Mad Hedge Technology Letter

May 17, 2018

Fiat Lux

Featured Trade:

(NVIDIA NAILS IT AGAIN)

(NVDA), (ZTE), (GOOGL), (AMD)

No one does it better than Nvidia (NVDA).

Fetch a measuring stick from the cupboard, gauge the levels of innovation around Silicon Valley, and Nvidia's name floats straight to the top of the list.

Nvidia has it all and more.

Not many firms can brandish one of the best CEOs in all of tech.

Nvidia CEO Jensen Huang is a true visionary.

When he hops on earnings calls, investors and analysts rejoice about the breadth of innovation percolating through the corridors in Santa Clara, CA.

Nvidia was able to increase quarterly revenue by an eye-popping 61% YOY. And this company is one of the quintessential growth companies in tech.

Huang is one of the few CEOs confident enough to talk all the way through the earnings call like he is talking about the back of his hand.

Most CEOs delegate to the CFO after a carefully choreographed introductory statement.

He knows everything about the company and is not afraid to go into detail.

The past few weeks have been hell for chip companies.

The cascade of downgrades undercut momentum with chip shares prices falling across the board.

Every nonsensical downgrade has proved unjustified with chip earnings displaying the robust potency that only FANGs can replicate.

Delve into Nvidia's latest performance and two parts of the business have gone into overdrive.

Gaming has burst to the forefront providing a sturdy pillar to Nvidia's income stream.

Fortunately, crypto mining and e-gamers are dual drivers fueling a rapidly expanding market.

In Q1, crypto miners and e-gamers faced a hysterical "scarcity" of high grade GPU hardware.

To make matters worse, Apple and Samsung are using the same memory as graphic cards.

These two global giants front ran other companies agreeing pricier per unit contracts to guarantee sufficient supply for their product lineup.

This led to a huge famine or feast environment to secure the necessary components.

Huang has ensured investors that Nvidia is moving mountains to meet demand and he hopes prices will "normalize" in the upcoming quarter.

Advanced Micro Devices (AMD) is the other player producing GPU chips that is experiencing a demand overload.

On the last sell-off, AMD dropped as low as 9.50 and was the perfect entry point into a great company led by Lisa Su, PhD.

AMD continued to bounce off the $9 handle and is trading at $13 after an outstanding earnings report.

Huang also caveated his hopes of chip prices normalizing by saying the "pent-up demand" could get worse because of the unbelievable gaming options in the market, such as blowout title Fortnite and popular online game Player Unknown's Battlegrounds that have sold more than 40 million copies throughout various platforms.

Nvidia has caught the innovation bug with new products coming off the conveyer belt sooner than expected.

Nvidia has announced NVIDIA RTX, the "holy grail" of graphic performance that will offer gamers Hollywood cinematic production quality lighting, reflections, and shadows.

This product has been in the works for the past 10 years and has gamers and miners drooling over this new technology called ray tracing.

Revenue from crypto miners is not a part of Nvidia's core mission, and the stronger than expected numbers are just the beginning.

If bitcoin takes another stab at $20,000, GPU demand will go through the roof.

As the price of cryptocurrencies rise, the profit-making opportunities to mine are greatly enhanced.

Another division running on all cylinders showing no sign of slowing down is the data center segment.

Initially, this industry was tabbed by Nvidia as a $30 billion opportunity by 2020.

They were completely wrong.

Nvidia moved the goal posts and announced at a recent investors day that it believes data center revenue will be a $50 billion market by 2023.

Data center revenue spiked 71% YOY to $701 million highlighting the innovation leadership Nvidia enjoys.

The data center incorporates Nvidia's Volta architecture and adoption has been broad-based.

Volta offers 500% more deep learning power than its previous edition Pascal.

The stamp of approval is evident with every major cloud player embracing the Volta technology.

At some points during the earnings call, it appeared to be a commercial for data center, gaming and crypto because of the strength of these two segments.

Huang did talk about other businesses such as autonomous driving buttering up its place in Nvidia's lineup.

Autonomous driving will be a $60 billion opportunity by 2035, according to conservative estimates.

Nvidia's DRIVE Constellation continues to be the bread-and-butter platform for automotive companies.

The platform allows car companies to use virtual reality (V.R.) to carry out driving trials.

Two servers have been built to aid in development.

The first server allows simulation in the form of a pseudo video game, and the other server is used to process the simulated data.

In whole, autonomous driving lagged gaming and data center with 4% growth YOY.

This should not alarm investors because Nvidia is in it for the long run.

The software system and infotainment in the first generation of commercial autonomous vehicles will have plenty of Nvidia chips hovering around under the hood.

At some point, every vehicle in the world will require autonomous technology. As Nvidia stays ahead of the innovation curve, buyers will gravitate toward its products.

The architecture of Nvidia chips allows car companies to advance their autonomous vehicle technology.

Nvidia is partnering with other industry leaders such as Tesla and Mercedes Benz, just to name a few.

Going forward developers will harness the power of artificial intelligence (A.I.) to build new software programs for the car.

The new car software will be part and parcel with voice recognition that has quickly come to the forefront of tech development.

Creating a whole autonomous vehicle system to just drag and drop into its business could lead to Nvidia's products becoming the industry standard.

Technical superiority eventually wins out.

Nvidia has diversified into every cutting-edge trend in technology.

Huang understands that to keep buyers salivating over its products, they must be the highest quality.

The reason Alphabet (GOOGL) or Apple partner and synergize with Nvidia so well is because it makes the best of the best and they cannot copy their products.

This is why ZTE, one of the biggest tech companies in China, practically went out of business after Donald Trump cut of its pipeline of critical American components.

Chinese companies have been attempting to buy American chip companies for years because the quality of chips is significantly superior.

Amid a backdrop of a trade war, Nvidia shares have been trading choppily from a strong support level of $200.

It is only a matter of time before Nvidia explodes through the $250 resistance level and climbs higher.

To watch a video demonstration on Nvidia's new RTX ray tracing technology click here.

_________________________________________________________________________________________________

Quote of the Day

"The United States must possess unquestioned capacity to launch crippling counter-cyberattacks. This is the warfare of the future ... America's dominance in this arena must be unquestioned and today, it's totally questioned." - said President of the United States Donald J. Trump.

Mad Hedge Technology Letter

May 16, 2018

Fiat Lux

Featured Trade:

(WHAT'S UP AT FACEBOOK?)

(FB), (NFLX), (GOOGL), (AMZN), (GS), (AAPL), (IBM)

Capitol Hill unleashed a healthy dose of criticism on Facebook (FB) CEO Mark Zuckerberg and he has mobilized the forces to avoid a repeat shellacking.

Zuckerberg's response has been to reshuffle his cabinet at the Menlo Park, CA, headquarters, and a few tell-tale signs offer a unique glimpse into Facebook's future.

Basically, something needed to change at Facebook.

The company single-handedly took the blame for the entire sector and was not the only company with a liberal stance on personal data.

Zuckerberg would like to eschew public humiliation and avoid being a sitting duck.

The episode in Washington highlights the need for Facebook to decouple itself from ad revenue, which makes up the lion's share of revenue at the firm and find other levers to pull.

Down the road, Facebook's ad business could get crimped by regulators, and a lack of fallback options haunts Facebook investors in their sleep.

Consequently, a whole slew of high-level management rotation is underway at Facebook.

It is the biggest shake-up in the history of Facebook.

The road map starts with one of Zuckerberg's best friends and protege Chris Cox who will manage the new "family of apps" segment.

This collection of projects he will preside over include WhatsApp, Messenger, Instagram, and the Facebook Core App.

The step up in responsibility is warranted for Chris Cox who was credited with creating the Facebook news feed after joining the company in 2005 after ditching his Stanford graduate degree program at the time.

The executive reshuffle coincided with WhatsApp co-founder Jan Koum, one of Silicon Valley's biggest advocates for data privacy, who quit his post as a show of disapproval to Facebook's business model.

Mark Zuckerberg wants to aggressively monetize the WhatsApp messenger service that was acquired for $19 billion in 2014.

Zuckerberg's blueprint involves using the WhatsApp phone numbers as a vehicle to monetize through offering different products.

Facebook would then collect the data from its 1 billion usership and WhatsApp would become Facebook's new advertisement clearing house.

WhatsApp's leadership vehemently refused this U-turn and Koum decided he would rather leave then see his baby ruined.

Facebook consistently refrained in the past from passing WhatsApp to the data mining scientists and was able to prevent full-scale implementations of advertisements onto its platform.

Currently, there are no ads on WhatsApp's interface, and users could be in store for a massive transformation in look and feel.

Facebook investors have been clamoring for Zuckerberg to start the process of making WhatsApp into a material revenue stream.

Time is of the essence as the big data police creep in from the shadows.

Putting Zuckerberg's top guy on the job embarks Facebook down a new path of hyper accelerated profit-making.

Well, that is the goal.

Compounding Facebook's pivot to other businesses is commissioning a new blockchain tech team.

Blockchain technology, the technology that helped unearth bitcoin, has seen a recent slew of endorsements from financial heavy hitters such as Goldman Sachs (GS), which acknowledged the formation of a new business brokering in bitcoin futures.

A year ago, no reputable organization would touch blockchain with a 10-foot pole.

The utilization of blockchain technology would allow trackability and provide more security.

That would help Facebook to understand the provenance of unique problems allowing staff to nip problems in the bud before they snowball.

Blockchain tech fits nicely within the constraints of the model and would enhance the existing Facebook product.

Let's not forget that Facebook has a mountain of cash to fix any problem that crops up.

It is not one of these early stage seed companies burning through heaps of cash waiting for "scalability" down the road.

Facebook is here and now, and it has the money to show for it.

The pillars of blockchain revolve around cryptography. Blockchain would effectively allow individuals to possess more power over their identity decentralizing the stranglehold from Menlo Park.

Thus, Facebook must invest deeply into blockchain to counter the fear that this technology can marginalize the core business.

This epitomizes the tendency for large-cap tech to become preemptive.

None of the powerful FANGs want to miss the next big shift in technology, and the cash hoard allows them to have skin in the game in each revolutionary trend.

The tide has changed at Facebook from the early years where growing the user base was paramount.

Now that user base has matured into a 2.2 billion marketplace.

Facebook's strategy has shifted to extracting more revenue per user and management closely follows this metric.

Mike Schroepfer, the CTO of Facebook, was tabbed as the man leading the charge for Artificial Intelligence (A.I.), Augmented Reality (A.R.), and Virtual Reality (V.R.) technology.

Facebook was able to poach Jerome Pesenti from IBM (IBM), where he was a critical cog in the development of IBM's Watson, to run the Facebook A.I. team. A.I. is routinely implemented into Facebook's core products to enhance performance.

Promoting Chris Cox as the next in line and giving him control over all the powerful products effectively pushes ad tech down the pecking order.

Javier Olivan is the new man at Facebook tasked for managing ads, analytics, and integrity, growth and product management.

Moving forward, the ad division will be laced with a certain level of security to avoid a repeat of Cambridge Analytica.

Zuckerberg must know that there are other Cambridge Analytica's hidden somewhere in the system; another incident would knock down the stock 5% to 10%.

Facebook could look vastly different in a few years if some of these profit drivers prove successful. It only needs one to work.

Disrupt or be disrupted.

At this point, the big tech companies are considering anywhere or anyone to capture accelerated growth. The FANGs are spilling over to other companies' turf.

Crossover is everywhere and this is just the beginning.

Expect Amazon's (AMZN) ad division to grow from the already $2 billion per quarter, gradually challenging the duopoly of Facebook and Alphabet in the digital ad revenue industry.

It is yet to be seen if the new revamp of management will produce better results.

This move could backfire as the management carousel excluded any fresh blood from taking part.

Effectively, Zuckerberg rotated his best friends into different parts of the business without demoting anyone.

Solidifying his close-knit circle of trust is no doubt a defensive reaction to being hounded the past few months, leaving his existing circle as the few people on which he can still count.

Facebook's stock remains healthy and the brouhaha stoked by the data leak gave investors a timely entry point.

I pounded on the table calling the bluff, begging readers to get into Facebook.

The long-term Facebook story is intact but the stock is overbought short-term.

Investors should not sleep on Facebook as it is a profit machine printing money like Apple (AAPL) and the executive revamp is a bullish development for Facebook.

My bet is that Chris Cox goes for the low hanging fruit monetizing WhatsApp, inciting the next leg up in Facebook shares later in the year.

_________________________________________________________________________________________________

Quote of the Day

"Simply put: We don't build services to make money; we make money to build better services." - said Facebook CEO Mark Zuckerberg

Mad Hedge Technology Letter

May 15, 2018

Fiat Lux

Featured Trade:

(HARD TIMES AT UBER)

(UBER), (NFLX), (GOOGL), (AMZN), (GRUB)

Uber has seen a ferocious challenge to its business model of late. It seems everything it touches turns into fool's gold.

It is easy to assign blame to the current CEO, but Dara Khosrowshahi was shoehorned into a difficult situation after previous CEO Travis Kalanick defiantly departed leaving the company in tatters in his wake.

What could go wrong went wrong.

The company was purged of its license to operate in London, which was one of its highest transactional cities.

Uber boasted a ridership of 3.5 million and sub-contracted 40,000 drivers in London that singlehandedly wiped out the Cockney black cab industry.

The land of fish and chips has not exactly been kind to Uber with the British seaside resort city Brighton the next location to excommunicate Uber from its sandy shores.

Uber's massive data breach of 2016, which took Uber a full year to publicly disclose, of 25.6 million names, 22.1 million mobile phone numbers, and 607,000 driver's license numbers was cited as one of the reasons Uber's license in Brighton was discontinued.

Is there a way back for CEO Dara Khosrowshahi?

The future looks turbulent at best.

Khosrowshahi has left no stone unturned carrying out his search for a new CFO. Uber has not had a CFO since 2015, and a CFO is required to shepherd the company through the IPO process.

Prospective candidates will not touch this position with a 10-foot pole.

Several high-profile hopefuls have already rebuffed offers.

It was painfully obvious to onlookers last week at Uber's Elevate conference in Los Angles that Alphabet (GOOGL) is dominating every potential business that Uber desires to penetrate.

Waymo, Alphabet's autonomous driving technology arm, is miles ahead of Uber after developing in secret for many years.

Waymo's self-driving testing began in 2009 while Uber's first test was carried out in September 2016 in Pittsburgh, conceding a seven-year head start to bitter rivals.

Even worse, Uber's trials have been sidelined as of late because of a casualty in the Phoenix program. Arizona is on the verge of removing Uber from possible future tests along with California making Pittsburgh the last place left to consolidate operations.

At the Elevate conference, Khosrowshahi elucidated Uber's roadmap to industry professionals, and his synopsis was largely underwhelming.

Khosrowshahi broke down the future into three easy-to-understand stages.

In the next two to three years, stage one consists of focusing on improving existing algorithms, enhancing ride share transactions, and expanding to different locations widening the companies ride-share footprint.

Stage 1.5 detailed refining its Uber Eats segment seizing further market share from Grubhub (GRUB) and Amazon (AMZN), the two biggest rivals.

In two to five years from now, stage two entails ramping up the e-bike segment through recently acquired e-bike firm Jump.

Lastly, stage three was proposed to happen in five to 10 years and encompass growing a newly minted air-taxi division called Elevate.

Up until today, Uber's core business has been an unmitigated failure of massive proportions.

In the fourth quarter of 2016, Uber hemorrhaged $2.8 billion then followed up the fourth quarter in 2017 with a $4.5 billion loss, a stark reminder that profits are hard to come by in the tech world.

If losses are what investors want, Uber gives it to you in spades.

If it cannot successfully monetize the core business using cars, the e-biking future is dead on arrival.

Stage 1.5 is all designer chocolates and fancy roses now because growth and margins remain healthy. However, this industry is fraught with booby traps that I chronicled in the recently published story about Grubhub (GRUB).

Stage three was a division that Khosrowshahi reviewed several times after he took the top job and it made the cut after deep contemplation.

Uber plans to start conducting trials in 2020 in Dallas or Los Angeles with the hope of commercial operations starting in 2023.

This timeline is wishful thinking because regulators would never grant operational authority to Uber in a mere five years when it cannot even succeed on asphalt with its self-driving technology.

Lamentably, Alphabet's co-founder Larry Page has an ace up his sleeve.

Since last October, stealth flight trials have been carried out in New Zealand by firm Kitty Hawk led by Sebastian Thrun one of the creators of Waymo, which is developing autonomous flying taxis.

Kitty Hawk was developed for years in secret and personally backed by Larry Page's personal wealth.

He has already poured more than $100 million of his own money into this venture.

To further develop its business, Kitty Hawk was forced to decamp to New Zealand as the Federal Aviation Administration (FAA) in America lacks a path to certification and commercialization.

New Zealand has embraced the revolutionary start-up, and New Zealand is the first country poised to develop a functional robo air-taxi network.

Kitty Hawk's hopes and dreams rely on the aircraft Cora. Please click here to visit its website for more information.

Cora is an all-electric affair powered by batteries with a 36-foot wingspan.

This meshes perfectly with New Zealand's hope to be carbon free by 2050.

Cora has been manufactured with capabilities of flying at heights up to 2,950 feet and a range of 62 miles.

New Zealand has bet the ranch on aerospace technology allowing even marginal start-ups within its borders such as Martin Jetpack, the first commercially sold jetpack, operating with a flight ceiling of 2,500 feet and sold at a starting price of $150,000.

It is ironic that Uber chose to host an aerial-taxi conference considering it is not the company building the flying taxis.

This is the crux of the problem in which Uber finds itself.

It does not produce anything unique.

The biggest winners that take home the lion's share of the spoils are the firms that create a proprietary product that cannot be replicated easily such as Netflix's original content or Google's advanced search engine.

The heavy lifters gain control and can dictate the path toward monetization.

Page's Kitty Hawk is in the driver's seat with the best technology and Uber's Khosrowshahi recently met with Thrun pitching his idea of partnering up.

Expectedly, Kitty Hawk declined to become buddies because nothing can be gained by collaborating with Uber.

Kitty Hawk stated that it plans to develop an app for its own robo-flights, which could crush Uber's dream of being the end all be all of transportation apps.

At the end of the day, Uber is just an app matching drivers and passengers, and creating this app is highly replicable.

It takes billions upon billions of dollars to build an autonomous aerial taxi from scratch. Uber's inability to produce aircraft gives it little negotiating power down the line.

On that note, Uber announced a partnership with NASA to build an air traffic control system, which would logically be used to construct landing ports similar to a helipad for aircraft to land.

By carving out a sliver of the industry mastering port construction, it gives Uber a narrow entranceway into the future of aero-taxi industry albeit a weaker strategic position than Page's Kitty Hawk.

Another day and another loss to Alphabet. Wave the white flag.

Each loss leads to the need for more funding.

More funding has brought on more losses for Uber in a vicious cycle that has seen Uber's valuation slip at the last round of financing.

In the next five years, onlookers can expect much of the same from Uber - underperformance in the form of accelerated losses from its core ride-sharing business.

Capital is disappearing into a black hole and the monetization of Uber Eats and Jump is nothing about which to boast.

These are side businesses at best.

The road map is wishy-washy at best. Uber's Elevate division could turn out to be lipstick on a pig hyping up the company for its 2019 IPO to attract more dollars - the same reason it needs to recruit a new CFO.

The IPO road show will give Uber a platform to explain how it plans to curtail losses. A miracle is required for Uber to finally turn into a profitable business by the time it goes public.

To visit Uber's Elevate division to watch a video of its version of the future of aerial taxis, please click here.

Kitty Hawk's Cora in New Zealand

_________________________________________________________________________________________________

Quote of the Day

"A computer once beat me at chess, but it was no match for me at kickboxing." - said American comedian Emo Philips.

Mad Hedge Technology Letter

May 14, 2018

Fiat Lux

Featured Trade:

(MEET THE NEW FANG),

(AMZN), (WMT), (FB), (NFLX), (GOOGL), (UBER)

Yes, it's Wal-Mart (WMT).

No, I'm not making this recommendation because they let you park your RV in their parking lots at night for free.

And no, I'm not smoking California's biggest cash crop either (it's not grapes).

I predicted as much in my recent research piece, "Who Will Be the Next FANG?" by clicking here.

It is the dawn of a new era with the world absorbing yet another FANG to add to the list of Facebook (FB), Alphabet (GOOGL), Amazon (AMZN), and Netflix (NFLX).

As the tech world powers on to new heights, nothing can slow down these juggernauts.

Let's face it - companies are more lucrative when technical expertise is ramped up and infused into the business model.

Ground zero of the tech movement - Silicon Valley - has helped supercharge the economy and prodigious earnings' results support this thesis.

New innovations will fuel the next level up in the tech arm's race but more crucially, so will new geographical locations.

Instead of throwing a dart at a world map, the locations are a no-brainer because tech scavenger hunts orbit around one idiosyncrasy and that is scale.

Scalability is a sacred word in the tech world.

If a start-up cannot scale up, investors can't imagine future profits, entrepreneurs can't imagine growth, and funding dries up.

End of story.

For instance, Amazon's business model does not mesh kindly with pint-sized Iceland.

Not because Amazon discriminates against Iceland's culinary delicacy of sheep testicles but because the population is only around 330,000 people.

Scale equals success.

Indisputably, every country with an Amazon-esque business is being bid up because big tech firms know how to digitally monetize, effectively out-sourcing an incredibly profitable business model that has worked unabated for the developed world for the past decade or two.

The heightened awareness of existential survival is pitting foreign money against each other in far-flung places jostling for the same digital assets after a decade of cheap financing enriching tech companies.

Remember that first mover advantage leads to dominance in the datasphere because the volume of data is directly correlated to the bottom line.

Examples are rife around the world, for instance Amazon's $580 million purchase of Souq.com, described as the Amazon of the Middle East headquartered in Dubai and the biggest e-commerce site in the Arab world.

E-commerce commands a paltry 2% of sales in the region. That number is poised to explode as digital-savvy, tech Millennials reach peak consuming age and the migration to mobile erupts.

A preemptive strike is usually the most compelling strategy for large cap tech as it pushes out the smaller players, which lack the resources to compete.

Even the corporate offices of Walmart (WMT) in Bentonville, Arkansas, would wholeheartedly agree with me after doling out for its new toy.

Yes, Walmart acquired a 77% share in the Amazon of India, Flipkart, for $16 billion after the real Amazon failed to cut a deal with the most famous e-commerce unicorn in India.

This new development is a game changer.

India is a country that tech executives pinpoint as the future because of its massive population, economic growth, and economic potential foreign investors hope to tap up.

The International Monetary Fund (IMF) has anointed India as the fastest growing economy in 2018, and the 7.4% growth this year will follow with an even sturdier 7.8% in 2019.

Amazon has been well aware of India's ascent. Its CEO Jeff Bezos pledged to invest more than $5 billion in India and Amazon began its e-commerce operation in 2013.

Amazon's early entrance into the Indian e-commerce industry has paid off grabbing 31% of market share putting it in second place behind Flipkart's 40%, according to big data firms.

The Indian e-commerce space was $20 billion in 2017, and by 2019, expect that number to grow to $35 billion.

Walmart CEO Doug McMillon noted that by 2026, the Indian e-commerce industry will surpass $200 billion. When it comes to clothing and fashion, Flipkart has a 70% share in India.

Even more valuable than the economic growth is the new pipeline of tech talent that will help Walmart compete with Amazon.

The Trump administration's crackdown on H-1B visas that Silicon Valley utilizes to bring developers to American shores has forced American tech companies to implement a work-around.

Essentially, the only difference now will be that the past recipients of H-1B visas will be sitting in an air-conditioned office in Bengaluru, India, until the visa documents come through.

Flipkart has a deep pipeline into the best engineering schools in India and the staff of more than 30,000 employees work on Indian wage levels.

This deal is one of the biggest talent grabs of tech developers the world has ever seen. And this group has the know-how of building an Amazon-style digital marketplace platform from zero.

The Flipkart investment comes after Walmart's purchase of Jet.com, an e-commerce company based in Hoboken, New Jersey.

The $3.3 billion purchase of Jet.com in 2016 was the beginning of Walmart's digital strategy, and it has come a long way in a very short time.

Walmart is now a vaunted member of the FANG group and has a new army of developers to back up this claim.

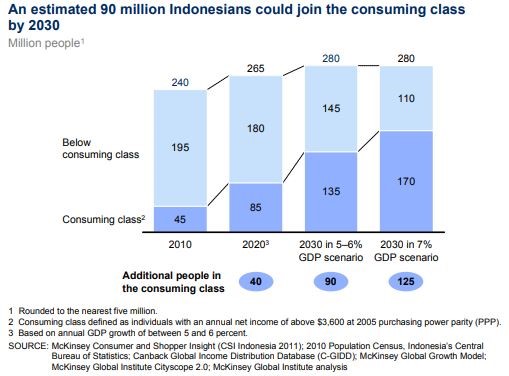

Glancing at the opportunities to scale, Indonesia is clearly the runner-up behind India.

Indonesia has been tagged as a tech new battleground with a population of 260 million in 2016 and growing.

The country has a medium age of 28, meaning this young population could turn into a reliable source of new tech developers who traditionally are young and digital natives.

Economic prosperity has been welcomed with open arms to this tropical island nation. It is poised to become the seventh largest economy by 2030, up from its rank of No. 16 today, creating a burgeoning middle class with newfangled discretionary spending.

The rural migration to urban environments will add another 90 million people living in Indonesian cities by 2030, while Internet access is growing by 20% each year in Indonesia.

Goldman Sachs recently issued a note to investors citing Indonesia's unbridled potential.

Capital is pouring into Indonesia at a breakneck speed with Alibaba investing $1.1 billion into Tokopedia, the Amazon of Indonesia.

Companies are coming to the stark realization that the domestic low hanging fruits have been picked, and aging developed countries are turning to undeveloped regions of growth to advance business objectives.

This is why South East Asia has been bombarded with an onslaught of Japanese, Korean, and Chinese investments and not only in the tech sector.

The Far East powerhouse countries are battling each other in Southeast Asia for consumer goods, infrastructure, high speed trains, and of course technology.

Uber just sold its Southeast Asian ride-sharing asset Grab to China's DiDi Chuxing and SoftBank for $2 billion.

The Southeast Asian region is one of the hottest places to make a deal because of a lack of FANG occupancy.

Walmart sold off on the Flipkart news because of the potential impairment to margins, but this move is a long-term positive for Walmart shareholders.

Flipkart does not turn a profit and Walmart is still solely judged by earnings. Unfortunately, it does not receive the same license to focus on growth like Tesla, Amazon, and Netflix.

However, I have a hunch that down the road, investors will agree this move by Walmart's McMillon was as shrewd as can be.

Like the colonial powers of yore, India and Southeast Asia are likely to be divvied up.

American companies already own more than 70% of market share in India e-commerce.

India is the biggest democracy in Asia and a staunch ally of the United States.

India's frosty relationship with China due to border spats and communist origins will stunt China's ability to take over and expand in India.

However, Southeast Asian countries are more likely to go the way of Cambodia, which is reliant on Chinese money to fund new initiatives, hamstrung by Chinese debt up to its eyeballs, and acquiesced political capital to the Mandarins.

Chinese investment's path of least resistance is Southeast Asia. This progression will be facilitated by the sizable Chinese expat population that resides in Indonesia, Vietnam, Thailand, Philippines, Myanmar, Laos and Cambodia.

Long-term shareholders of Amazon and Walmart will be rewarded. However, expect a few more Indians walking around Bentonville, Seattle, and Hoboken.

_________________________________________________________________________________________________

Quote of the Day

"My life is now a constant assessment of whether what's happening in real life is more entertaining than what's happening on my phone." - said television host Damien Fahey.

Mad Hedge Technology Letter

May 11, 2018

Fiat Lux

(COME MEET JOHN THOMAS AT HIS GLOBAL STRATEGY LUNCHEONS)

Mad Hedge Technology Letter

May 10, 2018

Fiat Lux

Featured Trade:

(WHO'S TRYING TO BREAK INTO YOUR HOME NOW?),

(GRUB), (DPZ), (AMZN), (BABA), (YUM), (YELP), (MS)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.