December 9, 2010 - Instant Gratification Alert

Featured Trades: (TBT), (YCS), (SSO)

2) Instant Gratification Alert. If you are one of the 1,000 recent new subscribers to The Diary of a Mad Hedge Fund Trader, religeously executed every trade I recommended, and ignore the naysayers and the party poopers, well done!

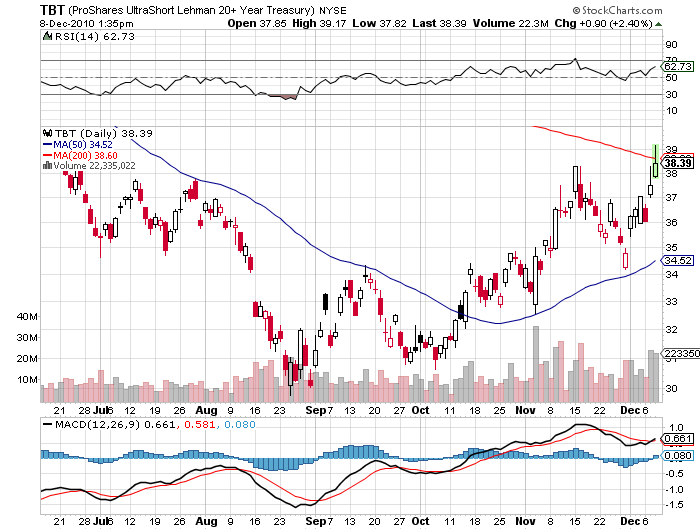

As I write this, the leveraged short Treasury bond ETF, the (TBT), has exploded to the upside, breaking the 200 day moving average. It has tacked on an impressive 10% from my cost last week, popping from $35.60 to $39.10. The options markets are now seeing massive buying of the December $40 calls. Of course, boosting our positions was the good old US Treasury, which slammed the market with $60 billion in new paper today. But we knew this was coming weeks ago.

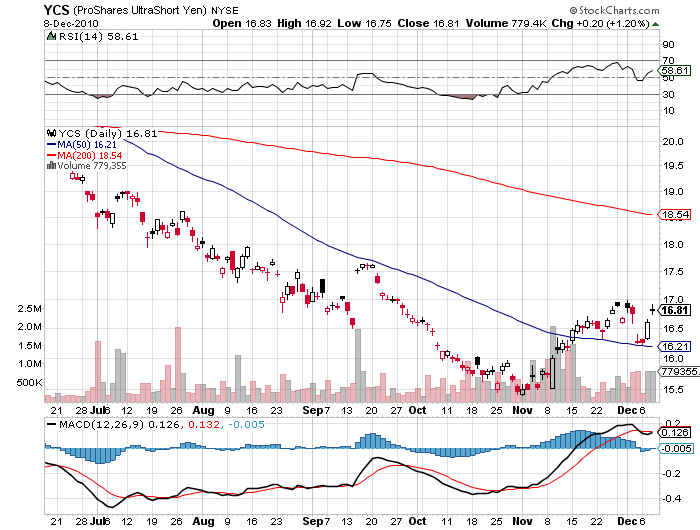

The yen saw a major breakdown, sending the short play ETF (YCS) off to the races. Good job to those who acted on my trade alert yesterday and doubled up.

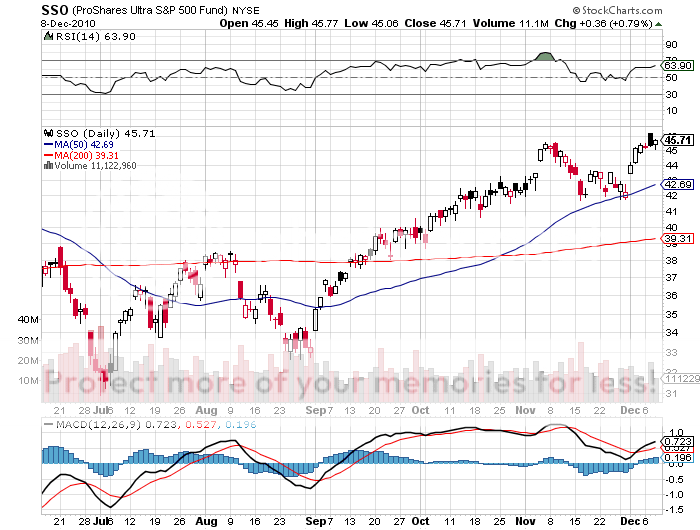

Stocks are holding up remarkably well against profit taking pressure off of Obama's tax compromise speech yesterday, a classic 'buy the rumor, sell the move' development. The really exciting thing is that Bank of America (BAC) is hugely outperforming to the upside, with the calls I recommended yesterday taking off like a scalded chimp. The March, 2011 $12-$14 call spread soared by 21%, while the aggressive version of this trade, paired with a short $10 BAC put, jumped by 100%. Not bad for a day's work. I knew I was good, but not that good!

New subscribers to my letter have clocked profits of up to 10% in a week, and all positions are now in the money. Some, who took on more leverage than I recommended, have seen their networth skyrocket by 20% in days. The portfolio has some nice cross hedges working, with any pullbacks in stocks more than offset by gains in short Treasuries and short yen. The strategy is firing on all 16 cylinders.

For those of you who have a need for instant gratification, you might consider cashing in here, calling it a year, and taking off for some skiing at Aspen, St. Barts for some sun bathing, or Wisconsin to visit the in-laws. In a zero return world, you don't get to coin 10-20% in a week very often, and sometimes it is prudent to take the money and run.

For those who thought this was the tenth big ticket Internet marketing scam they purchased in the past year and just sat back and watched with skepticism, don't worry. There will be other opportunities, and plenty of good entry points. There are so many rip offs out there, I will be the last one in the world to blame you for your jaundiced eye. I come from an unforegiving, uncompromising world where only results backed by cold, hard numbers have value, not empty words and hollow promises.

As for me, I'll be hanging on to my positions, and even looking to increase them. I'll be the guy who stays in the bar until they pile the chairs on the tables, mop up the spilled champaigne, flicker the lights a few times, and all of a sudden, every girl still hanging around suddenly looks beautiful. I think that I have sunk my teeth into some solid, sustainable trends here that will be good for months, if not years. I'll leave the day trading to the kids.

Watch your trade alerts. Fiat Lux.

-

-

-

Will It Be Trading for Christmas?

-

Or Sunbathing?