(SUMMARY OF JOHN’S JANUARY 24, 2024 WEBINAR)

January 26, 2024

TITLE: New All-Time Highs

PERFORMANCE:

Since inception: 670.74%

Average annualized return: 51.27%

Trailing one-year return: 52.86%

January 2024: -3.88%

POSITIONS:

(MSFT) 2/$330-$340 call spread

(AMZN) 2/$130-135 call spread

(V) 2/$240-$250 call spread

(PANW) 2/$260-$270 call spread

(CCJ) 2/$38-$41 call spread

(TLT) 2/$90-$90 call spread

Total Net Position 60%

THE METHOD TO MY MADNESS:

Markets are overbought but keep rising for the time being.

All economic data is globally slowing, except for the U.S. presenting as the only good economy in the world.

Oil is still being pulled down by a collapsing China. Look for improvement in the second half of this year as China starts to pick up.

Domestic plays have gone back to sleep on rates.

Buy stocks and bonds but only after substantial dips.

Commodities and industrials are a second half play.

THE GLOBAL ECONOMY

University of Michigan Consumer Sentiment Index surges up to 78.8 for January, its highest level since July 2021.

US Retail Sales comes in the best in three months, up 0.6% in December, as analysts continue to underestimate the American consumer.

Weekly Jobless claims plunge to 187,000, a 17-month low, underlining the “soft landing” scenario.

PPI falls 0.1% in December, putting the interest rate cutting scenario back on.

Consumer Price Index Flies, coming in at 0.3% for December instead of the anticipated 0.2%, a 3.4% annual rate.

Fed rate cuts just got pushed back from March to June.

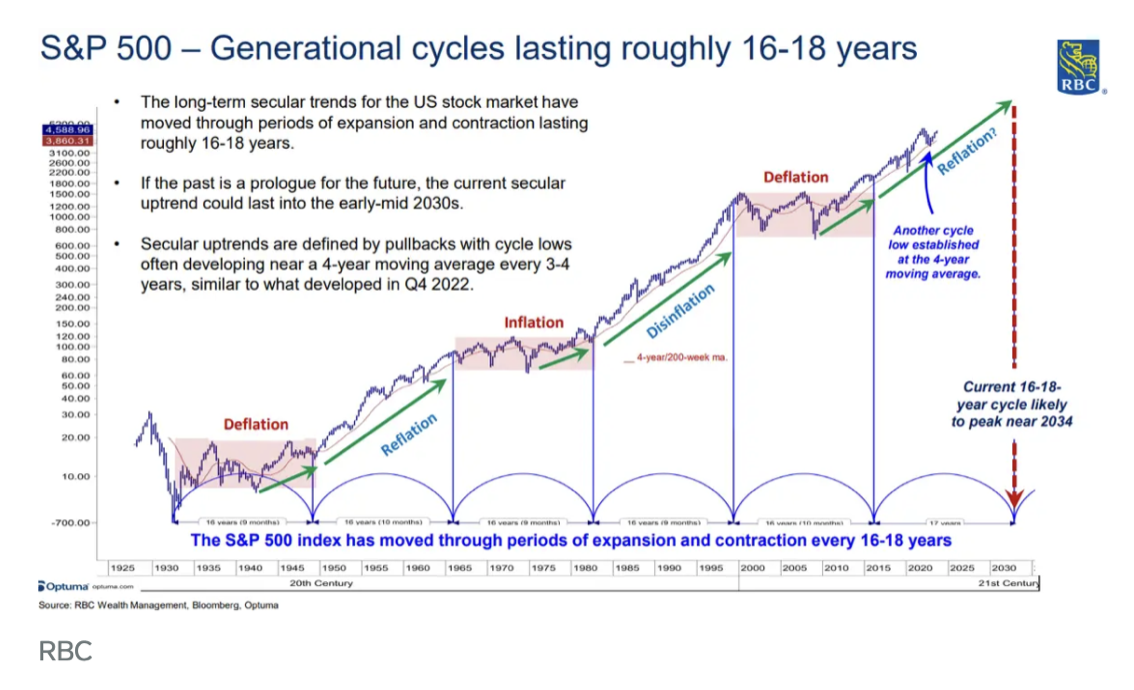

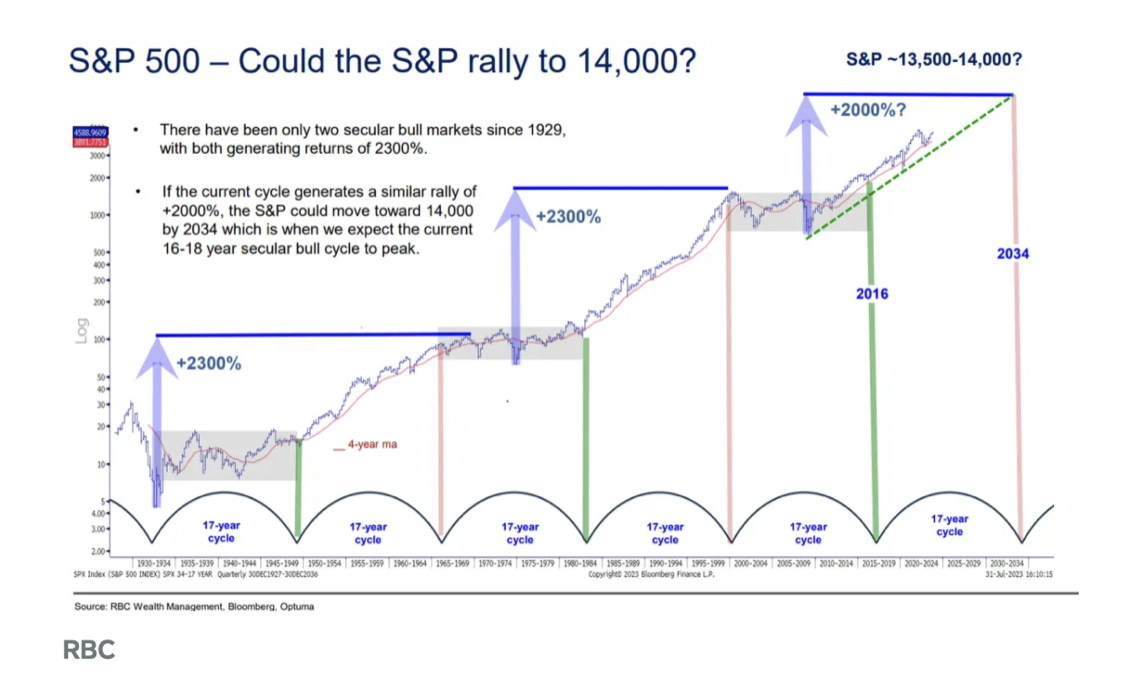

STOCKS – New All-Time Highs

SPY breaks to new high on strong consumer sentiment.

Big Tech continues to dominate.

Market will continue to revalue all AI plays.

Bull move could continue into February as investors are underinvested, or even short.

Analysts are vastly underestimating technology earnings, only upgrading in 5% increments creating constant upside surprises.

Domestic plays have gone back to sleep on rising rates.

The flip-flop continues between tech and domestics.

TSLA – if Tesla hits $190 a good trade would be a 150/160 LEAPS two years out. But I would suggest holding off until the dust settles and the price war is over.

BA – LEAPS two years out = double your money.

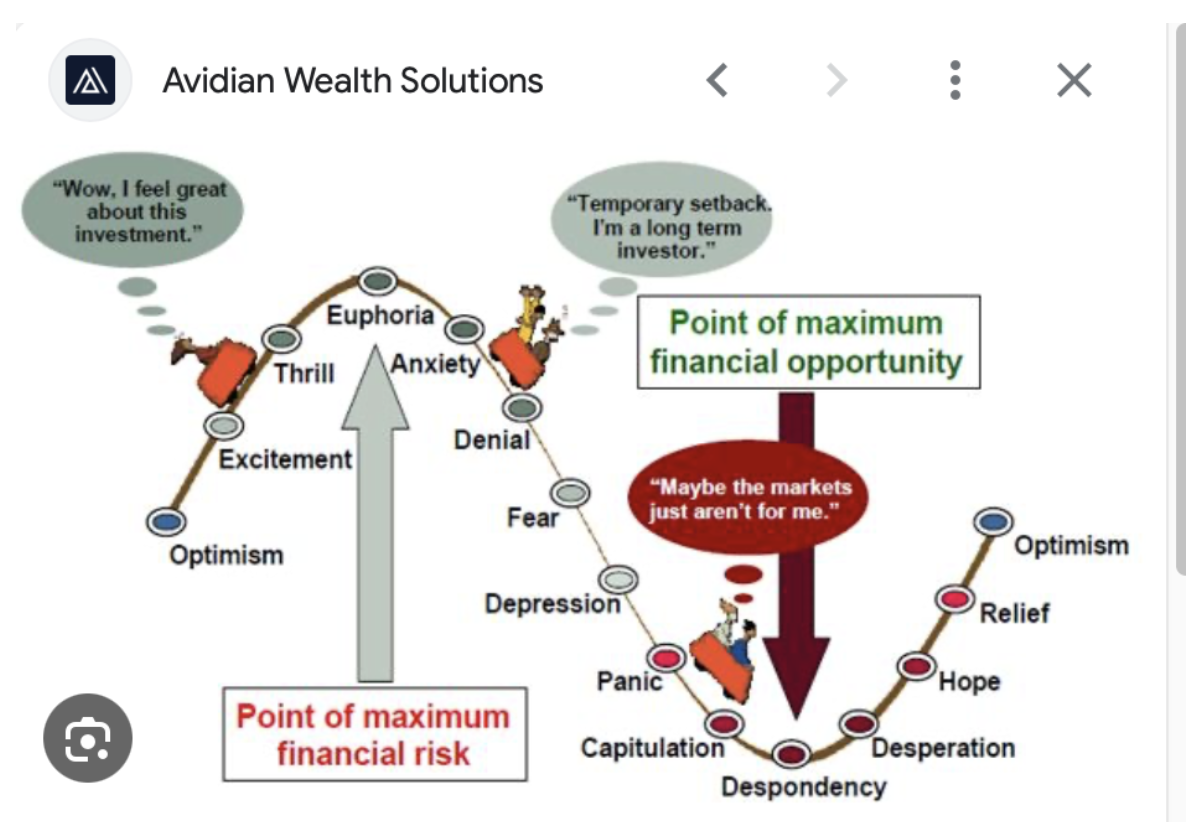

Market timing index is at 76 – in sell territory, so don’t get greedy. Be patient and wait.

Don’t try and time the market – keep the AI five stocks. You generate a tax bill if you sell and may have difficulty getting back into the stock at a good price.

BONDS – Still Fading

U.S. Budget funded for two more months, kicking the can down to March 8.

U.S. Budget Deficit tops $500 billion in Q1.

Bonds could be the big trade of 2024.

After the sharpest 19-point two-month rise in market history, markets are taking a break.

Markets are discounting three cuts in 2024. May 2024 the mostly likely start date.

Junk bond ETFs (JNK) and (HYG) are holding up extremely well with a 0.50% yield and 18-month high.

John is looking for an $18-$28 point gain in 2024.

Buy (TLT) on dips.

FOREIGN CURRENCIES – giving up gains.

Foreign currencies give up 2024 gains because of the return of higher U.S. interest rates.

A dollar rally could last a couple of months, so a new currency entry point is approaching.

However, according to John, falling interest rates guarantee a falling dollar for 2024.

Bank of Japan eases grip on Bond yields, ending its unlimited buying operation to keep interest rates down.

China markets dive on news that the central bank was forced into the currency markets to support the yuan.

(FXA) to rally on the coming bull markets in commodities.

Buy (FXY) on dips.

ENERGY & COMMODITIES – it’s all about China.

China in free fall is destroying the oil market, the world’s largest energy consumer.

Libya returns 300,000 b/d of production to the market.

U.S. Big Freeze takes 400,000 b/d off the market from North Dakota.

John says that if you throw good news on a commodity and it fails to rally you get rid of it.

This is despite the U.S. government coming in to buy 1-3 million barrels daily for the SPR.

Copper to rise 75% in 2024, say industry analysts.

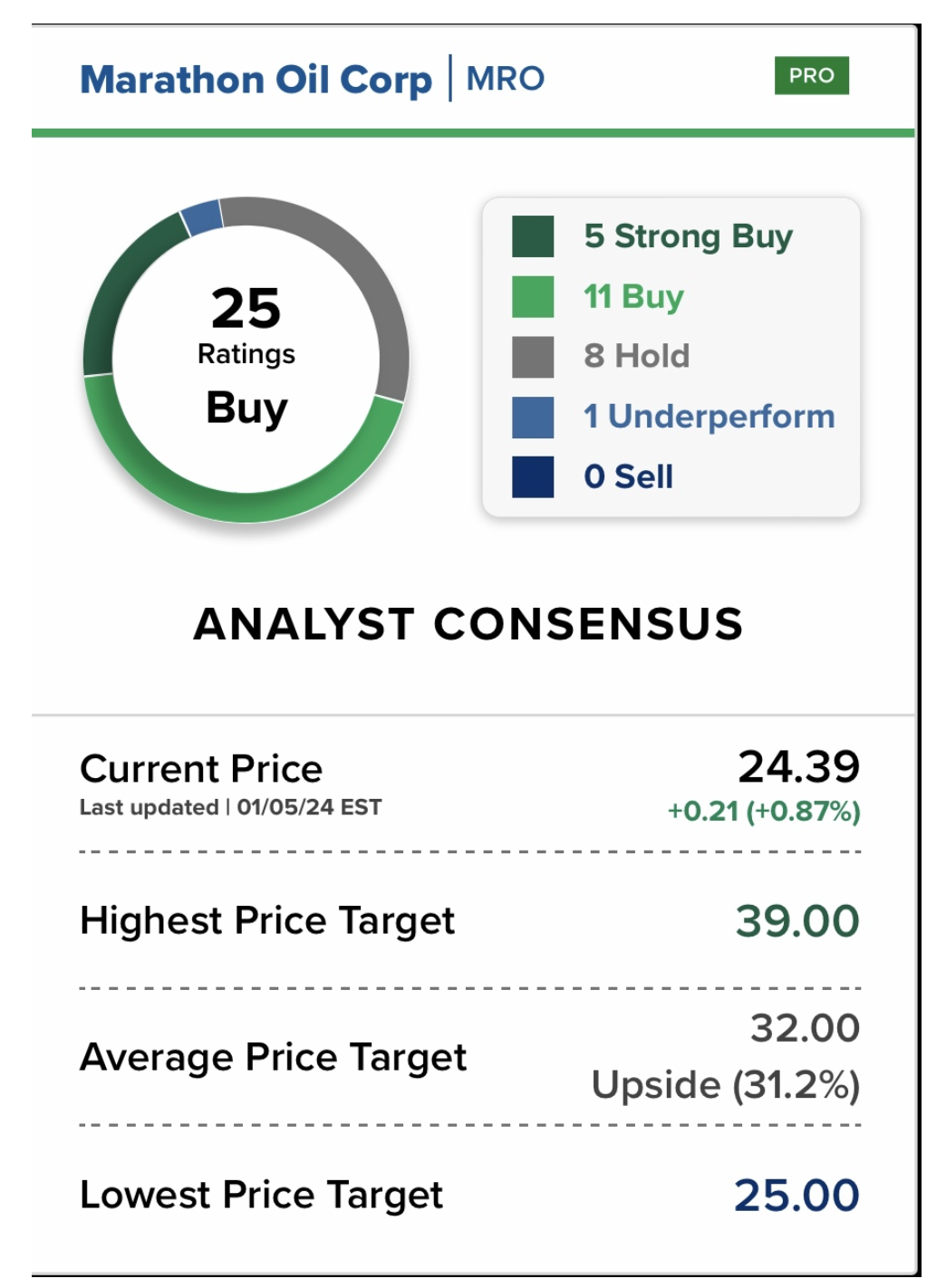

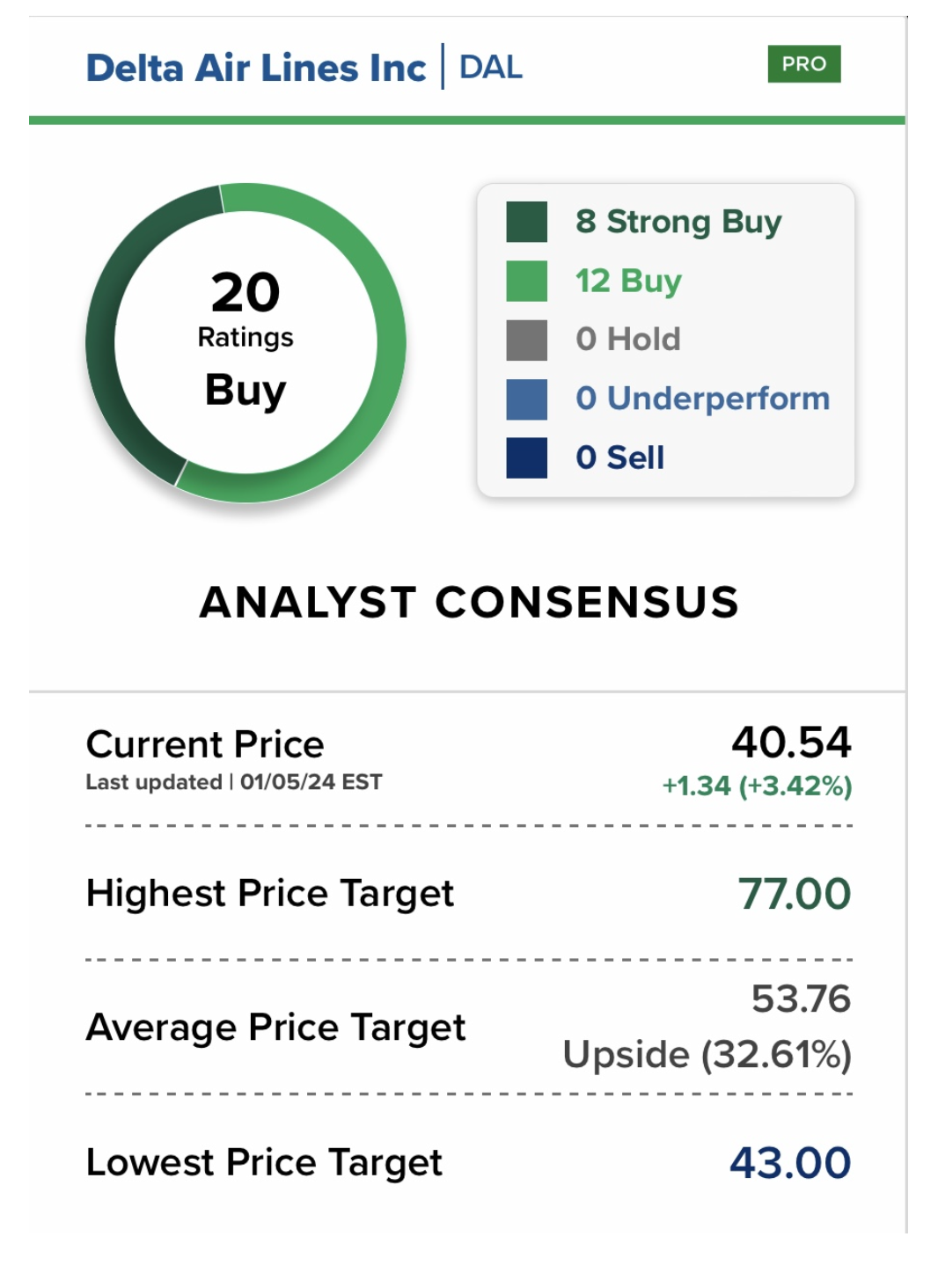

There is a “BUY” setting up here in energy when the global economy reaccelerates on a lower interest rates world. Watch (XOM) and (OXY).

Natural gas gives up much of 2024 gains.

PRECIOUS METALS – Interest Rate Hit

Gold takes a hit on rising U.S. interest rates.

Gold needs a return of falling interest rates to resume rally

Investors are picking up gold as a hedge for 2024 volatility.

Gold headed for $3,000 by 2025 but will retreat first from new all-time highs.

Silver is the better play with a higher beta.

Russia and China are also stockpiling gold to sidestep international sanctions.

Good LEAPS candidates setting up here: check out GOLD and NEM, SLV, SIL, and WPM.

REAL ESTATE – Ready for Blast off.

Existing home sales come in weak in December MOM, according to the National Association of Realtors.

Sales were 6.2% lower than December 2022, marking the lowest level since August 2010.

Inventory fell 11.5% from November to December, but it was up 4.2% from December 2022.

There were 1 million homes for sale at the end of December, making for a 3.2-month supply at the current sales price.

A six-month supply is considered balanced between buyer and seller.

Real estate is far stronger than people realize.

Refi demand rockets, as interest rates plunge to four-month lows.

Tight supply and still-strong demand have kept pressure on home prices.

ITB – buy any dip – U.S. is short about 10 million homes.

TRADE SHEET

Stocks – buy any dips

Bonds – buy dips

Commodities – buy dips

Currencies – sell dollar rallies, buy currencies

Precious Metals – buy dips

Energy – buy dips

Volatility – buy $12

Real Estate – buy dips

Next Webinar is on February 7, 2024.

“Success is nothing more than a few simple disciplines, practiced every day.” - Jim Rohn

Cheers,

Jacquie