Global Market Comments

April 20, 2022

Fiat Lux

Featured Trade:

(TESTIMONIAL),

(TEN MORE TRENDS TO BET THE RANCH ON),

(AAPL), (AMZN), (GOOGL), (TSLA), (CRSP), (EDIT), (NTLA)

Global Market Comments

April 20, 2022

Fiat Lux

Featured Trade:

(TESTIMONIAL),

(TEN MORE TRENDS TO BET THE RANCH ON),

(AAPL), (AMZN), (GOOGL), (TSLA), (CRSP), (EDIT), (NTLA)

Global Market Comments

April 19, 2022

Fiat Lux

Featured Trade:

(WHERE THE ECONOMIST “BIG MAC” INDEX FINDS CURRENCY VALUE TODAY),

(UUP), (FXE), (FXY), (CYB)

Global Market Comments

April 18, 2022

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or GET READY TO SELL IN MAY)

($INDU), (SPY), (TLT), (WFC), (JPM), (TSLA), (TWTR)

So when you are supposed to “Sell in May and go away”, what are you supposed to be doing on April 18?

Not much.

War, inflation, disease, runaway energy prices, and soaring interest rates are usually not a good backdrop for trading stocks. When the wind is blowing against me with gale-force winds instead of behind me, I tend to quit. I only like playing games that are rigged in my favor, or in yours.

Retreating to fight another day sounds like a good strategy to me because it’s much easier to dig out of a small hole than a large one. And it’s impossible to recover if you lost all your money chasing marginal low-quality trades. That 100-day cruise around the world that Cunard is offering right now looks pretty good. If the central bank says it is set on slowing the economy, believe it. The free Fed put is a distant memory.

But whatever Armageddon we are facing out there, it will be a modest one. We now have an unemployment rate of 3.6%, but there are still 11 million open jobs. That means there are more jobs in the US right now than workers, a first in history.

There are in fact several big positives the markets are ignoring right now because it is fashionable to do so. You know these supply chain problems? They’re slowly going away. You see this in falling freight rates for US truckers.

The Cass Freight Index measure of domestic shipping demand edged up a bare 0.6% in March from the month before, an unseasonable slowing of growth at the end of the quarter. From where I sit, the number of Chinese container ships at anchor in San Francisco Bay is on a definite decline.

Going into real recessions, consumers usually baton down the hatches, don their hard hats, and reign in spending. And while they tell pollsters they are worried about the economy, they act like they believe in the opposite, spending with reckless abandon. Wells Fargo (WFC) has seen spending on credit cards soaring by 33% in Q1, while it has jumped by an impressive 29% at JP Morgan (JPM).

There is also a great positive out there which is being completely ignored by the market. The pandemic is gone. Daily cases have dropped from one million to only 20,000 in two months, a record drop in the history of epidemiology. Masks are now only required at mass events like rock concerts and the San Francisco Ballet.

So I will endeavor to entertain you with my stories long enough to keep you from getting bored until trading stocks becomes the slam dunk no-brainer affair it once was. That would be in anything from 2-5 months.

Elon Musk makes $53 billion takeover bid for Twitter in a move that gobsmacked Wall Street. He made the offer in a 281-character tweet to the board of directors. His goal will be to end all censorship, which means bringing back the crazies and the violent. If they don’t accept his premium offer, then he will sell the 9.9% of shares that he already owns and the board will get sued to death by shareholders.

Inflation jumps to 8.5% YOY, a 40-year high, with half of the increase coming from gasoline prices. Stocks and bonds were up on a “buy the rumor, sell the news” move. Unless oil prices completely collapse, next month will be worse.

Producer Price Index rockets by 11.2%, an 11-year high. This is on the heels of yesterday’s red hot Core Inflation report. It makes a half-point rate hike on April 29 a sure thing.

Retail Sales jumped 0.5% in March, and up 6.9% YOY, while import prices hit an 11-year high.

Bonds hit new three-year lows, with yields soaring to 2.81% overnight. The market is transitioning from a Fed that is raising rates from a quarter point at each meeting to a half point. We may be reaching the end of this leg down, off $9.00 in weeks. Only sell the big rallies. (TLT) LEAPS holders are sitting pretty.

Mortgage Refis down 67% YOY, thanks to a 30-year fixed rate mortgage that has topped 5.0%. It looks like the loan sharks won’t be grabbing as much in fees. This market won’t recover for several years. If you didn’t refi last year at century low rates, you’re screwed.

NVIDIA downgraded from outperform to neutral and the price target was chopped from $360 to $225 by Baird & Co. It’s a bold move as (NVDA) has long been a Mad Hedge favorite and 70-bagger over the last five years. Baird cites cancellations driven by a combination of excess GPUs, or graphics processing unit in Western Europe and Asia, as well as a slowdown in consumer demand, especially in China. Slowing consumer demand for GPUs was evident in the continuing reduction in graphics card pricing. I believe any slowdowns are temporary and you should keep buying (NVDA) on dips.

Used Car Sales take a hit, as affordability becomes a major issue. Carmax just reported a 6.5% plunge in Q4. I can sell my Tesla Model X for more than I paid three years ago because it takes a year to get a new one.

Weekly Jobless Claims hit 185,000, up 18,000 from the previous week. The stock market may be worried about a coming recession but the jobs market sure isn’t.

Morgan Stanley blows away earnings. Equity trading came in a hot $3.2 billion and bond trading $2.9 billion. The shares popped 7% on the news. Buy (MS) on dips.

Mercedes breaks 600 miles range on a single charge with its EQXX prototype, driving from Stuttgart to the French Riviera. But the cost per watt is still double Tesla’s. Mercedes plans to go all-electric by the end of the decade.

My Ten-Year View

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still historically cheap, oil peaking out soon, and technology hyper accelerating, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The America coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 240,000 here we come!

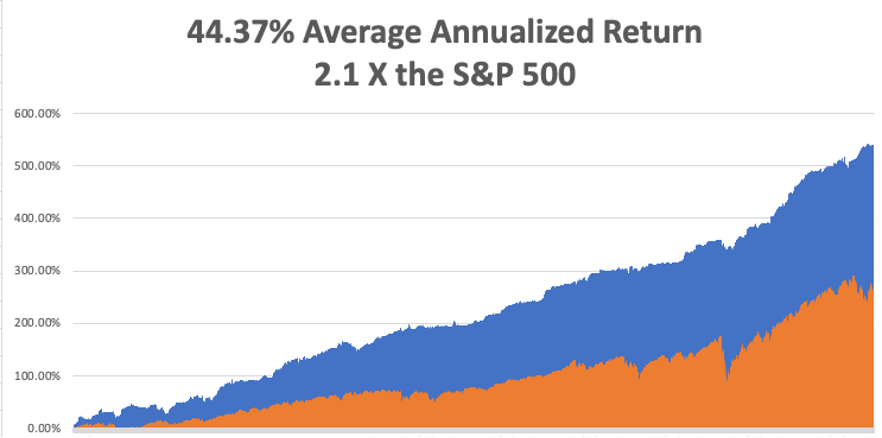

My March month-to-date performance retreated to a modest 0.38%. My 2022 year-to-date performance ended at a chest-beating 27.23%. The Dow Average is down -5.1% so far in 2022. It is the greatest outperformance on an index since Mad Hedge Fund Trader started 14 years ago. My trailing one-year return maintains a sky-high 68.55%.

On the next capitulation selloff day, which might come with the April Q1 earnings reports, I’ll be adding long positions in technology, banks, and biotech. I am currently in a rare 100% cash position awaiting the next ideal entry point.

That brings my 13-year total return to 539.79%, some 2.10 times the S&P 500 (SPX) over the same period. My average annualized return has ratcheted up to 44.36%, easily the highest in the industry.

We need to keep an eye on the number of US Coronavirus cases at 80.6 million, up only 300,000 in a week and deaths topping 988,000 and have only increased by 3,000 in the past week. You can find the data here. Growth of the pandemic has virtually stopped, with new cases down 98% in two months.

On Monday, April 18 at 7:00 AM EST, the NAHB Housing Market Index is out. Bank of America (BAC) reports.

On Tuesday, April 19 at 8:30 AM, Housing Starts for March are published. Netflix (NFLX) reports.

On Wednesday, April 20 at 8:30 AM, the Existing Home Sales for March are printed. Tesla (TSLA) reports.

On Thursday, April 22 at 7:30 AM, the Weekly Jobless Claims are printed. Union Pacific (UNP) reports.

On Friday, April 23 at 8:30 AM, the S&P Global Composite Flash PMI is disclosed. American Express (AXP) reports. At 2:00 PM, the Baker Hughes Oil Rig Count are out.

As for me, the call from Washington DC was unmistakable, and I knew what was coming next. “How would you like to serve your country?” I’ve heard it all before.

I answered, “Of course, I would.”

I was told that for first the first time ever, foreign pilots had access to Russian military aircraft, provided they had enough money. You see, everything in the just collapsed Soviet Union was for sale. All they needed was someone to masquerade as a wealthy hedge fund manager looking for adventure.

No problem there.

And can you fly a MiG29?

No problem there either.

A month later, I was wearing the uniform of a major in the Russian Air Force, my hair cut military short, sitting in the backseat of a black Volga limo, sweating bullets.

“Don’t speak,” said my driver.

The guard shifted his Kalashnikov and ordered us to stop, looked at my fake ID card and waved us on. We were in Russia’s Zhukovky Airbase 100 miles north of Moscow, home of the country’s best interceptor fighter, the storied Fulcrum, or MiG-29.

I ended up spending a week at the top-secret base. That included daily turns in the centrifuge to make sure I was up to the G-forces demand by supersonic flight. Afternoons saw me in ejection training. There in my trainer, I had to shout “eject, eject, eject,” pull the right-hand lever under my seat, and then get blasted ten feet in the air, only to settle back down to earth.

As a known big spender, I was a pretty popular guy on the base, and I was invited to a party every night. Let me tell you that vodka is a really big deal in Russia, and I was not allowed to leave until I had finished my own bottle, straight.

In 1993, Russia was realigning itself with the west, and everyone was putting their best face going forward. I had been warned about this ahead of time and judiciously downed a shot glass of cooking oil every evening to ward off the worst effects of alcohol poisoning. It worked.

Preflight involved getting laced into my green super tight gravity suit, a three-hour project. Two women tied the necessary 300 knots, joking and laughing all the while. They wished me a good flight.

Next, I met my co-pilot, Captain A. Pavlov, Russia’s top test pilot. He quizzed me about my flight experience. I listed off the names: Laos, Cambodia, Thailand, Israel, Croatia, Serbia, Bosnia, Kuwait, Iraq, and Saudi Arabia. It was clear he still needed convincing.

Then I was strapped into the cockpit.

Oops!

All the instruments were in the Cyrillic alphabet….and were metric! They hadn’t told me about this, but I would deal with it.

We took off and went straight up, gaining 50,000 feet in two minutes. Yes, fellow pilots, that is a climb rate of an astounding 25,000 feet a minute. They call them interceptors for a reason. It was a humid day, and when we hit 50,000 feet, the air suddenly turned to snowflakes swirling around the cockpit.

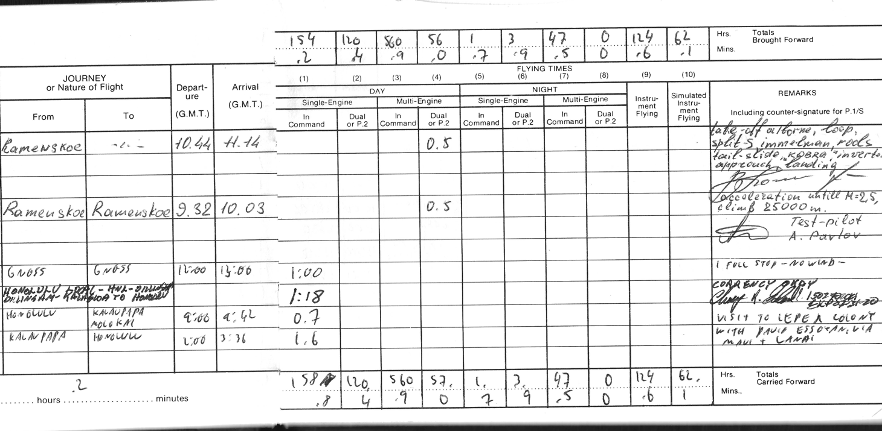

Then we went through a series of violent spins, loops, and other evasive maneuvers (see my logbook entry below). Some of them seemed aeronautically impossible. I watched the Mach Meter carefully, it frequently danced up to the “10” level. Anything over ten is invariably fatal, as it ruptures your internal organs.

Then Pavlov said, “I guess you are a real pilot, and he handed the stick over to me. I put the fighter into a steep dive, gaining the maximum handbook speed of March 2.5, or 2.5 times the speed of sound, or 767.2 miles per hour in seconds. Let me tell you, there is nothing like diving a fighter from 90,000 feet to the earth at 767.2 miles per hour.

Then we found a wide river and buzzed that at 500 feet just under the speed of sound. Fly over any structure over the speed of sound and the resulting shock wave shatters concrete.

I noticed the fuel gages were running near empty and realized that the Russians had only given me enough fuel to fly for an hour. That’s so I wouldn’t hijack the plane and fly it to Finland. Still, Pavlov trusted me enough to let me land the plane, no small thing in a $30 million aircraft. I made a perfect three-point landing and taxied back to base.

I couldn’t help but notice that there was a MiG-25 Foxbat parked in the adjoining hanger and asked if it was available. They said “yes”, but only if I had $10,000 in cash on hand, thinking this was an impossibility. I said, “no problem” and whipped out my American Express gold card.

Their eyes practically popped out of their heads, as this amounted to a lifetime of earnings for the average Russian. They took a picture of the card, called in the number, and in five minutes I was good to go.

They asked when I wanted to fly, and as I was still in my gravity suite I said, “How about right now?” The fuel truck duly back up and in 20 minutes I was ready for takeoff, Pavlov once again my co-pilot. This time, he let me do the takeoff AND the landing.

The first thing I noticed was the missile trigger at the end of the stick. Then I asked the question that had been puzzling aeronautics analysts for years. “If the ceiling of the MiG-25 was 90,000 feet and the U-2 was at 100,000 feet, how did the Russians make up the last 10,000 feet?

“It’s simple,” said Pavlov. Put on full power, stall out at 90,000 feet, then fire your rockets at the apex of the parabola to make up the distance. There was only one problem with this. If your stall forced you to eject, the survival rate was only 50%. That's because when the plane in free fall hit the atmosphere at 50,000 feet, it was like hitting a wall of concrete. I told him to go ahead, and he repeated the maneuver for my benefit.

It was worth the risk to get up to 90,000 feet. There you can clearly see the curvature of the earth, the sky above is black, you can see stars in the middle of the day, and your forward vision is about 400 miles. We were the highest men in the world at that moment. Again, I made a perfect three-point landing, thanks to flying all those Mustangs and Spitfires over the decades.

After my big flights, I was taken to a museum on the base and shown the wreckage of the U-2 spy plane flown by Francis Gary Powers shot down over Russia in 1960. After suffering a direct hit from a missile, there wasn’t much left of the U-2. However, I did notice a nameplate that said, “Lockheed Aircraft Company, Los Angeles, California.”

I asked, “Is it alright if I take this home? My mother worked at this factory during WWII building bombers.” My hosts looked horrified. “No, no, no, no. This is one of Russia’s greatest national treasures,” and they hustled me out of the building as fast as they could.

It's a good thing that I struck while the iron was hot as foreigners are no longer allowed to fly any Russian jets. And suddenly I have become very popular in Washington DC once again.

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Russian Test Pilot A. Pavlov

Entries in my Logbook (Notice visit to leper colony on line 9)

U-2 Spyplane

Global Market Comments

April 14, 2022

Fiat Lux

Featured Trade:

(JULY 22 ZERMATT, SWITZERLAND STRATEGY SEMINAR)

(THE BULL CASE FOR BANKS),

(JPM), (BAC), (C), (WFC), (GS), (MS)

Global Market Comments

April 13, 2022

Fiat Lux

Featured Trade:

(JOIN ME ON CUNARD’S MS QUEEN VICTORIA

FOR MY JULY 9, 2022 SEMINAR AT SEA)

(SOME BASIC TRICKS FOR TRADING OPTIONS)

With Covid cases down 70% in two weeks and headed much lower, it's time for me to re-introduce you to the Mad Hedge Seminar at Sea. I firmly believe that the pandemic will be over by the summer, and what better way to celebrate than with an elegant Norwegian Fjord cruise.

Come join me on Cunard Line’s elegant and luxurious Queen Victoria on a seven-day Norwegian Fjord Cruise.

For the first time in ten years, I am hosting a Seminar at Sea. I had planned to do this earlier but ran head-on into the pandemic, which should be gone by next summer. On the last Seminar at Sea, I and a group of subscribers crossed the Atlantic Ocean on the Queen Mary 2, passing over the Titanic wreck.

The Queen Victoria departs Southampton, England at 12:00 noon on July 3, 2022 and returns to Southampton on July 10. There I will be conducting the Mad Hedge Fund Trader’s Strategy Update, a three-hour discussion on the global financial markets. You will have to get to Southampton under your own steam, which is about an hour south of Victoria Station by train.

I’ll be giving you my up-to-date view on stocks, bonds, currencies, commodities, precious metals, and real estate. I’ll highlight the best long and short opportunities. And to keep you in suspense, I’ll be tossing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week.

Tickets are available for $499 for the seminar only.

Attendees will be responsible for booking their own cabins through Cunard, which is offering staterooms for this cruise for as little as $959 a person. To book your cruise, please click here. The cruise you need to book is no. V216. The Queen Victoria has not sailed for two years and this will be one of the first post-pandemic voyages.

To get the details of the cruise, please click here. The July 9 seminar will be held in the ship owner’s suite while we are crossing the North Sea in of the most elegant accommodations afloat on the seven seas. For a video of the owner’s suite, please click here.

Just visit Cunard’s website, or call them directly at 800-528-6273 to make your own arrangements.

The weather this time of year can range from balmy to tempestuous, depending on our luck. A brisk walk three times around the boat deck adds up to a mile. Full Internet access will be available for a price to follow the markets. Every dinner during the voyage will be black tie, so you might want to stop at Saks Fifth Avenue in Manhattan to get fitted for a second tux. I have arranged a few dinners with the captain for myself and will pass on any nuggets I gain in a future letter.

Don’t forget to bring your Dramamine and sea legs, although the 90,049-tonne, 964.5-foot long billion-dollar ship is so big, I doubt you’ll need them. Her facilities include seven restaurants, thirteen bars, three swimming pools, a ballroom, and a theater. I spend most of my time on these cruises writing deep research pieces, although I might take a few fencing classes.

Cunard is requiring Covid vaccination cards of all passengers, and so am I. They may also require a negative Covid test within three days of departure, as are most cruise lines these days. We’ll be sailing all the way up to 61 degrees, 81 minutes north latitude, about the same latitude as Anchorage, Alaska.

I look forward to meeting you and thank you for supporting my research. To purchase tickets for the seminar alone, click here or go to my online store at www.madhedgefundtrader.com and click on the “LUNCHEONS” tab.

Join Me for Lunch?

Global Market Comments

April 12, 2022

Fiat Lux

Featured Trade:

(A DAY IN THE LIFE OF THE MAD HEDGE FUND TRADER),

(SPY), (SPX), (QQQ), (FSLR), (SCTY), (TLT), (TBT), (FXE), (GLD), (GDX), (USO)

Diary Entry for Thursday, April 7, 2022

Dear Diary,

4:30 PM - the day before- Thought I’d check my Bloomberg to see how the Asian markets were opening. Yikes! They’re hammering bonds again. About damn time.

It looks like it is going to be a ‘RISK OFF” day. Better fasten my seat belt, put on my hard hat, and get ready for a busy day. No rest for the wicked. At least for the first 15 minutes.

5:00 PM - the day before Call from one of the top New York hedge funds. What’s going on with the markets? Prices for bonds and the major stock indexes look like they are in free fall.

Worse, he is losing money.

I told him that the memo is out. The bull market is over, as I have been predicting all year, and we are now probing for the lows. The “buy the dip” crowd retired to their Caribbean yachts.

Look what happened after the Pandemic surprise in 2020. Those who dumped stocks back then are still trying to get back in. Every dip was a “BUY” for two years. This is why 70% of active managers are underperforming their benchmarks this year.

By the way, had he read my new book, “Stock to Buy for the Coming Roaring Twenties”? (click here for the link). It outlines which sectors you should be accumulating now for the next bull market.

I said he owed me a nice dinner at Masa at Time Warner Center on Columbus Circle because he’s made so much money off me last year.

I don’t care if it costs $500 a person. High-end Japanese sake is cheaper than the best Bordeaux’s because Chinese billionaires have bid up the prices so much. Just get an algorithm to make a reservation, as it is now almost impossible for a human to get one.

Then he told me the real reason for his call. He knew I grew up near Hollywood, had dated several movie stars, and even appeared in a movie as an extra (Francis Ford Coppola’s Apocalypse Now).

What did I think of Coda, which his firm had put up the money to make? Is the film worth seeing?

I said only for the guys. I saw the film on the day it came out to gain insights on what my hardy ancestors went through. It’s about deaf family trying to run a commercial fishing business out of Gloucester, Massachusetts.

Even on a good day, this is a tough business. When I was a kid, my dad took me out on a commercial boat to see how the other half lived and I was seasick the entire time.

9:00 PM-Call from a friend at the People’s Bank of China in Beijing.

Who is going to win your midterm election? If the Republicans win, they will go to war with China immediately. Should we be worried?

I told him to put his concerns out of his mind. By November, the economy will still be booming, unemployment at record lows, inflation will be lower, gasoline will be cheaper, and the stock market might be at all time highs. With Trump still the party leader Democrats should maintain control….just.

Markets love a pro-globalization candidate, as this has been buttering their bread for the past 70 years. China does too, which has seen the Shanghai Index ($SSEC) finally crawling off the bottom after an 18-month meltdown. Mexico (EWW) looks good too.

Then he asked, did I, by any chance, recommend the film, No Time to Die, the latest James Bond flick and Daniel Craig’s last? Everyone in the Politbureau was seeing it.

“Absolutely,” I answered. I loved it. I always see the Bond films because I can revisit the many places around the world in have visited over the past 60 years. Got to love the cars, the gadgets, and the beautiful women. Real spies don’t look anything like them.

The plot does take a modern twist with a biotech weapon of mass destruction that looks suspiciously like covid. When did Bond learn how to fly a seaplane? Is there anything this guy can’t do?

Rumor is that the next Bond will be female.

There is also a nice family-oriented back-story, so it is safe to take the wife.

9:30 PM- Hit the rack and try to catch some shuteye before the next call.

2:00 AM-One of my former staff members at Morgan Stanley calls me from a Private Bank in Geneva to tell me that the Euro (FXE) is getting killed. Is it time to buy?

Not yet. After all the hawkish Fed talk on Friday, the US will certainly become the first developed country to raise interest rates in a decade.

As interest rate differentials are far and away the biggest drivers of the foreign exchange markets, that means the dollar will remain strong and the Euro weak for the foreseeable future. The war is also dragging on the Euro.

Then he moved on to the real purpose of his call. He was planning to take his kids out this weekend. Should they go to see Disney’s new film Encanto?

I loved it. The technology and graphics have taken a generational leap forward and the colors are amazing. It has an upbeat story, as do all Disney films. It gave my Spanish a workout. Notice how many Disney films are now aimed at minorities? That’s because the US is becoming a minority majority country, which is now only 58% white.

I slammed the phone back on the hook and went back to sleep.

6:00 AM - My website administrator called me in a panic. My online store is down. A hack attack prompted PayPal to suspend my account. Since I am one of their larger customers, I call my account rep and get it reopened.

The North Koreans should know better than to try to take down my site. One call to Beijing and I could have them all shot. Go hack Sony instead. I hear it’s a lot easier.

7:00 AM - Another call from my website administrator. The website is down. My book, the “Mad Hedge Guide to Trading Bitcoin,” (click here for the link) brought a traffic spike that is causing the servers to melt. I am burning up the Internet.

Is it something I said?

10:00 AM- I get a call from a leading money manager in London’s Mayfair district. Europe is closing. With gold flatlining last month, is it time to buy?

I said, “Not yet.” Look at the long-term charts, and it is clear that the barbarous metal is attempting to put in a short-term bottom.

World gold production fell for the first time in Q4 and will continue for the next four years by as much as 20%. After going nowhere last year, gold is “sold out.”

Russia is buying more of the yellow metal to dodge the sanctions imposed by the US government. So is the Chinese central bank, which is attempting to diversify away from dollar assets.

The next big bull market for the yellow metal won’t begin until the 2020s, as the commodity boom continues. Then it should run to $3,000-$5,000. Not until then will gold bugs be able to afford new suits.

If you really want to play the precious metals, you’re better off buying silver, which has a huge tailwind from exploding EV and solar panel production.

In the meantime, the Fed will continue to torture gold bulls until their coming Open Market Committee meeting where they will raise interest rates by 50 basis points. Then it is off to the races again.

And go have a pint of bitter for me at the Pig & Whistle next door, will you? Tell the owner, Nigel, to put it on my running tab. He owes me from my last Manchester United win.

He then raved about last summer’s sci-fi film, Dune, which won six Oscars but didn’t even get nominated for best picture. Did I see it?

I did and liked it. As a hard-core Trekkie, I am always a sucker for new big-budget sci-fi films. What is “spice” anyway?

I hate to think that this is the direction in which Hollywood is moving. But foreigners love these things. Explosions are easier to understand than the English language.

1:15 PM - My friend, JR, a senior executive at an oil major, calls from Houston. What the hell was going on with the price of oil (USO)? Only two years ago, it was at negative $37 in the futures market, then he blinked, and it was over $100.

I said don’t worry. Oil will cool off once the Ukraine war ends. It isn’t going to zero, or even the $20 handle again. But we may never see $130 again either. US production is ramping up to a level thought impossible only a month ago. And Biden is dumping a million barrels a day from the Strategic Petroleum Reserve.

Investors piling into the sector now risk buying the next top.

The junk bond market (HYG) is suggesting that more than half of all energy issuers are going to default.

Eventually, the strong end up swallowing the weak (think Exxon (XOM)). However, major institutions have already started picking up shares in the companies with the best balance sheets, buying quality at a once-in-a-generation discount.

Activists, like Carl Icahn, and the value players, such as Warren Buffet, are already involved.

In the meantime, buy some solar plays while they are cheap, like First Solar (FSLR). Sales are soaring, and costs are collapsing, setting up a ten bagger for the whole industry.

A 26% alternative investment tax credit means government support for stretches as far as the eye can see.

He said thanks, and the next time I was in town, he would buy me a 24-ounce chicken fried steak at Billy Bob’s that spilled over both sides of the plate (2,500 calories). I can’t wait. I’ll let my doctor have the heart attack.

He then told me why he really called. He knew I was a science buff. His buddies down on the ranch had just seen Belfast and liked it. Should he bother?

I loved the film, but it brought back bitter memories for me. The Irish Republican Army blew up one Morgan Stanley office building in the eighties, the Commercial Union Building, and tried to destroy a second at the Docklands with a truck bomb. It was such a stupid war, Catholics flighting Protestants.

But if you collect mid-century modern furniture, as I do, it's killer. It's in almost every scene.

2:00 PM - Still haven’t started on the letter yet. I have been answering dozens of email requests for information about the Trade Alert Service. This always happens whenever I have a hot performance streak on. The watchers want to become players. With my 11-year return approaching 540%, new subscribers are pouring in.

4:45 PM - Well, I got the letter done, but I’m too late. The web editor has gone to the DMV to register his new Prius, and the backup has gone to the yoga studio.

5:00 PM - I put on a 60-pound pack and my heavy climbing boots and head out the back door on a ten-mile hike up to the Tahoe Rim Trail. Gotta stay boot camp ready!

You never know when Uncle Sam is going to come calling again. Who cares if I’m 70? I can still hit a quarter on a tree at 50 yards with my Winchester Model 98 30-30.

I listen to an audiobook on my iPhone 13, the seven-volume Truman, by David McCullough about our 33rd president.

It is an amazing story.

Considered by most to be an average man at best, he dropped the atomic bombs on Japan, negotiated with Stalin at Potsdam, created the CIA and the Defense Department, desegregated the Army, ordered the Berlin airlift, went forward with the Hydrogen bomb project, stared down a megalomaniac senator McCarthy (Donald Trump?), and fought the Korean war to a draw.

By the time I hit the trail, a layer of thick fog already blanketed the city below me.

9:00 PM Back to my screens. The Euro has broken $1.01 again. Where was I last week? Asleep? Still, I am going to avoid the Euro for now. It has recently had such a sharp move down over the past two years, that the risk of a sudden, rip-your-face-off, short-covering rally is ever present.

I rather keep some dry powder and buy it a few cents lower. At this point, The World is short the Euro. Maybe they read my letter?

10:00 PM-Time to call it a night and break out a bottle of Duckhorn merlot. Jeez, Louise, it seems people only wanted to talk about the movies today. Is the market really that hard to trade?

The phone rings. Does anybody want my job?

Global Market Comments

April 11, 2022

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD,

or WATCH OUT FOR THE RECESSION WARNINGS)

(TLT), (TSLA), (FB), (CRSP), (TDOC), (GILD), (EDIT), (SQ), (INDU), (NVDA), (GS)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.