(CHINA HAS A MESSAGE FOR AUSTRALIA AND IT BEGINS WITH A PANDA)

June 17, 2024

Hello everyone,

Week ahead calendar

Monday, June 17

8:30 a.m. Empire State Index (June)

Earnings: Lennar

Tuesday, June 18

8:30 a.m. Retail Sales (May)

9:15 a.m. Capacity Utilization (May)

9:15 a.m. Manufacturing Production (May)

10 a.m. Business Inventories (April)

12:30 a.m. Australia Interest Rate Decision

Previous: 4.35%

Wednesday, June 19

Juneteenth Holiday

10 a.m. NAHB Housing Market Index (June)

2:00 a.m. UK Inflation Rate

Previous: 2.3%

Thursday, June 20

8:30 a.m. Building Permits preliminary (May)

8:30 a.m. Current Account (Q1)

8:30 a.m. Continuing Jobless Claims (06/08)

8:30 a.m. Housing Starts (May)

8:30 a.m. Initial Claims (06/15)

8:30 a.m. Philadelphia Fed Index (June)

7:00 a.m. UK Interest Rate Decision

Previous: 5.25%

Earnings: Kroger, Darden Restaurants

Friday, June 21

9:45 a.m. PMI Composite preliminary (June)

9:45 a.m. S&P PMI Manufacturing preliminary (June)

9:45 a.m. S&P PMI Services preliminary (June)

10 a.m. Existing Home Sales (May)

10 a.m. Leading Indicators (May)

2:00 a.m. UK Retail Sales

Previous: -2.3%

Earnings: CarMax

The summer season is upon us. Analysts are divided on how the market will behave over the next few months. Some see a 20% to 30% correction. Others see a sideways move and then more upside. The market taking a breath is not a bad thing. I am not ruling out DOW 38,000 or even an extension to 37,000.

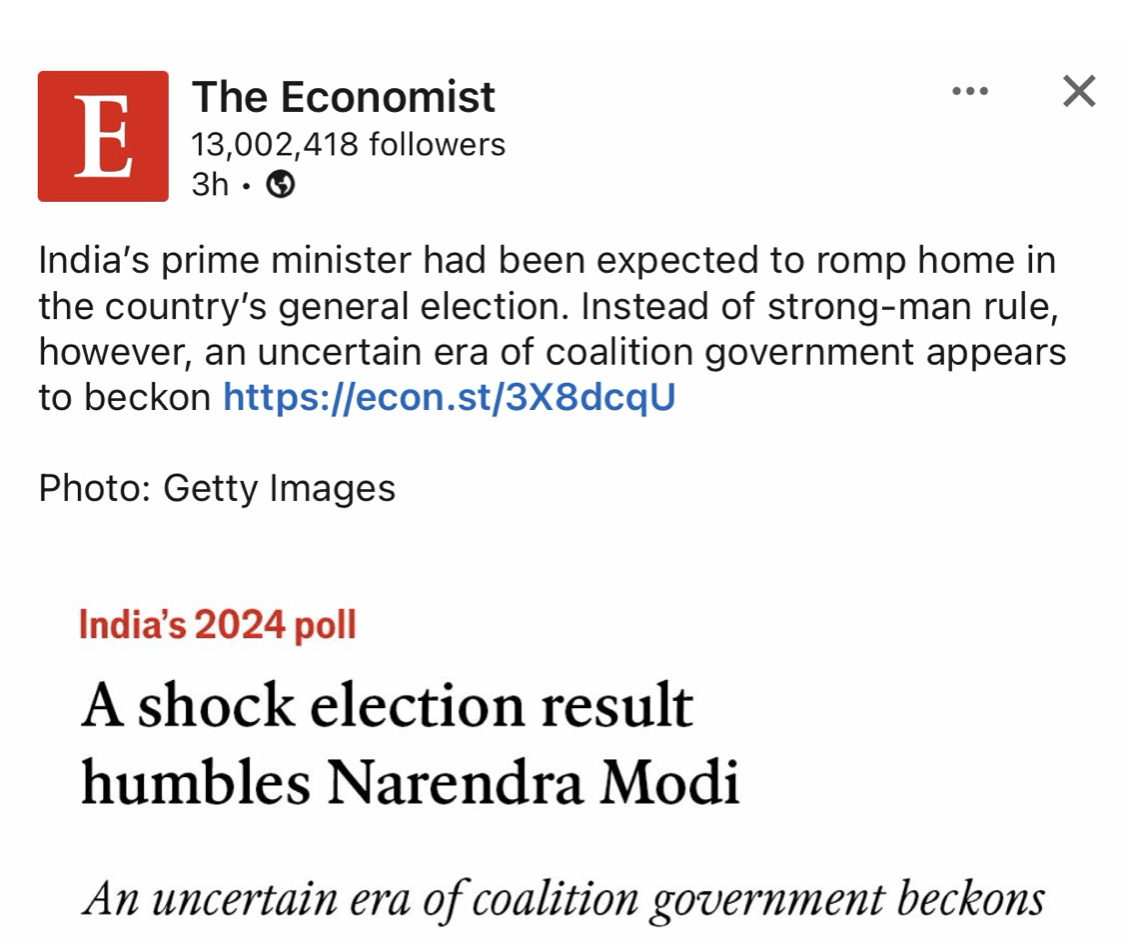

The Reserve Bank of Australia and the Bank of England are scheduled to set their interest rates this week. All eyes will be on the Bank of England this week to see if it follows the lead of the European Central Bank in lowering its rates. Some analysts are predicting that the Bank of England will cut as many as three times this year.

The Diplomatic Play of the Panda Loan

China’s pandas can be seen as ambassadors with a significant role to play in global politics.

Adelaide Zoo will receive a pair of pandas soon to replace Wang Wang and Fu Ni, who have been in Australia for 15 years. They will be returned to China.

The Chinese premier, Li Qiang is in Australia now. It’s the first trip to Australia by a Chinese premier in seven years. The Chinese government's loan to Australia of two new pandas conveys a message regarding Australia-China relations.

Loaning pandas is seen as promoting mutual partnerships between China and the recipient countries while withdrawing pandas, as China did with the US in 2023, was widely viewed as souring relations.

The panda loan can be interpreted as a ‘seal’ agreed to once China turns a corner with a country, be it in diplomatic, trade, or security matters.

Australia has given various marsupials, platypuses, and crocodiles to friends and allies over the last two decades, while Sri Lanka and Vietnam have gifted elephants to many countries.

Animal diplomacy dates back centuries. During the 1950s, Chairman Mao Zedong was known to send pandas as gifts to the country’s communist allies, which included North Korea and the Soviet Union.

US First Lady, Pat Nixon, commented during a state function in China about her love for animals, and in a period when the two countries were normalizing relations, the Chinese government gifted them.

By the 1980s, panda diplomacy changed, and pandas were loaned for 10 years with the option to extend.

This shift to panda lending allowed China to keep promoting its image abroad and build “guanxi”, a Mandarin term for trust. Loaning pandas was seen as promoting mutual partnerships between China and the recipient countries.

In turn, host countries would pay an annual fee of about $1 million per bear.

Two pandas were sent to Scotland in 2011 after the two countries signed an oil deal.

The list of panda recipients includes Denmark, Germany, South Korea, Russia, and Qatar.

From left, Penny Wong, Australia’s foreign minister, South Australian Premier, Peter Malinauskas, and China’s Premier, Li Qiang pictured visiting Adelaide Zoo in Australia on Sunday, June 16, 2024.

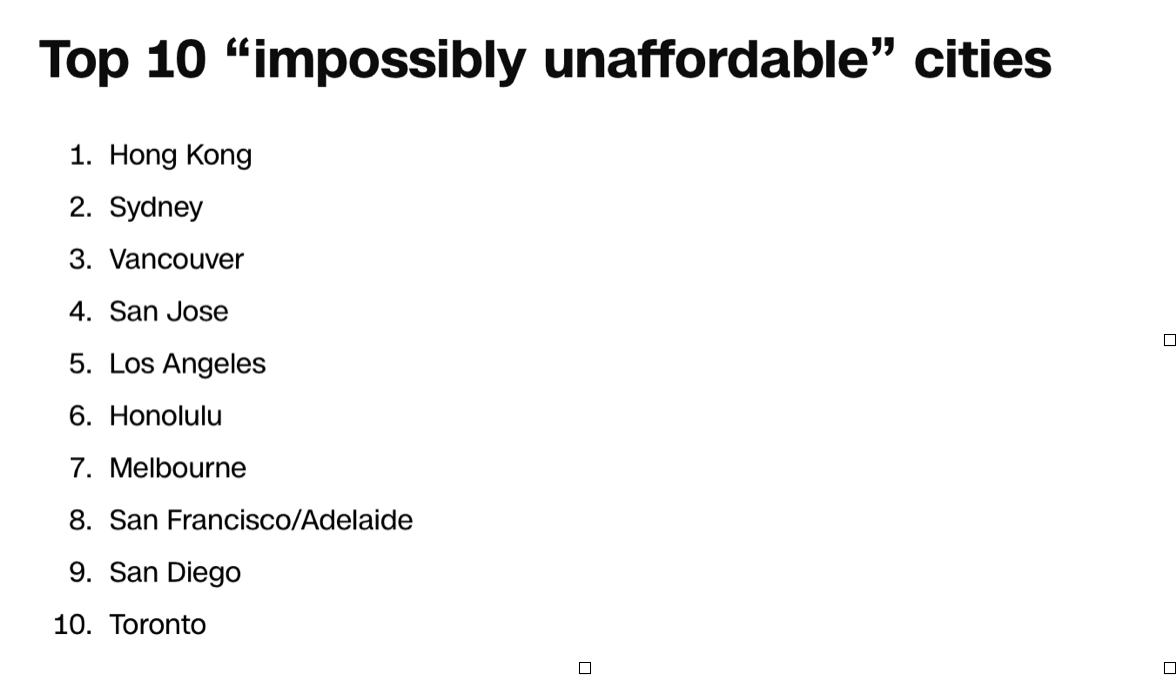

Australia hits the No.2 spot of the most unaffordable cities to live in in the world. The cost-of-living crisis is forcing many people to leave Sydney and Melbourne for the State of Queensland. Brisbane is cheaper, but the gap is quickly narrowing between house prices in Brisbane and Sydney and Melbourne. Regional areas such as the Gold Coast, Sunshine Coast, Toowoomba, and Brisbane outskirts have seen strong growth. With rate cuts not forecast in Australia until 2025, the migration north is only set to gather pace.

Portfolio Update

If you own any of these stocks exit out of them completely. There are opportunities setting up where our funds would be better placed.

Stock Purchase Price & Date Price Friday (06/14)

Delta Airlines (DAL) $40.54 (01/08/24) $48.72

Solaris Resources (SLSR) $3.33 (04/24/24 $3.08

Arizona Metals Corp $2.21 (04/24/24) $1.59

Global X Silver Miners $23.00 (02/15/24) $31.58

ETF (SIL)

Note: Re: (SIL) By selling out of (SIL) I am not saying the bull market in the metals is over. I want to take the profit and put it into another metal play that is setting up nicely.

Liberty All State

Equity Fund (USA) $6.66 (02/02/24) $6.78

Market Update

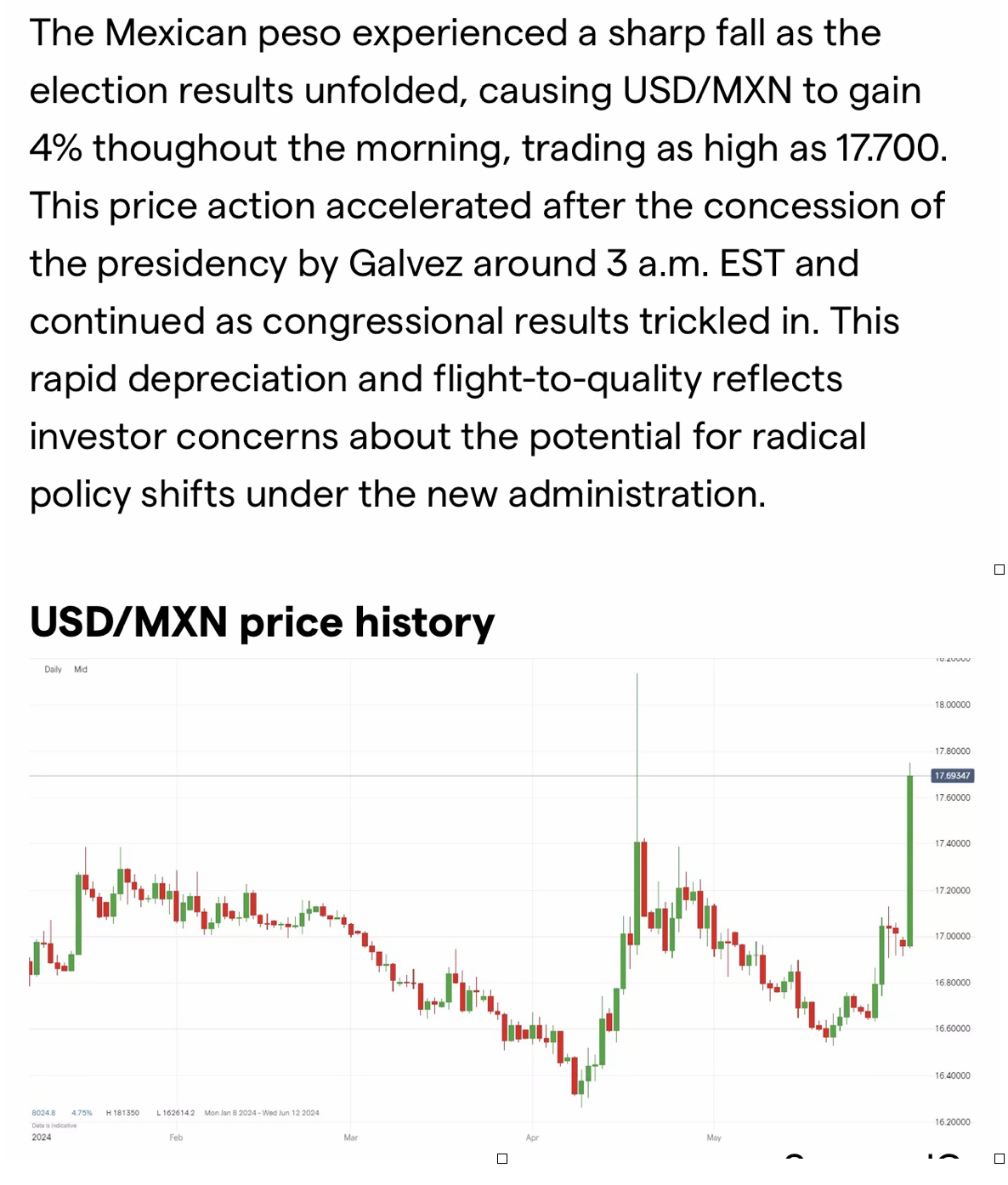

US$ - expecting the dollar to rally a little more before topping out. Euro, Pound Sterling, Aussie and Kiwi, and Japanese Yen should weaken in the short term. Those downside moves will provide a great opportunity to enter long positions. Look at FXA, FXE, and FXB.

S&P 500 – market could pull back to 5,140 before the upside continues.

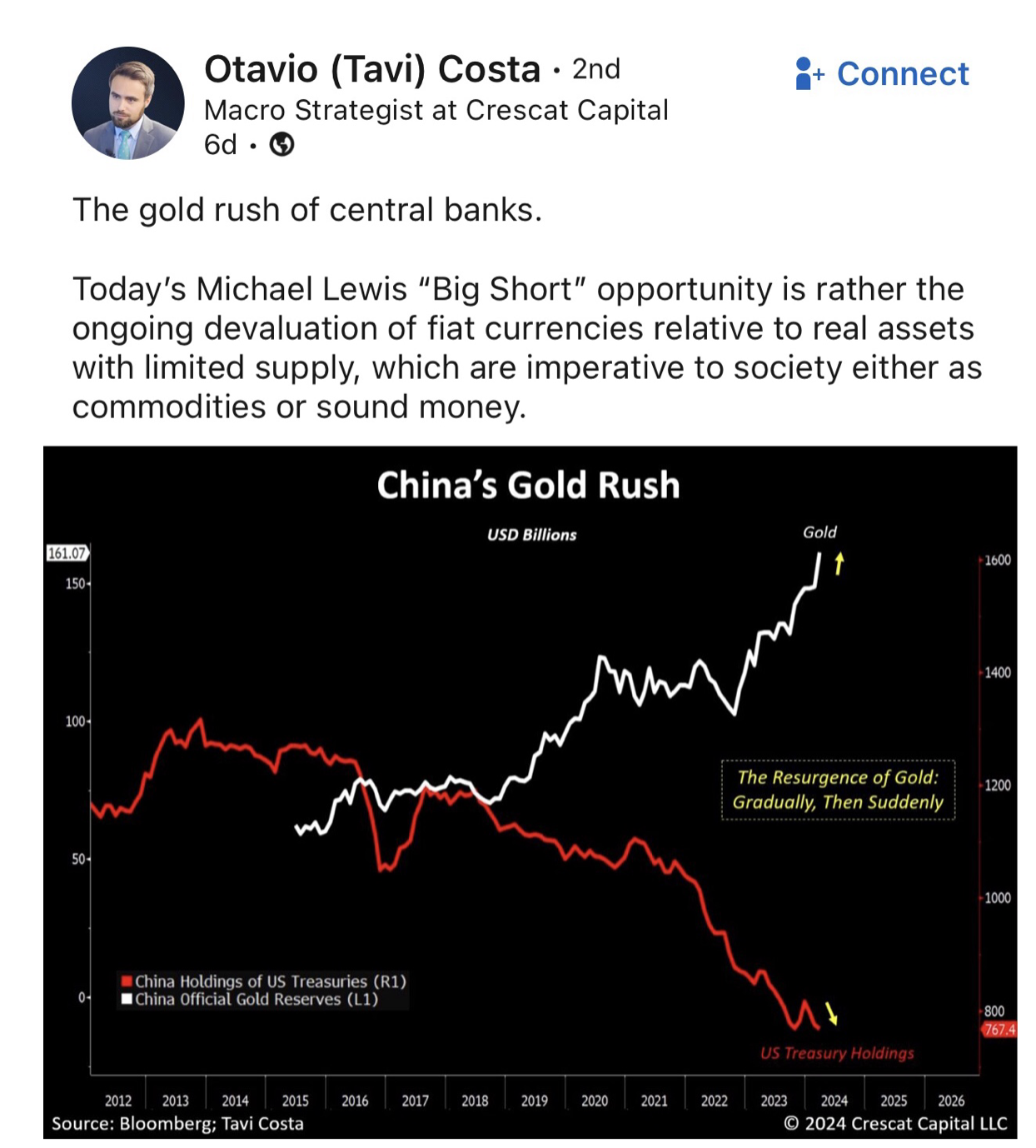

Gold – correction in progress – looking for support around 2250 – 2270, but correction to 2220 cannot be ruled out.

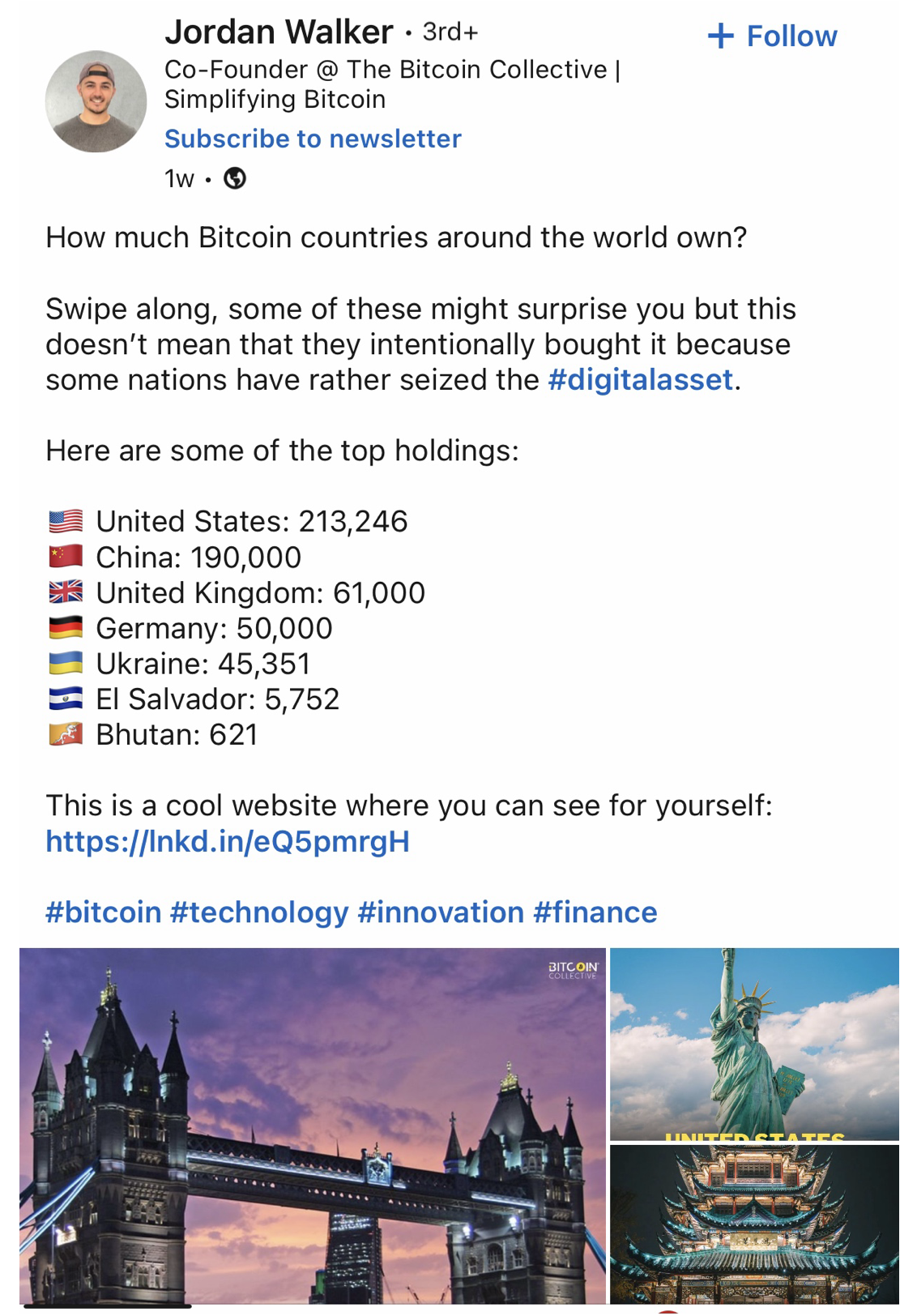

Bitcoin – correction in progress - possible targets are 60,000, 55,000, and maybe even as low as 52,000. Scale in as the crypto falls to these price zones.

Cheers,

Jacquie