( THE YEN IS FACING A DILEMMA)

May 1, 2024

Hello everyone,

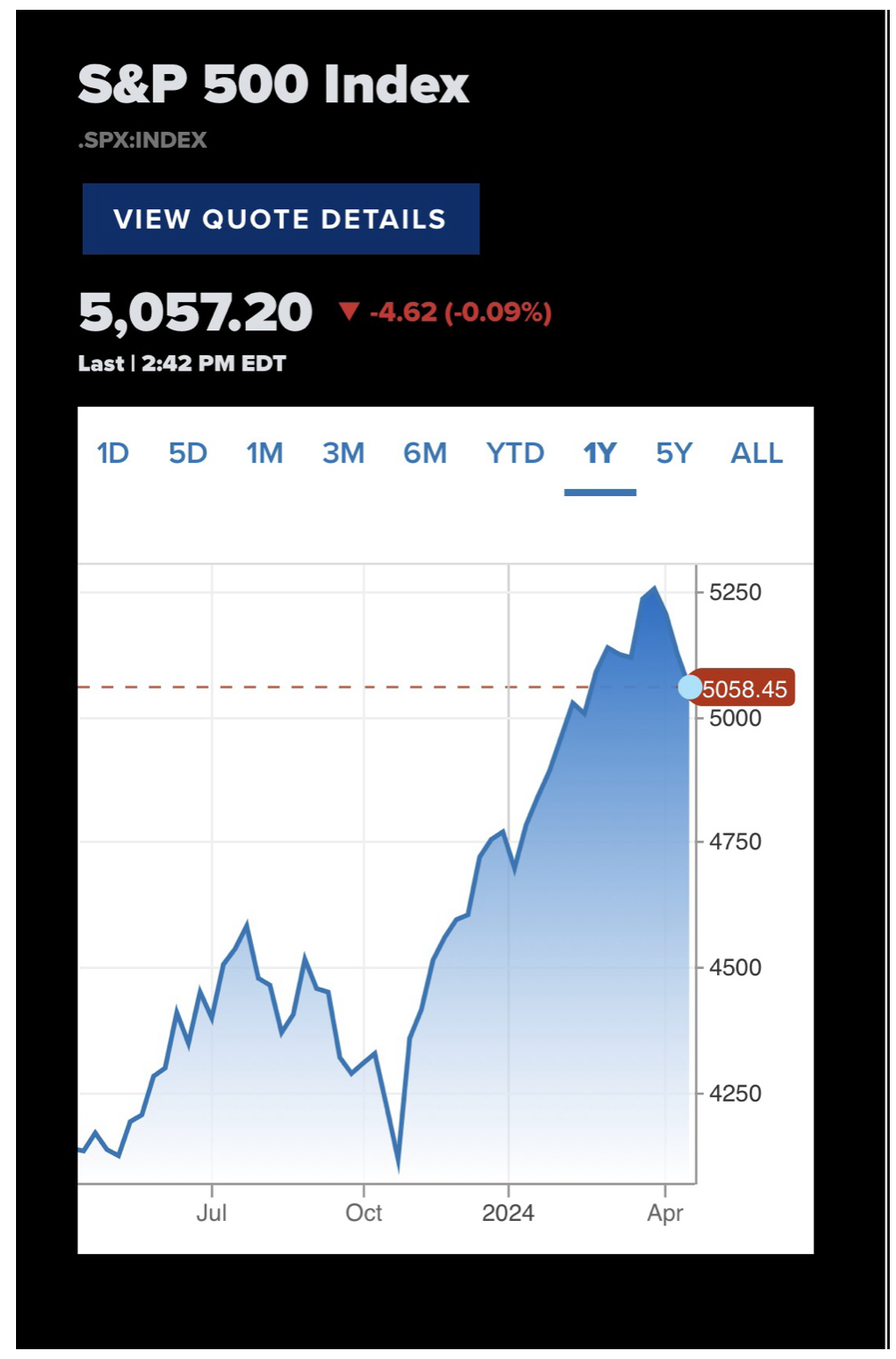

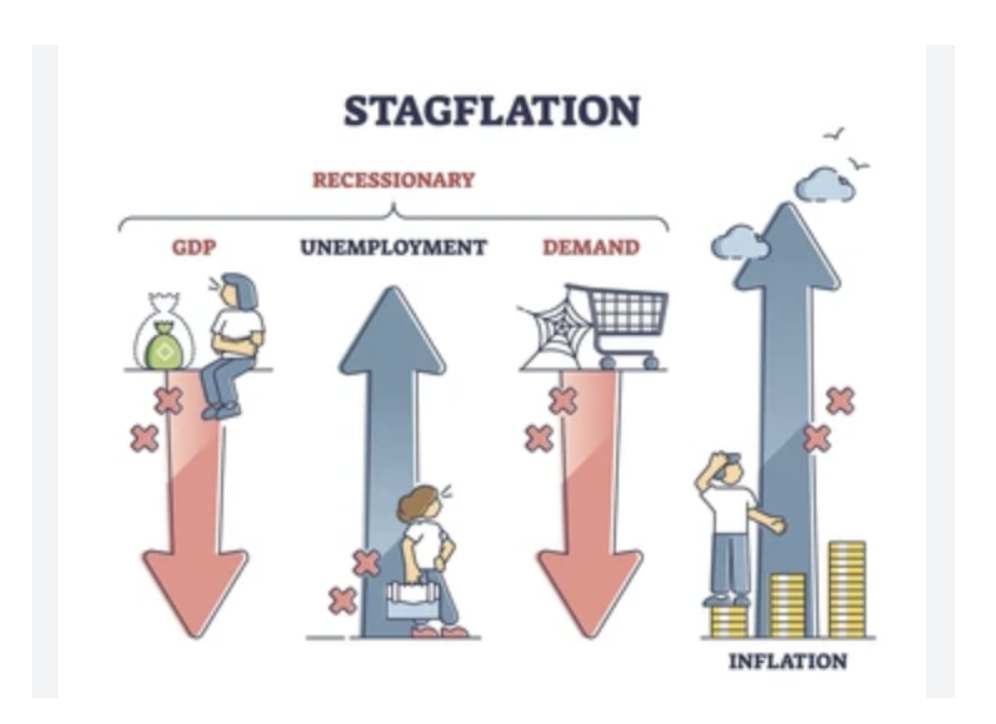

Welcome to May, and what could be a continuation of the market behaviour we saw in April. The market is in the doldrums about what the Fed might say on Wednesday. Investors are already interpreting and theorizing possible outcomes, hence putting the market on the back foot.

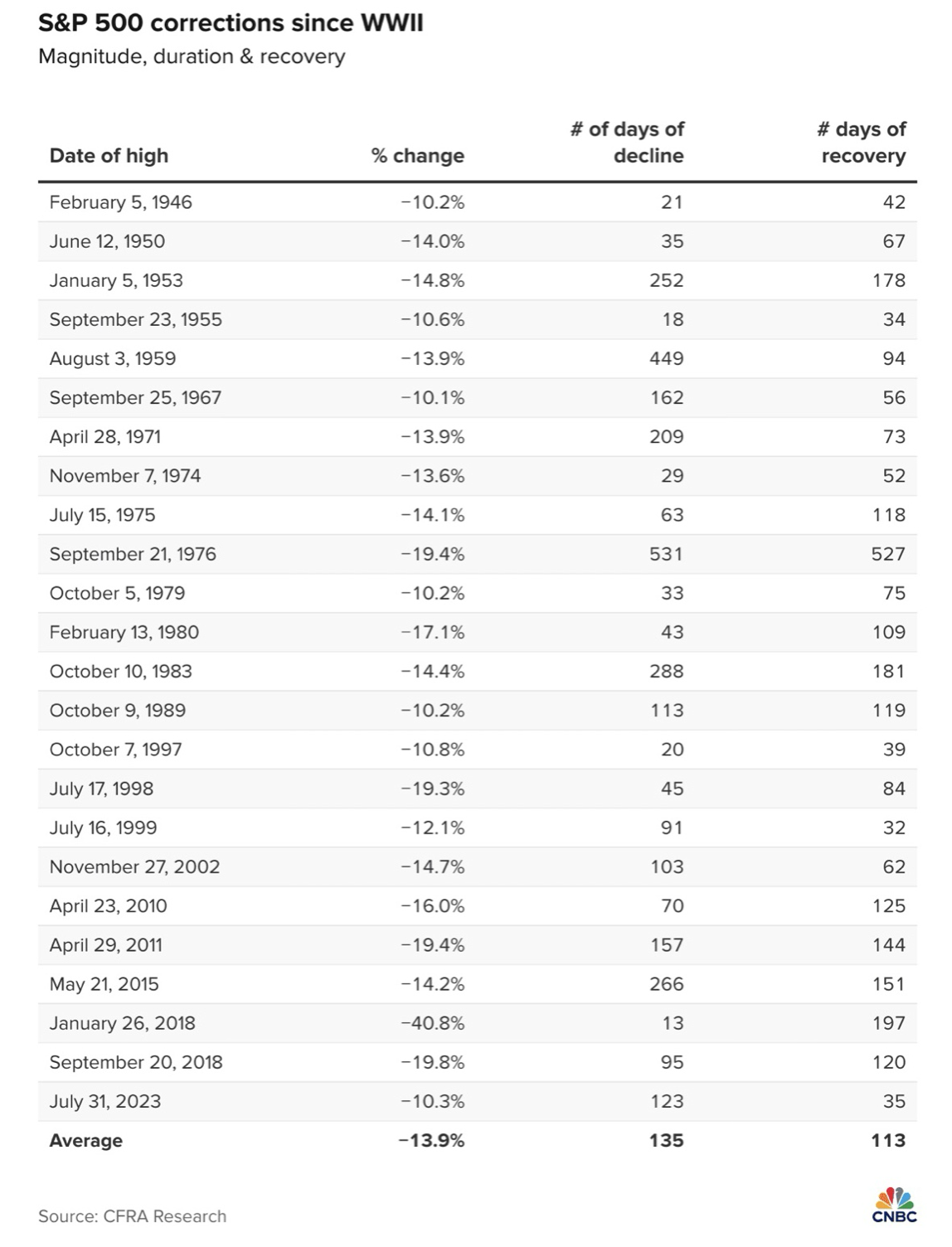

As we wait to decipher the Fed’s stance on the road ahead, let’s look at what Bank of America thinks about this market correction.

According to the firm, investors should not panic. Instead, they should use the downside movement as a promising entry point before the market swings back to the green this summer.

It’s that ‘buy on the low, sell on the high’ idea. Most of the reluctance to buying at these times comes from the mindset: ‘But, what if the market (or stock) goes lower?’ Answer: you buy in small parcels at different levels, average in.

That’s how I approach the market. Take what the market gives you.

During election years, headwinds in April and May can be expected. But this is mostly temporary. Seasonality supports buying the dip prior to a summer rally. Volume indicators for the S&P 500 are suggesting a pause ahead of upsides in the summer.

Why is the Japanese Yen cratering?

The Japanese stock market has been rallying over the past few years. From its Covid-induced low in 2020, the Nikkei has run to a record high of over 38,000. That gallop has even outdone the U.S. S&P500 over the same period.

Japan’s previous three decades saw stagnant performance and low economic growth. Now in 2023/2024, we see Japan’s stock market entering a new era of strength, but alongside this strength, the Japanese Yen has collapsed.

On Monday morning the Yen briefly touched 160, a 34-year low compared to the U.S. dollar. However, in what may have been the Bank of Japan's intervention, the dollar dived below 157 in a heartbeat not long after the low was reached. In January 2023 the Yen was sitting at 129. So, what gives?

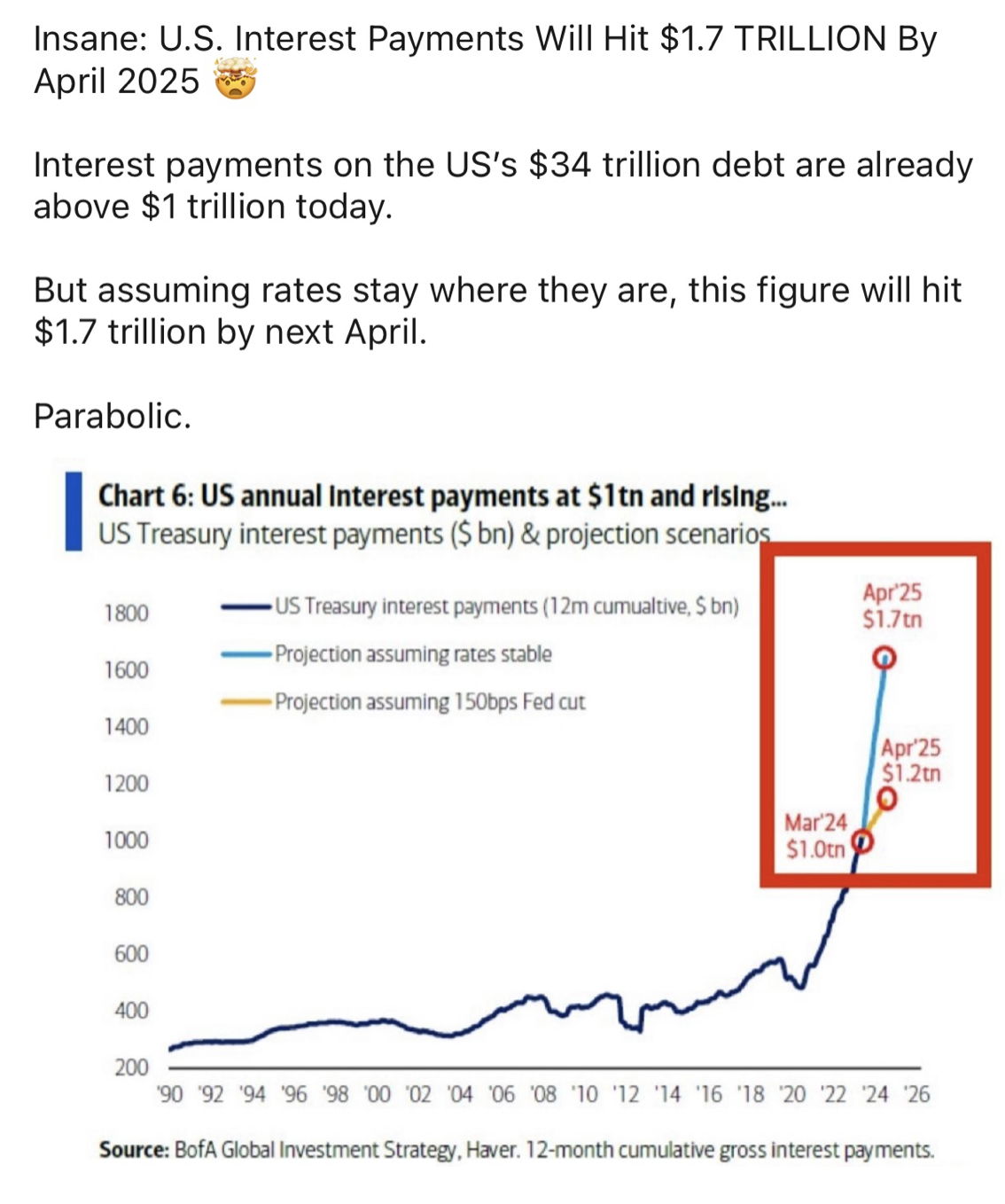

The Yen’s collapse can mostly be explained by the rising U.S. interest rates. The currency’s fortunes are mostly tied to expected interest rate differentials. In other words, the Yen will fluctuate in accordance with the anticipated difference between the interest rates in Japan and other parts of the world, most particularly the U.S.

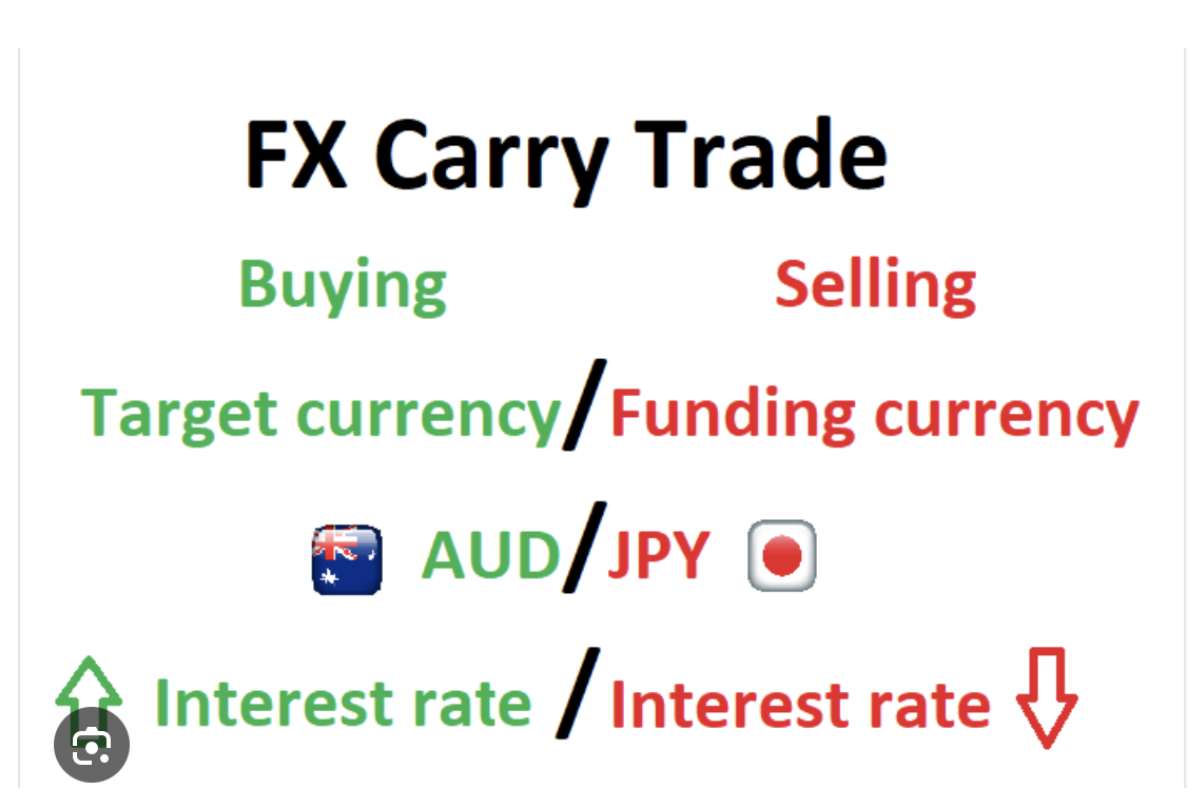

So, when the U.S.’s interest rates are higher than Japan’s, it puts pressure on the yen. And the reasons for this are twofold. Firstly, due to Japan’s low interest rates, the yen is often used in the so-called “carry trade.” This means investors can borrow at a low interest rate to invest in an asset with a higher return. So, you might see a fund manager borrowing yen and investing it in a higher-yielding foreign instrument, pocketing the difference.

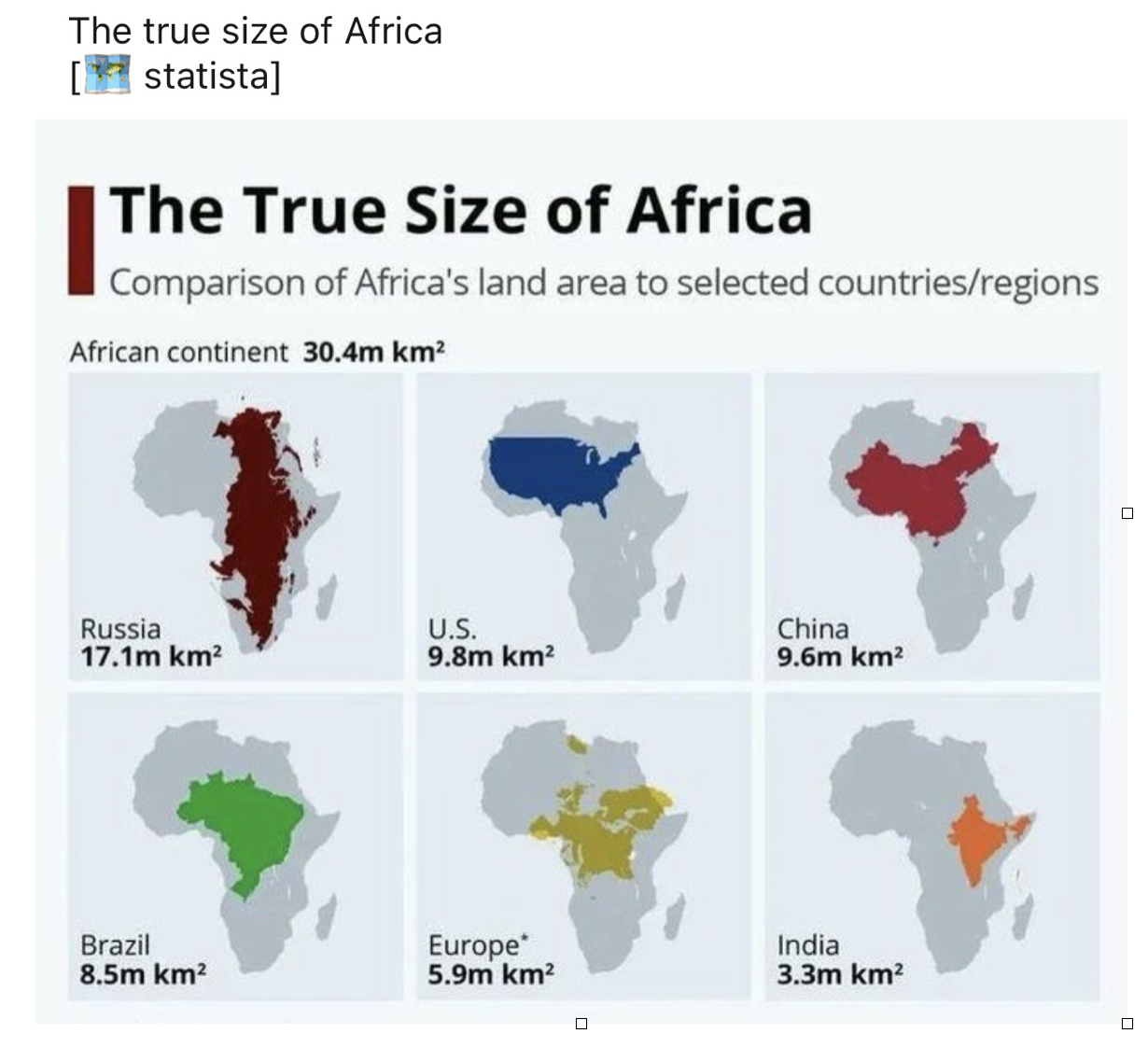

The interest rate differentials between Western powers and Japan also impact investment and hedging in Japan’s $4.2 trillion portfolio of overseas assets. When Japanese investors see that interest rates are far higher in other developed nations, they’ll often increase their investment in these overseas assets, pulling down the yen. Hence the rising interest-rate differential between the U.S. and Japan has become quite a dilemma for the yen over the past few years.

In the short to medium term, there is little likelihood of change here for JPY/USD. With the resilient U.S. economy and inflation showing signs of accelerating, many believe the Fed is unlikely to cut interest rates soon, which will see the yen remaining at the mercy of developments, particularly in the U.S.

But the tide will eventually turn. U.S. and European central banks will eventually cut their respective interest rates, lessening the painful interest-rate differential for Japan.

Bank of America argues that the Bank of Japan may hike rates in the third quarter, and the U.S. could cut rates. This would then pave the way for yen appreciation.

QI Corner

Cheers,

Jacquie