December 10, 2009

December 10, 2009

Featured Trades: (COPPER), (FCX),

(CRUDE), (XTO), (RIG), (USO), (MUSTANGS)

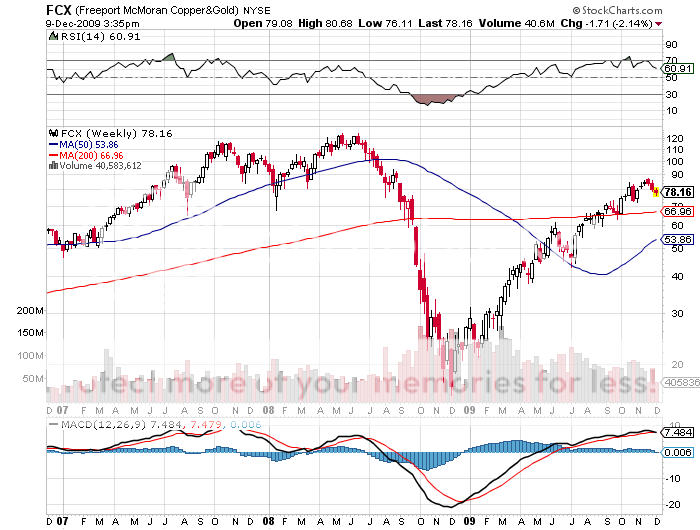

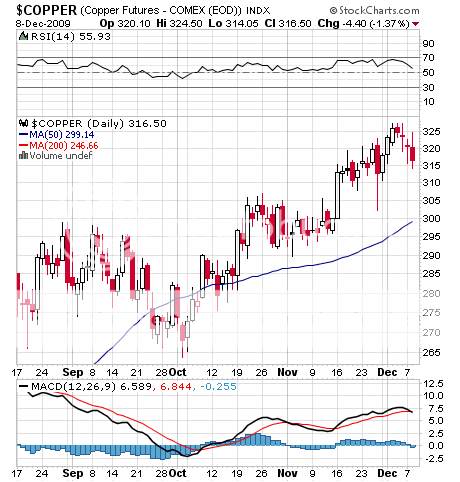

1) I have to tell you that my old friend, Dr. Copper, the only commodity that has a PhD in economics, looks like he may be giving the market an ?F? on its latest exam. If you recall, I was feverishly pounding on the table trying to get people to buy the red metal at $1.35 in January (click here for the call) . It tickled $3.28 last week. I also was pushing the world?s largest copper producer, Freeport McMoRan (FCX) at $30, which eventually ran to $88, and has been one of my best performing stocks this year.? Watching the two charts roll over in tandem like a Busby Berkeley musical merits a quick review of the base metals. If this were happening in isolation, I would just write it off to another hiccup in the long supply chain to China. But coming against a backdrop of a sharp rally in the dollar, and sell offs in gold and oil, it is possible that something more ominous is at work. If we get a New Year liquidity surge you might want to lighten up on these positions. Of course, the long term bull market in the red metal is still alive and well. But wouldn?t you like to have enough dry powder to buy more copper 60 cents cheaper? And watch out for that next report card.

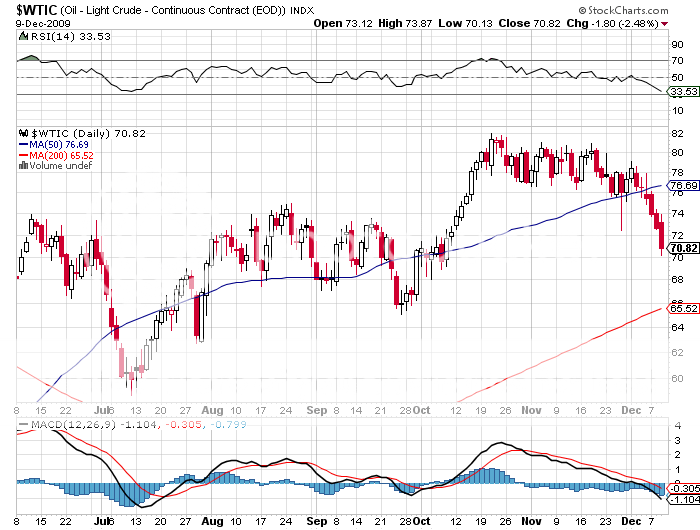

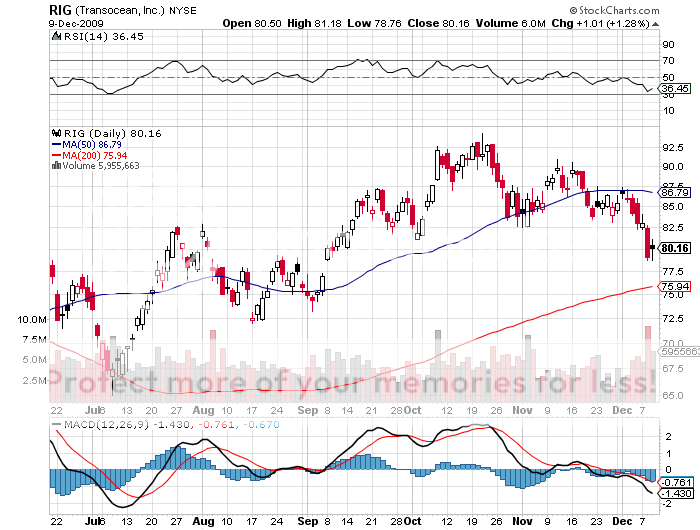

2) I recently spent an evening with Ambassador Richard Jones, the Deputy Executive Director of the International Energy Agency in Paris, who had some eye opening things to say about the energy space. The IEA was first set up as a counterweight to OPEC during the oil crisis in 1974, and has since evolved into a top drawer energy research organization. World GDP will grow an average 3.1%/year through 2030, driving oil demand from the current 84 million barrels/day to 103 million b/d. That means we will have to find the equivalent of six Saudi Arabia?s to fill the gap or prices are going up, possibly a lot. His conservative target has crude at $190 in twenty years. Some 39% of that increase in demand will come from China and 15% from India. A collapse in investment caused by the financial crisis last year means that supply can?t recover in time to avoid another price spike. More than 1.5 billion people today don?t have electricity at all, but would love to have it. The best the Copenhagen climate negotiations can hope for is for CO2 to rise until 2020, and then plateau after that, because once this greenhouse gas enters the atmosphere it is very hard to get out. This will require a massive decarbonization effort reliant on nuclear, hydro, alternatives, and carbon capture and storage. Up to half of the needed carbon reduction can be achieved through simple efficiency measures, like ditching the incandescent light bulb, driving more hybrids, and closing dirty, old coal fired power plants. Natural gas will be a vital bridge, as it is cheap, in abundant supply, and emits only half the carbon of traditional fossil fuels. The total 20 year bill for the rebuilding of our new energy infrastructure will exceed $10 trillion. Richard, who comes from a long diplomatic career in Kuwait, Kazakhstan, and Israel, certainly didn?t pull any punches. I have been a huge fan of the IEA?s data for 35 years. Better use the current plunge in oil prices to accumulate long term positions in crude through the futures (LOH10), the ETF (USO), the offshore drilling companies like Transocean (RIG), and leveraged oil and gas plays like XTO Energy (XTO). When oil comes back, it will do so with a vengeance.

3) The Western US has found a new wrinkle in the housing collapse, where homeowners are desperately struggling to cut living costs to meet the next doubling of their adjustable rate mortgage payments on their underwater houses. Raising horses can cost more than children, so Nevadans are turning them loose to join herds of wild mustangs, to dodge the $30,000/year it costs to board and care for these voracious animals. Local populations are exploding, eating local ranchers out of house and home, who depend on public grazing lands to feed commercial livestock. This week the Bureau of Land Management held hearings on where to place 25,000 excess animals. Mustangs are the feral descendents of horses which escaped the conquistadores, and there are now thought to be 30,000 running wild, down from a 19th century peak of 2 million. The BLM has another 30,000 in pens, and is making 10,000/year available for adoption at $125/each. The problem is that many who adopt ?pets? who then flip them to Canadian slaughterhouses, which cater to the odd French taste for horseflesh. To see how this works, watch Clark Gable, Marilyn Monroe, and James Dean?s last film, The Misfits. Madeleine Pickens, the wife of famed oil trader T. Boone Pickens, has offered to take the BLM?s entire herd and put them out to pasture at an undisclosed million acre location. If there is anyone who could have an undisclosed million acres, it is Boone. I have frequently run into majestic and beautiful mustang herds over the years while camping in the remote desert (no, I don?t go to Burning Man). Reminding me that there is still some ?wild? in the ?West?, I will miss them when they are gone.