?One must marvel at where the stock market is in relation to the rest of our world. With the economy in relation to the politics, it?s not a happy time. If you look at how they were viewing Obama just before the election, we?ve just walked through the raindrops in regards to the stock market with the fiscal cliff, the debt ceiling crisis, and all sorts of other issues that were plaguing the market,?

said legendary hedge fund manager and chairman of Wisdom Tree Investments, Michael Steinhardt.

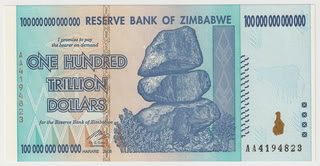

?Over the long term, all of the fiat currencies of the world are involved in a competitive devaluation. The structural stresses in most of the western economies are such that centrals banks will attempt to continue to substitute liquidity for solvency.? said Rick Rule, chairman of Sprott US Holdings, a precious metals specialist.

?Changes in consumption stemming from per capita income rises from $1,000 a year to $5,000, as you are seeing in India, or $5,000 to $10,000, as you are seeing in China, is a very different kind of consumption. It is much more commodities heavy, it is food heavy, it draws a lot more on water supplies,? said Ian Bremmer, president of the Eurasia Group, an New York Based think tank.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.