China?s Rate Cut is a Game Changer

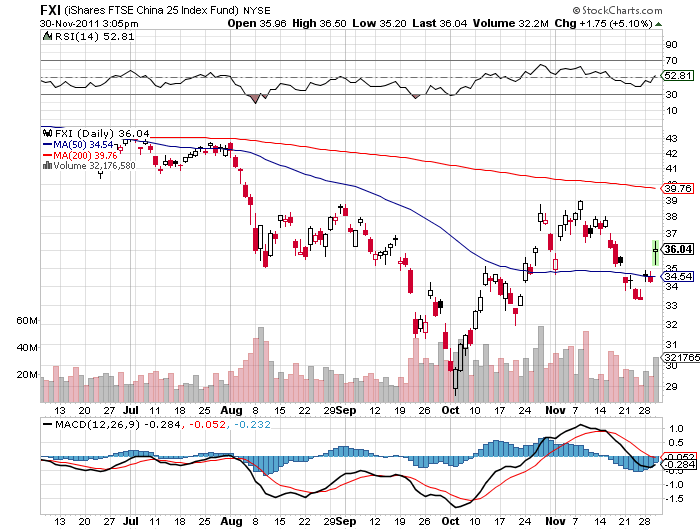

For the first time in three years, China (FXI) has cut its prime lending rate by 50 basis points. The timing caught many analysts by surprise, as such move was not expected until the lunar new year in early February. Perhaps recent data showing collapsing exports prompted the Mandarins in Beijing to hurriedly move up the timetable.

The Middle Kingdom?s action is one of the most important developments in financial markets this year, since it represents a major sea change, and is hugely positive for the global economy. It could signal a coming year of additional incremental interest rate cuts and bank reserve reductions designed to keep the country above the ?red line? GDP growth rate of 8%. Observers were also stunned by the magnitude of the cut, 50 basis points, compared to the usual 25 basis point move seen by the People?s Bank of China.

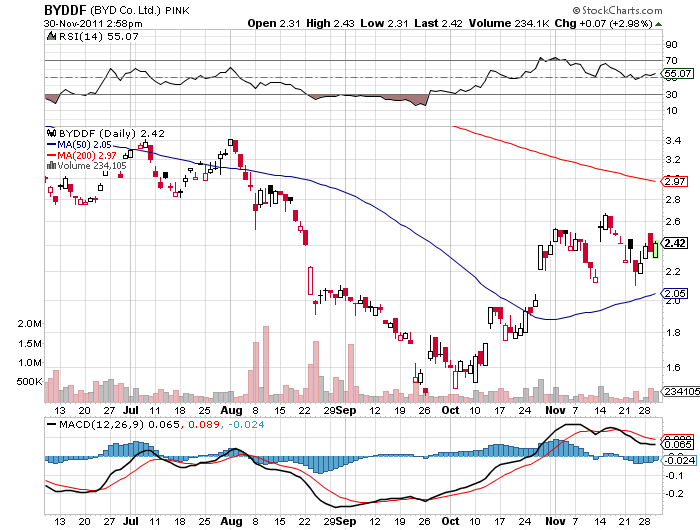

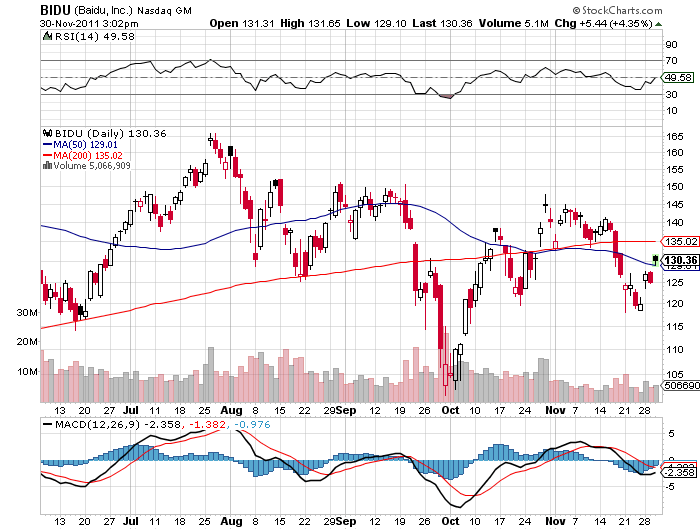

I have been comfortably out of Chinese equities for more than a year, vowing not to return to the mainland until interest rates fell. Now the worm has turned. It may be time to take another look at companies like Build Your Dreams (BYDDF), which has risen by 50% since my undercover visit there last month. Other names like China Telecom, China Mobile, and Baidu (BIDU), are also starting to look interesting.

We Want Lower Interest Rates!