December 9, 2009

December 9, 2009

Featured Trades: (MERRIDETH WHITNEY), (SPX),

(SEF), (SKF), (SDS), (COFFEE), (KTH10.NYM),

(CARBON CAPTURE & STORAGE), (CER's)

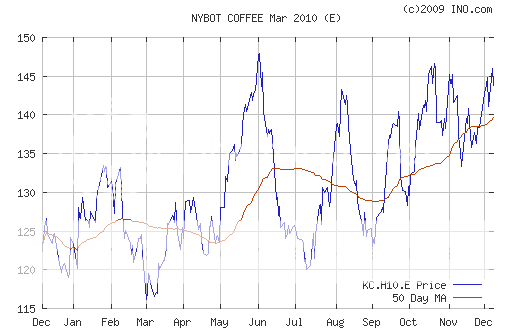

2) Where is the tidal wave of global hot money surging to next? Coffee has moved up 24% to $1.48/pound since the July low, to a new high for the year on decent volume, and technicians are pounding the table that an upside breakout is imminent. This is both good and bad news, as coffee can be your worst nightmare to trade, being an unholy marriage of weather and international politics. Brazil is still the Saudi Arabia of global coffee production, with traders glued to screens looking for the most recent weather forecasts that might affect the country's fragile Arabica and Robusta trees. That makes coffee an indirect play on Brazil's appreciating currency, the real. Rising fertilizer prices and El Nino are causing supply problems in Vietnam and Indonesia. A multiyear draught is hurting production in Kenya. And demand is soaring where? In China, where fashion conscious consumers are replacing traditional teas with coffee. Yes, coffee is a rising emerging market standard of living play. If I haven't scared you off, you can trade coffee futures on the New York Mercantile Exchange, where one March, 2010 contract (KTH10.NYM) buys you 37,500 pounds of the caffeine laden commodity worth $55,500, with a margin requirement of only $3,640. My coffee consumption alone in preparing this letter makes it a strong buy. If you want to know how to get set up on trading these, or any other futures contracts, please email me at madhedgefundtrader@yahoo.com.

3) With the negotiations going hot and heavy in Copenhagen this week over the future of greenhouse gasses, I thought it would be useful to examine the astronomical cost of one of the proposals being bandied about. I got the low down from some friends at Lawrence Livermore National Laboratory. The modern day descendent of the Atomic Energy Commission, where I had a student job in the seventies, the leading researcher on laser induced nuclear fission, and the administrator of our atomic weapons stockpile, I figured they'd have some good numbers. Dirty coal currently supplies the US with 50% of our electricity, and total electricity demand is expected to go up by 30% by 2030. The industry is spewing out 32 billion tons of carbon dioxide (CO2) a year and the global warming it is causing will lead us to an environmental disaster, possibly within decades. Carbon Capture and Storage technology (CCS) locks up these emissions deep underground forever. The problem is that there is only one of these plants with any real operational history in North Dakota, a legacy of the Carter administration, and they cost $4 billion each. The low estimate to replace the 250 existing coal plants in the US is $1 trillion, and this will produce electricity that costs 30%-50% more than we now pay. And while we can build all the walls we want to keep out immigrants, it won't keep out CO2. I know from my nuclear testing day that it only takes a week for gases to cross from the Middle Kingdom to the US. This is a big problem, as China is currently completing one new coal fire plant a week. In fact, China is rushing to perfect cheaper CCS technologies, not only for their own use, but also for selling to us. That's why Secretary of Energy, Dr. Steven Chu, says it is economically vital for the US to be a leader, not a follower in this field. Expect to hear a lot of handwringing about Obama's controversial, big ticket climate bill when it comes up for a vote in 2010.

4) I can tell you right now that cap and trade is going to win the political battle over a carbon tax, hands down. Don't waste a nanosecond of your time even thinking about it. Obama doesn't wants to be tarred with pushing yet another new tax, and Wall Street is gearing up to make a fortune in the new trading vehicle. Europe has already adopted the system, and a Paris based exchange called Bluenext, partnered with NYSE Euronext, trades Certified Emission Reduction credits (CERS's). Some 4-6 million CER's trade each day worth $50-$75 million. After peaking last year at ???30, CER's crashed to ???7.5 in February and then bounced to ???13.14 today. They are traded in 1,000 unit lots, and are backed up with far month futures contracts. Check out their cool website by clicking here. Morgan Stanley and Goldman Sachs have already set up trading operations in the instrument. The EC government grants CER's to green companies, which then sell them to big polluters, which must buy them to expand their business. The true costs are passed on to consumers. The system contributed to a 3.8% reduction in CO2 emissions in Europe last year. The current world market for carbon credits is $126 billion, but if the US joins the system, that will jump by $1 trillion. I was involved in the creation of the Japanese equity warrant market in the early eighties, and I can tell you from experience that new, poorly understood markets with spreads wide enough to drive a truck through are a license to print money for the early players. Perhaps there is hope after all for the legions of traders, market makers, brokers and analysts left unemployed by last year's collapse.

'The biggest trend of 2010 is to see who gets kicked out of the banking system,' said Meredith Whitney, who runs a boutique financial research firm