Global Market Comments

April 12, 2022

Fiat Lux

Featured Trade:

(A DAY IN THE LIFE OF THE MAD HEDGE FUND TRADER),

(SPY), (SPX), (QQQ), (FSLR), (SCTY), (TLT), (TBT), (FXE), (GLD), (GDX), (USO)

Global Market Comments

April 12, 2022

Fiat Lux

Featured Trade:

(A DAY IN THE LIFE OF THE MAD HEDGE FUND TRADER),

(SPY), (SPX), (QQQ), (FSLR), (SCTY), (TLT), (TBT), (FXE), (GLD), (GDX), (USO)

Diary Entry for Thursday, April 7, 2022

Dear Diary,

4:30 PM - the day before- Thought I’d check my Bloomberg to see how the Asian markets were opening. Yikes! They’re hammering bonds again. About damn time.

It looks like it is going to be a ‘RISK OFF” day. Better fasten my seat belt, put on my hard hat, and get ready for a busy day. No rest for the wicked. At least for the first 15 minutes.

5:00 PM - the day before Call from one of the top New York hedge funds. What’s going on with the markets? Prices for bonds and the major stock indexes look like they are in free fall.

Worse, he is losing money.

I told him that the memo is out. The bull market is over, as I have been predicting all year, and we are now probing for the lows. The “buy the dip” crowd retired to their Caribbean yachts.

Look what happened after the Pandemic surprise in 2020. Those who dumped stocks back then are still trying to get back in. Every dip was a “BUY” for two years. This is why 70% of active managers are underperforming their benchmarks this year.

By the way, had he read my new book, “Stock to Buy for the Coming Roaring Twenties”? (click here for the link). It outlines which sectors you should be accumulating now for the next bull market.

I said he owed me a nice dinner at Masa at Time Warner Center on Columbus Circle because he’s made so much money off me last year.

I don’t care if it costs $500 a person. High-end Japanese sake is cheaper than the best Bordeaux’s because Chinese billionaires have bid up the prices so much. Just get an algorithm to make a reservation, as it is now almost impossible for a human to get one.

Then he told me the real reason for his call. He knew I grew up near Hollywood, had dated several movie stars, and even appeared in a movie as an extra (Francis Ford Coppola’s Apocalypse Now).

What did I think of Coda, which his firm had put up the money to make? Is the film worth seeing?

I said only for the guys. I saw the film on the day it came out to gain insights on what my hardy ancestors went through. It’s about deaf family trying to run a commercial fishing business out of Gloucester, Massachusetts.

Even on a good day, this is a tough business. When I was a kid, my dad took me out on a commercial boat to see how the other half lived and I was seasick the entire time.

9:00 PM-Call from a friend at the People’s Bank of China in Beijing.

Who is going to win your midterm election? If the Republicans win, they will go to war with China immediately. Should we be worried?

I told him to put his concerns out of his mind. By November, the economy will still be booming, unemployment at record lows, inflation will be lower, gasoline will be cheaper, and the stock market might be at all time highs. With Trump still the party leader Democrats should maintain control….just.

Markets love a pro-globalization candidate, as this has been buttering their bread for the past 70 years. China does too, which has seen the Shanghai Index ($SSEC) finally crawling off the bottom after an 18-month meltdown. Mexico (EWW) looks good too.

Then he asked, did I, by any chance, recommend the film, No Time to Die, the latest James Bond flick and Daniel Craig’s last? Everyone in the Politbureau was seeing it.

“Absolutely,” I answered. I loved it. I always see the Bond films because I can revisit the many places around the world in have visited over the past 60 years. Got to love the cars, the gadgets, and the beautiful women. Real spies don’t look anything like them.

The plot does take a modern twist with a biotech weapon of mass destruction that looks suspiciously like covid. When did Bond learn how to fly a seaplane? Is there anything this guy can’t do?

Rumor is that the next Bond will be female.

There is also a nice family-oriented back-story, so it is safe to take the wife.

9:30 PM- Hit the rack and try to catch some shuteye before the next call.

2:00 AM-One of my former staff members at Morgan Stanley calls me from a Private Bank in Geneva to tell me that the Euro (FXE) is getting killed. Is it time to buy?

Not yet. After all the hawkish Fed talk on Friday, the US will certainly become the first developed country to raise interest rates in a decade.

As interest rate differentials are far and away the biggest drivers of the foreign exchange markets, that means the dollar will remain strong and the Euro weak for the foreseeable future. The war is also dragging on the Euro.

Then he moved on to the real purpose of his call. He was planning to take his kids out this weekend. Should they go to see Disney’s new film Encanto?

I loved it. The technology and graphics have taken a generational leap forward and the colors are amazing. It has an upbeat story, as do all Disney films. It gave my Spanish a workout. Notice how many Disney films are now aimed at minorities? That’s because the US is becoming a minority majority country, which is now only 58% white.

I slammed the phone back on the hook and went back to sleep.

6:00 AM - My website administrator called me in a panic. My online store is down. A hack attack prompted PayPal to suspend my account. Since I am one of their larger customers, I call my account rep and get it reopened.

The North Koreans should know better than to try to take down my site. One call to Beijing and I could have them all shot. Go hack Sony instead. I hear it’s a lot easier.

7:00 AM - Another call from my website administrator. The website is down. My book, the “Mad Hedge Guide to Trading Bitcoin,” (click here for the link) brought a traffic spike that is causing the servers to melt. I am burning up the Internet.

Is it something I said?

10:00 AM- I get a call from a leading money manager in London’s Mayfair district. Europe is closing. With gold flatlining last month, is it time to buy?

I said, “Not yet.” Look at the long-term charts, and it is clear that the barbarous metal is attempting to put in a short-term bottom.

World gold production fell for the first time in Q4 and will continue for the next four years by as much as 20%. After going nowhere last year, gold is “sold out.”

Russia is buying more of the yellow metal to dodge the sanctions imposed by the US government. So is the Chinese central bank, which is attempting to diversify away from dollar assets.

The next big bull market for the yellow metal won’t begin until the 2020s, as the commodity boom continues. Then it should run to $3,000-$5,000. Not until then will gold bugs be able to afford new suits.

If you really want to play the precious metals, you’re better off buying silver, which has a huge tailwind from exploding EV and solar panel production.

In the meantime, the Fed will continue to torture gold bulls until their coming Open Market Committee meeting where they will raise interest rates by 50 basis points. Then it is off to the races again.

And go have a pint of bitter for me at the Pig & Whistle next door, will you? Tell the owner, Nigel, to put it on my running tab. He owes me from my last Manchester United win.

He then raved about last summer’s sci-fi film, Dune, which won six Oscars but didn’t even get nominated for best picture. Did I see it?

I did and liked it. As a hard-core Trekkie, I am always a sucker for new big-budget sci-fi films. What is “spice” anyway?

I hate to think that this is the direction in which Hollywood is moving. But foreigners love these things. Explosions are easier to understand than the English language.

1:15 PM - My friend, JR, a senior executive at an oil major, calls from Houston. What the hell was going on with the price of oil (USO)? Only two years ago, it was at negative $37 in the futures market, then he blinked, and it was over $100.

I said don’t worry. Oil will cool off once the Ukraine war ends. It isn’t going to zero, or even the $20 handle again. But we may never see $130 again either. US production is ramping up to a level thought impossible only a month ago. And Biden is dumping a million barrels a day from the Strategic Petroleum Reserve.

Investors piling into the sector now risk buying the next top.

The junk bond market (HYG) is suggesting that more than half of all energy issuers are going to default.

Eventually, the strong end up swallowing the weak (think Exxon (XOM)). However, major institutions have already started picking up shares in the companies with the best balance sheets, buying quality at a once-in-a-generation discount.

Activists, like Carl Icahn, and the value players, such as Warren Buffet, are already involved.

In the meantime, buy some solar plays while they are cheap, like First Solar (FSLR). Sales are soaring, and costs are collapsing, setting up a ten bagger for the whole industry.

A 26% alternative investment tax credit means government support for stretches as far as the eye can see.

He said thanks, and the next time I was in town, he would buy me a 24-ounce chicken fried steak at Billy Bob’s that spilled over both sides of the plate (2,500 calories). I can’t wait. I’ll let my doctor have the heart attack.

He then told me why he really called. He knew I was a science buff. His buddies down on the ranch had just seen Belfast and liked it. Should he bother?

I loved the film, but it brought back bitter memories for me. The Irish Republican Army blew up one Morgan Stanley office building in the eighties, the Commercial Union Building, and tried to destroy a second at the Docklands with a truck bomb. It was such a stupid war, Catholics flighting Protestants.

But if you collect mid-century modern furniture, as I do, it's killer. It's in almost every scene.

2:00 PM - Still haven’t started on the letter yet. I have been answering dozens of email requests for information about the Trade Alert Service. This always happens whenever I have a hot performance streak on. The watchers want to become players. With my 11-year return approaching 540%, new subscribers are pouring in.

4:45 PM - Well, I got the letter done, but I’m too late. The web editor has gone to the DMV to register his new Prius, and the backup has gone to the yoga studio.

5:00 PM - I put on a 60-pound pack and my heavy climbing boots and head out the back door on a ten-mile hike up to the Tahoe Rim Trail. Gotta stay boot camp ready!

You never know when Uncle Sam is going to come calling again. Who cares if I’m 70? I can still hit a quarter on a tree at 50 yards with my Winchester Model 98 30-30.

I listen to an audiobook on my iPhone 13, the seven-volume Truman, by David McCullough about our 33rd president.

It is an amazing story.

Considered by most to be an average man at best, he dropped the atomic bombs on Japan, negotiated with Stalin at Potsdam, created the CIA and the Defense Department, desegregated the Army, ordered the Berlin airlift, went forward with the Hydrogen bomb project, stared down a megalomaniac senator McCarthy (Donald Trump?), and fought the Korean war to a draw.

By the time I hit the trail, a layer of thick fog already blanketed the city below me.

9:00 PM Back to my screens. The Euro has broken $1.01 again. Where was I last week? Asleep? Still, I am going to avoid the Euro for now. It has recently had such a sharp move down over the past two years, that the risk of a sudden, rip-your-face-off, short-covering rally is ever present.

I rather keep some dry powder and buy it a few cents lower. At this point, The World is short the Euro. Maybe they read my letter?

10:00 PM-Time to call it a night and break out a bottle of Duckhorn merlot. Jeez, Louise, it seems people only wanted to talk about the movies today. Is the market really that hard to trade?

The phone rings. Does anybody want my job?

Global Market Comments

April 11, 2022

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD,

or WATCH OUT FOR THE RECESSION WARNINGS)

(TLT), (TSLA), (FB), (CRSP), (TDOC), (GILD), (EDIT), (SQ), (INDU), (NVDA), (GS)

The drumbeat of a coming recession is getting louder and louder.

There is no doubt that the traditional signals of a slowing economy are already flashing yellow, if not bright red.

Rocketing interest rates are the most obvious one, with ten-year US Treasury bonds yield soaring from 1.33% to 2.71% in a mere four months. This is why investors pulled a gut-punching $87 billion out of bond funds in Q1.

If the Fed continues with a quarter point rise at every meeting for the rest of the year, we might escape this cycle without a recession. If the Fed ramps up to a half point rate at every meeting as was discussed last week a recession becomes a sure thing.

Imminent positive real yields for the first time in a decade also threaten to draw money out of stocks and into bonds.

I happen to be in the non-recessionary camp and the reason is very simple. Companies are making too much damn money. This is especially true for technology companies, which account for some 75% of the profits made in the US. If anything, their profits are accelerating, although at a lower rate than seen in 2021.

Certainly, the tech companies themselves aren’t buying the recession scenario. They are hiring and investing as if the economic boom will continue forever. Tesla alone has completed two new factories in the past month, in Berlin, Germany and Austin, Texas, each capable of producing a half million vehicles a year. Tesla’s existing factories are all expanding capacity.

Sitting here in Silicon Valley, I can tell you that the job market is as hot as ever. Those who have jobs, like my own kids, are besieged with multiple job offers. It seems the standard time to keep a job these days is a year, after which one takes the next upgrade, promotion, and batch of stock options.

But the stock market seems hell-bent on discounting a recession anyway. You see this in the most economically sensitive sectors of the market, banks, semiconductors, and transport, which have just clocked a miserable month. If I am right (I’m always right), and there is no recession, these will be the sectors that lead the recovery.

Until the market makes up its mind, the disciplined among us will have to while away our time constructing lists of companies to buy for the rebound. That’s when the next leg of the bull market resumes.

We find out when this happens on Wednesday when the next batch of inflation data is released, which is likely to be diabolical.

Quantitative Tightening to Start as Soon as May, according to Fed Governor Brainard. That means our central bank will start selling its vast $9 trillion in bond holding in two months, a huge market negative. Bonds tanked. The Fed only quit quantitative easing in March.

Tesla Blows Away Q1 Sales, shipping 310,000 vehicles, far above expectations. This is despite supply chain problems, soaring interest rates, and the Ukraine War. Sky-high gasoline prices helped a lot, which is driving buyers into Tesla showrooms in drives. All other competitors are falling farther behind, unable to obtain parts and commodities which Tesla locked up long ago. This puts Tesla well on its way to its 1.5 million production goal for this year. Keep buying (TSLA) on dips. My long-term target is $10,000 a share.

The Metaverse May be Worth $13 Trillion by 2030, says Citibank. The same is so for Web 3.0, which includes virtual worlds, like gaming and applications in virtual reality. Citi’s broad vision of the metaverse includes smart manufacturing technology, virtual advertising, online events like concerts, as well as digital forms of money such as cryptocurrencies like I’ll be looking for the best plays.

Biotech May Be Staging a Comeback, after spending a year in hell, taking some shares down 80%-90%. Investors are also nibbling at the sector as a recession and bear market plays, as these companies keep growing regardless of the economic cycle. Buy (CRSP), Teledoc (TDOC), Gilead Sciences (GILD), ad Editas Medicine (EDIT) on dips.

US Bonds Just Suffered their Worst Quarter in a Half Century, with yields rocketing from 1.33% to 2.71%, and Mad Hedge was triple short most of the way down. Bear LEAPS holders, which are many of you, made fortunes. We could stall around current levels until the Fed delivered both barrels of a shot gun, two back-to-back half point rate rises from the Fed.

30-Year Fixed Rate Mortgage Rates Top 5.00%, trashing the home builders. If you thought buying a home was tough, its worst now. So far, no impact on home prices.

US Dollar Hits New Two-Year High. It’s all about rising interest rates. Expect a stronger greenback to come before the turn. The coming QT will put a two-step turbocharger on the move.

German Battery Sales Soar By 67%, to residential buyers to cope with pending energy shortages. Germany already has 2.2 million solar installations out of a population of 83 million. It’s a very smart move as batteries powered by solar panels can remove you from the grid entirely, as I have amply proven with my own installation. It may be the permanent solution to over-dependence on Russian energy supplies.

Tesla Moving into Bitcoin Mining, in partnership with Blockstream and Block, formerly Square (SQ). Tesla will supply the electric power with its massive 3.8-megawatt solar array. That is the size of a large nuclear power plant. The mining facility is designed to be a proof of concept for 100% renewable energy bitcoin mining at scale. If Elon Musk likes Bitcoin maybe you should too.

The Bank of Japan Now Owns 7% of the Japanese Stocks Market. The central bank had to buy the shares after it had already bought all the bonds in the country to support the economy. So, what happens when the policy flips from QE to QT? How about unloading $371 billion worth of shares on the market. This would e a neat trick since so much of the country’s shares are locked up in corporate cross holdings. Methinks I’ll be steering clear of Japanese stocks for the foreseeable future.

My Ten-Year View

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still historically cheap, oil peaking out soon, and technology hyper accelerating, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The America coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 240,000 here we come!

My March month-to-date performance retreated to a modest 0.38%. My 2022 year-to-date performance ended at a chest-beating 27.23%. The Dow Average is down -4.20% so far in 2022. It is the greatest outperformance on an index since Mad Hedge Fund Trader started 14 years ago. My trailing one-year return maintains a sky-high 68.89%.

On the next capitulation selloff day, which might come with the April Q1 earnings reports, I’ll be adding long positions in technology, banks, and biotech. I am currently in a rare 100% cash position awaiting the next ideal entry point.

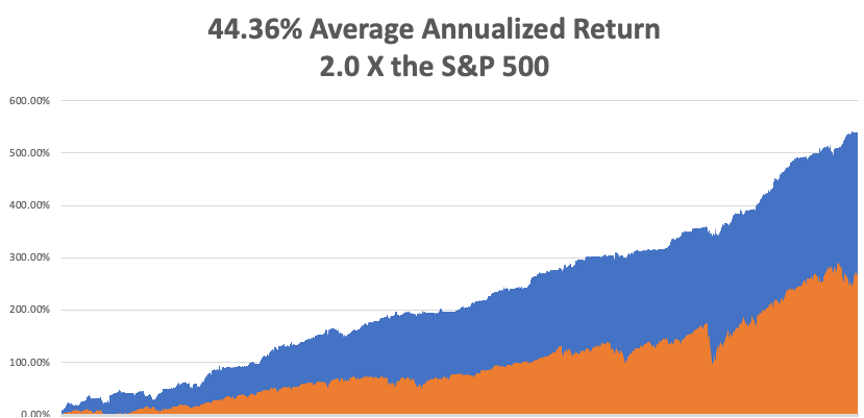

That brings my 13-year total return to 539.79%, some 2.10 times the S&P 500 (SPX) over the same period. My average annualized return has ratcheted up to 44.36%, easily the highest in the industry.

We need to keep an eye on the number of US Coronavirus cases at 80.3 million, up only 100,000 in a week and deaths topping 985,000 and have only increased by 2,000 in the past week. You can find the data here. Growth of the pandemic has virtually stopped, with new cases down 98% in two months.

On Monday, April 11 at 8:00 AM EST, Consumer Inflation Expectations are released.

On Tuesday, April 12 at 8:30 AM, the Core Inflation Rate for March is announced.

On Wednesday, April 13 at 8:30 AM, the Producer Price Index for March is printed.

On Thursday, April 14 at 7:30 AM, the Weekly Jobless Claims are printed. We also get Retail Sales for March.

On Friday, April 8 at 8:30 AM, NY Empire State Manufacturing Index for March. At 2:00 PM, the Baker Hughes Oil Rig Count is out.

As for me, back in 2002, I flew to Iceland to do some research on the country’s national DNA sequencing program called deCode, which analyzed the genetic material of everyone in that tiny nation of 250,000. It was the boldest project yet in the field and had already led to several breakthrough discoveries.

Let me start by telling you the downside of visiting Iceland. In the country that has produced three Miss Universes over the last 50 years, suddenly you are the ugliest guy in the country. Because guess what? The men are beautiful as well, the decedents of Vikings who became stranded here after they cut down all the forests on the island for firewood, leaving nothing with which to build long boats. I said they were beautiful, not smart.

Still, just looking is free and highly rewarding.

While I was there, I thought it would be fun to trek across Iceland from North to South in the spirit of Shackleton, Scott, and Amundsen. I went alone because after all, how many people do you know who want to trek across Iceland? Besides, it was only 150 miles or ten days to cross. A piece of cake really.

Near the trailhead, the scenery could have been a scene from Lord of the Rings, with undulating green hills, craggy rock formations, and miniature Icelandic ponies galloping in herds. It was nature in its most raw and pristine form. It was all breathtaking.

Most of the central part of Iceland is covered by a gigantic glacier over which a rough trail is marked by stakes planted in the snow every hundred meters. The problem arises when fog or blizzards set in, obscuring the next stake, making it too easy to get lost. Then you risk walking into a fumarole, a vent from the volcano under the ice always covered by boiling water. About ten people a year die this way.

My strategy in avoiding this cruel fate was very simple. Walk 50 meters. If I could see the next stake, I proceeded. If I couldn’t, I pitched my tent and waited until the storm passed.

It worked.

Every 10 kilometers stood a stone rescue hut with a propane stove for adventurers caught out in storms. I thought they were for wimps but always camped nearby for the company.

I was 100 miles into my trek, approached my hut for the night, and opened the door to say hello to my new friends.

What I saw horrified me.

Inside was an entire German Girl Scout Troop spread out in their sleeping bags all with a particularly virulent case of the flu. In the middle was a girl lying on the floor soaking wet and shivering, who had fallen into a glacier fed river. She was clearly dying of hypothermia.

I was pissed and instantly went into Marine Corp Captain mode, barking out orders left and right. Fortunately, my German was still pretty good then, so I instructed every girl to get out of their sleeping bags and pile them on top of the freezing scout. I then told them to strip the girl of her wet clothes and reclothe her with dry replacements. They could have their bags back when she got warm. The great thing about Germans is that they are really good at following orders.

Next, I turned the stove burners up high to generate some heat. Then I rifled through backpacks and cooked up what food I could find, force-fed it into the scouts and emptied my bottle of aspirin. For the adult leader, a woman in her thirties who was practically unconscious, I parted with my emergency supply of Jack Daniels.

By the next morning, the frozen girl was warm, the rest were recovering, and the leader was conscious. They thanked me profusely. I told them I was an American “Adler Scout” (Eagle Scout) and was just doing my job.

One of the girls cautiously moved forward and presented me with a small doll dressed in a traditional German Dirndl which she said was her good luck charm. Since I was her good luck, I should have it. It was the girl who was freezing the death the day before.

Some 20 years later I look back fondly on that trip and would love to do it again.

Anyone want to go to Iceland?

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Iceland 2002

“By 2027, 75% of the companies in the Fortune 500 will not be there unless they make bold changes and digitally transform their companies. It’s do or die,” said Bill McDermott, CEO of ServiceNow (NOW), which offers cloud computing platforms for companies. I couldn’t agree more.

Global Market Comments

April 8, 2022

Fiat Lux

Featured Trade:

(WEDNESDAY, JUNE 29, 2022 LONDON STRATEGY LUNCHEON)

(APRIL 6 BIWEEKLY STRATEGY WEBINAR Q&A),

(SPY), (TSLA), (TLT), (TBT), (AAPL), (IBB), (GOOGL), (ADBE), (NVDA), (FXE), ($BTCUSD)

Below please find subscribers’ Q&A for the April 6 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Silicon Valley.

Q: The iShares Biotechnology ETF (IBB) is down quite a bit—do I wait a bit longer to put on a debit call spread LEAPS for the end of this year and possibly the end of 2024?

A: This is really one of the two most interesting parts of the market right now. The biotech stocks have been absolutely destroyed over the past year—down 70, 80, 90% in some cases; and at that level, the worst-case scenario is in the price. Maybe we bounce along the bottom for another year. In the best case, these things all double or triple or even go up 10 times. We’re very close to putting on a 2024 call spread in the best biotech names, and if you get the Mad Hedge Biotech Letter (Click here for the link), you already know what they are because the downside risk on these things is getting close to nil, and the upside is 10 times. I like that kind of math—when the upside versus the downside is 10 to 1 in your favor. When I see specific LEAPS opportunities, I’ll send them out to you, but the answer is: not yet. We’re getting very close on biotech, however.

Q: I sold about a third of my ProShares UltraShort 20+ Year Treasury (TBT) position at $22.00 for a nice 40% gain, thank you very much. Should I hold the rest for a while? And is there a significant upside for 2022?

A: I’ve been telling everyone: hold those shorts. I know those of you who put on the December $150-$155 vertical bear put spread or the December $145-$150 vertical bear put spread already have substantial profits, but the time value on these options is still large, so there is still quite a lot of these profits to be made hanging on to all of your put spreads in the ProShares UltraShort 20+ Year Treasury Bond ETF (TLT). And is there a substantial downside from here? I think yes! If the Fed goes to a half-point rate hike schedule for the next 4 meetings, the (TLT) is absolutely going down to a $105 or $110 level or so. So, keep those shorts and add to shorts on rallies. We came close. I said sell on a $6 point rally and we got a $5 point rally. I didn't pull the trigger, and of course, now we’re here at new lows.

Q: Are we close to buying LEAPS in tech?

A: Yes, I think that once this current meltdown finishes, I want to go back in there. But I want to go long-dated.

Q: What does rapid unwind of the Fed balance sheet mean for the markets?

A: It’s terrible! The Fed has a balance sheet close to $9 trillion dollars. Before the financial crisis of ‘07, it was $800 million dollars, and in fact, in the last 4 years, it has gone up from $20 trillion to $30 trillion. So these are just bubblicious levels for the Fed to own. And what is QT or quantitative tightening? They sell those bonds. And of course, everyone knows they’re going to sell, so they’re dropping bids for bonds like crazy right now—that's why you’re getting the meltdown in the (TLT). This is bad for the stock market; there’s no world in which the stock market goes up with sharply rising interest rates. The best case is that you give up 20% and then make some of it back, and then give up 20% and then make some of it back. So yeah, expect to hear a lot about QT. We only ended QE or quantitative easing about 3 weeks ago, and it looks like we may go straight into QT as soon as May. And boy, the bond market is sure reflecting that today.

Q: How long will wage inflation last? Can I count on 10% pay increases forever?

A: No, it will last until the next recession. I have a feeling that the unemployment rate will hit all-time lows next month—probably 3.2% or 3.3%. And we’re essentially at a full employment economy right now. What happens next? Recession probably in one or two years. Then those wage hikes disappear completely, and people start getting laid off, and goodbye to inflation of all kinds since 60% or 70% of the inflation calculation is wage cost.

Q: What is a good age to retire?

A: Never. I can’t tell you how many friends I’ve had who retire and die within a year. I had one friend retire and he died the next day. What you could do is keep your old job and cut your hours by half, or you could retire from your old job to go on to a new job that you love, like opening a restaurant or a job built around your lifetime hobby, whatever that is. As long as you stay engaged, you keep Alzheimer’s at bay and you’re an active contributing person to society. As soon as you stop doing that and just start doing something like golf, your days are numbered.

Q: What factors will create a recession in 2022?

A: Well I don't think that's going to happen; that would be like multiple 1% rate rises by the Fed, and the Fed completely panicking like we said, and causing a premature recession. But I do think that by 2024 rates will be so high that we will get a recession, probably a short one, maybe 6 months. A lot also depends on the war and if Europe can replace their Russian gas/oil fast enough or they go into an oil shock and recession there.

Q: Will the Fed destroy the economy in order to save it?

A: Yes, they will, if we get inflation up into the teens, which we saw in the 1980s, they absolutely will raise rates. And then I think the 10-year made it to 12% in the early 80s when Volcker was around, and the overnight rate got to 18%. And I know that because I bought a coop in New York City with a mortgage rate of 18%. I took out one of the first floating rate mortgages and by the time I sold the house, the mortgage rate had dropped down to 11% and the value of the home had doubled.

Q: Google (GOOG), Adobe (ADBE), and Apple (AAPL) spreads are treading water.

A: That is a sign that these are the stocks that will lead the next recovery. So, only 20% down, top to bottom, in Apple while all other stocks were getting hammered for 40% or more means Apple is going to lead any recovery in the market. Watch these big tech stocks carefully—they are the new leaders, they just don’t know it yet.

Q: What will inflation do to the housing market? Should I sell or hold my investment properties?

A: Keep them. Housing is one of the biggest beneficiaries of inflation. Not only do the house prices go up, so does everything that goes into the house, like the copper, steel, lumber, kitchen appliances, etc. You really have the best play on inflation, and I don’t think interest rates will kill the housing market. I think all that will happen is people will move from 30-year fixed to 5-year adjustables, as they have done in previous high interest rate cycles.

Q: Where is the buy territory on the Mad Hedge Market Timing Index?

A: Below 20. It’s almost impossible to lose money when you buy at a market timing index of 20. You may get a day or two visit down into the teens, but if you hang on, that’ll become a big moneymaker for you. That’s been working for me for 50 years—it should work for you too.

Q: Do the chips and transports breaking down worry you about the general market?

A: No, I think they’re discounting a recession that isn’t going to happen. Remember half of all the recessions discounted in the market don’t actually happen, and I think that these are one of those non-recessionary selloffs. But it may take them a couple of months to figure out that this bull market still has a couple of years of life to it and that it’s too early to sell. By the way, once people realize that they discounted the recession too early, what are they going to pour back into the fastest? The semiconductor stocks. That's why I’ve got a laser focus on NVIDIA (NVDA).

Q: If there is no recession coming, are the retailers getting too oversold?

A: Yes, but in the world that’s out there, where you really only want to own two or three of the best sectors and avoid the other 97, retailers are the ones you want to avoid—unless there's some specific single company story that you know about.

Q: Housing prices can’t fall when there's such enormous demand coming from millennials, right?

A: That’s true. In fact, the number of houses that need to be built to meet this demand is anywhere from one to five million, so this is a shortfall that will take at least a decade to address, and house prices don’t fall in that situation. They may appreciate at a slower rate, but they will appreciate, nonetheless.

Q: Is there any level where you would consider a call spread in the TLT?

A: Well, I had the April $127-$130 vertical bull call spread and I had my head handed to me. So somewhere, but clearly not yet—again, it depends a lot on what the Fed does and how fast.

Q: What’s the outlook for the Euro (FXE), (NVDA)?

A: Lower. Until the Ukraine War ends, they get an economic recovery, and they wean themselves off of Russian energy and move over to American energy. And that's at least a year down the road, so I’m not rushing into any European investment—stocks, bonds, or currencies.

Q: Are rising interest rates good for banks?

A: Yes, but right now those benefits are being offset by recession fears which will probably go away in a couple of months. So that kind of makes banks a strong buy right here.

Q: When the Shanghai lockdown ends, will it create another surge in commodity prices?

A: Absolutely, yes. China is the world's largest consumer of commodities, and the restoration of any of their purchasing power will certainly be great for all commodity prices—food, energy, metals, you name it.

Q: Is Tesla (TSLA) a LEAPS candidate?

A: Yes but wait for it to take a run at the $700 low that we saw last month. We probably won’t get there, but $800 this time around is probably a great LEAPS candidate for Tesla going forward. I expect them to meet all of their goals for production this year.

Q: Won’t Bitcoin ($BTCUSD) keep falling if equity markets are lower?

A: Yes, but we don’t have that much lower to go in equity markets—maybe 10%. So just as we’re looking to buy equities and the smaller technology stocks on dips, we're also looking to buy Bitcoin on dips. If we can get back into the $30,000 handle, that might be a ripe buy territory for all the cryptocurrency plays.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Stay Healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

April 7, 2022

Fiat Lux

Featured Trade:

(HOW THE COST OF ENERGY IS GOING TO ZERO),

(SPWR), (TSLA)

Global Market Comments

April 6, 2022

Fiat Lux

SPECIAL CRISPR TECHNOLOGY ISSUE

Featured Trade:

(HOW CRISPR TECHNOLOGY MAY SAVE YOUR LIFE),

(TMO), (OVAS), (CLLS), (SGMO)

Global Market Comments

April 5, 2022

Fiat Lux

Featured Trade:

(DEMOGRAPHICS AS DESTINY),

(EIS)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.