Cheniere Energy (LNG) Gets the Green Light

There is never any guarantee that a government agency will not do something idiotic. This time it didn?t, thankfully. The Federal Energy Regulatory Commission (FERC) granted the final license needed by Cheniere Energy (LNG) to build the first of two liquifaction plants at Sabine Pass on the Texas Louisiana border on the Gulf of Mexico. These will be the first such plants built in the US in 40 years.

FERC gave to go ahead despite vocal opposition from the Sierra Club, which claimed that fracking caused environmental damage. This, of course, is complete bunk. MIT recently published a study of 50 incidents where gas made it into local water supplies. In every case, it was shown to be the cause of subcontractor incompetence and inexperience, not because of any fundamental flaws with the technology.

The move is a crucial step towards turning the US into a major natural gas (UNG) exporter. The company has already contracted to sell 89% of the plants? planned annual output of 16 million tonnes. Buyers include BG Group of the UK, Gas Natural Fenosa of Spain, Gail of India, and Kogas of South Korea. Initial deliveries are expected to commence at the end of 2015.

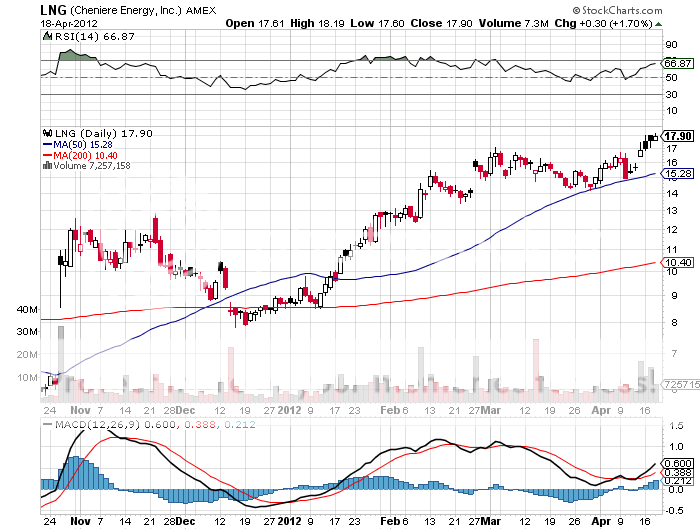

The shares jumped to $18, a new high for the year, and reached as high as $19 in premarket trading. You may recall that I recommended this stock to readers back on March 7 when it was trading at $16.10 a share (click here for ?Take a Look at Cheniere Energy (LNG)?). I think it is just a matter of time before the stock surpasses its next hurdle at $20, especially if natural gas continues its collapse under $2/MM BTU.

Ready for Export