Lunch with the Central Intelligence Agency is always interesting, although five gorillas built like brick shithouses staring at me intently didn't help my digestion.

Obama's pick of Leon Panetta as the agency's new director was controversial because he didn't come from an intelligence background- upsetting the career spooks at Langley to no end. But the President thought a resume that included 16 years as the Democratic congressman from Monterey, California, and stints as Clinton's Chief of Staff and OMB Director, was good enough. So when Panetta passed through town on his way home to heavenly Carmel Valley for the holidays, I thought I'd pull a few strings in Washington to catch a private briefing.

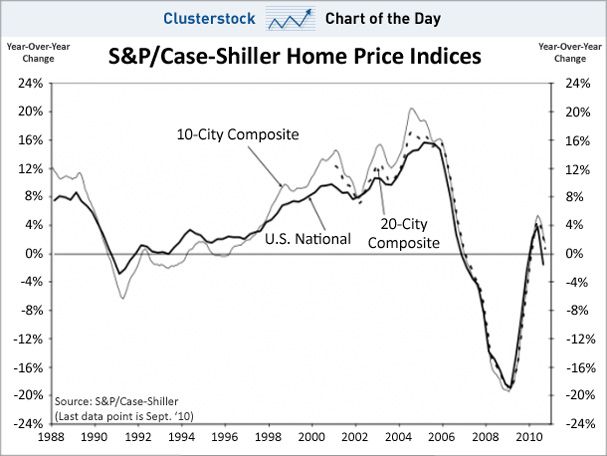

The long term outlook for supplies of food, natural resources, and energy is becoming so severe that the CIA is now viewing it as a national security threat. Some one third of emerging market urban populations are poor, or about 1.5 billion souls, and when they get hungry, angry, and politically or religiously inspired, Americans have to worry. This will be music to the ears of the hedge funds that have been stampeding into food, commodities, and energy since March. It is also welcome news to George Soros, who has quietly bought up enough agricultural land in Argentina to create his own medium sized country.

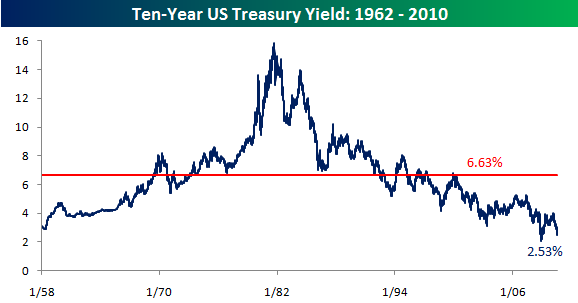

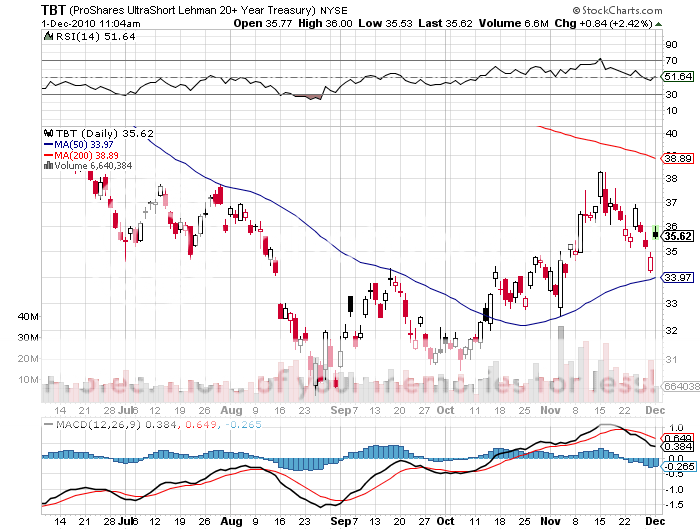

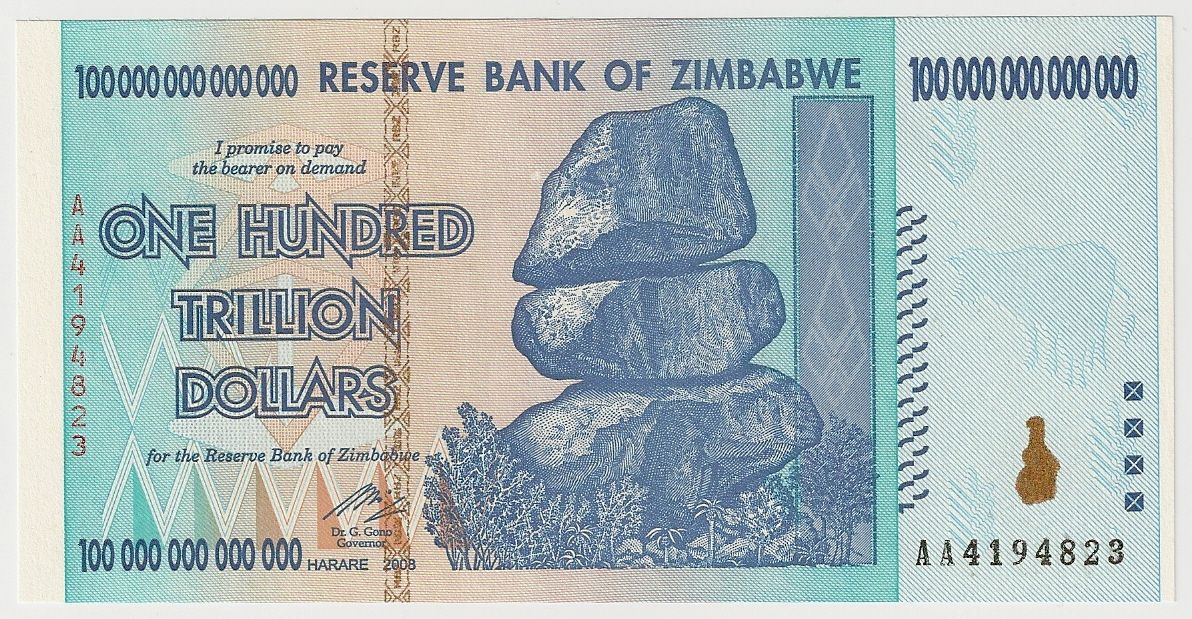

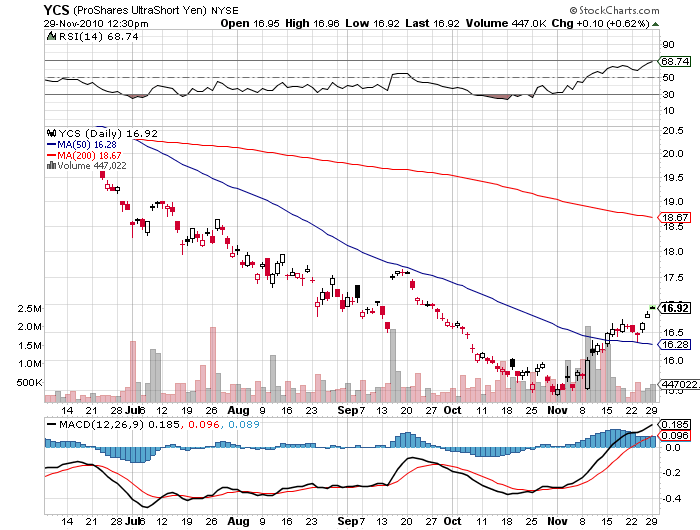

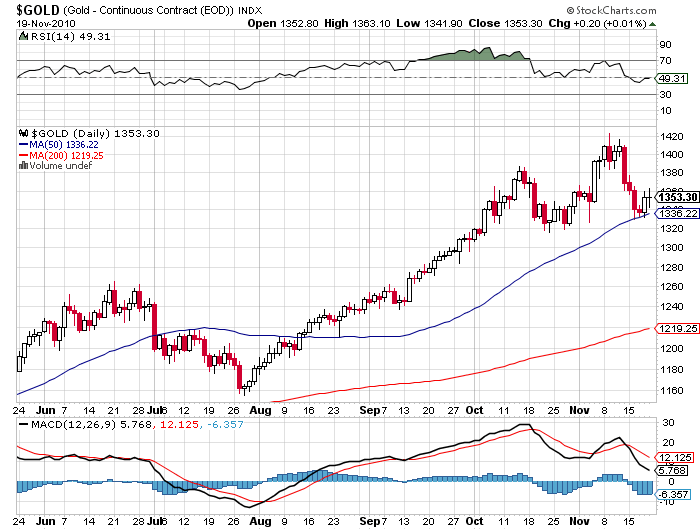

Panetta then went on to say that the current monstrous levels of borrowing by the Federal government abroad is also a security issue, especially if foreigners decide to turn the spigot off and put us on a crash diet. I was flabbergasted, not because this is true, but that it is finally understood at the top levels of the administration and is of interest to the intelligence agencies. Toss another hunk of red meat to my legions of carnivorous traders in the TBT, the leveraged ETF that profits from falling Treasury bond prices!

Job one is to defeat Al Qaida, and the agency has had success in taking out several terrorist leaders in the tribal areas of Pakistan with satellite directed predator drones. The CIA could well win the war in Afghanistan covertly, as they did the last war there in the eighties, with their stinger missiles supplied to the Taliban for use against the Russians. The next goal is to prevent Al Qaida from retreating to other failed states like Yemen and Somalia. The Agency is also basking in the glow of its discovery of a second uranium processing plant in Iran, sparking international outrage, and finally bringing Europeans to our side with sanctions against Iran.

Cyber warfare is a huge new battlefront. Some 100 countries now have this capability, and they have stolen over $50 billion worth of intellectual property from the US in the past year. As much as I tried to pin Panetta down on who the culprits were, he wouldn't name names, but indirectly hinted that the main hacker-in-chief was China. This comes on the heels of General Wesley Clark's admission that the Chinese cleaned out the web connected mainframes at both the Pentagon and the State Department in 2007. The Bush administration kept the greatest security breach in US history secret to duck a hit in the opinion polls.

I thought Panetta was incredibly frank, telling me as much as he could without those gorillas having to kill me afterwards. I have long been envious of the massive budget that the CIA deploys to research the same global markets that I have for most of my life, believed to amount to $70 billion, but even those figures are top secret. If I could only manage their pension fund with their information with a 2%/20% deal! I might even skip the management fee and go for just the bonus. The possibilities boggle the mind!

Panetta's final piece of advice: don't even think about making a cell phone call in Pakistan. I immediately deleted the high risk numbers from my cell phone address book.

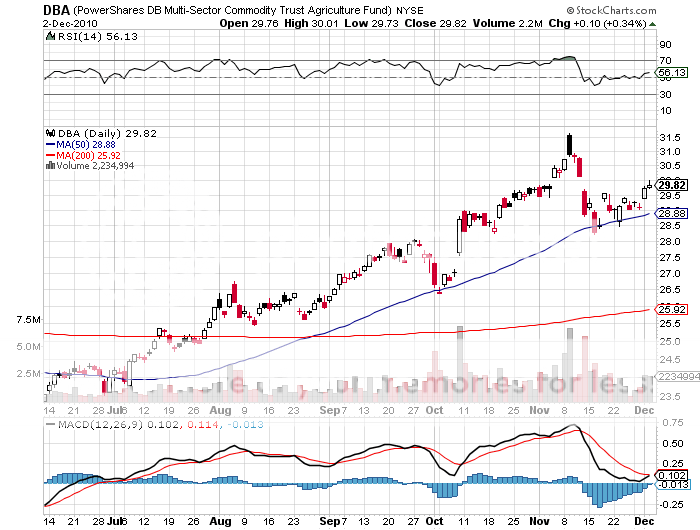

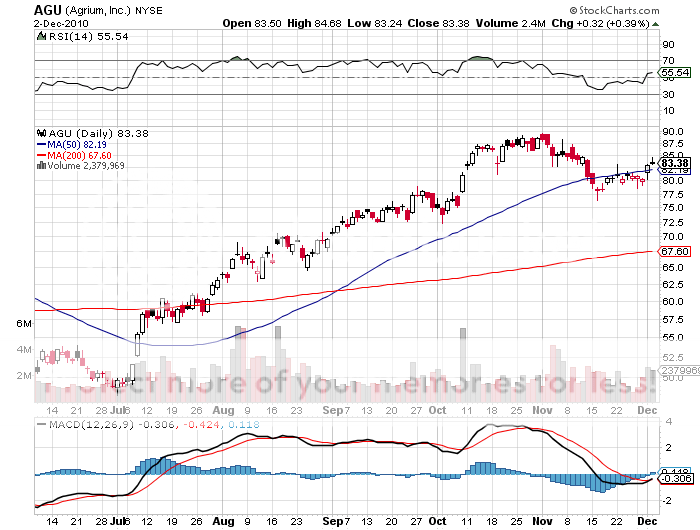

I have been pounding the table with these guys for four decades to focus more on the resource issue, but they only seemed interested in missiles, planes, tanks, subs, and satellites. What a long strange trip it's been. Better take another look at the Market Vectors agricultural ETF (DBA), their agribusiness ETF (MOO), as well as my favorite ag stocks, Monsanto (MON), Mosaic (MOS), and Agrium (AGU). Accidents are about to happen in their favor.

-

-