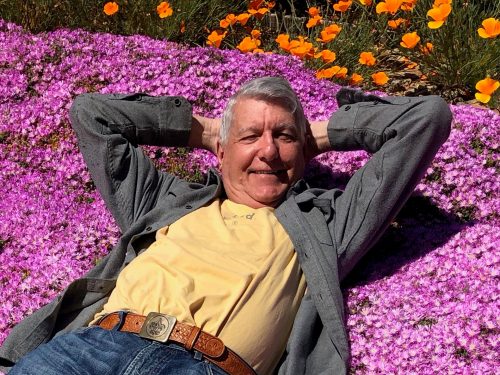

I constantly receive emails from readers around the world inquiring how I accomplish this or that in my far-reaching travels around the globe.

After all, I have visited 125 countries over the past 50 years. What's more, I have run the Mad Hedge Fund Trader Global Empire for the past 10 years, on the fly, from a laptop and a cell phone.

Given that Europe is now 20% cheaper than last year, and 40% less expensive than four years ago, an increasing number of you are going to cross the pond for your summer vacation.

That certainly was the case this year, when I saw a substantially larger number of American families traveling with children.

For the first time in decades, I am finding gaggles of American students in train stations backpacking their way around the continent with a Eurail Pass, much like I did in the 1960s.

With the right information, your cell phone can make your trip vastly more enjoyable, while preventing it from becoming wildly expensive. In fact, it is hard to imagine how we got along without them. So here goes:

1) Hardware

U.S. issued phones only work abroad if you have an international SIM card, as do most iPhones. Before you leave, call your cell phone provider and ask if you have an international SIM card in your phone.

Each company has exactly one person who knows how this works. If you don't have one, get one. The person at Verizon is named Maria.

Upon arriving abroad, the truly adventurous remove their American SIM cards and install a local one, signing up for a local plan. This can cut your international bill to as little as $10 a month.

You just reinstall your U.S. SIM card when you return home. However, as SIM cards are too small for me to see, I have yet to attempt this bit of technological acrobatics.

If you keep your U.S. SIM card, to make a call when abroad you have to assume you are still in the United States, since you have a U.S. number.

To call another country in Europe just hold down the "0" in your phone number pad until a + sign appears. Then dial 011 for the international exchange, and the numbers for the local country and city codes.

To call the U.S. from abroad, hold the "0" until a + sign appears, then dial 1, then the area code and number.

2) Roaming

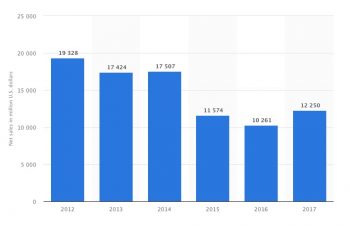

International roaming can cost a fortune. Before I figured out the game, I was spending $500 a week downloading email, newspapers, and research reports. TED talks are the worst, costing at least $25 each to watch over foreign air.

So it is crucial to turn off the roaming feature on your phone. On an iPhone you do this by going into settings, then cellular data, and then turning the cellular data function off. Do this, and you will still be able to receive voice calls, such as from a lost traveling companion in distress.

Here is the key rule: Only access the Internet through the free Wi-Fi at your hotel. Download all your big files, news, email here. This saves you a ton of money.

You will need to turn on you cellular roaming to get your apps to work. But if you have already downloaded the big files, the additional cost to check your stock prices, weather forecast, or the way to a sought-after restaurant will be minimal.

Another tactic is to de spam your email accounts. Find all of those useless, unsolicited marketing emails promising get rich quick schemes, dating opportunities, or male enhancements. Then mark them as spam (unless they are from me). When you do use your cellular roaming, they won't eat up all of your data budget.

Warning: Start doing this every day a month before you leave. That's how much spam is out there. You can always unmark email as spam from senders you like, such as the local public library, when you return home.

American companies finally now offer international plans. This year Verizon is offering 250 MB of data, 250 emails and text messages, and 250 minutes of talk time for $80 a month. This is nowhere near enough, but it is a start.

Every time you cross a border, the local cell phone company will text you with usage and overage rates, which is usually $25 per 100 MB of data, or 10 cents a minute for voice or messaging.

You can find the Americans on a train when their phones all ping at once, often when you cross a bridge, or come out of a tunnel, or land at an airport.

3) Apps

Google Maps can provide perfect, detailed directions on how to reach the most remote destinations, whether you are in the Istanbul Bazaar, the Marrakech Medina, or the back alleys of Rome.

You can choose instructions whether you are on foot or driving. As soon as you arrive at your hotel, type in the address so you can always find home. The really great thing about Google Maps is that, unlike paper maps, it tells you where you are.

Just be careful not to bump into another traveler who is similarly staring at his cell phone to find his way (I walked straight into a concrete lamppost once in Tokyo and almost knocked myself out).

Be sure to download a free flashlight app before you leave home. These are great for navigating your way down dark streets, reading a menu in an ill lit restaurant, or finding the keyhole in your door.

The weather app is indispensable. It will allow you to fine-tune your travel plans up to a week in advance.

Being an ex-Boy Scout, I find a compass app particularly useful. Knowing where magnetic north is comes in handy when using those free tourist maps.

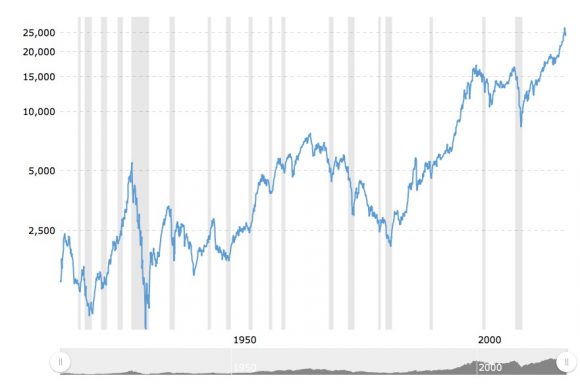

Stock market apps will bring you the assurance that the Mad Hedge Fund Trader Alerts are working well and paying for the entire trip. Remember that the New York Stock Exchange opens at 3:30 PM on the European continent because of the time change.

Travel in Europe is made much easier when you speak seven languages, although it's hard to find a living Roman centurion to practice your Latin. Limited to the King's English?

No problem! Get free language apps for the countries of your destination. Sometimes, the translation of a single word can mean the difference between life and death.

It's better to pay a couple of bucks and get the expanded vocabulary apps so you never come up short. That is how I found out yesterday that "sardi" is a type of Italian pasta unique to Northern Italy, and not a sardine.

You may have your own special apps you use. I like to visit my Tesla occasionally, verifying that it is still in my garage and fully charged. I also like to check the daily output of my solar panels to prove that my house is still standing.

Coming from California, I can never be sure. Google Earth is useless here because the pictures can be up to six months old. They are obviously lacking on satellite time.

4) Security

Identity theft is exploding in Europe, thanks to the close proximity of a hacker's paradise in unpoliced Eastern Europe. Never access your financial accounts through a free public network that is not password protected. It's like leaving your wallet in the middle of Saint Mark's Square in Venice and expecting to find it there an hour later.

Don't even attempt an innocent checking of balances. And I don't mean a password like 123456789. You can count on your accounts getting cleaned out. There is no greater bummer than being told by a hotel clerk that you can't check out because all of your credit cards have been canceled.

If you do need to check your balance on the run, do it only through your cell phone, and only over a cell network (no Wi-Fi), where an extra level of security is provided. The same is true with inter-account transfers. This can be expensive, but it is worth it.

Please note, that in China, the security situation is becoming so severe that many multinationals will not permit employees to bring their laptops. They have adopted "cell phone only" policies in the Middle Kingdom, where the security is so much better.

Too many western visitors were getting their entire hard drives copied by these crooks searching for western intellectual property, in addition to the easy pickings among bank accounts.

5) Entertainment

OK, so watching Wheel of Fortune in German, French, or Italian is not your cup of tea. Before you leave home and still have reasonable broadband, download a batch of old movies from iTunes, Netflix, or Amazon to your laptop.

That way, you have something to do in the middle of the night waiting for your jet lag to adjust. Bring a 6-foot HDMI cable and you can change the input channel on your hotel TV, plug in, and watch your flick there.

6) Bandwidth

European bandwidth can vary all over the map, from lightning fast (the Ritz Carlton in Barcelona) to painfully slow (Agadir, Morocco). Europeans just don't seem to grasp how fast apps are growing, and bandwidth demand is accelerating.

More than a few times, I have had to crawl under front desks and reboot routers to get systems working again.

Suffice it to say, the more you pay, the faster your Wi-Fi. If you check into your hotel and see half the residents sitting in the lobby checking their email, it is not a good sign.

Wi-Fi was invented in the U.S., where 2-by-4 wooden studs and 1-inch sheetrock used in construction is common.

Two-foot thick stonewalls typical in historic European city centers (where you will want to stay) are terrible for Wi-Fi range, and it is not unusual to have no access from your room.

If Apple or Microsoft want to upgrade your operating system on the road, wait until you get home. Otherwise, you might crash your system and not be able to use your device until you return home.

7) Tickets

It is now possible to do a search of your next foreign city for coming events while you are on a train, buy tickets online, and show the ticket on your phone to gain admission.

I also have settled a couple of checkout disputes proving that I prepaid hotel stays by displaying proof of payment from my PayPal or bank account.

Incredible, but true.

I will be following this piece up with another on general travel tips in a couple of weeks entitled Travel Tips from a Pro, which I am now working on.

In the meantime, enjoy your trip.