Cisco's Downward Spiral

The technology infrastructure company Cisco sold off over 2% after Goldman Sachs analyst Rod Hall downgraded the stock to neutral from buy.

His downgrade was based on a guess that enterprise spending will weaken further, and that telecom spending will continue to remain unimpressive.

This shows you how far the bank of the elite has fallen and the quality of their research considering Cisco’s earnings report was in August and this call should have gone out far earlier.

Goldman Sachs (GS) has trimmed headcount fiercely as their traditional businesses from IPOs to trading have been squeezed to suffocating levels forcing the bank to go into the subprime segment with the Apple (AAPL) credit card.

In Silicon Valley, Cisco’s shares will be subdued for the foreseeable future because the telecom segment is softening up as we motor into 2020 nicely, noted by Goldman.

The headwinds stem from the slow adoption of 5G and requisite carrier network automation implementation.

If you thought 5G would happen with a mere snap of the fingers, you are wrong. It will be implemented in agonizingly slow stages with lots of trial and error along the way.

Enterprise spending has also tapered off boding ill for the company that supplies the foundational technology to the software startups.

Adding fuel to the fire, waning business confidence at large enterprise driven by trade volatility as opposed to a broader macro slowdown is somewhat disconcerting and Cisco will most likely trade sideways in a stupor until external catalysts either pick up the stock or the bizarre world of geopolitics slams it down.

The floor of the stock is solid and deeply rooted in the profitability of the stock.

This is a great company and is one of the premier brands that slide in nicely in most offices in Silicon Valley.

The company isn’t a growth company, yet not written off into the legacy dustbin, and the sudden paradigm shift to value has made this stock even more attractive.

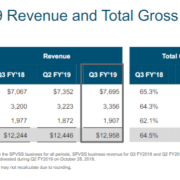

The 7% revenue YOY growth last quarter is not a problem as risk appetites are reigned back as the economic cycle ends.

EPS grew to $3.10 highlighting the ultra-profitable nature of the company.

Many of the recent tech selloffs in individual names have been induced by sour forward-looking outlooks and Cisco followed suit calling for 0-2% revenue growth, and GAAP EPS growth of -14% year-over-year.

The company has turned to the exciting revenue stream of subscriptions accounting for around 70% of the company's software sales.

This has created inflated net margins with Cisco improving from 16.7% five years ago to 25.8% today.

Cisco is a cash cow generating $15.8 billion of cash flows from operations, up 16% year-over-year.

The bump up in cash flow has made it easier to justify M&A which Cisco has routinely turned to in an effort to shore up different areas of the business.

A dividend was initiated in 2011 providing shareholders with strong annual double-digit percentage increases.

Financial engineering doesn’t stop there with Cisco's buyback approach resulting in reducing its outstanding share count by roughly 16.3% over the past 5 years adding to the profitability narrative.

Macro-risks have gone up the wazoo in the external market and Cisco is a legitimate candidate for a short-term trade to safety at these levels and a long-term investment.

Considering that their Chinese business is only in the single digits and revenue growth is in the high single digits, value-added management should make this company even more compelling.

And as the next wave of 5G adoption hits, this stock will experience a tidal wave of asset appreciation.

I can guarantee that the best is yet to come, and the status quo isn’t all that bad too.