Deflation is Accelerating

A number of friends have recently approached me asking the best way to refinance their home.

Should they be ultra conservative and lock in a historically low 3.9% conventional fixed rate 30-year loan? Or should they throw caution to the wind and be seduced by a 5/1 ARM (adjustable rate mortgage) available for half the monthly payment?

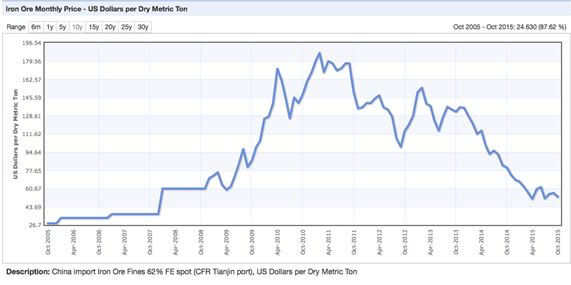

I tell them that the answer is obvious. All they have to do is closely watch the iron ore market for Chinese delivery.

Last week, the price of this principal raw material for steel fell to $43.5 per metric tonne, the lowest since the 2008 crash, off a gut churning 77% from its 2010 high.

I don?t think I?ll be singing ?Waltzing Matilda? in the shower anytime soon. That?s the national anthem of Australia, the world?s largest producer of the orange rocks.

If my answer puzzles them, I then direct them to the recent statement by the Saudi Oil Minister, Ali al-Naimi. He says his kingdom will continue its present record levels of oil production, even if the price plummets to $20 a barrel.

If they then appear perplexed, I point out to them that US ethanol production just surpassed a once unimaginable 1 million barrels a day, a new all time high. Corn prices have fallen so far that it is cheaper to burn food than to eat it.

At this point, the expression on my friends? faces is now one on complete befuddlement. They start checking their watch, their iPhone for any new text messages, look for new tweets, or updates to their Facebook account.

Then I move in for the kill.

I point out that the Baltic Freight Index ($BDX) has just hit an eight year low. This is the widely followed index for the cost of moving bulk raw materials, like coal, grain, and iron ore.

Now my friends are utterly clueless. Wasn?t this supposed to be a conversation about homes, loans, and interest rates.

If they still don?t get it, I then spell it out more clearly, with the appropriate soaring logic and literary flourishes.

The bottom line for all of these disparate data points is that deflation is accelerating.

The continuing collapsing cost of all commodities is still driving prices relentlessly downward. This year, I think only the price of coca has risen.

Adding fuel to the fire is the relentless march of technology, which replacing expensive humans with cheap machines, further lowering costs.

The offshoring of jobs, once a major driver of the ongoing price collapse, is barely a factor anymore. Rapidly rising wages are steadily pricing Chinese labor out of the market.

Sure, there has been some modest cost increases on the US wage front with the new minimum wage movement. Many cities like Seattle and San Francisco have already mandated wage hikes from $8 to $15 an hour.

But this will only bring higher prices for those who eat fast food cheeseburgers, tacos, and burritos, which my doctors have expressly forbidden me to consume.

What this means is that interest rates are going to remain far lower for longer than even the Federal Reserve can imagine.

Sure, we will get a 25 basis point rise in December, followed by a second one in March, or June. But that may be it.

As unbelievable as it may seem, we might go into the next recession WITH INTEREST RATES ALREADY CLOSE TO ZERO!

All of this makes my friends? choice about how to refinance their home a complete no-brainer. Take the 5/1 ARM, NOW!

Chances are that we will enter a recession sometime in the next five years, before the first five-year interest rate reset. Then they can refinance again, probably at an interest rate even lower than the subterranean one they are getting now.

They can also reconsider the 30-year fixed rate at that time, as I expect inflation to return with a vengeance sometime in the 2020?s.

More than a few homeowners have already figured out that the only way to afford sky-high housing prices in San Francisco and New York is to finance them with the ultra low giveaway cost of money.

The only pre-conditions for this plan to work is for them to keep their jobs, the payments on time, and their credit rating up.

At this stage, my friends thank me effusively and rush off to call their loan brokers.

People who have known me a long time are used to me to making incredible, spectacular, out of consensus long-term forecasts, which eventually come true.

Yes, gold is going from $34 to $1,000 an ounce (1972).

Of course the Nikkei Average is about to rise tenfold from Y3,500 to Y35,000 (1982).

Dow 10,000 by 2,000? You betcha (1992)!

Why can?t oil collapse from $100 to $50 if we make peace with Iran (2014)?

Consider it all part of being Mad.

So, Where?s the Inflation?

So, Where?s the Inflation?

$20 Oil? No Problem!

$20 Oil? No Problem!