Global Market Comments

April 7, 2022

Fiat Lux

Featured Trade:

(HOW THE COST OF ENERGY IS GOING TO ZERO),

(SPWR), (TSLA)

Global Market Comments

April 7, 2022

Fiat Lux

Featured Trade:

(HOW THE COST OF ENERGY IS GOING TO ZERO),

(SPWR), (TSLA)

Global Market Comments

April 6, 2022

Fiat Lux

SPECIAL CRISPR TECHNOLOGY ISSUE

Featured Trade:

(HOW CRISPR TECHNOLOGY MAY SAVE YOUR LIFE),

(TMO), (OVAS), (CLLS), (SGMO)

Global Market Comments

April 5, 2022

Fiat Lux

Featured Trade:

(DEMOGRAPHICS AS DESTINY),

(EIS)

If demographics is destiny, then America’s future looks bleak. At least, that is the inevitable conclusion if demographics is your only consideration.

Suddenly, Biden’s decision to allow 100,000 Ukrainian refugees into the US makes all the sense in the world.

I have long been a fan of demographic investing, which creates opportunities for traders to execute on what I call “intergenerational arbitrage”.

When the numbers of the middle-aged are falling, risk markets plunge. Front run this data by two years, and you have a great predictor of stock market tops and bottoms that outperforms most investment industry strategists.

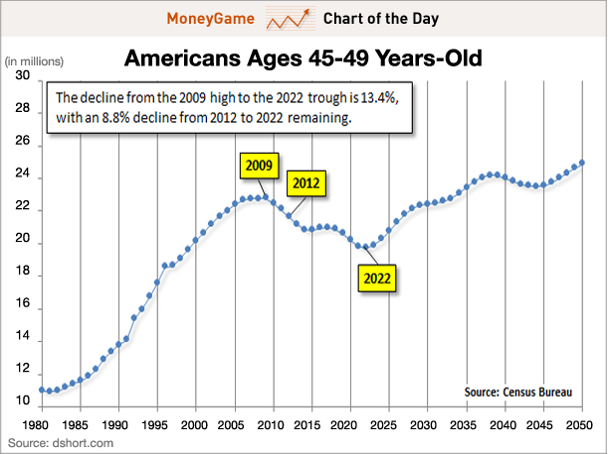

You can distill this even further by calculating the percentage of the population that is in the 45-49 age bracket, according to my friend, demographics guru Harry S. Dent.

The reasons for this are quite simple. The last five years of child-rearing are the most expensive. Think of all that pricey sports equipment, tutoring, braces, first cars, first car wrecks, and the higher insurance rates that go with it. I can vouch for this idea as I have been through it five times.

Older kids need more running room, which demands larger houses with more amenities. No wonder it seems that dad is writing a check or whipping out a credit card every five seconds. I know because I have five kids of my own. As long as dad is in spending mode, stock and real estate prices rise handsomely, as do most other asset classes. Dad, you’re basically one giant ATM.

As soon as kids flee the nest, this spending grinds to a juddering halt. Adults entering their fifties cut back spending dramatically and become prolific savers, seeing retirement on the horizon.

Empty nesters also start downsizing their housing requirements, unwilling to pay for those empty bedrooms, which in effect, become expensive storage facilities.

This is highly deflationary and causes a substantial slowdown in GDP growth. That is why the stock and real estate markets began their slide in 2007, while it was off to the races for the Treasury bond market.

The data for the US is not looking so hot right now. Americans aged 45-49 peaked in 2009 at 23% of the population. According to US census data, this group then began a 13-year decline to only 19% by 2022. This was a major reason why I ran huge shorts across all “RISK ON” assets in 2008, which proved highly profitable.

You can take this strategy and apply it globally with terrific results. Not only do these spending patterns apply globally, they also back test with a high degree of accuracy. Simply determine when the 45-49 age bracket is peaking for every country and you can develop a highly reliable timetable for when and where to invest.

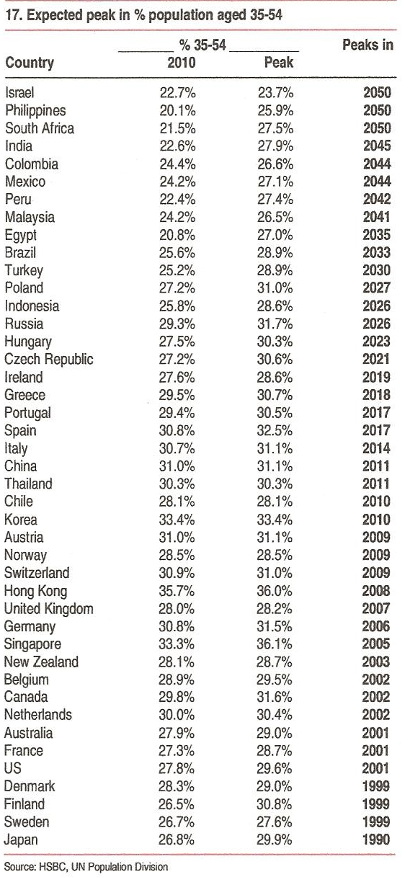

The numbers explain a lot of what is going on in the world today. I have reproduced it below. From it, I have drawn the following conclusions:

* The US (SPY) peaked in 2001 when our first “lost decade” began.

*Japan (EWJ) peaked in 1990, heralding 30 years of falling asset prices, giving you a nice back test.

*Much of developed Europe, including Switzerland (EWL), the UK (EWU), and Germany (EWG), followed in the late 2,000’s and the current sovereign debt debacle started shortly thereafter.

*South Korea (EWY), an important G-20 “emerged” market with the world’s lowest birth rate peaked in 2010.

*China (FXI) topped in 2011, explaining why we have seen three years of dreadful stock market performance despite torrid economic growth. It has been our consumers driving their GDP, not theirs.

*The “PIIGS” countries of Portugal, Ireland (EIRL), Greece (GREK), and Spain (EWP) didn’t peak until the end of the last decade. That means you could see some ballistic stock market performances if the Ukraine debacle is dealt with in the near future.

*The outlook for other emerging markets, like Russia (RSX), Indonesia (IDX), Poland (EPOL), Turkey (TUR), Brazil (EWZ), and India (PIN) is quite good, with spending by the middle age not peaking for 7-25 years.

*Which country will have the biggest demographic push for the next 38 years? Israel (EIS), which will not see consumer spending max out until 2050. Better start stocking up on things Israelis buy.

Like all models, this one is not perfect, as its predictions can get derailed by a number of extraneous factors. Rapidly lengthening life spans could redefine “middle age”. Personally, I’m hoping 70 is the new 40.

Immigration could starve some countries of young workers (like Japan), while adding them to others (like Australia). Foreign capital flows in a globalized world can accelerate or slow down demographic trends. The new “RISK ON/RISK OFF” cycle can also have a clouding effect.

So why am I so bullish now? Because demographics is just one tool in the cabinet. Dozens of other economic, social, and political factors drive the financial market's long-term.

To buy Harry Dent’s insightful tome at discount Amazon pricing, please click here.

In the meantime, I’m going to be checking out the shares of the matzo manufacturer down the street.

Global Market Comments

April 4, 2022

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or WELCOME TO THE ROUND TRIP MARKET)

(SPY), (TLT), (VIX)

If you had followed my advice and taken a cruise around the world in December, you would be getting home about now. A review of your portfolio would review that most of your positions were either unchanged or down slightly.

And if you had chunky positions in bond shorts, as I pleaded, begged, and cajoled you into taking on, you would be sitting pretty. In fact, you could well afford to take yet another cruise around the world.

That could be the best advice I can give right now, for the next quarter, the market will remain trapped in a wide but volatile range. That’s fine if you are backed up with mainframe computers, a programming staff of a dozen strong, and dedicated lightning-fast fiber optic cables, all the resources of a high-frequency trader shooting for pennies per trade.

If instead, you’re trading on your iPhone in between meetings at work, on every other hole at the golf course, or whenever you have free time, as many of you do, you may well want to sit Q2 out. There are not any great trades out there at the moment, the market is still expensive and the challenges ahead are legion.

For a start, stocks are in the process of discounting one of those annoying recessions that aren’t going to happen, as it does about half the time. I know this is important for many of you who run their own businesses remorselessly tied to the economic cycle.

Yes, I know that there is a rising tide of recession calls from the analyst community. But the models that reliably worked in the past are missing two crucial factors.

They never had to account for Medusa’s head of supply chain problems we now face, where perhaps 5% of US GDP is tied up on the West coast docks stacked in containers ten high. Untie this Gordian knot and you get another surprise spurt for the economy.

The other is the coming reconstruction of Ukraine, one of the greatest public works projects of all time, on a scale with the WWII Marshall Plan. Every major engineering company in the world will have to get involved, including Fluor (FLR), Bechtel (private), and those in Europe, Japan, and China. I reckon it could add 1% of global growth per year for the next several years.

How are the impoverished Ukrainians going to pay for all this work? With the $1 trillion in overseas Russian assets already seized, Ukraine easily gets control through proceedings at the World Court.

All Putin really accomplished with his war was to bring forward the end of oil by 20 years, at least for Russia, and to shrink the Russian standard of living by 90% practically overnight. It has been duly kicked out of the global economy. A million Russians have already lost their jobs and the shelves in Moscow are empty.

By the way, you may have noticed that Apple was up every day for 11 days for the first time since 2003. All the war really meant is that you got to buy Apple for a few minutes at $150 instead of $160. This is not what coming recessions are made of. The Volatility Index (VIX) at $19 is screaming as much.

It all confirms my 2022 scenario of a rambunctious H1 followed an H2 zeroing in on new all-time highs. You heard it here first!

Now for last week’s highlights:

Unemployment Plunges to 3.6%, a new cycle low, with the hot 431,000 March nonfarm Payroll. It’s yet another reason for the Fed to raise interest rates and increases the prospects of a 50-basis point rise this month. Leisure and Hospitality gained an eye-popping 118,000, Professional & Business Services 102,000, and Manufacturing 38,000. The U-6 “discouraged worker rate” fell to an incredible 6.9%. The back months saw big upward revisions. Overall, it was a blowout report.

ADP up 455,000 in March, showing the jobs market is still on fire. Services are seeing huge gains. Leisure & Hospitality continues its post covid bounce back. It makes the coming Nonfarm Payroll report on Friday look pretty industry.

JOLTS Comes in Red Hot, showing that there were 11.3 million job openings in February, 5 million more than the number of unemployed. The great labor shortage continues and may be permanent, dashing all recession fears.

Will the Fed Screw Up? That is the biggest risk to the markets according to 46% of all investors. Rising inflation comes in at 33%. If the Fed panics and excessively raises interest rates in a tardy response to higher prices the 46% will be right.

The Five- and 30-Year Bonds Invert, meaning it is cheaper to borrow for 30 years than it is for five. Such a move usually presages a recession. Other than that, Mrs. Lincoln, how was the play?

Oil Plunges 8% on China Lockdown Fears, to $104.50 a barrel, as a new Covid wave hits Shanghai. China is the world's largest importer of oil by a large margin.

Tesla to Split Shares and Pay Dividend, according to SEC filings, sending the shares soaring by $90. (TSLA) has more than doubled since the last split in August 2020. Buy (TSLA) on dips.

S&P Case Shiller Up 19.2% in January, yet another new all-time high. Phoenix (33%), Tampa (31%), and Miami (28%) were the big winners and January is when mortgage interest rates started to rise sharply. This has led to an increase in all cash offers and buyers no longer qualify for loans. Home prices should keep rising for the rest of the decade, although at a slower rate.

Biden to Boost Battery Metal Production, by invoking the Defense Production Act, to hasten the end of our reliance on oil. Permitting and environmental regulation will get eased for the miners of lithium, cobalt, and nickel. The government has figured out that there are nowhere near the materials needed to meet the lofty sales forecasts of EV makers, like Tesla.

The Energy Sector Has Hit a Gusher in Profits, with earnings up an eye-popping 228% YOY. But if you are not in already, you missed it. Topping out risk is beginning, especially if the Ukraine War ends, cratering oil prices.

Biden to release 1 Million Barrels a Day for the SPR, the most in the 47-year history of the facilities, putting a serious dent in the current energy shortage. That’s against daily US consumption of 20 million barrels. The Strategic Petroleum Reserve currently has 714 barrels. It should be emptied and shut down as it is nothing more than a government subsidy for three two red states, Texas and Louisiana. Russia says it will only take rubles for oil and gas sales from Friday.

My Ten-Year View

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 240,000 here we come!

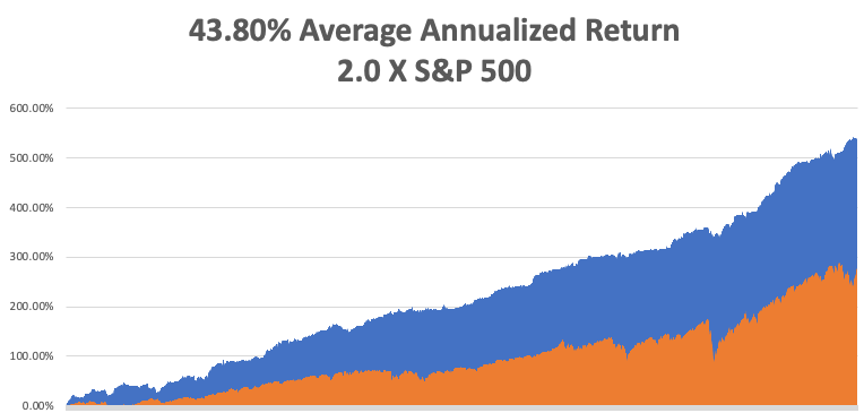

With near-record volatility, my March month-to-date performance retreated to a still blistering 12.26%. My 2022 year-to-date performance ended at a chest beating 26.85%. The Dow Average is down -4.00% so far in 2022. It is the greatest outperformance on an index since Mad Hedge Fund Trader started 14 years ago.

On the next capitulation selloff day, which might come with the April Q1 earnings reports, I’ll be adding more long positions in technology.

That brings my 13-year total return to 539.41%, some 2.10 times the S&P 500 (SPX) over the same period. My average annualized return has ratcheted up to 43.80%, easily the highest in the industry.

We need to keep an eye on the number of US Coronavirus cases at 80.2 million and rising quickly and deaths topping 983,000 and have only increased by 1,000 in the past week. You can find the data here. The growth of the pandemic has virtually stopped, with new cases down 98% in two months.

On Monday, April 4 at 7:00 AM EST, US Factory Orders for February are published.

On Tuesday, April 5 at 9:00 AM, the ISM Non-Manufacturing Index for February is printed.

On Wednesday, April 6 at 11:00 AM, The minutes from the last Fed meeting are released and will almost certainly lean hawkish.

On Thursday, April 7 at 7:30 AM, the Weekly Jobless Claims are printed.

On Friday, April 8 at 8:30 AM, Wholesale Inventories for February are announced. At 2:00 PM, the Baker Hughes Oil Rig Count is out.

As for me, when I backpacked around Europe in 1968, I relied heavily on Arthur Frommer’s legendary paperback guide, Europe on $5 a Day, which then boasted a cult-like following among impoverished, but adventurous Americans. The charter airline business was then-booming, and suddenly Europe came within reach for ordinary Americans like me.

Over the following years, he directed me down cobblestoned alleyways, dubious foreign neighborhoods, and sometimes converted WWII air raid shelters, to find those incredible travel deals. When he passed through town some 50 years later, I jumped at the chance to chat with the ever cheerful worshipped travel guru.

Frommer believes there are three sea change trends going on in the travel industry today. Business is moving away from the big three travel websites, Travelocity, Orbitz, and Priceline, who have more preferential lucrative but self-enriching side deals with airlines than can be counted, towards pure aggregator sites that almost always offer cheaper fares, like Kayak.com, Sidestep.com, and Fairchase.com.

There is a move away from traditional 48-person escorted bus tours towards small group adventures, like those offered by Gap Adventures, Intrepid Tours, and Adventure Center, that take parties of 12 or less on culturally eye-opening public transportation.

There has also been a huge surge in programs offered by universities that turn travelers into students for a week to study the liberal arts at Oxford, Cambridge, and UC Berkeley. His favorite was the Great Books programs offered by St. John’s University in Santa Fe, New Mexico.

Frommer says that the Internet has given a huge boost to international travel, but warns against user-generated content, 70% of which is bogus, posted by hotels and restaurants touting themselves.

The 81-year-old Frommer turned an army posting in Berlin in 1952 into a travel empire that publishes 340 books a year or one out of every four travel books on the market. I met him on a swing through the San Francisco Bay Area (his ticket from New York was only $150), and he graciously signed my tattered, dog-eared original 1968 copy of his opus, which I still have.

Which country has changed the most in his 60 years of travel writing? France, where the citizenry has become noticeably more civil since losing WWII. Bali is the only place where you can still actually travel for $5/day, although you can see Honduras for $10/day. Always looking for a deal, Arthur’s next trip is to Chile, the only country in the world he has never visited.

Arthur’s Next Big Play is Bali

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

“I didn’t wait until the age of 80 to engage in such an obviously fraudulent transaction,” said Barry Diller, currently under investigation for insider trading on Microsoft’s takeover of Activision.

Global Market Comments

April 1, 2022

Fiat Lux

Featured Trade:

(WHY I AM GOING TO LIVE FOREVER)

Global Market Comments

March 31, 2022

Fiat Lux

Featured Trade:

(WHY SOLID-STATE BATTERIES ARE THE “NEXT BIG THING”)

(TSLA), (QS)

Tesla shares have recently gotten their mojo back, exploding by an incredible 60% in the past month, and that can only mean one thing: mass production of solid-state batteries is fast approaching.

For the last 30 years, the cutting edge of battery design has been trapped in lithium-ion liquid or gel states. This originally Japanese technology took us from the first generation of smartphones in the early 1990s to the 1,200-pound, 405-mile range behemoths of today.

Now it’s time for the next big thing.

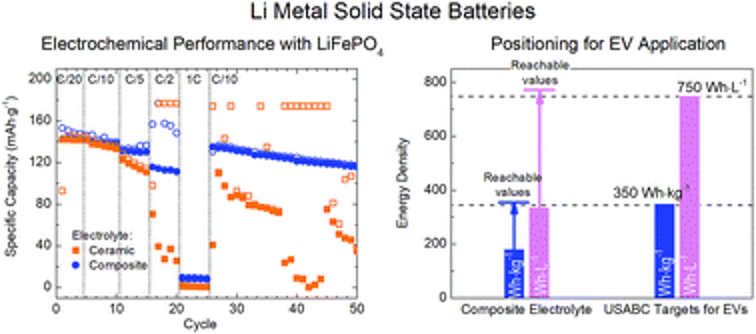

Solid-state batteries, made of oxide, sulfide, and phosphate ceramics, have existed in labs for decades and are currently used in pacemakers and other small devices. But economic mass production has remained elusive.

That may be about to change.

Bill Gates-backed QuantumScape gained a listing on the New York Stock Exchange via a SPAC (special purpose acquisition corporation) with Kensington Capital Acquisition Corp. (click here for the link). The deal valued the company at $3.3 billion, a high figure for a firm with no salable product.

QuantumScape is a decade-old San Jose, CA-based startup which has been pioneering solid-state battery technology. It obtained a $100 million investment from Volkswagen in 2018. QuantumScape’s goal is to supply the batteries for an all-electric VW Golf by 2025.

And here is the big deal about solid state. It offers energy densities 2.5 greater than existing lithium-ion batteries. It also presents far less risk of catching fire when punctured, as we have seen dramatically on TV a few times over the last couple of years with unfortunate Teslas.

With such technology, Tesla can cut battery sizes from 1,200 pounds to 500 pounds, chop $6,000 off the cost of production of each car, and further extend ranges because of less weight.

That would enable Tesla to enter the mass market with a $36,000 entry-level Tesla 3 or small SUV Model Y with minimal fuel cost and maintenance for the life of the car. This is how Tesla boosts production from last year’s 500,000 units to 5 million units annually by 2025. This is what the recent $700 Tesla share price is all about.

There are even more advanced battery technologies on the horizon. Samsung is working on graphene technology for its smartphones. The University of Chicago has developed a lithium dioxide battery seven times more powerful than those currently available. Silicon nanowire technology will become viable in three years that offer a further multiplication of ranges.

In the end, Elon Musk may surprise us all. In 2019, Tesla bought Maywell Technologies and their dry battery technology which can produce batteries at 16 times greater energy density at 20% less cost, giving a 20-fold improvement in battery performance.

That is a greater leap in energy densities than we have seen over the past decade when costs dropped by 80%.

As a long-time Tesla owner (chassis no. 125 of the assembly line), I can tell you that it has been a battle to keep up with Tesla’s rapidly emerging technology. As soon as I bought a Model X three years ago with a 275-mile range, a new 351-mile range was announced. I did get a great deal on the car though and I’ll never drive another vehicle.

As an old venture capitalist once told me, “When you’re in tech, you’re in the bakery business. You have to sell whatever you have in three days before it goes stale.”

For a YouTube video of Bill Gates explaining his involvement in QuantumScape, please click here.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.