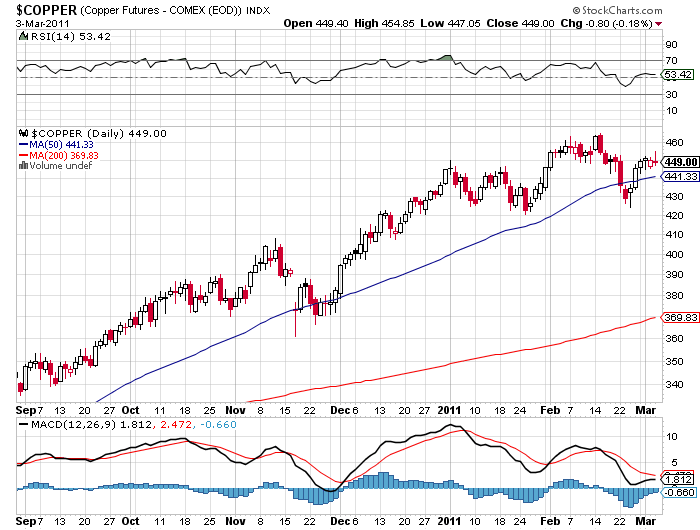

He agreed with my own view that we are in the midst of a major long term bull market for the grains and commodities. His next target is $4.84 for copper, up 5.6% from today's level of $4.49. The food sector is getting an assist from high oil prices, as all types of farming have substantial energy inputs. He promised to get back to me on specific targets for corn, wheat, and soybeans. Suffice it to say, that you better be stockpiling your seven years of plenty.

We agreed that our previous bet over Cisco (CSCO) was a push. I was right, in that I was able to capture a quick double of my capital on my call spread, and then scampered. He was right when an earnings disappointment ultimately caused the stock to crash once again. We may well put on the same bet again, for the fiery case of the Dutch liquor, Bols, when I strap this trade on again after the next generalized equity sell off.

I always end every one of our conversations by pinning Charles down on the one trade he would pull the trigger on today with new money. Wait for the Euro to hit $1.40 against the dollar, and then go short, with a $1.4050 stop. At that point the European currency will have had an impressive 12 cent rally against the greenback and will be well overdue for a correction. European Central Bank president Jean Clause-Trichet has shot his wad with his promise today of rate hikes, and from here traders will want to see the color of his money. But break the $1.4050 stop and you should run for the hills, as the next target is $1.46.

I promised to take him wave hopping in my plane on his visit to the West coast. He agreed, as long as I promised not to do it upside down.

-

-

-

-

-

-

Oops, Forgot That Promise!

Featured Trades: (FEBRUARY NONFARM PAYROLL)

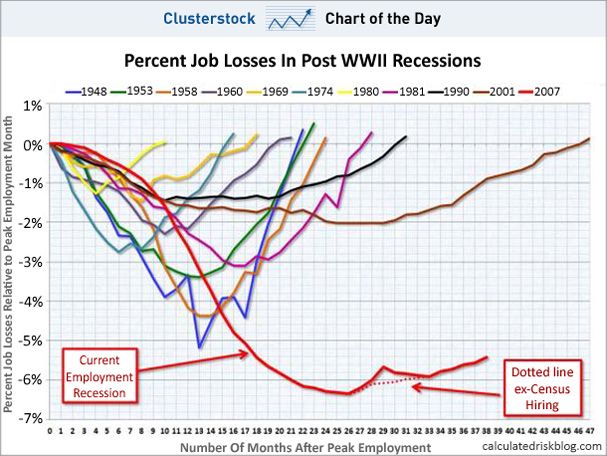

3) The February Nonfarm Payroll. President Obama's political advisors were no doubt popping the champagne bottles on Friday morning when the February nonfarm payroll showed a gain of 192,000. It was the best report in two years. The headline unemployment rate handily dropped from 9.0% to 8.9%. The December and January reports saw revisions upward of another 50,000 jobs.

Private sector hiring leapt by 222,000, with big gains in manufacturing (33,000) and construction (33,000). The good news was partially offset by 30,000 job losses by state and local authorities, a trend which I expect to continue for decades to come. There are still 13.7 million unemployed in the US, including 6 million for six months or more.

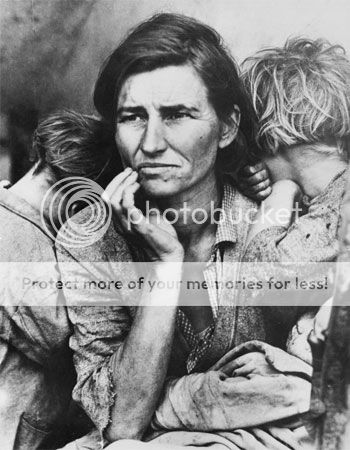

I think that best case, the unemployment rate will drop to the 7% handle by the next recession, which will probably begin sometime in 2012. Then we will rocket to new post Great Depression highs. The 25 million jobs we shipped to China and other emerging markets during 2000-2010 are never coming back.

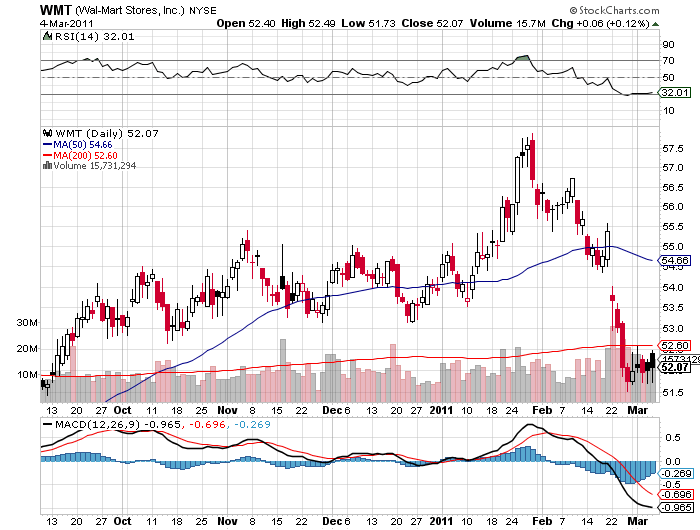

Many of those who lost their jobs then, some 10% of the work force, may be permanently frozen out of the economy and are now part of the structural unemployed. We saw the same thing happen in Germany during the seventies and eighties. This is why I have studiously avoided retail stocks during this bull market. When one tenth of the population permanently drops out of the economy, consumer spending is not going to come roaring back, especially at the low end. This may be what the stock price of Wal-Mart may be telling us.

-

-

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.