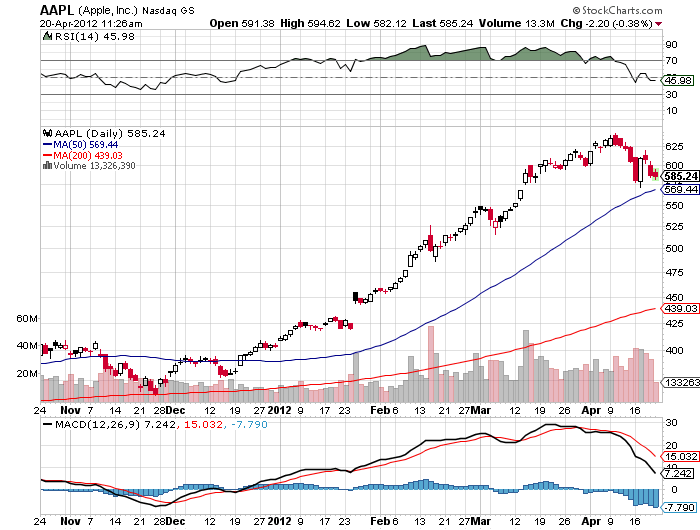

Closing My Apple Position

My Apple April $450-$480 call spread expired deep in the money at the close on Friday. Legally, these expire at midnight on Saturday night, so your broker won?t take these off your statement until the following Monday. The position should be zeroed out and you should receive a cash credit. You will also find that the margin requirement has disappeared.

Your net profit on this position should be $1,855, or? $1.86% for the notional $100,000 portfolio. Well done. Here is how the profit is calculated in detail:

Execution

March $450 call cost?????... $97.60

March $480 call premium earned?-$70.25

Net Cost???????.........?. $27.35

Profit Calculation at Expiration

Expiration value???????..$30.00

Purchase cost ?..??????. . $27.35

Net Profit????????.??.$2.65

Total profit = ($2.65 X 100 X 7) = $1,855 = $1.86% for the notional $100,000 portfolio.

I will go back into another position like this in the future, but only after a substantial dip in the share price. I still think that Apple will continue on its march to $1,000 a share. Coming down the road we have Apple TV and the iPhone 5. Of far greater importance will be the adoption of Apple standards by corporate America, which has long avoided Steve Jobs? creations. This is going on everywhere, and is being hastened by the demise of Blackberry (RIMM). But it is a trip that will take years, not weeks or months.

Thanks, Steve