Below please find subscribers’ Q&A for the February 2 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Incline Village, Nevada.

Q: Thoughts on Palantir Technologies Inc. (PLTR)?

A: Well, we got out of this last summer at $28 because the CEO said he didn’t care what the share price does, and when you say that, the market tends to trash your stock. But Palantir is also in a whole sector of small, non-money-making, expensive stocks that have just been absolutely slaughtered. And of course, PayPal (PYPL) takes the prize for that today, down 25% and 60% from the top. So, we’re giving up on that whole sector until proven otherwise. Until then, these things will just keep getting cheaper.

Q: Given the weakness in January, do you think we still have to wait until the second half of the year for a viable bottom?

A: Definitely, maybe. If things are going to happen, they are going to happen fast; we got the January selloff, but that’s nowhere near a major selloff of 20%. And the fact is, the economy is still great so that’s why this is a correction, not a bear market. At some point, you want to buy into this, but definitely not yet; I think we take another run at the lows again sometime this month. We just have to let all the shorts come out and take their profits so they can reestablish again.

Q: Why are bank stocks struggling?

A: A lot of the interest rate rises that we’re getting now were already discounted last year—banks had a great year last year—so they were front running that move, which is finally happening. To get more moves out of banks, you’re going to have to get more interest rate rises, which we will get eventually. We still like the banks long term, we still like financials of every description, but they are taking a break, especially on the “sell everything” index days. A lot of the recent selling was index selling—banks have a heavy weighting in the index, about 15%. So, they will go down, but they will also be the ones that come back the fastest. We’re seeing that in some of the financials already, like Berkshire Hathaway (BRKB) and Morgan Stanley (MS) which are both close to all-time highs now.

Q: What about the situation with Russia and Ukraine?

A: It’s all for show. This is a situation where both the US and Russia need a war, or threat of a war, because the leaders of both countries have flagging popularity. Wars solve those problems—that’s why we have so many of them by the United States. We’ve been at war essentially for most of the last 40 years, ever since Ronald Reagan came in.

Q: I didn’t exit my big tech positions before the crash, should I just hang onto them at this point?

A: The big ones—yes. The Apples (AAPL), the Googles (GOOGL), the Amazons (AMZN) —they’re only going to drop about 20% at the most, maybe 25%, and then they’ll go to new highs, probably before the end of the year. If you’re good enough to get out and get back in again on a 20% move, go for it. But most people can’t do that unless they’re glued to their screens all day long. So, if you have stock, keep the stock; if you have options, get out of the options, because there the time decay will wipe you out before a turnaround can happen. This is not an options environment, unless you’re playing on the short side in the front month, which is what we’re doing.

Q: When you send out the trade alerts, I have a hard time getting them executed. How do you advise?

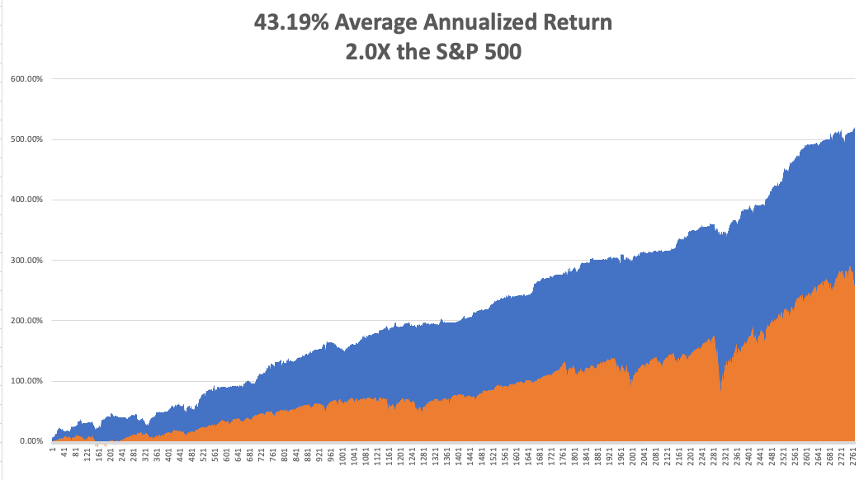

A: Move the strike price, go out in maturity, and you can get our prices at slightly higher risk. Or, just leave it and, quite often, people’s limit orders get done at the end of the day when the algorithms have to dump their positions at the close because they’re not allowed to carry overnight positions. Also, even if you get half of my trade alerts, you’re doing pretty good—we’re running at a 23% rate in 6 weeks, or 200% annualized. And remember, when I send out a trade alert, you’re not the only one trying to get in there, so you can even go onto a similar security. If I recommend Alphabet (GOOGL), consider going over to Microsoft (MSFT), because they all tend to move together as a group.

Q: I am sitting on a 16% profit in the ProShares Ultra Technology (ROM), which you recommended. Should I take the money and run, and get back in at a lower price?

A: Yes, this is just a short covering rally in a longer-term correction, and you make the money on the volume. You win games by hitting lots of signals, not hanging on to a few home runs where people usually strike out.

Q: You said inflation will be short lived, so why would there be 9 interest rates after the initial 4?

A: It’s going to take us 8 interest rates just to get us back to the long-term average interest rate. Remember the last 2% is totally artificial and only happened because there was a financial crisis 13 years ago. So, to normalize rates you really need to get overnight rates back up to about 3.0%. And that means 12 interest rate hikes. If you don’t do that, you risk inflation going from controllable to uncontrollable, and that is the death of the Fed. So, that’s why I expect a lot more interest rate rises.

Q: Will the tension between Russia and the Ukraine affect the market?

A: No, it hasn’t so far and I don’t expect it to. Although, it’s hard to imagine going through all of this and not seeing a shot fired. When that one shot gets fired, then maybe you get a down-500-point day, which it then makes back the next day.

Q: Anything to do with Alphabet (GOOGL) announcing its 20 to one split?

A: No, it’s too late. We had a trade alert out on a Google 20 call spread which we actually took profits on this morning. So, nice win for the Mad Hedge Technology Letter there. There’s nothing to do with these splits, it’s not like they’re going to un-announce it, this isn’t a risk-arbitrage situation where there’s always an antitrust risk hovering over the deal that may crash it. This is pretty much a done deal and doesn’t even happen until July 1. People think bringing the share price from $3,000 down to $150 makes it available for a lot more potential retail buyers, which it does. It also makes call spreads on the options a lot cheaper too. When we put out these alerts, we can only do one or two contracts, even tying up $10,000—divide that by 20 and all of a sudden your cheapest Google call spread cost $500 instead of $10,000.

Q: Can you speak about the liquidity on your strikes? Sometimes we’re trading against strikes that have no open interest.

A: Whenever you put in an order for one strike, even if there’s nothing outstanding on that strike, algorithms will arbitrage against that strike—where your order is—against all the other strikes on the whole options chain. So, don’t worry if you have limited open interest or no open interest on our trade alerts. They will get done, and it may get done by some algorithm or some market maker taking more of another strike, that’s how these things get done. It’s all thanks to the magic of computers.

Q: Do you have thoughts about Freeport-McMoRan (FCX)? I have some profitable LEAP positions open.

A: It’ll go higher, keep them. And I like the whole commodity space, which means iron ore (BHP), copper, steel (X), etc.

Q: Would you trade Barclays iPath Series B S&P 500 VIX Short-Term Futures ETN (VXX) at this point?

A: No, because we’re dead in the middle of the recent range. That’s a horrible place to enter—you only enter (VXX) on extremes on the upsides and the downside.

Q: What should I do about Airbnb (ABNB) at this price? They’ve been profitable for 2-3 years, with revenues rising.

A: I think Airbnb is one of the best run companies in the world, and I expect their earnings to keep growing like crazy, especially once we get out of the pandemic. I am also a very frequent Airbnb user, having stayed in Airbnb’s in at least 10 countries, so I’m a big fan of them. The stock just got dragged down by the small tech bust but it will come back. This is a “throwing the baby out with the bathwater” situation.

Q: Are there any good LEAPS candidates now?

A: I’m not doing any LEAPS until we reach the final cataclysmic selloff of the correction. Otherwise, the time value will run against you enormously; I’d rather wait for better prices.

Q: Do you see a cataclysmic selloff?

A: Yes, I do. Maybe in a few more weeks, and maybe next week if we get a really hot 8%+ inflation rate—that would really kill the market.

Q: What will tell you if inflation is ending or slowing labor?

A: Labor is 70% of the inflation calculation. So, when these huge pay awards slow down, that's when inflation slows down. By the way, a lot of pay increases that are happening now are catch-up from the last 40 years of no pay increases for American workers in real inflation adjusted terms. So, a lot of this is catch-up—once that’s done, you can forget about inflation. Also, the long-term pressure of technology on prices is downwards, so allow that to reignite deflation, and that will be your bigger issue over the long term.

Q: What should I do about Editas Medicine Inc (EDIT) or CRSPR Therapeutics AG (CRSP)?

A: Don’t touch the sector, it’s out of favor. Let this thing die a slow death. When they come up with profitable products, that’s when the sector recovers. So far, everything they have works in labs but there are no mass-produced Crispr products, they’re trying for mass production on sickle cell anemia and a couple of other things, but still very early days in CRSPR technology.

Q: When will this recording be posted?

A: In two hours, it will be posted on the website. Go to “My Account” and you’ll find the last 13 years of recorded webinars.

Q: What do you mean by “stand aside from Foreign Exchange”?

A: The volatility in the foreign exchange market is just so low compared to equities and bonds, it’s not worth trading right now. When you can trade everything in the world—foreign exchange is at the bottom of the list. If I see a good entry point, I’ll do a trade; but do I trade Tesla (TSLA) with a volatility of 100%, or foreign exchange with a volatility of 5%? Those are the choices.

Q: Should I do any short plays in oil (USO)?

A: Generally, you don’t want to short any commodity unless you're a professional; I say that having been short beef futures when Mad Cow Disease hit in 2003 and you had three limit-up days in a row in the futures market. That happens in the commodity areas—liquidity is so poor compared to stocks and bonds that if you get caught in one of these one-way moves, you can’t get out. So that is the risk; and I’ve known people who have gone bust trading oil both long and short, so this is for professionals only. With stocks you get vastly more data and information than you do in the commodity markets where industry insiders have a much bigger advantage.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last ten years are there in all their glory.

Good Luck and Stay Healthy!

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

The Aga Sophia Mosque in Istanbul