I usually try to catch three or four trend changes a year, which might generate 100-200 trades, and often come in frenzied bursts.

Since I am one of the greatest tightwads that ever walked the planet, I only like to buy positions when we are at the height of despair and despondency, and traders are raining off the Golden Gate Bridge like a heavy winter downpour.

Similarly, I only like to sell when the markets are tripping on steroids and ecstasy and are convinced that they can live forever.

Some 99% of the time, the markets are in the middle, and there is nothing to do but deep research and looking for the next trade. That is the purpose of this letter.

Over the five decades that I have been trading, I have learned a number of tried and true rules which have saved my bacon countless times. I will share them with you today.

1) Don’t over-trade. This is the number one reason why individual investors lose money. Look at your trades of the past year and apply the 90/10 rule. Dump the least profitable 90% and watch your performance skyrocket. Then aim for that 10%. Over-trading is a great early retirement plan for your broker, not you.

2) Always use stops. Risk control is the measure of a good hedge fund trader. If you lose all your capital on the lemons, you can’t play when the great trades set up. Consider cash as having an option value.

3) Don’t forget to sell. Date, don’t marry your positions. Remember, hogs get fed and pigs get slaughtered. My late mentor, Barton Biggs, told me to always leave the last 10% of a move for the next guy.

4) You don’t have to be a genius to play this game. If that was required, Wall Street would have run out of players a long time ago.

If you employ risk control and stops, then you can be wrong 40% of the time, and still make a living. That’s a little better than a coin toss. If you are wrong only 30% of the time, you can make millions.

If you are wrong a scant 20% of the time, you are heading a trading desk at Goldman Sachs. If you are wrong a scant 10% of the time, you are running a $20 billion hedge fund that the public only hears about when you pay $100 million for a pickled shark at a modern art auction.

If someone says they are never wrong, as is often claimed on the Internet, run a mile, because it is impossible. By the way, I was wrong 12% of the time in 2019. That’s what you’re paying me for.

5) This is hard work. Trading attracts a lot of wide-eyed, naïve, but lazy people because it appears so easy from the outside. You buy a stock, watch it go up, and make money. How hard is that?

The reality is that successful investing requires twice as much work as a normal job. The more research you put into a trade, the more comfortable you will become, and the more profitable it will be. That’s what this letter is for.

6) Don’t chase the market. If you do, it will turn back and bite you. Wait for it to come to you. If your miss the train, there will be another one along in minutes, hours, days, weeks, or months. Patience is a virtue.

7) Limit Your Losses. When I put on a position, I calculate how much I am willing to lose to keep it. I then put a stop just below there. If I get triggered, I just walk away. Emotion never enters the equation.

Only enter a trade when the risk/ reward is in your favor. You can start at 3:1 which means only risk a dollar to potentially make three.

8) Don’t confuse a bull market with brilliance. I am not smart, just old as dirt and have seen everything ten times over. I only have to decide which movie they’re replaying.

9) Tape this quote from the great economist and early hedge fund trader of the 1930s, John Maynard Keynes, to your computer monitor: "Markets can remain illogical longer than you can remain solvent." Hang around long enough, and you will see this proven time and again (ten-year US Treasuries at 1.45%?!).

10) Don’t believe the media. I know, I used to be one of them. Look for the hard data, the numbers, and you’ll see that often the talking heads, the paid industry apologists, and politicians don’t know what they are talking about (the Gulf oil spill will create a dead zone for decades?).

Average out all the public commentary, and half are bullish and half bearish at any given time. The problem is that they never tell you which one is right (that is my job). When they all go one way, the markets usually go the opposite direction.

11) When you are running a long/short portfolio, 80% of your time is spent managing the shorts. If you don’t want to do the work, then cash beats a short any day of the week.

12) Sometimes the conventional wisdom is right.

13) Invest like a fundamentalist, execute like a technical analyst. This is what all the pros do.

14) Use technical analysis only, and you will buy every rally, sell every dip, and end up broke. That said, learn what an “outside reversal” is, and who the hell is that Italian guy, Leonardo Fibonacci.

15) The simpler a market approach, the better it works. Everyone talks about “buy low and sell high”, but few actually do it. All black boxes eventually blow up, if they were ever there in the first place.

16) Markets are made up of people. Understand and anticipate how they think, and you will know what the markets are going to do.

17) Understand what information is in the market and what isn’t and you will make more money.

18) Do the hard trade, the one that everyone tells you that you are “Mad” to do. If you add a position and then throw up on your shoes afterward, then you know you’ve done the right thing. This is why people started calling me “Mad” 40 years ago. (What? Tech stocks were a huge buy the first week of January?).

19) If you are trying to get out of a hole, the first thing to do is quit digging and throw away the shovel. Sell everything. A blank position sheet can be invigorating and illuminating.

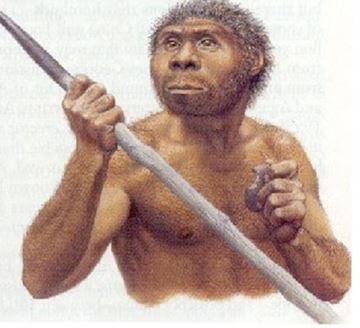

20) Making money in the market is an unnatural act, and fights against the tide of evolution.

We, humans, are predators and hunters who evolved to track the game on the horizon of an African savanna. If you don’t believe me,b v just check out how sharp your front incisor teeth are. They’re for tearing raw meat. Modern humans are maybe 5 million years old, but civilization has been around for only 10,000 years.

Our brains have not had time to make the adjustment. In the market, this means that if a stock has gone up, you believe it will continue to do so.

This is why market tops and bottoms see volume spikes. To make money, you have to go against these innate instincts.

Some people are born with this ability, while others can only learn it through decades of training. I am in the latter group.

With all that said, good luck and good trading. Fresh content resumes next week when I am back from Australia.

Great Trader