There isn’t a CEO in the country who hasn’t halted capital investment in the face of today’s unprecedented uncertainty. You can’t invest in a business without a credible GDP forecast, and Q1 is certain to deliver a large negative number, the first half of a recession.

There isn’t a consumer that isn’t cutting back on spending. With the price of everything rising, they have no choice. Entire markets, like real estate, are frozen.

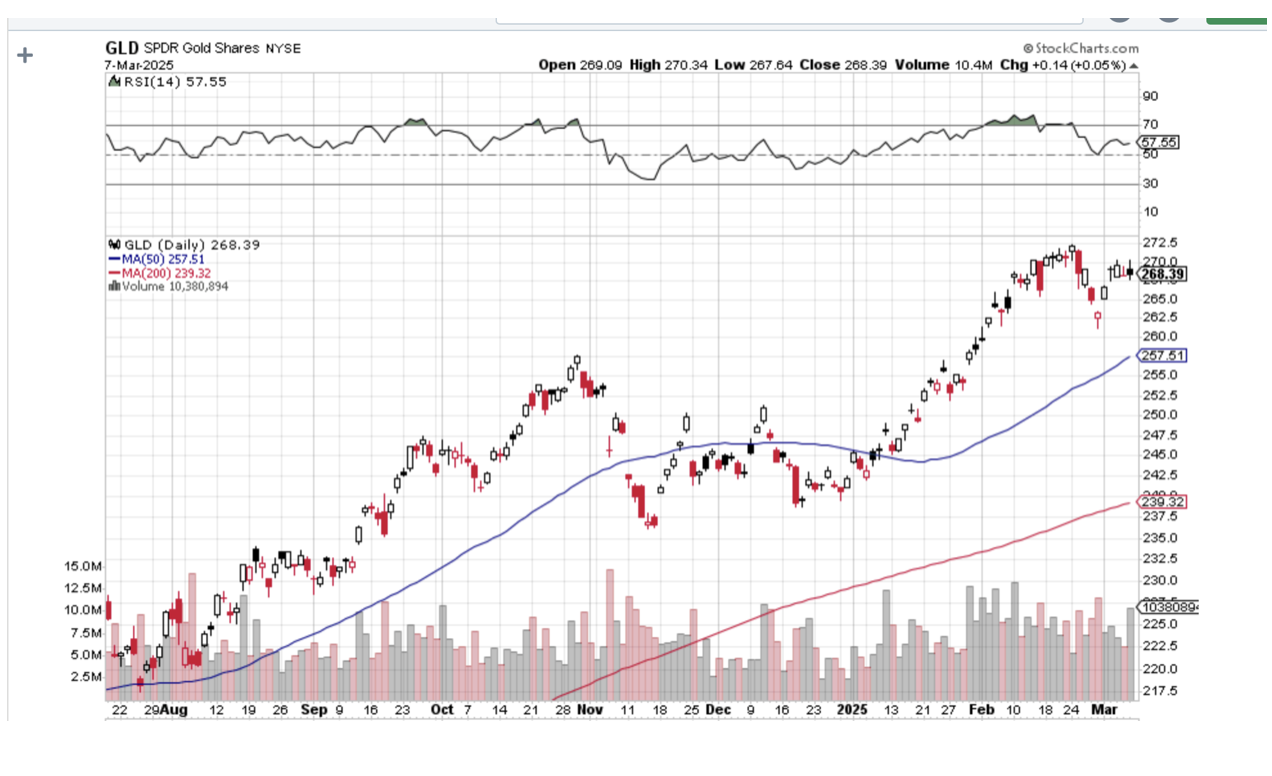

Worst of all, there isn’t an investor who hasn’t postponed additional stock purchases. There is an unprecedented capital flight out of the US and into Europe and China taking place. Anything American, like the US dollar, has suddenly become toxic.

One of my favorite expressions is that “Money is like water; it flows to wherever it is treated best.” Right now, there is a Panama Canal’s worth of money flowing elsewhere, or into 90-day US Treasury bills.

And stocks are down by only 8.13% so far?

Welcome to government by reality TV.

The goal isn’t to create jobs, grow the economy, and help stabilize the world. The intention is to shock, amaze, appall, upset, disrupt, and maximize clicks for certain online social media platforms and websites. If so, they are wildly successful. So far, investors are giving the show very poor ratings, subterranean ones, and a definite thumbs down.

Last week was the worst one for stocks in two years. The Magnificent Seven are now down 15% year to date, and I bet that Tesla (TSLA), its stock down 50% in less than three months, is running at an operating loss. I would not be surprised if the country’s retirement savings have cratered by 10% so far in 2025.

Last week, I called my weekly letter “Armageddon”. I was too modest, reticent, and cautious. It should have been entitled “Armageddon on Steroids.” The US economy is probably in recession now, but we won’t see a hint of this until the Q1 numbers are out on April 30 and the confirmation on August 28.

The implications are global.

It's not a recession I’m worried about; it’s a Great Depression, a recession that a broken economy can’t get out of. There isn’t an economy in the world that isn’t being disrupted and turned on its head.

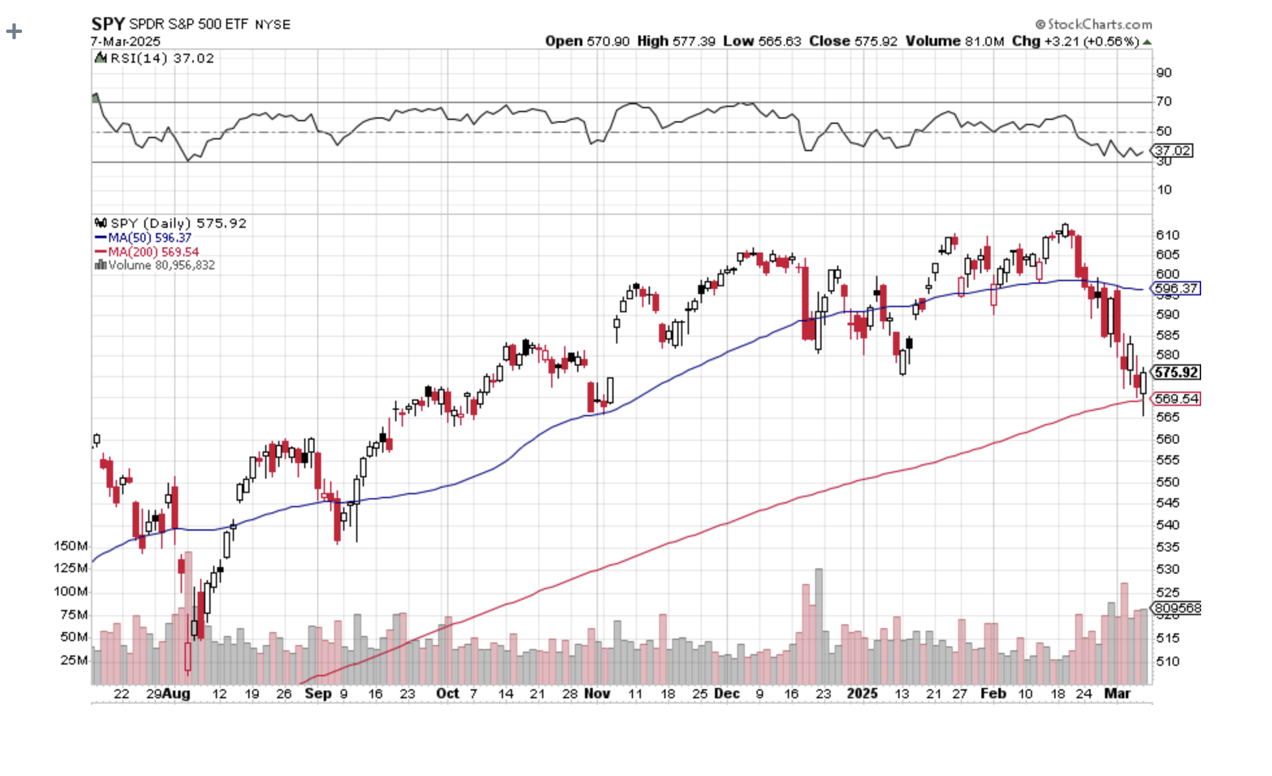

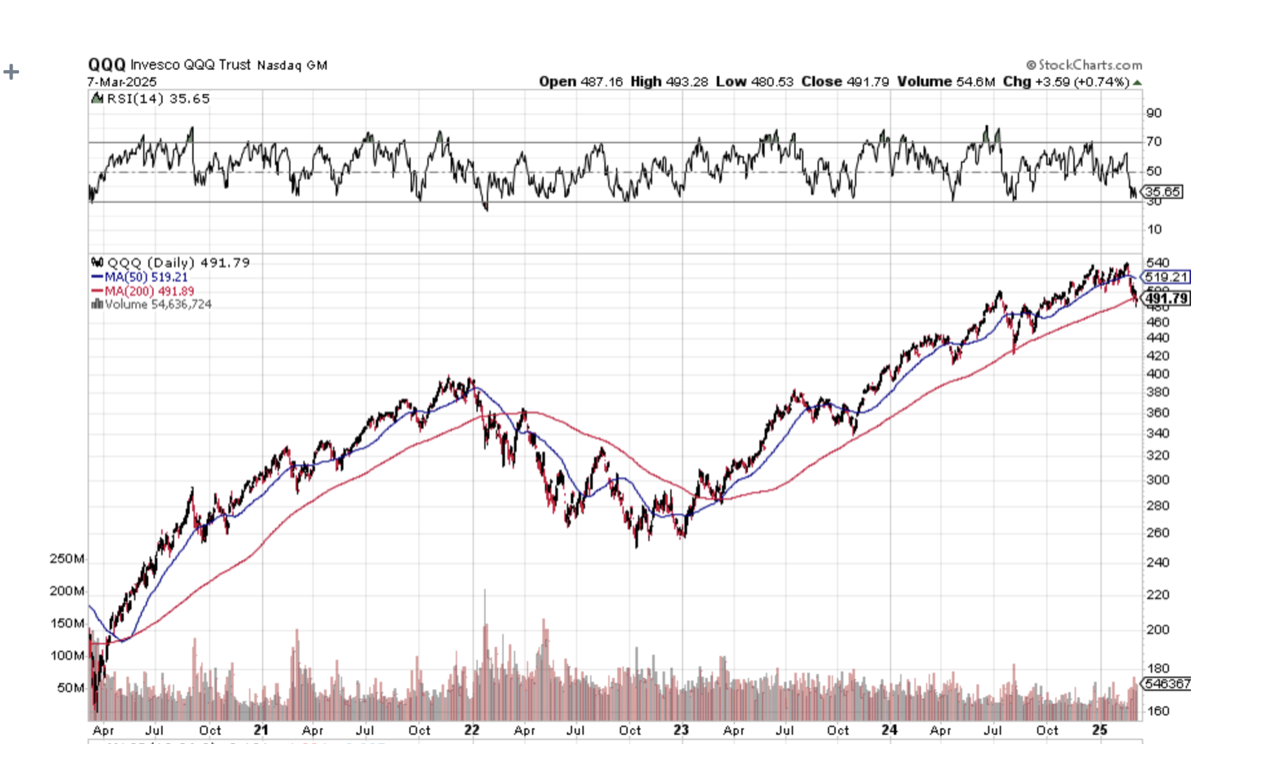

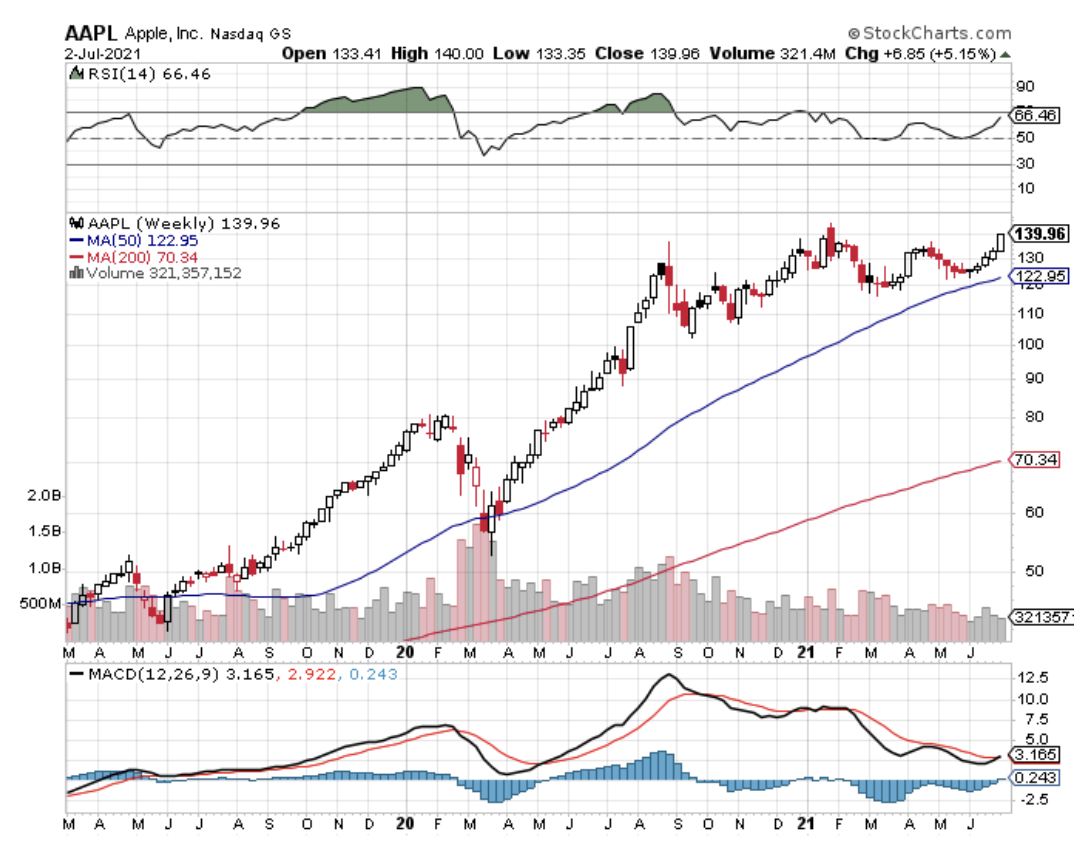

All asset classes are now screaming a recession. Oil is at a six-month low, interest rates are at a three-month low, and both the S&P 500 (SPY) and NASDAQ (QQQ) have broken their 200-day moving averages for the first time in 3 years when they fell 32% and 40%, respectively. And that was when interest rates were still at zero. The Atlanta Fed has ratcheted down its Q1 GDP forecast down to 2.4%, part one of a recession.

If you went to top up your coffee, you probably missed a 600-point move in the Dow Average ($INDU).

And here is the next black swan that is going to bite you.

The U.S. trade deficit surged in January, as import growth dwarfed a smaller increase in exports by 10:1. Imports rose 10% to $401.2 billion as businesses rushed to beat the tariffs, knocking 1.5% off of GDP. Exports climbed by a mere 1.2% to $269.8 billion. That yielded a net deficit of $131.4 billion, 34% greater than the $98.1 billion deficit in December. February is likely to be worse.

The Trump administration is setting up the perfect stagflation economy, with falling growth and rising prices. I suffered through this in the 1970s during the Nixon, Ford, and Carter administrations, and believe me, it was no fun. The triggers were two oil shocks and taking the US off the gold standard. This time, the Trigger is Trump.

It was a grim time. This was when the Dow Average flatlined for a decade, and stockbrokers drove taxis to make a living. It’s why, out of university, I went to work for The Economist magazine in London for ten years instead of heading straight for Wall Street. Brokers weren’t hiring. I didn’t get to Morgan Stanley until 1983, a year after the great bull market began.

The complete collapse of the banking sector has a very clear message: We are now in a recession. That means a 20% drawdown in this correction is a sure thing, and a 50% crash is not impossible. The promised deregulation and easier M&A policies never showed.

Keep adding protection through raising cash, executing buy-writes, and piling on bearish ETFs like the (SH) and (SDS). Tariffs will drop corporate profits by half if they continue and will wipe them out completely if they are increased in a future escalation.

When you impoverish your customers, as the tariffs are doing to Canada and Mexico practically overnight, you impoverish yourself. Their recession becomes our recession.

By the way, the jobs impact on the federal budget has been wildly exaggerated. Federal government jobs are at 3 million, versus 5 million state jobs, and 15 million local government jobs. Salaries account for only 4% of the federal budget as government employees are generally low-paid workers. If you cut them by half or by 1.5 million workers, it only knocks off 2% from federal spending.

Each government job directly creates two new private sector jobs or bout 5 million jobs.

The last safe job in the country was a government job. For centuries, government workers accepted lower pay in exchange for safety and stability. Government unions have not been allowed to go on strike. That contract has been broken this year. Companies are piggybacking their only layoffs on top of the government ones, using them as cover. This will have a leveraged effect on pushing unemployment upward.

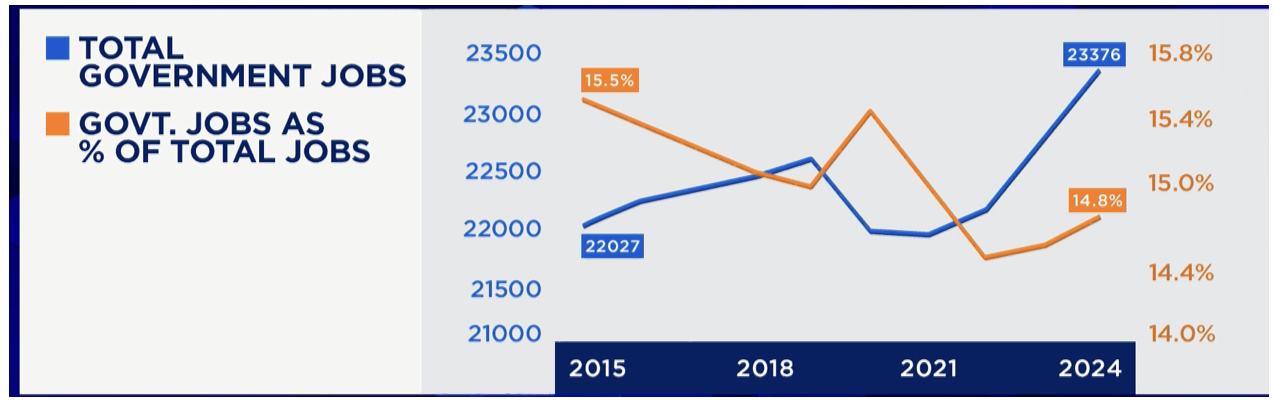

Here's another reality check. Per capita, government jobs have been falling for a decade.

The US population rises by about 1% a year and increased to 340 million in 2024. It is up by 22 million in ten years. Population increases alone demanded the gross increase in government jobs of 300,000. Federal government jobs, in fact, have been growing at a declining rate for the past decade when compared to the private sector.

Oh, and you wanted to know about Tesla? The downside target is $140, last summer’s low, or down 72% from the top when Tesla was under 23 government investigations. If that doesn’t hold, we’re going to the 2022 low of $105, down 79%, but only if Elon Musk cares, which so far, he doesn’t. But Tesla will have no government investigations underway.

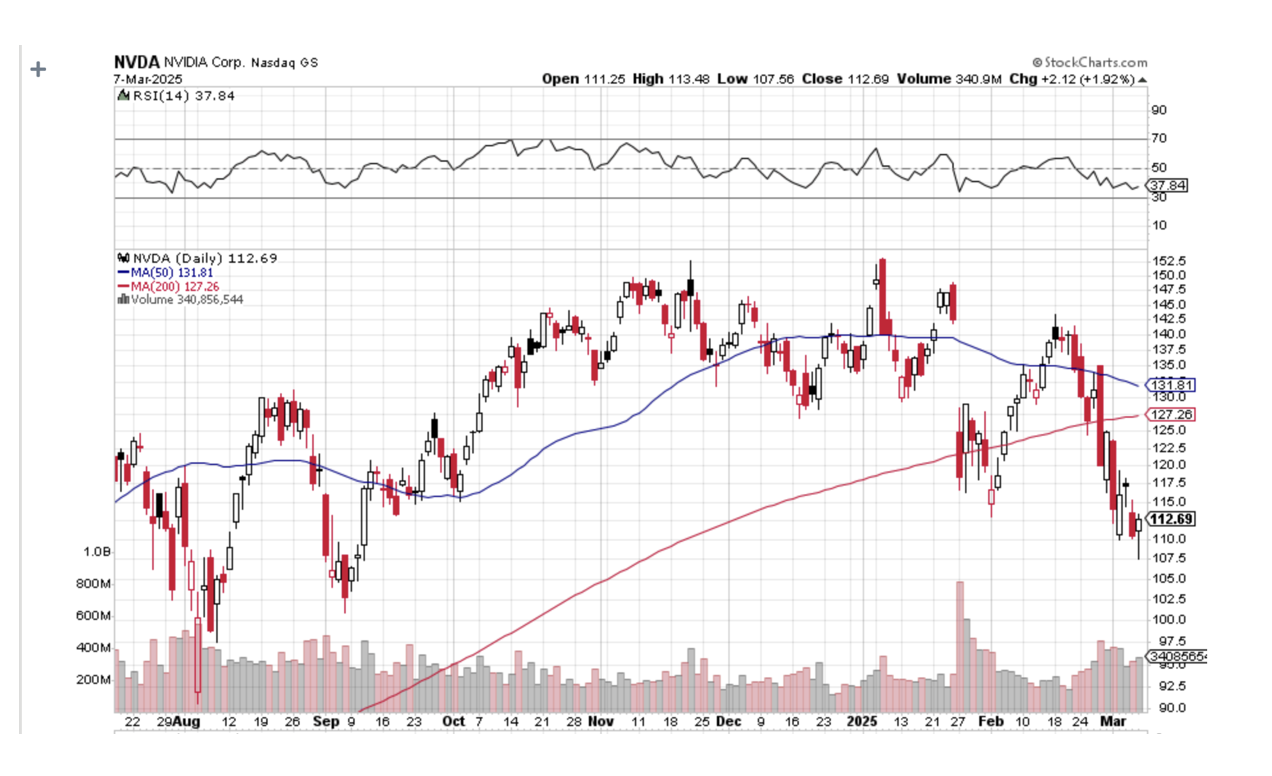

As for Nvidia, I am much more bullish. I see it going down to $90, down 41% from the top.

Read it and weep.

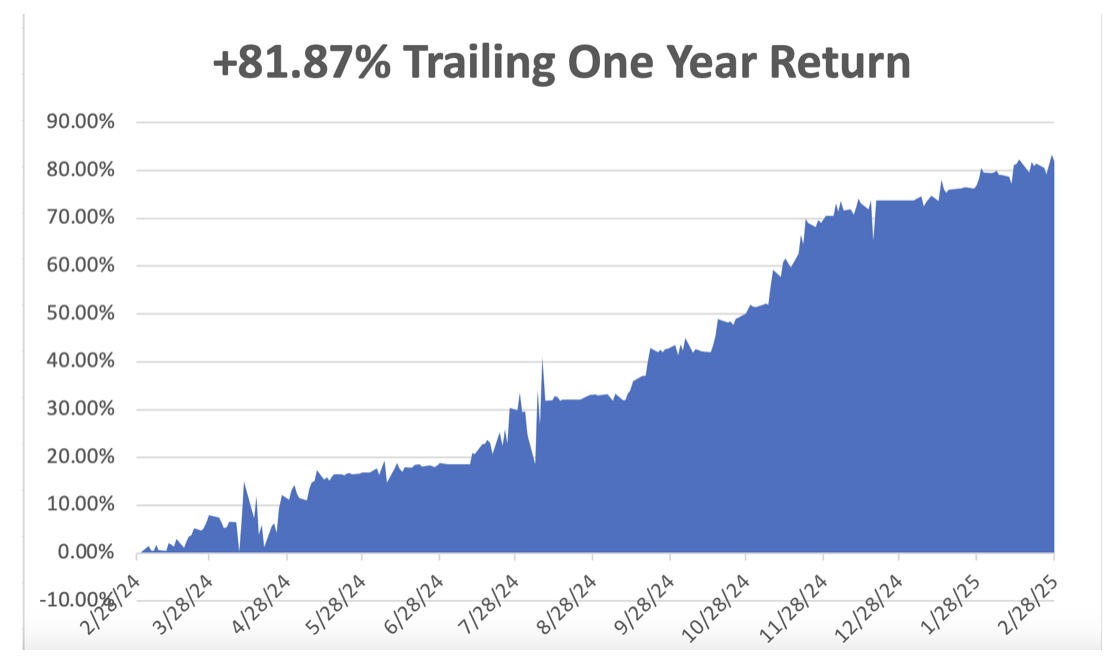

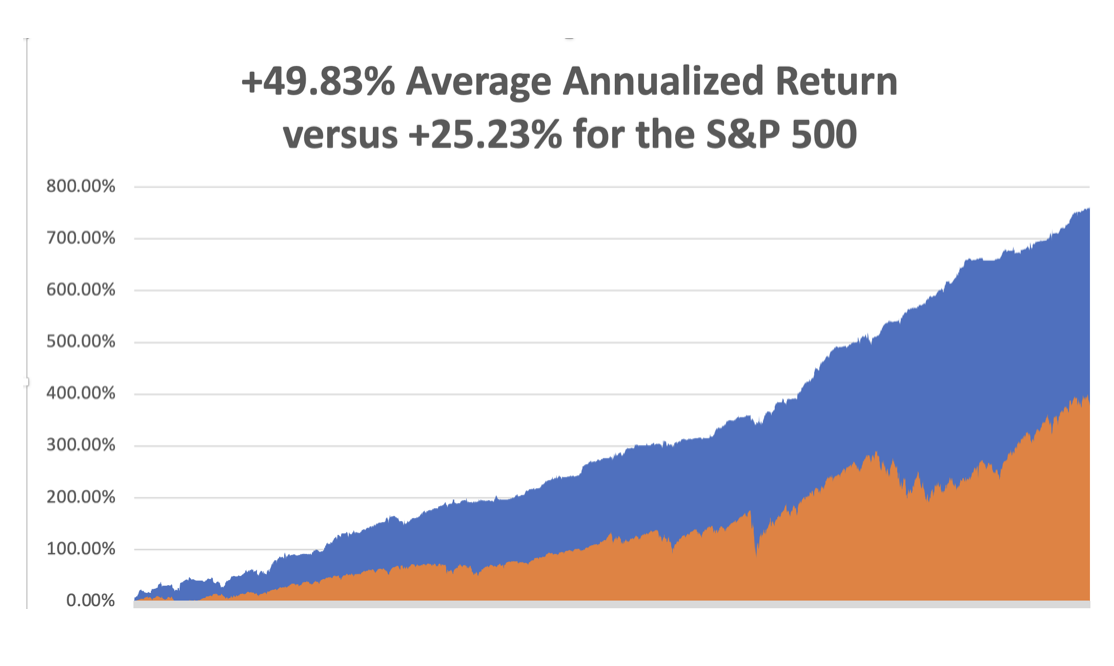

The Money Is Now Pouring Out

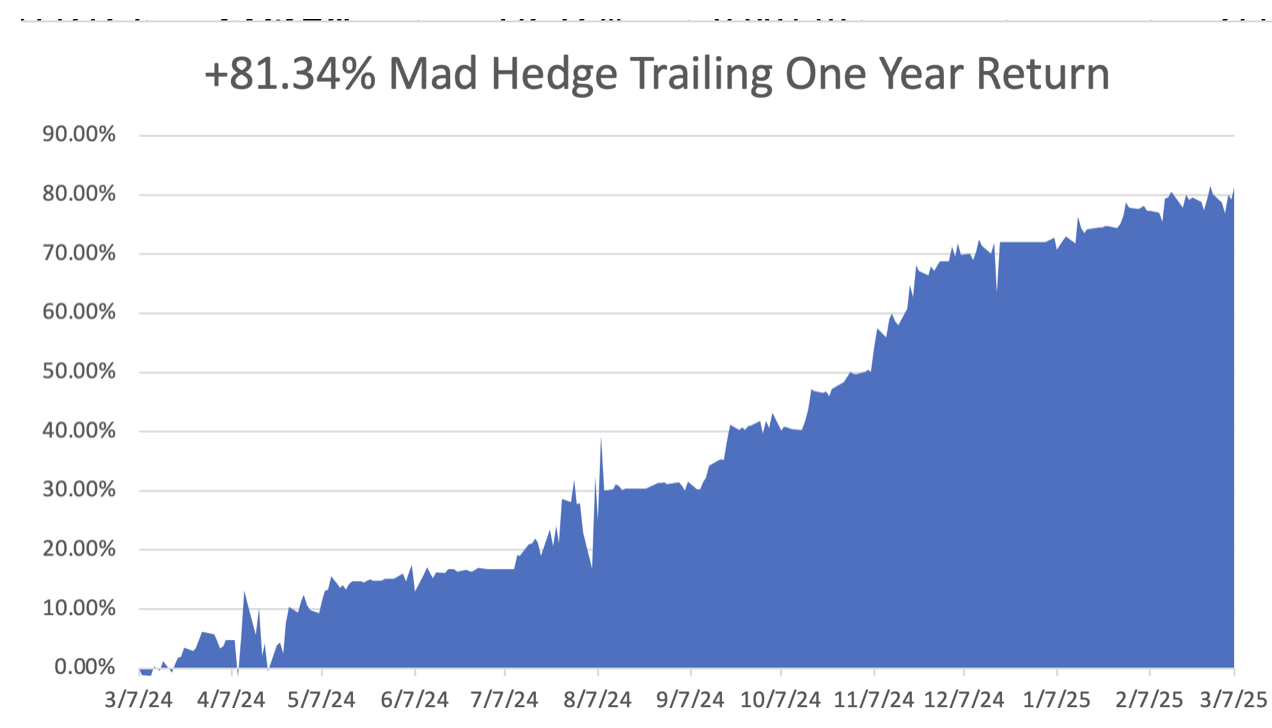

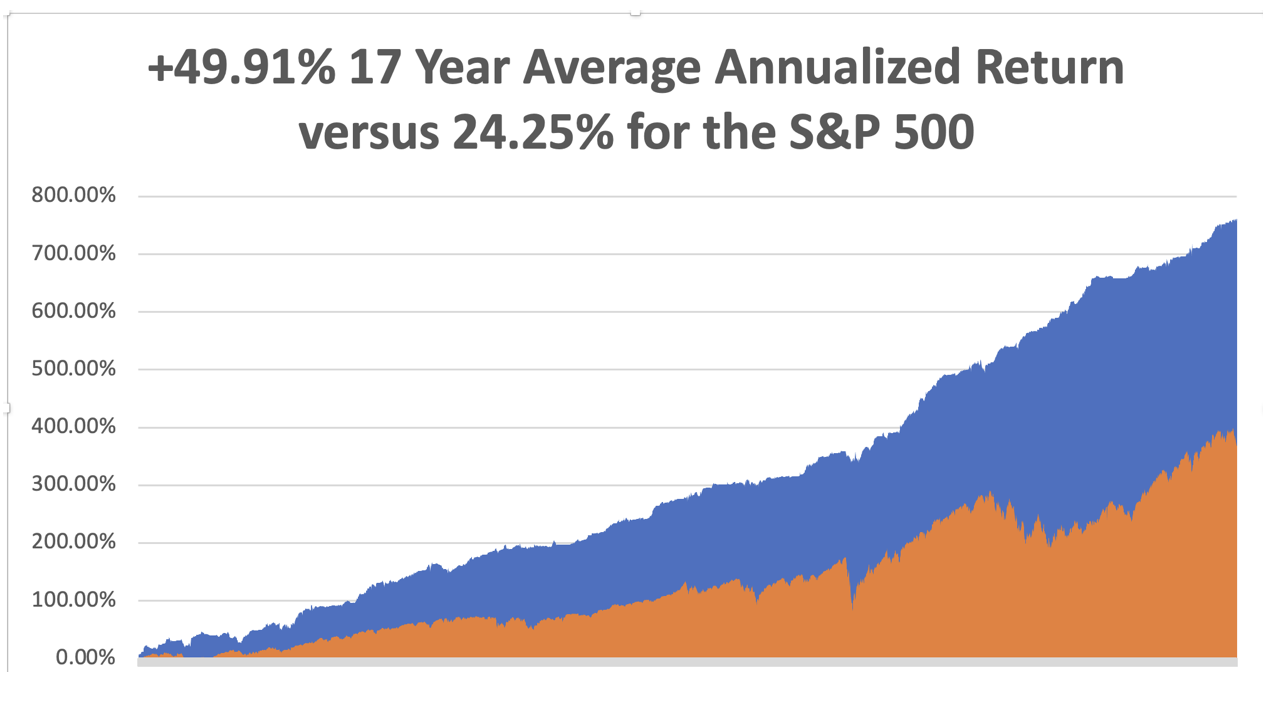

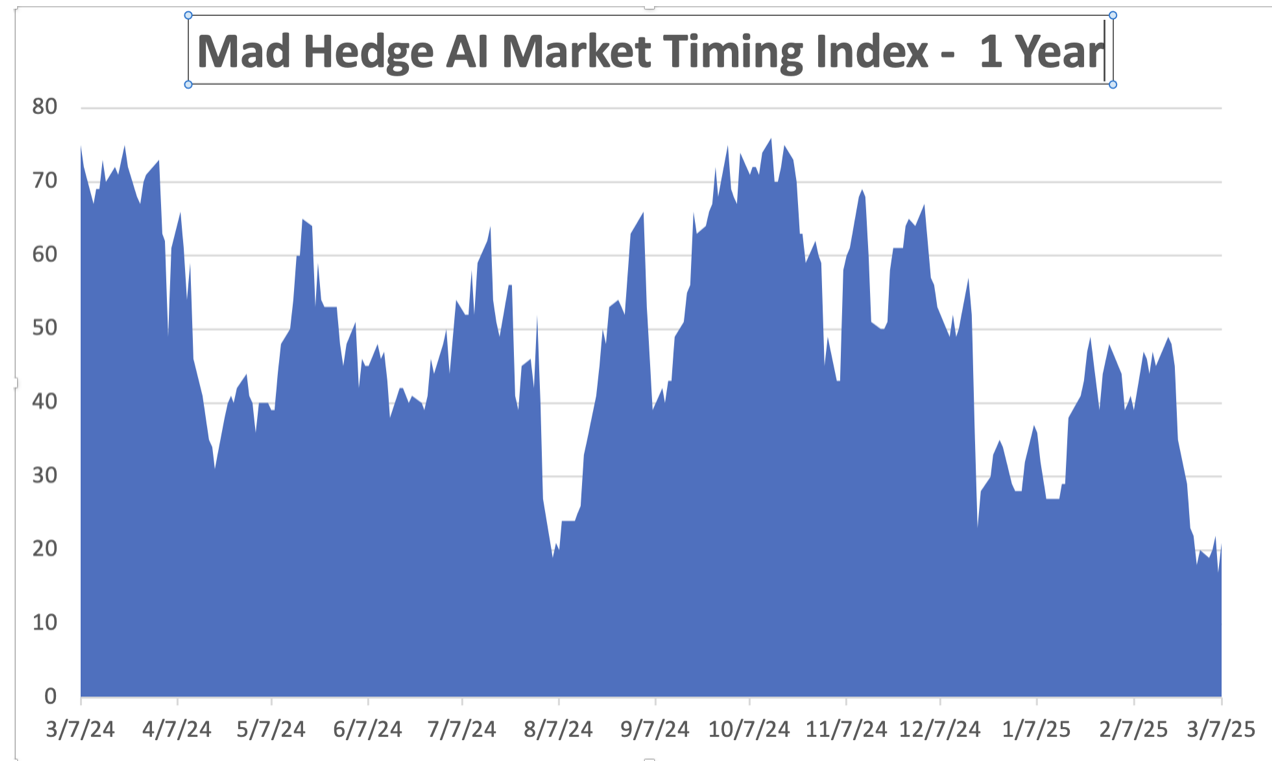

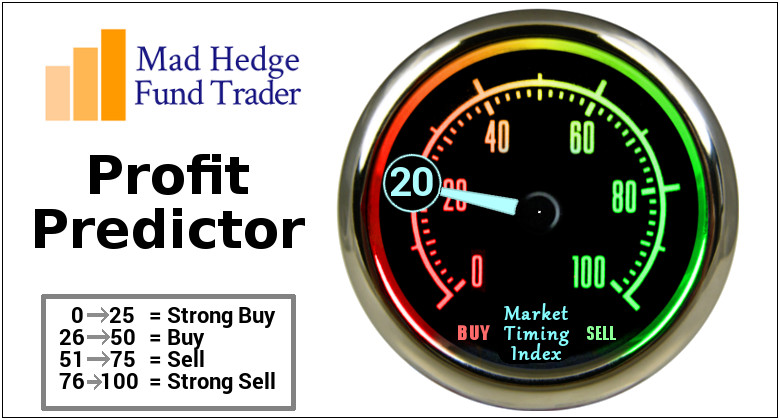

February is now flat at -0.87% return so far, which most people will take given this year’s 8.13% swan dive in the (SPY). That takes us to a year-to-date profit of +8.60% so far in 2025. That means Mad Hedge has been operating as a perfect short S&P 500 ETF since the February high. My trailing one-year return stands at a spectacular +81.34%. That takes my average annualized return to +49.91% and my performance since inception to +760.49%.

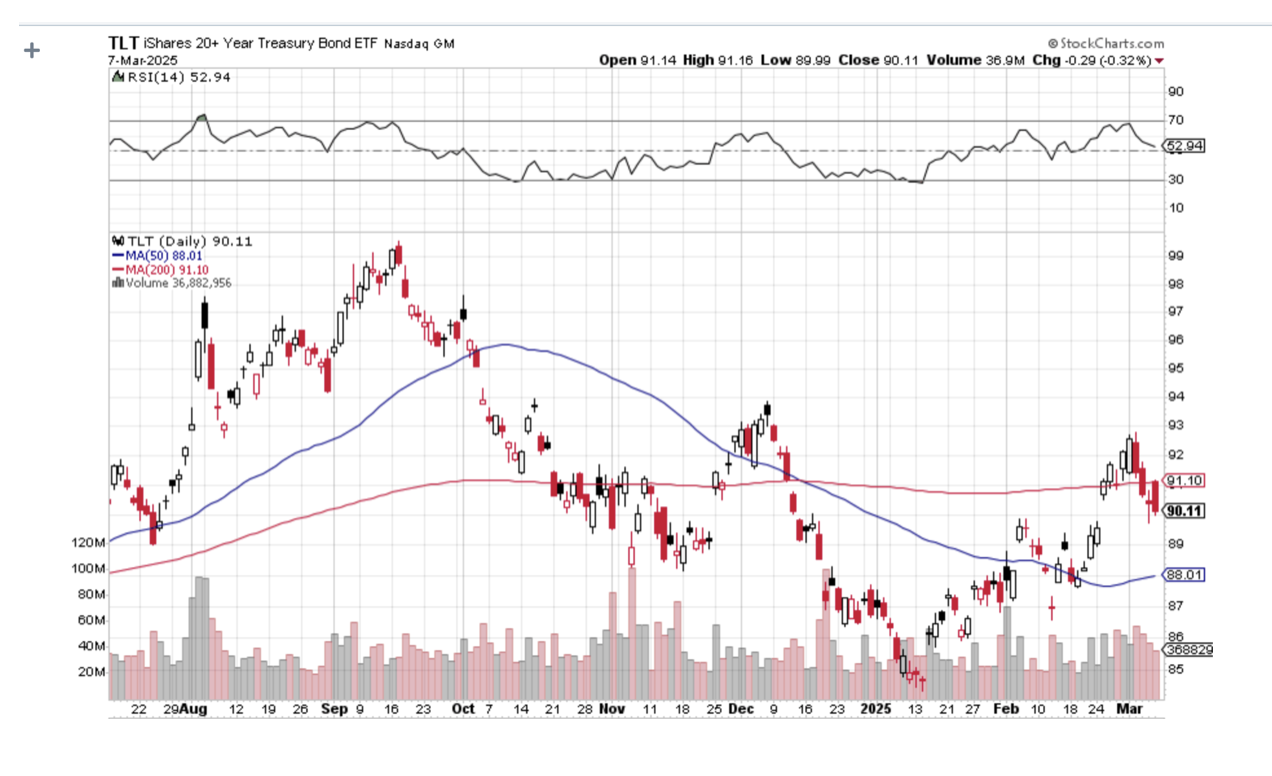

It has been a busy week for trading. I cut my risk by stopping out of a long in (JPM) near cost. I added a bearish downside play with the (SH) and a short in (GM). I started taking profits on my short positions that had completely collapsed, such as with the (TLT) and (TSLA). I used the meltdown to add very deep in-the-money long with (NVDA). Next week will probably be as busy.

Some 63 of my 70 round trips, or 90%, were profitable in 2023. Some 74 of 94 trades have been profitable in 2024, and several of those losses were really break-even. That is a success rate of +78.72%.

Try beating that anywhere.

Layoffs Hit Five-Year High. Challenger, an international firm that helps laid-off workers find new jobs, said that job losses spiked a whopping 245% to 172,017 last month, higher than any month since the middle of the COVID-19 pandemic in July 2020 and the highest in any February since 2009. The layoffs have only just begun.

ADP Collapses, with private sector hiring falling to only 77,000, a two-year low. Companies are frozen in the headlights, unable to take action in a trade environment that is changing by the day and an economy that is rapidly deteriorating. It’s another recession confirmation data point.

Atlanta Fed Says US GDP Shrank by -2.4% in Q1 of 2025, meaning we are already well on our way into recession. The Atlanta Fed always has the most extreme forecasts. That’s the latest reading from the Atlanta Federal Reserve Bank's GDP Now model, which is considered the central bank's primary tool for measuring growth in real-time.

January Trade Deficit Hits 80-Year High, as importers rushed to beat business killing Trump tariffs. The goods trade gap surged 25.6% to $153.3 billion last month, the Commerce Department's Census Bureau said on Friday. Goods imports vaulted 11.9% to $325.4 billion. The problem for investors is that this money is subtracted from the US GDP calculation, as these are products made abroad and not in America. Expect horrific economic numbers going forward.

Consumer Spending Falls to Four-Year Low at -0.5%. US consumers unexpectedly pulled back on spending on goods like cars in January amid extreme winter weather, and a slowdown in services, if sustained, may raise concerns about the resilience of the economy. Inflation-adjusted consumer spending fell by the biggest monthly decline in almost four years after a robust holiday season. The drop in outlays was driven by an outsize decline in motor vehicle purchases and drops in categories like recreational goods.

Bitcoin Gives Up All Post-Election Gains, plunging from $108,000 to 82,000, down 24%. My bet is that in bear markets, crypto will fall faster than stocks. Avoid all crypto.

The Oil Market is in Turmoil, with crude prices dropping below $66, a four-month low. A global recession is looming large. The administration has pulled Chevron out of Venezuela, losing 300,000 barrels a day there. But OPEC has increased production, and Iraq has been pressured into reopening its northern pipeline. “Drill baby, drill” threatens to swamp American consumers with excess supply. Avoid all energy plays for now.

The Tesla Collapse Accelerates, with February sales in Germany down -76%, Norway down -46%, and France -26%. The company is also falling behind in China, and there is no way US sales targets will be met. Consumers don’t want to make a political statement with an EV purchase. Shares are now down 49% in three months. Sell all (TSLA) rallies. The final target could be $140 a share, last summer’s low. Where is the CEO?

Germany Passes Massive $1.3 Trillion Spending Stimulus, devoted to defense spending and infrastructure. It caused the biggest drop in German bond prices and rise in yields in 35 years. It was enough to drag US interest rates up, giving bonds here a terrible day. Germany is now expanding its growth while we are shrinking ours. Is Germany now the global economic engine and the US the caboose?

The New Magnificent Seven Speaks German, with European defense rising 30% so far in 2025. After being dead money for 20 years, the Frankfurt stock market has suddenly come alive. The goal is to replace American weapons in Ukraine with German ones. Among the largest defense companies, Germany’s Rheinmetall (RHM) rose 14% on Tuesday, and Italy’s Leonardo (LDO) closed 16% higher, while BAE Systems (BA) was up 15% at the end of trading. France’s Thales (HO) rose 16%, and aircraft makers Dassault Aviation (AM) and Saab (SAAB) rose 15% and 12%, respectively.

Weekly Jobless Claims Fall, by 21,000 to 221,000.

Turbulence lies ahead from tariffs on imports and deep government spending cuts. That was flagged by other data on Thursday showing layoffs announced by U.S.-based employers jumped in February to levels not seen since the last two recessions amid mass federal government job cuts, canceled contracts, and fears of trade wars.

My Ten-Year View – A Reassessment

We have to substantially downsize our expectations of equity returns in view of the election outcome. My new American Golden Age, or the next Roaring Twenties, is now looking at multiple gale-force headwinds. The economy will completely stop decarbonizing. Technology innovation will slow. Trade wars will exact a high price. Inflation will return. The Dow Average will rise by 600% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

My Dow 240,000 target has been pushed back to 2035.

On Monday, March 10, at 8:30 AM EST, the Consumer Inflation Expectations are announced.

On Tuesday, March 11, at 8:30 AM, the JOLTS Job Openings Report is released.

On Wednesday, March 12, at 8:30 AM, the Consumer Price Index is printed.

On Thursday, March 13, at 8:30 AM, the Weekly Jobless Claims are disclosed. We also get the Producer Price Index.

On Friday, March 14, at 8:30 AM, the University of Michigan was announced as well At 2:00 PM, the Baker Hughes Rig Count is printed.

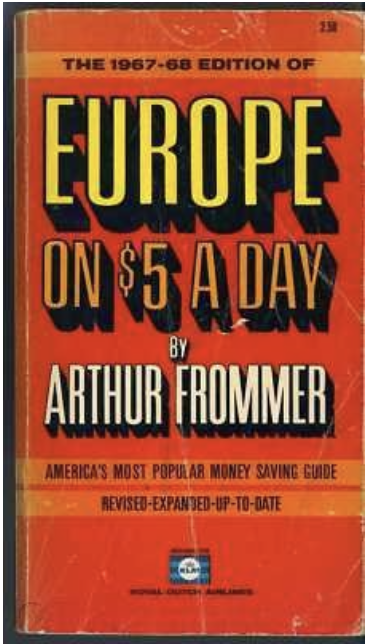

As for me, since many of you are now planning long-overdue summer vacations, I thought I would pass on what I learned from the ultimate travel guru of all time before he passed away last year.

After all, who knows how long it will be until the next pandemic? The next decade, next year, or next week?

When I backpacked around Europe in 1968, I relied heavily on Arthur Frommer’s legendary paperback guide, Europe on $5 a Day, which then boasted a cult-like following among impoverished but adventurous Americans. The charter airline business was then booming, plunging airfares, and suddenly Europe came within reach of ordinary Americans like me.

Over the following years, he directed me down cobblestoned alleyways, dubious foreign neighborhoods, and sometimes converted WWII air raid shelters to find those incredible travel deals. When he passed through town some 50 years later, I jumped at the chance to chat with the ever-cheerful, worshipped travel guru.

Frommer believed there are three sea change trends going on in the travel industry today. Business is moving away from the big three travel websites, Travelocity, Orbitz, and Priceline, who have more preferential lucrative but self-enriching side deals with airlines than can be counted, towards pure aggregator sites that almost always offer cheaper fares, like Kayak.com, Sidestep.com, and Fairchase.com.

There is a move away from traditional 48-person escorted bus tours towards small group adventures, like those offered by Gap Adventures, Intrepid Tours, and Adventure Center, that take parties of 12 or less on culturally eye-opening public transportation.

There has also been a huge surge in programs offered by universities that turn travelers into students for a week to study the liberal arts at Oxford, Cambridge, and UC Berkeley. His favorite was the Great Books program offered by St. John’s University in Santa Fe, New Mexico.

Frommer says that the Internet has given a huge boost to international travel, but warns against user-generated content, 70% of which is bogus, posted by the hotels and restaurants touting themselves.

Frommer turned an army posting in Berlin in 1952 into a travel empire that publishes 340 books a year, or one out of every four travel books on the market. I met him on a swing through the San Francisco Bay Area (his ticket from New York was only $150), and he graciously signed my tattered, dog-eared original 1968 copy of his opus, which I still have.

Which country has changed the most in his 60 years of travel writing? France, where the citizenry has become noticeably more civil since losing WWII. Bali is the only place where you can still actually travel for $5/day, although you can see Honduras for $10/day. Always looking for a deal, Arthur was on his way to Chile, the only country in the world he had never visited.

Arthur Fromer passed away in 2024 at the age of 95.

Arthur’s Last Big Play in Bali

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader