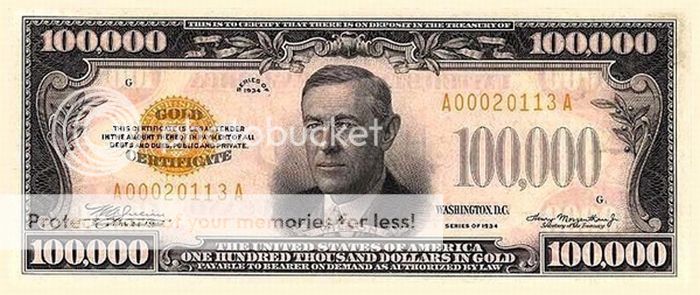

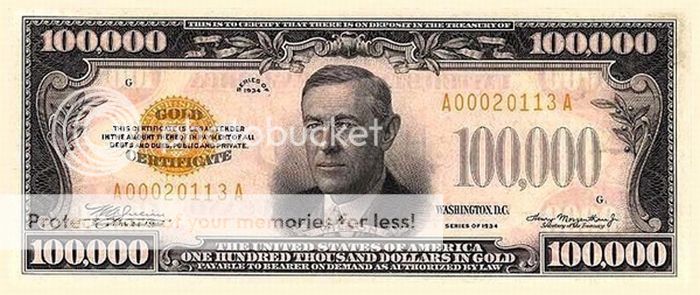

?Green pictures of dead presidents suddenly have a lot of appeal,? said Art Cashin of UBS Securities.

?Green pictures of dead presidents suddenly have a lot of appeal,? said Art Cashin of UBS Securities.

?Transparency is a good idea. Like my shower door, it lets in the light, but keeps out the flies,? said former Federal Reserve governor, Bob McTeer.

In 1933, a supporter told Franklin Delano Roosevelt that if the New Deal succeeded, he would be remembered as the greatest president in history. He replied, ?If I fail, I will be remembered as the last US president.?

?Each politician pursues self-interest while the common cause imperceptibly decays,? lamented the Greek philosopher and historian, Thucydides.

?The one thing that is not safe is the dollar in your pocket. That is certainly going to be worth a lot less over time. The greatest asset to own is your own ability,? said Oracle of Omaha, Warren Buffett, about the European debt crisis.

?For every one book written about deflation there are 25 written about inflation. We are starting to look more like Japan every day,? said Scott Shellady at Bradford Capital Management.

?The reasonable man adapts himself to the world. The unreasonable one persists in trying to adapt the world to himself. Therefore, all progress depends on the unreasonable man? said George Bernard Shaw, an early 20th century writer and philosopher.

?I view Euro as a doomsday machine,? said a European economics professor.

?Republicans and Democrats won?t engage in any kind of austerity because there is no consequence for the fiscal profligacy they are allowing today. With the Fed taking 60% of the Treasury?s bond issuance they are pulling the policeman off of the freeway so everyone can keep speeding. Until the bond market moves, you are not going to see a change in the current fiscal situation.? said Kyle Bass, founder of hedge fund Hayman Capital Management.

?A rich guy never has to pay for anything?, said Berkshire Hathaway?s Warren Buffett, about his friends? practice of giving him free ties to replace his old, battered ones.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.