December 11, 2009

December 11, 2009

SPECIAL NUCLEAR POWER ISSUE

Featured Trades: (NUCLEAR ENERGY),

(CCJ), (NLR), (WIND TURBINES), (GE),

(HEDGE FUND RADIO)

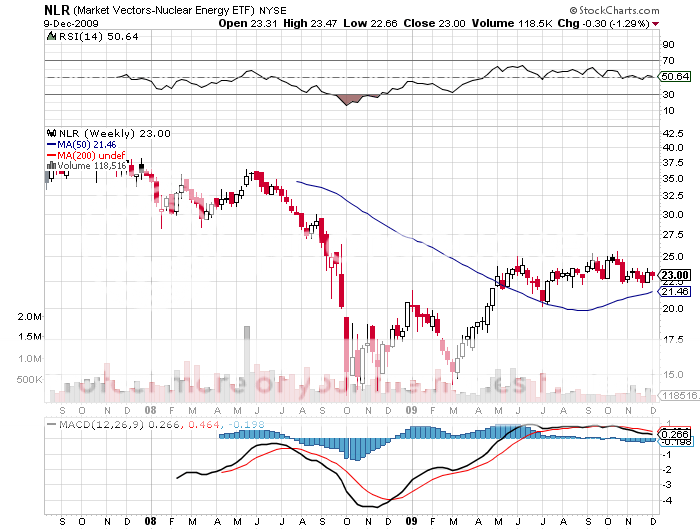

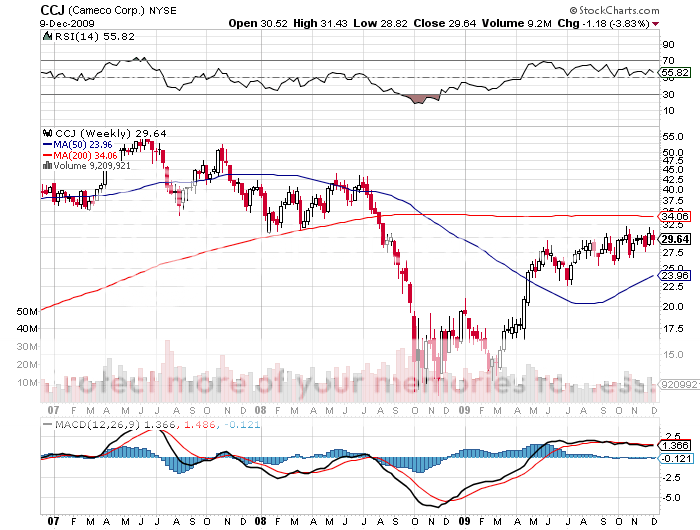

1) The seventies are about to make a comeback. No, don?t drag your leisure suits, bell bottoms, and Bee Gee?s records out of your storage facility. I mean the nuclear industry, which has been in hibernation since the accident at Three Mile Island in 1979. There is absolutely no way we can deal with our energy crunch without a huge expansion of our nuclear capacity, which sits at a lowly 20% of our power generation. France has already achieved 85%, followed by Sweden at 60% and Belgium at 54%. Unless you?re a nuclear engineer, you are probably unaware how far the technology has moved ahead in the last 30 years. The first generation produced the aging behemoths we now see on coasts and rivers, which used high grade fuel that would melt down if someone forgot to flip a switch. Think Chernobyl. Generations two and three never got off the drawing board. Generation four is known as a pebble reactor,? which relies on a new form of fuel embedded in graphite tennis balls that is just hot enough to generate electricity, but too weak to allow a disaster. This eliminates the need for four foot thick, steel reinforced concrete containment structures, which accounted for 50% of the old design?s cost. Low grade waste can be stored on site, not shipped to Nevada or France. I?ll write more about this fascinating technology later. The permitting process is being shortened from 15 years to four by confining new construction to existing facilities instead of green fields, urged on by a less fearful public and even some CO2 conscious environmentalists. At least 30 new reactors are expected to start construction in the US over the next five years, and over 90 in China. There is a great equity play here, and I would use any substantial dip in the market to scale in.? The Market Vectors Nuclear Energy ETF (NLR), which has jumped an impressive 78% to $25 since March, is the easiest way in. You can also buy its largest components, like Cameco (CCJ) (click here for their website), the world?s largest uranium producer, which has seen its stock clock a nice double this year. And you might start practicing your ?hustle? once again.

2) On my recent trip to Oregon I met with venture capital investors in NuScale Power, which is trailblazing the brave new world of ?new? nuclear. Their technology has been pioneered by Dr. Jose Reyes, dean of the School of Engineering at Oregon State University in Corvallis. This is definitely not your father?s nuclear power plant. The company has applied for design certification with the Nuclear Regulatory Commission for a mini light water reactor with a passive cooling system rated at 45 megawatts. The idea is to site a dozen of these together which in aggregate can generate 540 Megawatts, little more than half the size of the old 1 gigawatt monsters. Running a dozen small reactors instead of one big one makes for vastly easier operation and maintenance, as individual units can be brought on and offline as needed. Small size also eliminates the need for gargantuan, expensive containment structures. This power source runs at night, when solar and wind plants are offline. Modular design makes mass production of these units economical. Once certification, approval, permitting, and construction are complete, we can expect to see the NuScale plants running by 2018. After all, if something similar works in nuclear powered submarines and aircraft carriers, why not in industrial zones on the outskirts of town? For more on NuScale?s innovative efforts visit their website by clicking here .

3) Deal of the Day??General Electric (GE) has sold 529 wind turbines to Caithness Energy for $1.4 billion for construction of the largest wind farm in the US. The Oregon facility will generate 757 megawatts of power, almost the size of a conventional nuclear power plant. The power will come online from 2011 and will be sold to California. This will no doubt help local utilities like Pacific Gas & Electric (PGE), which has a state mandate to obtain 20% of its power from renewable sources by 2017. Europe has a 20% target by 2020, and China has a similar goal, but the US has no fixed objective, although 30 individual states do. America currently gets a miserable 6% of its energy from renewable sources. The long term trend towards renewables hit a violent air pocket in 2008-2009 as the financial crisis dried up funding. Just ask T. Boone Pickens about this and you?ll get an earful. Conditions are now easing, as this deal shows, but there are still huge obstacles, like the needed upgrade of the national transmission grid (click here for more background on the crucial Tres Amigas project). GE originally got into this business by buying the wind assets of Enron for pennies on the dollar. If you had any doubt that alternative energy is THE NEXT BIG THING, this is the proof in the pudding.

4) My guest on Hedge Fund Radio this week is Charles Nenner of the Charles Nenner Research Center in Amsterdam. Charles hails from Holland, and has a long career that includes stints at medical school, Merrill Lynch, Rabobank, and ten years at Goldman Sachs. He has spent three decades developing his proprietary Cycle Analysis System, which generates calls of tops and bottoms for every major market in the world. Charles developed a huge following after 2007, when he accurately nailed the top in the Dow at 14,500 and urged his clients to put on short positions when everyone else was predicting that the market would keep grinding higher. I have been following Charles daily research reports myself for two years, and found them to be uncannily accurate. Today, Charles Nenner counts major hedge funds, banks, brokerage houses, and individuals among his clients. You can find out more about Charles? work at his website at www.charlesnenner.com. Hedge Fund Radio is broadcast every Saturday morning at 12:00 pm Eastern time, 11:00 am Central time, 9:00 am Pacific Coast Time, and 5:00 pm Greenwich Mean Time. For the online link to the live show, please go to www.bizradio.com or click here , click on ?Listen Live!?, and click on ?Houston 1110 AM KTEK.?? For archives of past Hedge Fund Radio shows, please go to my website by clicking here.

?

?Ben Bernanke is not going to take the punchbowl away, but he may turn the music down,? said Bernie McSherry, senior VP of strategic initiatives at Cuttone & Co., a New York prime broker.