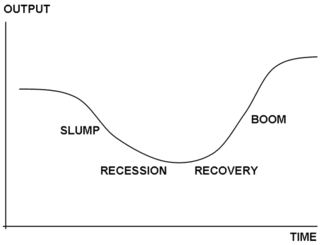

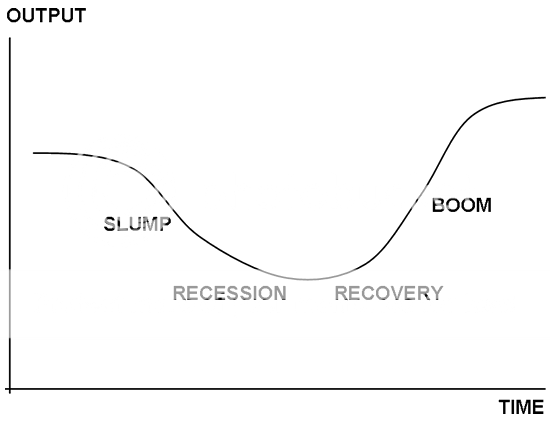

?We?re getting three business cycles a week with this kind of volatility,? said Kevin Ferry of Cronus Futures.

?It?s ironic that just as we break out of a three year trading range, the market is about to be hit by a sledge hammer,? said Dave Rovelli at Canaccord Genuity.

?There seems to be an impression that we can solve our problems without pain. There is no conceivable way that can happen,? said former Federal Reserve chairman, Alan Greenspan.

?People think that Treasury bonds are riskless, but a 100 basis point rise in interest rates leads to an 18% capital loss,? said Andrew Neale, a portfolio manager at Fogel Neale Partners.

?It?s a bit like looking for gold in a minefield,? said Fidelity International?s China Special Situation Fund manager, Anthony Bolton, amid widespread accounting fraud in the country.

?The rule of thumb is to do your homework, do your analysis, and don?t give up prudent risk management for the sake of certain fads. Look for real valuations, and stay true to your time frames,? said Marc Chandler, the global head of currency strategy at Brown Brothers Harriman.

?The consumer in the United States has basically disappeared. There are no jobs, no wage increases, and therefore no spending,? said Bill Gross of bond giant, PIMCO.

?We didn?t get here by accident. America is the product of the greatest public/private partnership in the history of the world,? said Tom Friedman, international affairs columnist at the New York Times.

?Computers crash, and you have to reboot them. That will happen to the global economy,? said Mark Faber, publisher of the Gloom, Boom, and Doom Report.

?Liquidate labor, liquidate stocks, liquidate the farmers, liquidate real estate,? said Andrew W. Mellon, President Herbert Hoover's Secretary of the Treasury. The Republicans did not win a presidential election for 20 years after that comment.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.