December 3, 2010 - Trade Alert for the (SSO)

Featured Trades: (SSO TRADE ALERT), (NSANY), (TM), (TTM)

3) Trade Alert for the (SSO). After the Dow's impressive 250 point blast off to the upside yesterday, my phone started ringing off the hook. Fundamental and technical analysts around the world were screaming at me that a major breakout was at hand, it was off to the races, and the 'RISK ON' trade was back from the dead in all its glory. The train was leaving the station, and if I didn't jump on now, I would be the one getting post cards from the successful aggressive traders visiting their Swiss bank accounts.

There was more confirming price action than Sarah Palin Bumper stickers at a National Rifle Association rally. The Treasury bond market took a nosedive, my TRADE ALERT yesterday to buy the (TBT) smelling like roses. The Australian dollar (FXA), a hedge fund darling because of its high yield, bounced hard off the AUS$0.9550 level. Crude oil rocketed from $83.90 to $87. Copper popped from $3.79 a pound to $3.94. The equity price action was impressive globally, from Indonesia to China (FXI), Poland (EPOL), Australia (EWA), Chile (ECH), and more. Suddenly, the path to take couldn't be more clear if it was outlined by high intensity landing lights.

Let me lay out the fundamental case for US stocks here. The American economy is currently enjoying a growth spurt, possible at a 3.5% annualized rate, while Japan and Europe drag. This is what the collapse of the Euro is telling us. One need look no further than US auto sales for November, which grew at a white hot 17% YOY rate, and is a huge driver for the broader economy. This is why I have three auto names in my model portfolio, Nissan (NSANY), Toyota (TM), and Tata Motors (TTM). This is what the collapse of the Euro is telling us. Quantitative easing is benefiting equities more than any other asset class, as its simulative effects are clearly working. The 30% of active managers that are underperforming the index are playing catch up by pouring money into the best performing names. Yesterday's blistering move is giving traders the trigger they were waiting for.

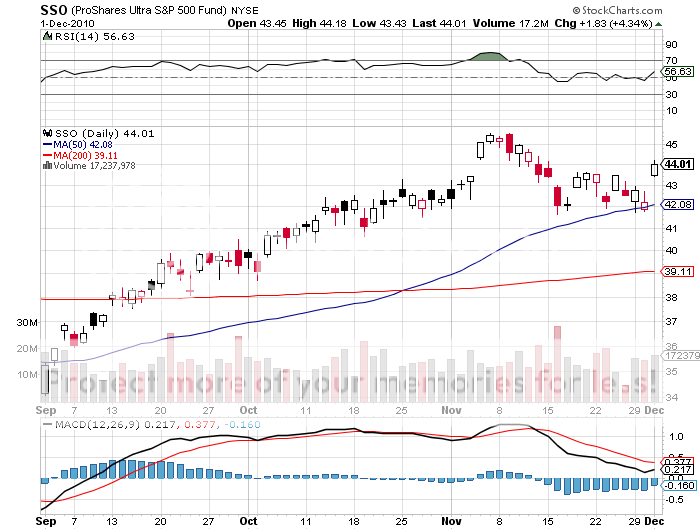

The best way to participate here is through the ProShares Ultra Index ETF (SSO), a 200% leveraged bet that the broader stock market goes up. Buy a half position at the opening today at $44, or 10% of your total portfolio, and the other half at the opening tomorrow after the release of the November nonfarm payroll figures. If we get a bad number, you'll buy the second lot lower and cut your average price. A good number will send the market off to the races again and raise your cost, but you will be in the money on you total position. Keep in mind that with a 20% position in a double leveraged instrument, you are 40% long the US market, a decent sized position.

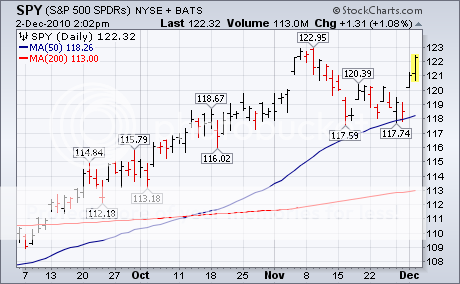

The technical set up is looking great. Look at the chart below and see how hard we bounced off the 50 day moving average. I think a New Year allocation liquidity burst could give this trade a six week life, and could take us as high as 1,348 in the S&P 500, or 12.1% higher than yesterday's closing price. That should take the (SSO) up 24%. Put a stop below at $41.70, well below the 50 day moving average. That means you are risking 5.2% to make 24%, a ratio of 4.6 to one, which is respectable.

What could go wrong with this trade? Congress fails to compromise on the extension of the Bush tax cuts, putting a double dip recession back on the table. My guess is that the opposite will happen. After much blustering, saber rattling, and threats of gridlock, which will cause brief scares for the market, some type of compromise will be reached. Congress will correctly conclude that the public is sick to death of their antics and do to right thing. The stock market should do hand flips and summersaults when this happens. See you in Zurich.

-

-

See You in Zurich