December 17, 2009

December 17, 2009 Featured Trades: (FXI), (EWH),

(COPPER), (GOLD), (F), (BA), (GE)

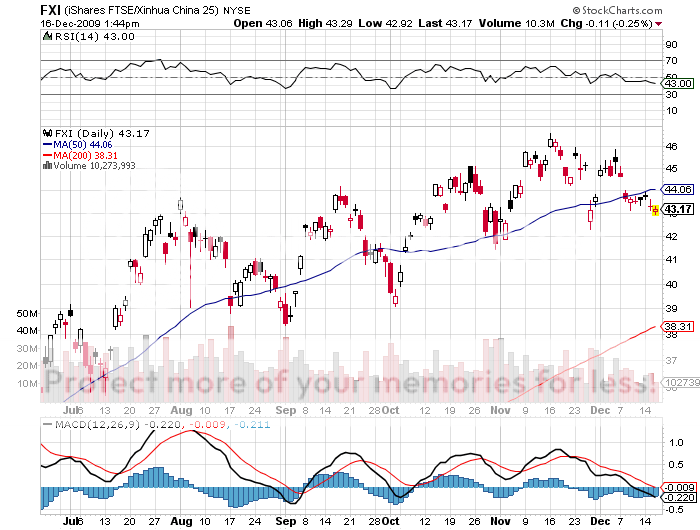

1) I confess that I am a total agnostic when it comes to specific investment philosophies, and a complete whore when it comes to trying out any new analysis that walks by. Maybe it?s because of my science and math background, but for me, raw data trumps opinion and hype any day of the week. So when someone I respect with a great track record argues that my core longs are setting up for a great short, I have to sit up and pay attention. No lesser being than famed short seller Jim Chanos of Kynikos Associates (?Kynikos? is Greek for cynic), says that China?s (FXI) much vaunted 8% GDP growth is being massively inflated. The game will continue as long as there is easy access to credit, but when reality sinks in, the resulting crash will equal the subprime crisis in its severity for the global economy.? China is Dubai times 1,000. While shorting ?A? shares on the mainland is illegal, Jim can short ?H? shares in Hong Kong (EWH)? as well as the growing roll call of US listed ADR?s, ETF?s and futures contracts. Jim is also looking at shorting the derivative commodity plays like copper (see my recent copper warning by clicking here ), cement, and yes, gold. I agree with Jim in that China is the best place to be long in rising markets, and the worst place in falling ones. This is why I have recently put out several global risk alerts, as the level of risk in all asset classes, not just China, is clearly much higher than it was just nine months ago. Jim also dislikes the auto industry, which is still facing backbreaking legacy costs, specifically Ford (F), and Fiat. EADS, the European airbus manufacturer, has myriad problems, and will eventually need a state bailout. Jim is neutral on banks, which are merely kicking the can down the road on bad loans and securities valuation.

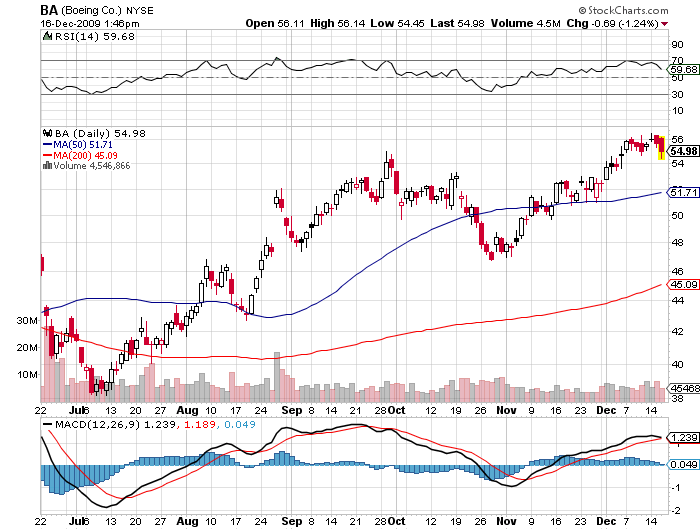

2) I know that airline service is pretty poor these days, but isn?t a two year wait for a flight a little extreme? I?m talking about the inaugural flight today of Boeing?s (BA) 787 Dreamliner, which was plagued with manufacturing glitches, like safely attaching the wings to the fuselage. Boeing has bet $13 billion on the next generation aircraft, which is a great leap forward, using advanced carbon fiber technology to produce lighter planes that improve fuel efficiency by 40%. The plane is clearly a make or break for the airline industry, especially if fuel prices rise substantially, as I expect. Some 840 have been ordered, making it far and away the most pre ordered commercial plane in history. That takes the order backlog to 2016, and Boeing is opening a second factory in Charleston, North Carolina to accommodate an ambitious ten plane per month production schedule. The first 787, which can carry up to 320 passengers, will be delivered to Japan?s All Nippon Airways (ANA) in Q1, 2011. To read my initial call to buy Boeing, as well as my family?s long history with the fabled company, click here .? I believe this is a classic case of buying the rumor and selling the news, so it may be time to take some profits here, as the 112% run from the March lows have far outrun the broader market. It looks like the company?s chances of getting a major Air Force tanker contract have been torpedoed yet again, and it will lose money on the first 200 Dreamliners delivered.

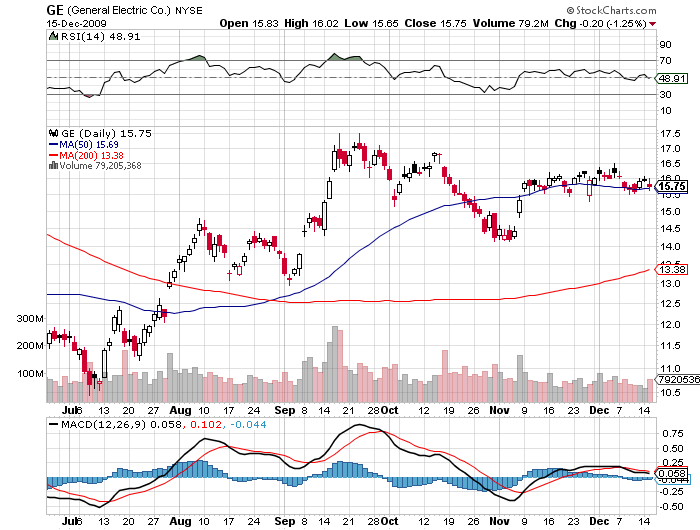

3) I met Jack Welch last night, the legendary retired CEO of General Electric (GE). ?Neutron? Jack gets the credit for boosting the market cap of GE from $13 billion to $400 billion in 20 years, turning it into a Wall Street darling in the process. The ?hedge fund that makes light bulbs? is the last big industrial finance company standing, and when the market turns it will make a fortune, because there is no competition left. Jack is currently on the board of a private equity firm, several Internet media start ups, and is advising me on the start up of this newsletter. He gives Obama an ?A? for leadership and communication, but believes his economic policies are seriously flawed. They are based on a 4% annual growth assumption for the next decade. We never managed to achieve that rate during the go go days of the eighties and nineties, let alone attempt it during a new age fraught with deleveraging and frugality. If we get only 2.5% instead, the deficit will explode from $13 trillion to $30 trillion, at which point ?we will be cooked.? Who knew Jack was a closet gold bug, dollar bear, and inflation hawk? Jack was passing through San Francisco at the end of a national tour promoting his wife Suzy?s new book ?10-10-10?, which is about how to create a ?values driven life.? In his heyday, Jack was considered the best manager in the country. Never one to mince words, he is an absolute terror now that shareholder feelings are no longer a consideration.

The genealogy website, Ancestry.com, says that president Obama and Warren Buffett share great grandfathers, making them seventh cousins. See the resemblance?