December 14, 2010 - The Upgrade Fever Pandemic

Featured Trades: (ECONOMY UPGRADE FEVER),

($SSEC), (SSO), (X), (CU), (COPPER)

1) The Upgrade Fever Pandemic. I knew it, I knew it, I knew it. As soon as Bill Gross at bond giant, PIMCO, announced that it was off to the races with a 1% mark up in his GDP forecast for 2011, upgrade fever would break out all over.

I look no further than my alma mater, Morgan Stanley, which followed suit with their revision for economic growth from 2.9% to 4.0%. David Greenlaw thinks that the tax deal Obama cut with the Republicans, to the chagrin of his own party, is great for exports, consumer spending, and capital spending. A sudden fall in weekly jobless claims by 17,000 to only 421,000 suggests he may be right. A sleigh full of more economic releases arrives this week, and I expect them all to surprise to the upside, leading to a further surge in corporate profits. Needless to say, this is all hugely bullish for equities.

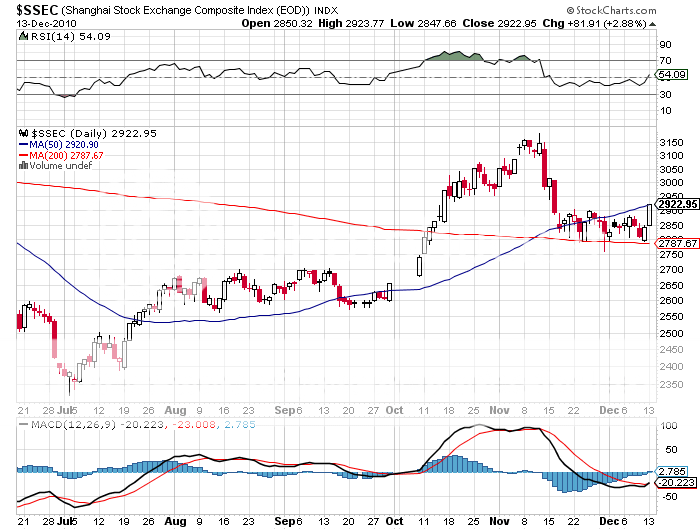

The other big development is that China (FXI) postponed its next interest rate rise by a few weeks, delivering a nice pop for the Shanghai market ($SSEC), and triggering a global melt up in commodities. Copper (CU) hit a new all time high today, and steel names, like US Steel (X) were on fire. I have a very heavy weighting in the sector in my long term portfolio, but my short term trading book is out for the moment, as the overheating is starting to scare me.

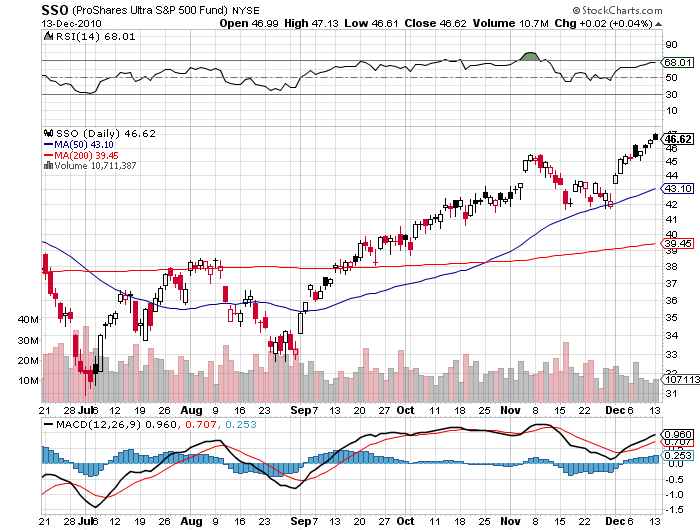

The 'FEAR' to 'CONFIDENCE' trade is on, and Santa Claus is mixing steroids into the reindeer feed as we speak to deliver a continued rally. Did I mention this is all hugely bullish for equities? It all makes my (SSO) position, the 200% leveraged bet that the S&P 500 is going up, smell like roses.

Optimism is Breaking Out All Over

-

-

My (SSO) Position is Smelling Like Roses