We need to look back to the ancient world to discover the origins of robots. During the industrial revolution, humans developed the structural engineering capability to control electricity so that machines could be powered with small motors.

The idea of the humanoid machine was developed in the early 20th century. The first uses of modern robots were in factories as industrial robots. A car company - General Motors - paved the way here first.

General Motors (GM) introduced the first industrial robot, called "The Unimate," back in 1959. It was just a simple hydraulic arm that did some repetitive welding tasks. Seven years later, "The Unimate" made a friendly appearance on The Tonight Show with Johnny Carson, where it played not such a bad imitation of golf.

As technology has improved and become cheaper, robots have become more prevalent. Robot sales in North America have hit record highs for the last three consecutive quarters. We now encounter robots in our daily lives in various forms: they vacuum floors (Zoomba), mow lawns, make coffee, and even provide companionship (see the movie Her).

Additionally, they help combat supply chain disruptions and inflation. Automation allows employees to focus on higher-value tasks and work efficiently. Robots now work successfully alongside humans.

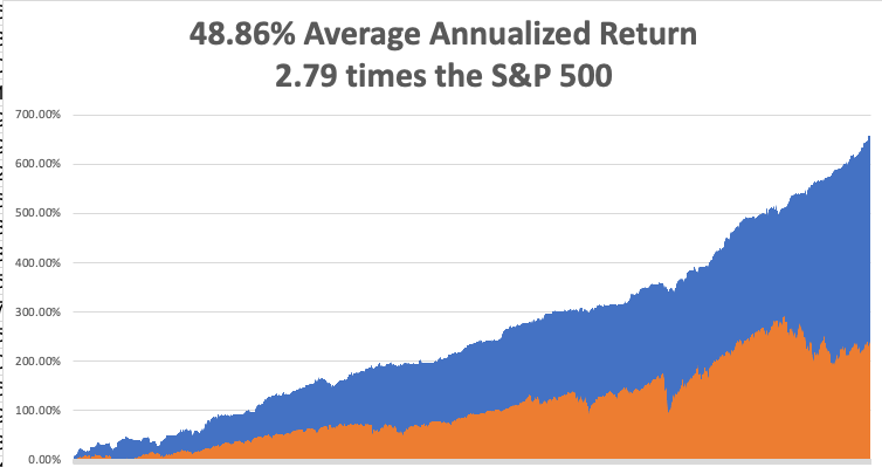

So, the robotics industry looks like a savvy investment.

Why?

The global robotics market is expected to grow at an impressive CAGR of 23% from 2021 to 2026, eventually hitting a cool $186.7 billion by the end of that span.

The range of robotics applications continues to expand at lightning speed and has become evident in everything from manufacturing to healthcare, logistics to agriculture, and beyond. It's all driven by many factors behind the scenes, like advancements in AI and machine learning, growing demand for automation, and improvements in sensor technologies. More and more companies are tapping into robotics R&D, and the stock market is taking notice.

One company that is particularly well-positioned to benefit from the growth of robotics is Intuitive Surgical (ISRG).

Intuitive Surgical is a pioneer in the field of robotic surgery, with its flagship da Vinci Surgical System being used in over 7 million surgeries worldwide. The company has a market cap of $125.6 billion, and its stock has been surging in recent years, growing by over 800% in the last decade.

Presently, about half of all robotic procedures are used in urological and gynecological procedures, but robotic surgery has applications across the medical field. Currently, only 3% of all surgeries are done robotically, so there is a lot of potential for growth in this area.

Another company that benefits from the growth of robotics is ABB (ABB), a Swiss-Swedish multinational corporation specializing in robotics, power, and automation technology.

ABB has a market cap of $67.2 billion and is a leader in industrial robotics, with applications ranging from welding and painting to packaging and palletizing. The company's robotics division has seen double-digit growth in recent years, and it is well-positioned to capitalize on the continued expansion of the global robotics market.

Of course, the growth of the robotics industry isn't limited to these two companies. Other publicly traded firms that are likely to benefit from this trend include Teradyne (TER), Yaskawa Electric (YASKY), and Fanuc (FANUY), among others.

Logistics is also benefiting from robotics. As online shopping and same-day delivery become more popular, companies need help to keep up and must find ways to streamline their supply chains and reduce costs.

Robotics play a major role in solving these problems. Autonomous robots can zip around warehouses, grab products off shelves, and even help load and unload trucks.

A company that is leading the charge in this area is Amazon (AMZN).

Amazon has been investing heavily in robotics for years, and its acquisition of Kiva Systems in 2012 has been instrumental in the company's ability to scale its logistics operations. The company now has over 200,000 robots deployed in its warehouses, and it is constantly experimenting with new ways to use robotics to increase efficiency and reduce costs.

An additional reason that robots are becoming more in demand involves the transportation industry.

People keep coming up with state-of-the-art ways to make cars and trucks, and these new production technologies require lots of robots. Moreover, factories worldwide are getting upgrades, so they need revolutionary robots to help them improve.

In 2020, BMW AG (BMWYY) and industrial robots and systems manufacturer KUKA (KUKAF) signed a deal to provide more than 5,000 robots to new production lines and factories worldwide. KUKA stated that these industrial robots would be utilized globally at the BMW Group's overseas manufacturing facilities to produce present and future vehicle models.

Industrial robot costs have become much more reasonable over the past thirty years. They have dropped by an average of 50%. This decrease makes adopting robotics technology in various industries a feasible option.

Robots are not replacing factory workers. Instead, they're working alongside their human counterparts to free up their time for more critical tasks. The Institute for Operations Research and the Management Sciences backs the idea that investments in robotics technology equaled firm employment.

Science fiction robotic concepts have arrived in our modern-day environments and investors will now be able to profit handsomely from this industry.

In the wise words of Warren Buffett, "Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble."

While the growth of robotics may lead to job displacement in some sectors, it's important to remember that this is a natural evolution of technology. As new jobs are created in various areas, such as robotics engineering and data analysis, we must adapt and embrace these changes.

In the meantime, savvy investors can capitalize on the continued expansion of the robotics market. Companies such as Intuitive Surgical, ABB, and Amazon are just a few examples of publicly traded firms well-positioned to benefit from this trend.

However, let's remember that the robotics industry is still in its early stages, and there are bound to be new players emerging in the coming years.

As with any investment, it's essential to do your due diligence and invest wisely. But the rewards could be massive for those willing to take the risk. So take Buffett’s advice and put out the bucket, to catch some of that golden rain.