Crypto Alert - (BLOK) October 21, 2021 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (BLOK) – BUY

BUY the Amplify Transformational Data Sharing ETF (BLOK) November 2021 $44-$47 in-the-money vertical Bull Call spread at $2.60

Opening Trade

10-21-2021

expiration date: November 19, 2021

Number of Contracts = 37 contract

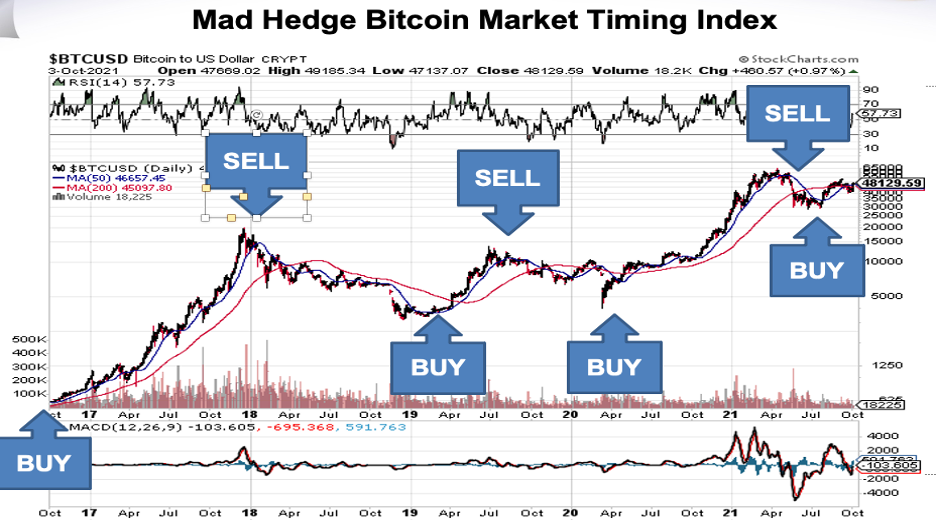

Bitcoin has gone almost parabolic as the momentum is unhinged at this point.

I am using this microscopic dip today, I guess we can call that, in BLOK ETF to get a foot on the crypto ladder.

Honestly, I have been waiting for an entry point, but it’s been tough sledding as the asset goes from strength to strength and optimal entry points are few and far between.

Ethereum is another crypto asset that readers should keep their eye out for — it will certainly pass $8,000 in 2022 as it cruises to all-time highs.

Just to remind readers, we executed a BLOK call spread last month and we exited the position with max profits. Although we have only rolled up the strike price $1 in BLOK, I consider that a massive victory considering the barrage of good news that will undergird bullish crypto sentiment.

If you don’t do options, buy the stock. My target for (BLOK) this year is $70.

I am therefore buying the Amplify Transformational Data Sharing ETF (BLOK) November 21 $44-$47 in-the-money vertical Bull Call spread at $2.60.

My favorite crypto ETF is Amplify Transformational Data Sharing ETF (BLOK) which has morphed into one of the best crypto ETFs on the market since its inception.

(BLOK) is an actively managed ETF that seeks to provide total return by investing at least 80% of its net assets in equity securities of companies actively involved in the development and utilization of blockchain technologies. It trades right at net asset value, meaning you don’t have to pay any premium whatsoever.

(BLOK)’s biggest two positions are Bitcoin proxy MicroStrategy (MSTR) and a Canadian crypto mining company called Hut 8 Mining Corp (HUT), which has already tripled since June.

I have already shot out a MicroStrategy (MSTR) trade alert to new readers and am incredibly bullish on the company.

However, this ETF encompasses more than (MSTR) offering broader exposure to firms related to Bitcoin, crypto miners, and software companies that are heavily into crypto.

Hut 8 engages in industrial-scale bitcoin mining operations. It also owns and operates 38 BlockBoxes in Drumheller, Alberta and 56 BlockBoxes in Medicine Hat, Alberta.

BlockBoxes is one of the most powerful and cost-effective bitcoin mining units available on the market.

(BLOK) doesn’t track bitcoin 1:1, but it does mimic the price action relatively closely albeit with less extreme swings.

Controlling excess volatility is something you should be happy about.

(BLOK) also has an expense ratio of only 0.71%, which isn’t too expensive for those who want to buy and hold the ETF and not trade the derivative.

Buying (BLOK) is most likely the best way to ensure safe trading under the framework of the SEC, but I understand others have a higher risk profile which is also welcome.

To understand more about the ETF (BLOK), click here.

Here are the specific trades you need to execute this position:

Buy to Open 37 November 2021 (BLOK) $44 calls at………….………$9.00

Sell to Open 37 November 2021 (BLOK) $47 calls at……….............$6.40

Net Cost:………………........................……..…….………..………….….....$2.60

Potential Profit: $3 - $2.60 = $.40

(37 X 100 X $.40) = $1,480 or 15.38% in 29 days

If you are uncertain on how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.