Global Market Comments

January 11, 2022

Fiat Lux

Featured Trades:

(THE BARBELL PLAY WITH BERKSHIRE HATHAWAY),

(BRKA), (BRKA), (BAC), (KO), (AXP), (VZ), (BK) (USB), (TLT), (AAPL), (MRK), (ABBV), (CVX), (GM), (PCC), (BNSF)

Global Market Comments

January 11, 2022

Fiat Lux

Featured Trades:

(THE BARBELL PLAY WITH BERKSHIRE HATHAWAY),

(BRKA), (BRKA), (BAC), (KO), (AXP), (VZ), (BK) (USB), (TLT), (AAPL), (MRK), (ABBV), (CVX), (GM), (PCC), (BNSF)

Global Market Comments

January 10, 2022

Fiat Lux

Featured Trades:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or WHY I FEEL SO MUCH BETTER)

(TSLA), (AAPL)

A month ago, I was wringing my hands, pacing the floor, and tossing and turning at night. I had no idea what the stock market was going to do in 2022.

Now, I feel so much better. For while getting snowed in at Lake Tahoe for two weeks, I dove into the deep research. Slowly, the fog cleared, the clouds lifted, and everything became crystal clear.

The markets vindicating my views with a sledgehammer, I feel so much better.

A year behind schedule, the great bond market crash has begun in earnest, taking ten-year US Treasury yields up an eye-popping 45 basis points in a month. Financial stocks have caught on fire. Technology stocks are getting mercilessly dumped. Any non-yielding security, be it gold, silver, Bitcoin, or small-cap tech stocks, have been taken to the woodshed.

So what happens next? More of the same. The out-of-tech into financials trade could continue for another three to five months.

Then the Fed’s cycle of rising interest rates will take a break by summer. Financials will be super-heated and at all-time highs. Technology stocks will be below their 200-day moving averages. So you reverse the trade. Tech will lead in the second half.

All I can say is that I am really glad that I am not the Chairman of the Federal Reserve right now. If Omicron convinces Jay Powell to delay interest rate hikes, he risks inflation getting out of control. If he continues to accelerate the rate high schedule he could kill the recovery.

And here’s the 800-pound gorilla in the room that no one is talking about. What is the biggest threat to the US and the global economy? No, it’s not Covid. It isn’t inflation. It’s not even a tempestuous midterm election, which has already begun.

It’s a stock market crash. Remember that stock market crash that took the Dow Average down 40%, as we saw in March-April 2020? That is first and foremost what is in Powell’s mind.

So if we breach the 10% correction that now appears underway, Jay may quietly pull back on the rate hike throttle. The folder making the argument will be quietly lost behind the radiator at 20th street and Constitution Avenue in Washington DC, the home of the Federal Reserve.

The Fed Minutes were a bombshell, indicating a serious acceleration of interest rate hikes is in the cards this year. The Fed may flip to a net seller of Treasury bonds by the fall. Bonds sold off hard and may break to new 2-year lows. Take profits on all short-dated bond plays, with the (TLT) down $14.00 in a month. Technology got crushed, posting the worst day in 11 months. Sell all tech option plays. You can buy them back cheaper later. But keep big tech stocks. They can only go don so much with 30% earnings growth this year.

NASDAQ Stocks down 50% hits record from one-year highs. It’s a Dotcom bust echo. Traders are selling first and doing the research later. That means half of all tech stocks are in bear markets. Soaring interest rates aren’t helping.

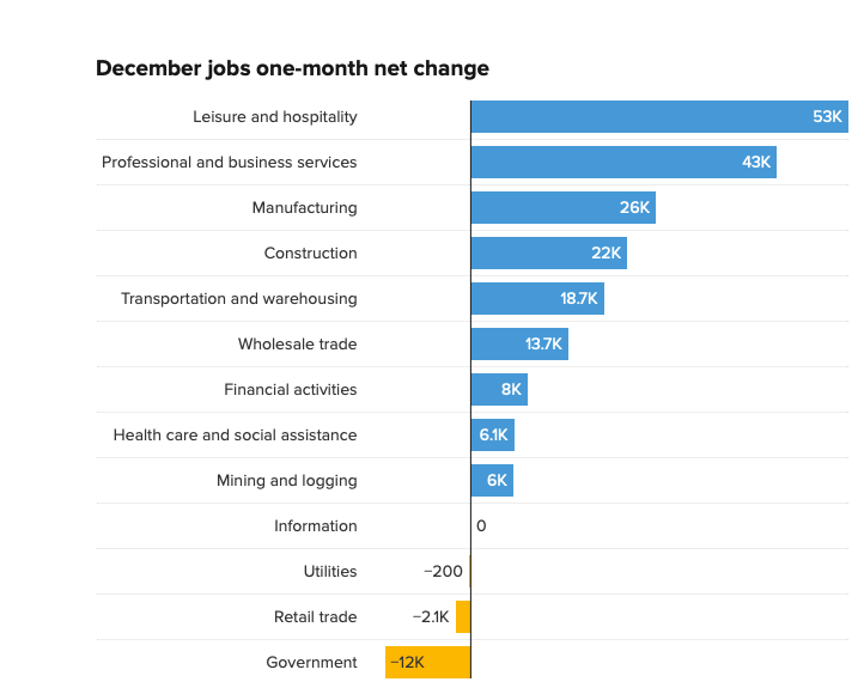

Nonfarm Payroll Report disappoints at 199,000 in December. But the Headline Unemployment Rate plunged from 4.2% to 3.9%, approaching a new century low. The U-6 “discouraged worker” rate dropped to 7.3%. Leisure & Hospitality led at 53,000, followed by Professional & Business Service at 43,000, and Manufacturing at 26,000. The government lost 12,000 jobs. Some 650,000 people gain jobs, with self-employment surging. Once again, the data is wildly contradictory as a post-pandemic America remakes itself. Bonds and tech were crushed, financials soared.

Apartment Occupancy hits all-time high, as growing numbers are priced out of home ownership. As a result, rental rates are now rising faster than home prices. Occupancy is now at 97.5%.

Tesla delivers a record 308,600 EVs in Q4, blasting all expectations, taking them nearly to Elon Musk’s 2021 target of one million. They managed to beat all supply chain challenges. In a brilliant move, when other car makers cancelled chip orders in 2020, Tesla bought them all up. Tesla remains far and away the mass production leader in EVs, and I am maintaining my $10,000 target. In addition, Musk is done selling the stock for another year.

US Dollar clocks best year in six, up 7%, powered by rising interest rate fears that never came. The Turkish lira was the worst-performing, down 44%, thanks to government mismanagement there.

Apple tops $3 trillion market cap, the shares rising above $183, well on the way to my $250 target for 2022. The stock is getting extended short term to raise cash to buy on the next selloff. I am hanging on to my own long term holding with a split-adjusted cost basis of 25 cents.

US Home Prices soar 18% in October according to S&P Case Shiller. Phoenix (32.3%), Tampa (28.1%), and Miami (25.7%) led. 30-year fixed rate mortgages at 3.05% were a huge help.

Bitcoin gets crushed, approaching a one-year low at $40,000, and will continue to do so. Not interest-bearing instruments like gold and crypto don’t do well during rapidly rising interest rates. In the meantime, some $3.2 billion in crypto was stolen in 2021, a rise of 516% from the previous year, mostly from those who don’t know how to protect their Defi platforms with no central exchange authority.

My Ten-Year View

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 240,000 here we come!

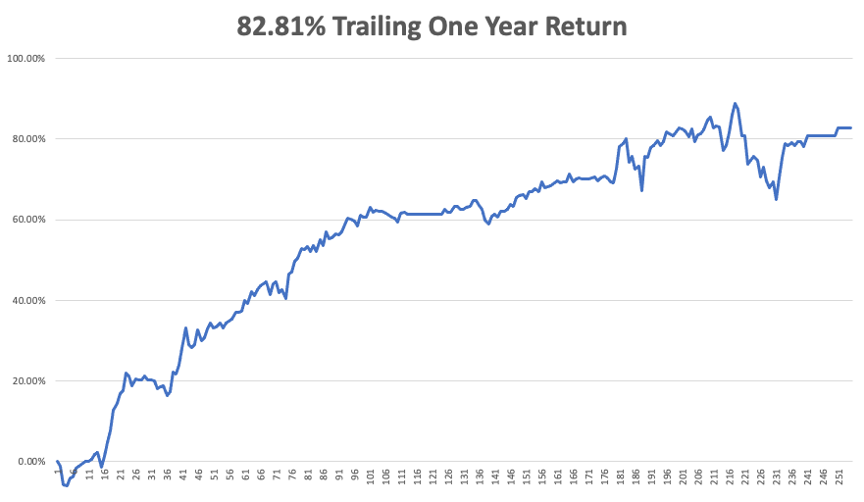

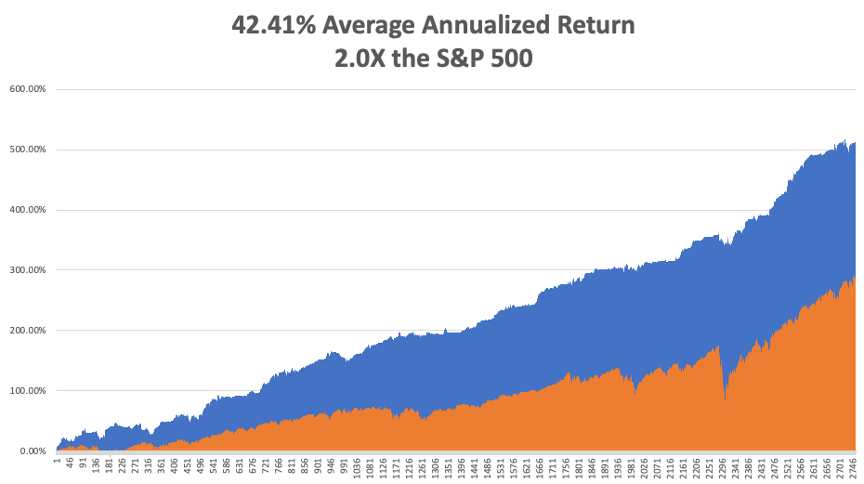

With the pandemic-driven meltdown on Friday, my December month-to-date performance bounced back hard to 11.26%. My 2021 final performance ended at 90.02%. The Dow Average was up 18.4% in 2021.

I have a 100% cash position, waiting for the ideal entry point to enter the market. With the 500-point crash today, suddenly the requests for new trade alerts have faded.

That brings my 12-year total return to 512.56%, some 2.00 times the S&P 500 (SPX) over the same period. My 12-year average annualized return has ratcheted up to 42.41% easily the highest in the industry.

We need to keep an eye on the number of US Coronavirus cases at 60 million and rising quickly and deaths going up t0 840,000, which you can find here at https://coronavirus.jhu.edu.

On Monday, January 10 at 8:00 AM, Consumer Inflation Expectations are announced.

On Tuesday, January 11 at 10:00 AM, Jay Powell testifies in front of Congress.

On Wednesday, January 12 at 8:30 AM, the Core Inflation Rate for December is released.

On Thursday, January 13 at 8:30 AM the Weekly Jobless Claims are disclosed.

On Friday, January 14 at 8:30 AM, the Retail Sales for December are out.

As for me, as this pandemic winds down, I am reminded of a previous one in which I played a role in ending.

After a 30-year effort, the World Health Organization was on the verge of wiping out smallpox, a scourge that had been ravaging the human race since its beginning. I have seen Egyptian mummies at the Museum of Cairo that showed the scarring that is the telltale evidence of smallpox, which is fatal in 50% of cases.

By the early 1970s, the dread disease was almost gone but still remained in some of the most remote parts of the world. So, they offered a reward to anyone who could find live cases.

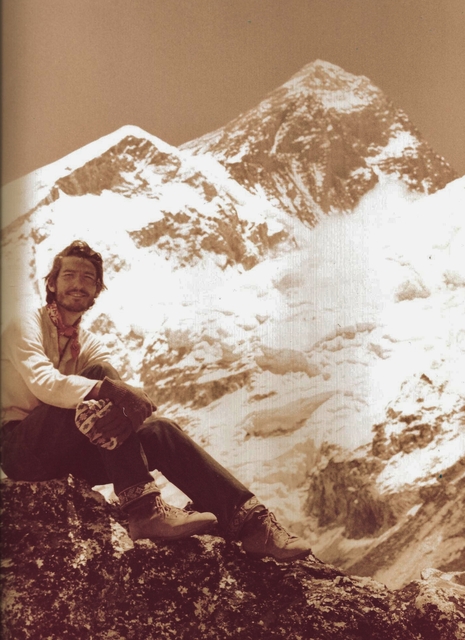

To join the American Bicentennial Mt. Everest Expedition in 1976, I took a bus to the eastern edge of Katmandu and started walking. That was the farthest roads went in those days. It was only 150 miles to basecamp and a climb of 14,000 feet.

Some 100 miles in I was hiking through a remote village, which was a page out of the 14th century, back when families threw buckets of sewage into the street. The trail was lined with mud-brick two-story homes with wood shingle roofs, with the second story overhanging the first.

As I entered the town, every child ran to their windows to wave, as visitors were so rare. Every smiling face was covered with healing but still bleeding smallpox sores. I was immune, since I received my childhood vaccination, but I kept walking.

Two months later, I returned to Katmandu and wrote to the WHO headquarters in Geneva about the location of the outbreak. A year later I received a letter of thanks at my California address and a check for $100 telling me they had sent in a team to my valley in Nepal and vaccinated the entire population.

Some 15 years later, while on customer calls in Geneva for Morgan Stanley, I stopped by the WHO to visit a scientist I went the school with. It turned out I had become quite famous, as my smallpox cases in Nepal were the last ever discovered.

The WHO certified the world free of smallpox in 1980. The US stopped vaccinating children for smallpox in 1972, as the risks outweighed the reward.

Today, smallpox samples only exist at the CDC in Atlanta frozen in liquid nitrogen at minus 346 degrees Fahrenheit in a high-security level 5 biohazard storage facility. China and Russia probably have the same.

That's because scientists fear that terrorists might dig up the bodies of some British sailors who were known to have died of smallpox in the 19th century and were buried on the north coast of Greenland remaining frozen ever since. If you need a new smallpox vaccine, you have to start from somewhere.

As for me, I am now part of the 34% of Americans who remain immune to the disease. I’m glad I could play my own small part in ending it.

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Mt. Everest in 1976

Global Market Comments

January 7, 2022

Fiat Lux

Featured Trades:

(JANUARY 5 BIWEEKLY STRATEGY WEBINAR Q&A),

(IWM), (RUA), (TSLA), (NVDA), (USO), (TBT), (ROM), (SDS), (ZM), (AAPL), (FCX), (HOOD), (BRKB)

Below please find subscribers’ Q&A for the January 5 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Incline Village, Nevada.

Q: What’s a good ETF to track the Russell 3,000 (RUA)?

A: I use the Russell 2,000 (IWM) which is really only about the Russell 1500 because 500 companies have been merged or gone bankrupt and they haven't adjusted the index yet. This is the year where value plays and small caps should do better, maybe even outperforming the S&P500. These are companies that do best in a strong economy.

Q: Should I focus on value dividends growth, or stick with the barbell?

A: I think you have to stick with the barbell if you’re a long-term investor. If you’re a short-term trader, try and catch the swings. Sell tech now, buy it back 10% lower. Keep financials; when they peak out you, dump them and go back into tech. It’ll be a trading year, but if a lot of you are just indexing the S&P500 or doubling up through a 2x ETF like the ProShares ultra S&P 500 (SSO), it may be the easiest way to go for this year.

Q: Will higher rates sabotage tech, particularly smaller companies?

A: They’ve already done so with PayPal (PYPL) down 44% in six months—I’d say that’s sabotaged. Same with Square (SQ) and a lot of the other smaller tech companies. So that has happened and will continue to happen a bit more, but we’re really getting into the extreme oversold levels on a lot of these companies.

Q: Should we cash out on the iShares 20 Plus Year Treasury Bond ETF (TLT) summer 150/155 put spread LEAPS?

A: No, because you haven't even realized half of the profit in that yet since there is so much time value left in those options. As long as you stay below $150 in the (TLT), which I'm pretty sure we will, you will get your full 100% profit on that position. On the six month and one year positions, they don’t really move very much because they have so much time value in them. Once you get into the accelerated time decay, which is during the last 3 months before expiration, they catch like a house on fire. So, if you're willing to keep a safe long-term position, this thing will write you a check every day for the next six months or a year to expiration. I know we have absolutely everybody in these deep in the money TLT puts; some people even did $165-$170’s—you know, my widows and orphans crowd—and they are doing well, but not as much as if you’d had a front month.

Q: What scares you most for the next 12 months?

A: Another variant that is more fatal than either Delta or Omicron. Unlikely, but not impossible.

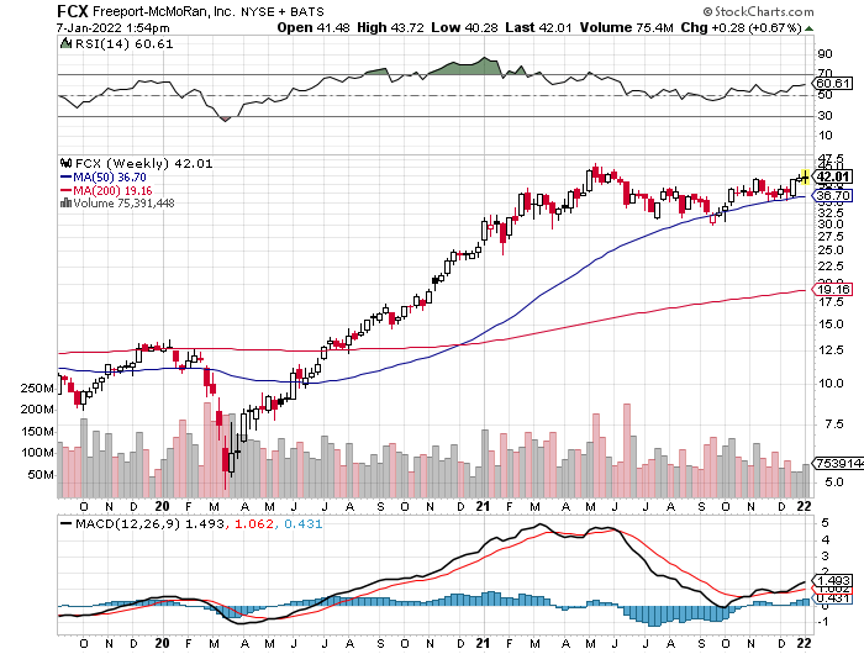

Q: Do you expect Freeport McMoRan (FCX) to break out to the upside?

A: I do, I did the numbers over the vacation for copper production to meet current forecast demands for electric vehicle production. Global copper has to increase 11 times, and that can’t be done, so prices are going to have to go up a lot. One of my concerns with these lofty EV projections (that even I make) is that there aren’t enough commodities in the world to make all these cars with the current infrastructure. And you’re not going to find a replacement for copper—it's just too perfect of an electrical conductor. So, that means higher prices to me—you increase demand 11 times on a stable supply, and it takes 10 years to bring a new copper mine online.

Q: Do you have any open trades?

A: No, and one reason is that I figured they would probably crash the market on the last trading day of the year, which they did. If I had positions, they would have crushed them on the last year and my performance. And all hedge fund traders do this; they try to go 100% cash at the end of the year to avoid these things. And whatever you lost on Friday you made back on Monday morning at the expense of last year's performance. But you have to wait 15 months to get paid on today's performance, and, that is the reason I do that. So, looking for higher highs to sell, lower lows to buy.

Q: Should I be buying NVIDIA (NVDA) and Tesla (TSLA) on the dip?

A: Absolutely yes, but Tesla's prone to 45% corrections—we had one last year and the year before—and Nvidia tends to have 25% corrections. So yes, NVIDIA could well be the stock of the decade, but you don’t want to buy it right now. It’s starting to lose steam already.

Q: Will ProShares Ultra Technology (ROM) be under pressure?

A: Keep your position small now, take some profits, look to buy on a bigger dip. If the big techs drop 10%, (ROM) will drop 20% and get you below $100.

Q: Do you offer trade alerts on small caps for short term traders?

A: No, because you can’t execute those trades. A lot of them are just so illiquid, you can’t even trade one share unless you want to pay a huge spread. Keep in mind, when I worked at Morgan Stanley (MS), I covered the Rockefeller Foundation, the Ford Foundation, George Soros, Paul Tudor Jones, the government of Abu Dhabi, California State Pension Fund, and a lot of other huge funds; and the last thing they’re interested in is short term trades for the small-cap stocks. So, I don't really know much about those, but they tend to change the names every year anyway. And it really is a beginner trader type area because the volatility is so enormous. You can get 10x moves one day going to zero the next. It is also an area full of scams, cons, and pump and dump schemes.

Q: What is your advice when it comes to the ProShares UltraShort 20+ Year Treasury (TBT)?

A: Short term, take the profits—you just got a $14 point rally in your favor. Short term traders, take profits on bonds here, cover your shorts. Long term investors keep it, the cost of carry is only about 4% right now, not that high, so I would keep it for a great year-end move for 2.5% yields on the ten-year.

Q: I hate oil (USO) because it’s going to zero. Should I keep trading in it?

A: Very few are nimble enough to trade oil, it’s really an insider’s game. No new capital is moving into the oil industry and oil companies themselves won’t invest in their own businesses anymore.

Q: Would you put on a new position on the iShares 20 Plus Year Treasury Bond ETF (TLT) today?

A: No, you don’t sell short things after they move down $14 points. You put them on before that. If I were to do a short-term trade in (TLT) I would be a buyer, I’d maybe buy it for a countertrend rally of maybe $4 or $5 points.

Q: What should I do with my FCX 2023 LEAP?

A: There is enough time on it, so I would keep running it along as is—don’t get greedy. Keep the LEAPS you have and you should do well by it.

Q: Could the iShares 20 Plus Year Treasury Bond ETF (TLT) bottom out in the near term?

A: Yes, it could, on a short-term basis. $141 is the nine-month low for the (TLT), so a great place to take short term profits. (TLT) is right now at $142.56, so we’re approaching that $141 handle closely. Every technical trader on the market’s going to cover their shorts on the $141 or $142 handle, so just congratulate yourself going into this move short, and take the money and run. You take every $14 point move in your favor in the (TLT); and let it rally 5 points and then reestablish, that’s how you trade.

Q: Do you think there will be a delay in the first interest rate hike due to COVID?

A: Yes, Jay Powell is the ultra-dove—any excuse to delay rate hikes, he’ll do it. And the way you’ll know is he’ll delay the end of other things which you don’t see, like daily mortgage bond purchases, daily US Treasury purchases, and other backdoor forms of QE. We’ll know well in advance if he’s going to raise or not by March or even June. We watch this stuff every day, we talk to people at the Fed every week. And remember, the Treasury Secretary Janet Yellen is a good friend of mine, I get a good handle on these things; this is why 99% of my bond trades make money.

Q: What if I have the $135-$140 put spread in January?

A: Sell it now, take what you can, take the hit; because that’ll expire at zero unless we break down to new lows on the (TLT) in the next ten days or so. That's not a good bet, especially on top of a $14 point drop. Capture what you can on that one and keep the cash for a better entry point. That’s exactly what I did—I sold all my January positions yesterday no matter what they were, because when you get to two weeks to expiration the moves become random.

Q: Do you think inflation will last longer than expected?

A: No, I think it will last shorter than expected because I think at least half of the inflation rate, if not more, are caused by supply chain problems which will end within the next six months, and therefore lead to the over-order problem that I was talking about earlier.

Q: What’s your outlook on energy this year?

A: It could go higher. On the way to zero, you’re going to have several double, tripling’s, even 10x increases in the price of oil, like we saw in the last 18 months. We went from negative numbers to 80, and what happens is oil becomes more volatile as the supply becomes more variable, that's a natural function. But trading this is not for non-professionals.

Q: Since sector rotation is happening, do you think we should sell all tech positions?

A: Short term yes, long term no. Tech will still lead with earnings, and even if they have a bad five months coming, they have a terrific long-term view. For the last 30 years, every sale of tech has been a mistake, especially in Apple (AAPL). So if you’re a trader, yes, you should have been selling since November. If you’re a long-term investor, keep them all.

Q: Is the ProShares UltraShort S&P 500 (SDS) a good position to buy up when the market timing index goes into sell territory?

A: Yes it is, and that will probably work better this year than it did last year because narrow range volatile markets are much more technically oriented than straight-up markets or long term bull markets. Pay close attention to those markets, you could make a lot of money trading them.

Q: Do Teslas have good car heaters for climates up North in -25 or -30?

A: You plug them in. When it gets below zero you actually get a warning message on your Tesla app telling you to plug it in, and then the car heats itself off of the power input. Otherwise, if you get to below zero, the range on the car drops by half. If you have a 300-mile range car like I do and then you freeze it, it drops to like 150 miles. In Tahoe, I keep my car plugged in all the time when I'm not using it, just to keep it warm and friendly.

Q: Is Zoom (ZM) a good buy here?

A: No, I think they’re going to keep punishing these overpriced small cap techs like they have been. We’re a long way from value on small tech. That was a 2020 story.

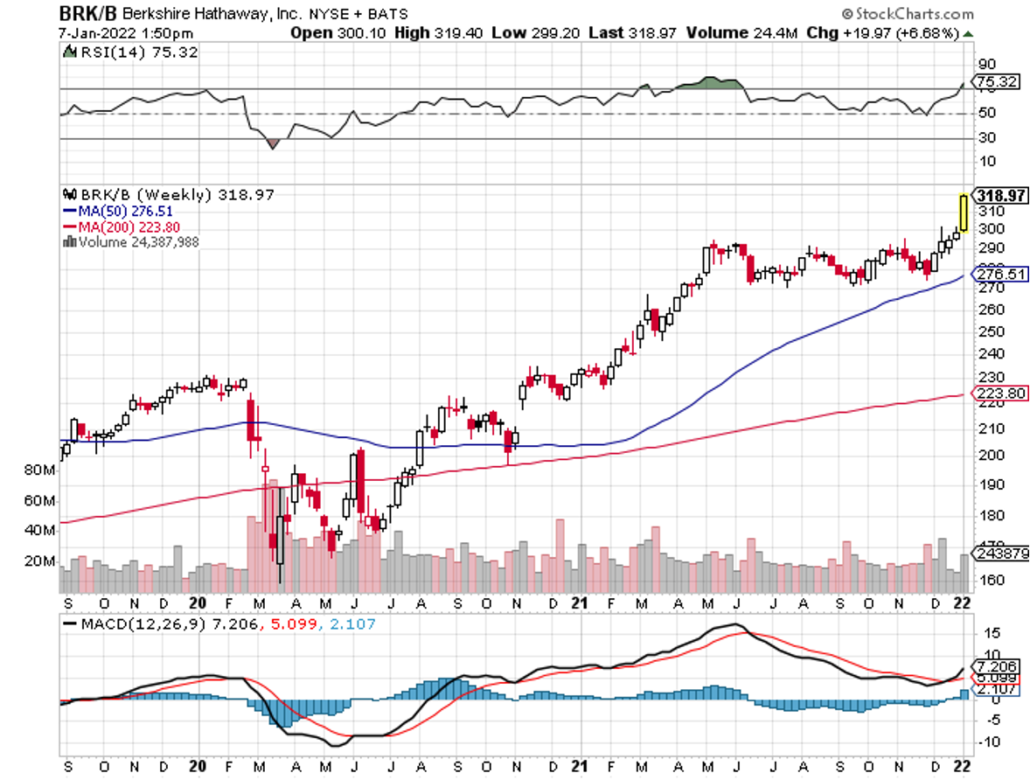

Q: What about Berkshire Hathaway (BRKB)?

A: Berkshire Hathaway is doing a major breakout because they own financials up the wazoo and they’re all breaking out. And YOU should be long up the wazoo on these things because I’ve been recommending them for the last 4 months.

Q: What do you think of Robinhood (HOOD)?

A: Robinhood I like long term, but it is high risk, high volatility. It is down 78% from the IPO so it is busted. Kind of tempting down here, but again, all the non-earning overvalued stocks are getting their clocks cleaned right here; I'm not in a rush to get involved.

Q: When you enter a LEAP, is the straight call or call spread?

A: It’s a call spread. You finance the high cost of one-year options by selling short a call option against it further out of the money. And that way you can get enormous leverage for practically nothing, 10 or 20 times in some cases, depending on how you structure the strikes.

Q: Best stock to play Copper?

A: Freeport McMoRan (FCX). I’ve been recommending it since it was $4.00.

Q: Oil is the pain train until EVs actually take over.

A: That’s true, and they haven’t. EVs have about a 6% market share now of new car sales worldwide, but that could rapidly accelerate given all the subsidies that EVs are getting. Also, we have many future recessions to worry about, during which oil could easily drop 290% like it did last year. If you can hack that kind of volatility, go for it, but I find better things to do quite honestly. And I think my next oil trade will be a short, especially if we go over $100.

Q: What about Bitcoin?

A: It could go sideways in a range for a while. If we can’t hold the 200-day, we’re going back down to the high 30,000s, where we were at the start of the year—we could give up the entire year of 2021. Bitcoin also suffers from rising interest rates since they don’t yield anything.

Q: Is this recorded?

A: Yes, the webinar recording goes out in about 2 hours. Log into the madhedgefundtrader.com website and go to my account, where you’ll find it with all the different products you’ve purchased.

Q: I just closed out my (TLT) 150 put option for the biggest single trade profit in my life; I just made 20% of my annual salary alone today. Thank you, John!

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com , go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last ten years are there in all their glory.

Good Luck and Stay Healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

“The Fed has no Incentive to inflate away government debt but the government does,” says Fed governor James Bullard.

Global Market Comments

January 6, 2022

Fiat Lux

Featured Trades:

(TESTIMONIAL),

(THE DEATH OF PASSIVE INVESTING),

(SPY), (SPX), (INDU)

(NOTICE TO MILITARY SUBSCRIBERS),

Global Market Comments

January 5, 2022

Fiat Lux

2022 Annual Asset Class Review

A Global Vision

FOR PAID SUBSCRIBERS ONLY

Featured Trades:

(SPX), (QQQ), (XLF), (XLE), (XLY),

(TLT), (TBT), (JNK), (PHB), (HYG), (PCY), (MUB), (HCP)

(FXE), (EUO), (FXC), (FXA), (YCS), (FXY), (CYB)

(BHP), (FCX), (VALE), (AMLP), (USO), (UNG),

(GLD), (GDX), (SLV), (ITB), (LEN), (KBH), (PHM)

I am once again writing this report from a first-class sleeping cabin on Amtrak’s legendary California Zephyr.

By day, I have two comfortable seats facing each other next to a panoramic window. At night, they fold into two bunk beds, a single and a double. There is a shower, but only Houdini could navigate it.

I am anything but Houdini, so I go downstairs to use the larger public hot showers. They are divine.

We are now pulling away from Chicago’s Union Station, leaving its hurried commuters, buskers, panhandlers, and majestic great halls behind. I love this building as a monument to American exceptionalism.

I am headed for Emeryville, California, just across the bay from San Francisco, some 2,121.6 miles away. That gives me only 56 hours to complete this report.

I tip my porter, Raymond, $100 in advance to make sure everything goes well during the long adventure and to keep me up-to-date with the onboard gossip.

The rolling and pitching of the car is causing my fingers to dance all over the keyboard. Microsoft’s Spellchecker can catch most of the mistakes, but not all of them.

As both broadband and cell phone coverage are unavailable along most of the route, I have to rely on frenzied Internet searches during stops at major stations along the way to Google obscure data points and download the latest charts.

You know those cool maps in the Verizon stores that show the vast coverage of their cell phone networks? They are complete BS.

Who knew that 95% of America is off the grid? That explains so much about our country today.

I have posted many of my better photos from the trip below, although there is only so much you can do from a moving train and an iPhone 12X pro.

Here is the bottom line which I have been warning you about for months. In 2022, you are going to have to work twice as hard to earn half as much money with double the volatility.

It’s not that I’ve turned bearish. The cause of the next bear market, a recession, is at best years off. However, we are entering the third year of the greatest bull market of all time. Expectations have to be toned down and brought back to earth. Markets will no longer be so strong that they forgive all mistakes, even mine.

2022 will be a trading year. Play it right, and you will make a fortune. Get lazy and complacent and you’ll be lucky to get out with your skin still attached.

If you think I spend too much time absorbing conspiracy theories or fake news from the Internet, let me give you a list of the challenges I see financial markets are facing in the coming year:

The Ten Key Variables for 2022

1) How soon will the Omicron wave peak?

2) Will the end of the Fed’s quantitative easing knock the wind out of the bond market?

3) Will the Russians invade the Ukraine or just bluster as usual?

4) How much of a market diversion will the US midterm elections present?

5) Will technology stocks continue to dominate, or will domestic recovery, and value stocks take over for good?

6) Can the commodities boom get a second wind?

7) How long will the bull market for the US dollar continue?

8) Will the real estate boom continue, or are we headed for a crash?

9) Has international trade been permanently impaired or will it recover?

10) Is oil seeing a dead cat bounce or is this a sustainable recovery?

The Thumbnail Portfolio

Equities – buy dips

Bonds – sell rallies

Foreign Currencies – stand aside

Commodities – buy dips

Precious Metals – stand aside

Energy – stand aside

Real Estate – buy dips

Bitcoin – Buy dips

1) The Economy

What happens after a surprise variant takes Covid cases to new all-time highs, the Fed tightens, and inflation soars?

Covid cases go to zero, the Fed flip flops to an ease and inflation moderates to its historical norm of 3% annually.

It all adds up to a 5% US GDP growth in 2022, less than last year’s ballistic 7% rate, but still one of the hottest growth rates in history.

If Joe Biden’s build-back batter plan passes, even in diminished form, that could add another 1%.

Once the supply chain chaos resolves inflation will cool. But after everyone takes delivery of their over orders conditions could cool.

This sets up a Goldilocks economy that could go on for years: high growth, low inflation, and full employment. Help wanted signs will slowly start to disappear. A 3% handle on Headline Unemployment is within easy reach.

2) Equities (SPX), (QQQ), (IWM) (AAPL), (XLF), (BAC)

The weak of heart may want to just index and take a one-year cruise around the world instead in 2022 (here's the link for Cunard).

So here is the perfect 2022 for stocks. A 10% dive in the first half, followed by a rip-roaring 20% rally in the second half. This will be the year when a big rainy-day fund, i.e., a mountain of cash to spend at market bottoms, will be worth its weight in gold.

That will enable us to load up with LEAPS at the bottom and go 100% invested every month in H2.

That should net us a 50% profit or better in 2022, or about half of what we made last year.

Why am I so cautious?

Because for the first time in seven years we are going to have to trade with a headwind of rising interest rates. However, I don’t think rates will rise enough to kill off the bull market, just give traders a serious scare.

The barbell strategy will keep working. When rates rise, financials, the cheapest sector in the market, will prosper. When they fall, Big Tech will take over, but not as much as last year.

The main support for the market right now is very simple. The investors who fell victim to capitulation selling that took place at the end of November never got back in. Shrinking volume figures prove that. Their efforts to get back in during the new year could take the S&P 500 as high as $5,000 in January.

After that the trading becomes treacherous. Patience is a virtue, and you should only continue new longs when the Volatility Index (VIX) tops $30. If that means doing nothing for months so be it.

We had four 10% corrections in 2021. 2022 will be the year of the 10% correction.

Energy, Big Tech, and financials will be the top-performing sectors of 2022. Big Tech saw a 20% decline in multiples in 2022 and will deliver another 30% rise in earnings in 2022, so they should remain at the core of any portfolio.

It will be a stock pickers market. But so was 2021, with 51% of S&P 500 performance coming from just two stocks, Tesla (TSLA) and Alphabet (GOOGL).

However, they are already so over-owned that they are prone to dead periods as long as eight months, as we saw last year. That makes a multipronged strategy essential.

3) Bonds (TLT), (TBT), (JNK), (PHB), (HYG), (MUB), (LQD)

Amtrak needs to fill every seat in the dining car to get everyone fed on time, so you never know who you will share a table with for breakfast, lunch, and dinner.

There was the Vietnam Vet Phantom Jet Pilot who now refused to fly because he was treated so badly at airports. A young couple desperately eloping from Omaha could only afford seats as far as Salt Lake City. After they sat up all night, I paid for their breakfast.

A retired British couple was circumnavigating the entire US in a month on a “See America Pass.” Mennonites are returning home by train because their religion forbade automobiles or airplanes.

The national debt ballooned to an eye-popping $30 trillion in 2021, a gain of an incredible $3 trillion and a post-World War II record. Yet, as long as global central banks are still flooding the money supply with trillions of dollars in liquidity, bonds will not fall in value too dramatically. I’m expecting a slow grind down in prices and up in yields.

The great bond short of 2021 never happened. Even though bonds delivered their worst returns in 19 years, they still remained nearly unchanged. That wasn’t good enough for the many hedge funds, which had to cover massive money-losing shorts into yearend.

Instead, the Great Bond Crash will become a 2022 business. This time, bonds face the gale force headwinds of three promised interest rates hikes. The year-end government bond auctions were a complete disaster.

Fed borrowing continues to balloon out of control. It’s just a matter of time before the last billion dollars in government borrowing breaks the camel’s back.

That makes a bond short a core position in any balanced portfolio. Don’t get lazy. Make sure you only sell a rally lest we get trapped in a range, as we did for most of 2021.

A Visit to the 19th Century

4) Foreign Currencies (FXE), (EUO), (FXC), (FXA), (YCS), (FXY), (CYB)

For the first time in ages, I did no foreign exchange trades last year. That is a good thing because I was wrong about the direction of the dollar for the entire year.

Sometimes, passing on bad trades is more important than finding good ones.

I focused on exploding US debt and trade deficits undermining the greenback and igniting inflation. The market focused on delta and omicron variants heralding new recessions. The market won.

The market won’t stay wrong forever. Just as bond crash is temporarily in a holding pattern, so is a dollar collapse. When it does occur, it will happen in a hurry.

5) Commodities (FCX), (VALE), (DBA)

The global synchronized economic recovery now in play can mean only one thing, and that is sustainably higher commodity prices.

The twin Covid variants put commodities on hold in 2021 because of recession fears. So did the Chinese real estate slowdown, the world’s largest consumer of hard commodities.

The heady days of the 2011 commodity bubble top are now in play. Investors are already front running that move, loading the boat with Freeport McMoRan (FCX), US Steel (X), and BHP Group (BHP).

Now that this sector is convinced of an eventual weak US dollar and higher inflation, it is once more the apple of traders’ eyes.

China will still demand prodigious amounts of imported commodities once again, but not as much as in the past. Much of the country has seen its infrastructure build out, and it is turning from a heavy industrial to a service-based economy, like the US. Investors are keeping a sharp eye on India as the next major commodity consumer.

And here’s another big new driver. Each electric vehicle requires 200 pounds of copper and production is expected to rise from 1 million units a year to 25 million by 2030. Annual copper production will have to increase 11-fold in a decade to accommodate this increase, no easy task, or prices will have to ride.

The great thing about commodities is that it takes a decade to bring new supply online, unlike stocks and bonds, which can merely be created by an entry in an excel spreadsheet. As a result, they always run far higher than you can imagine.

Accumulate commodities on dips.

6) Energy (DIG), (RIG), (USO), (DUG), (UNG), (USO), (XLE), (AMLP)

Energy may be the top-performing sector of 2022. But remember, you will be trading an asset class that is eventually on its way to zero.

However, you could have several doublings on the way to zero. This is one of those times.

The real tell here is that energy companies are drinking their own Kool-Aid. Instead of reinvesting profits back into their new exploration and development, as they have for the last century, they are paying out more in dividends.

There is the additional challenge in that the bulk of US investors, especially environmentally friendly ESG funds, are now banned from investing in legacy carbon-based stocks. That means permanently cheap valuations and shares prices for the energy industry.

Energy stocks are also massively under-owned, making them prone to rip-you-face-off short squeezes. Energy now counts for only 3% of the S&P 500. Twenty years ago it boasted a 15% weighting.

The gradual shut down of the industry makes the supply/demand situation more volatile. Therefore, we could top $100 a barrel for oil in 2022, dragging the stocks up kicking and screaming all the way.

Unless you are a seasoned, peripatetic, sleep-deprived trader, there are better fish to fry.

7) Precious Metals (GLD), (DGP), (SLV), (PPTL), (PALL)

The train has added extra engines at Denver, so now we may begin the long laboring climb up the Eastern slope of the Rocky Mountains.

On a steep curve, we pass along an antiquated freight train of hopper cars filled with large boulders.

The porter tells me this train is welded to the tracks to create a windbreak. Once, a gust howled out of the pass so swiftly, that it blew a passenger train over on its side.

In the snow-filled canyons, we saw a family of three moose, a huge herd of elk, and another group of wild mustangs. The engineer informs us that a rare bald eagle is flying along the left side of the train. It’s a good omen for the coming year.

We also see countless abandoned 19th century gold mines and the broken-down wooden trestles leading to them, relics of previous precious metals booms. So, it is timely here to speak about the future of precious metals.

Fortunately, when a trade isn’t working, I avoid it. That certainly was the case with gold last year.

2021 was a terrible year for precious metals. With inflation soaring, stocks volatile, and interest rates going nowhere, gold had every reason to rise. Instead, it fell for almost all of the entire year.

Bitcoin stole gold’s thunder, sucking in all of the speculative interest in the financial system. Jewelry and industrial demand was just not enough to keep gold afloat.

This will not be a permanent thing. Chart formations are starting to look encouraging, and they certainly win the price for a big laggard rotation. So, buy gold on dips if you have a stick of courage on you.

8) Real Estate (ITB), (LEN)

The majestic snow-covered Rocky Mountains are behind me. There is now a paucity of scenery, with the endless ocean of sagebrush and salt flats of Northern Nevada outside my window, so there is nothing else to do but write.

My apologies in advance to readers in Wells, Elko, Battle Mountain, and Winnemucca, Nevada.

It is a route long traversed by roving banks of Indians, itinerant fur traders, the Pony Express, my own immigrant forebearers in wagon trains, the transcontinental railroad, the Lincoln Highway, and finally US Interstate 80, which was built for the 1960 Winter Olympics at Squaw Valley.

Passing by shantytowns and the forlorn communities of the high desert, I am prompted to comment on the state of the US real estate market.

There is no doubt a long-term bull market in real estate will continue for another decade, although from here prices will appreciate at a 5%-10% slower rate.

There is a generational structural shortage of supply with housing which won’t come back into balance until the 2030s.

There are only three numbers you need to know in the housing market for the next 20 years: there are 80 million baby boomers, 65 million Generation Xer’s who follow them, and 86 million in the generation after that, the Millennials.

The boomers have been unloading dwellings to the Gen Xers since prices peaked in 2007. But there are not enough of the latter, and three decades of falling real incomes mean that they only earn a fraction of what their parents made. That’s what caused the financial crisis.

If they have prospered, banks won’t lend to them. Brokers used to say that their market was all about “location, location, location.” Now it is “financing, financing, financing.” Imminent deregulation is about to deep-six that problem.

There is a happy ending to this story.

Millennials now aged 26-44 are now the dominant buyers in the market. They are transitioning from 30% to 70% of all new buyers of homes.

The Great Millennial Migration to the suburbs and Middle America has just begun. Thanks to Zoom, many are never returning to the cities. So has the migration from the coast to the American heartland.

That’s why Boise, Idaho was the top-performing real estate market in 2021, followed by Phoenix, Arizona. Personally, I like Reno, Nevada, where Apple, Google, Amazon, and Tesla are building factories as fast as they can.

As a result, the price of single-family homes should rocket during the 2020s, as they did during the 1970s and the 1990s when similar demographic forces were at play.

This will happen in the context of a coming labor shortfall, soaring wages, and rising standards of living.

Rising rents are accelerating this trend. Renters now pay 35% of their gross income, compared to only 18% for owners, and less, when multiple deductions and tax subsidies are taken into account. Rents are now rising faster than home prices.

Remember, too, that the US will not have built any new houses in large numbers in 13 years. The 50% of small home builders that went under during the crash aren’t building new homes today.

We are still operating at only a half of the peak rate. Thanks to the Great Recession, the construction of five million new homes has gone missing in action.

That makes a home purchase now particularly attractive for the long term, to live in, and not to speculate with.

You will boast to your grandchildren how little you paid for your house, as my grandparents once did to me ($3,000 for a four-bedroom brownstone in Brooklyn in 1922), or I do to my kids ($180,000 for a two-bedroom Upper East Side Manhattan high rise with a great view of the Empire State Building in 1983).

That means the major homebuilders like Lennar (LEN), Pulte Homes (PHM), and KB Homes (KBH) are a buy on the dip.

Quite honestly, of all the asset classes mentioned in this report, purchasing your abode is probably the single best investment you can make now. It’s also a great inflation play.

If you borrow at a 3.0% 30-year fixed rate, and the long-term inflation rate is 3%, then, over time, you will get your house for free.

How hard is that to figure out? That math degree from UCLA is certainly earning its keep.

9) Bitcoin

It’s not often that new asset classes are made out of whole cloth. That is what happened with Bitcoin, which, in 2021, became a core holding of many big institutional investors.

But get used to the volatility. After doubling in three months, Bitcoin gave up all its gains by year-end. You have to either trade Bitcoin like a demon or keep your positions so small you can sleep at night.

By the way, right now is a good place to establish a new position in Bitcoin.

10) Postscript

We have pulled into the station at Truckee in the midst of a howling blizzard.

My loyal staff has made the ten-mile trek from my beachfront estate at Incline Village to welcome me to California with a couple of hot breakfast burritos and a chilled bottle of Dom Perignon Champagne, which has been resting in a nearby snowbank. I am thankfully spared from taking my last meal with Amtrak.

After that, it was over legendary Donner Pass, and then all downhill from the Sierras, across the Central Valley, and into the Sacramento River Delta.

Well, that’s all for now. We’ve just passed what was left of the Pacific mothball fleet moored near the Benicia Bridge (2,000 ships down to six in 50 years). The pressure increase caused by a 7,200-foot descent from Donner Pass has crushed my plastic water bottle. Nice science experiment!

The Golden Gate Bridge and the soaring spire of Salesforce Tower are just around the next bend across San Francisco Bay.

A storm has blown through, leaving the air crystal clear and the bay as flat as glass. It is time for me to unplug my Macbook Pro and iPhone 13 Pro, pick up my various adapters, and pack up.

We arrive in Emeryville 45 minutes early. With any luck, I can squeeze in a ten-mile night hike up Grizzly Peak and still get home in time to watch the ball drop in New York’s Times Square on TV.

I reach the ridge just in time to catch a spectacular pastel sunset over the Pacific Ocean. The omens are there. It is going to be another good year.

I’ll shoot you a Trade Alert whenever I see a window open at a sweet spot on any of the dozens of trades described above.

Good luck and good trading in 2022!

John Thomas

The Mad Hedge Fund Trader

Global Market Comments

January 4, 2022

Fiat Lux

Featured Trade:

(PLAYING THE SHORT SIDE WITH VERTICAL BEAR PUT SPREADS),

(TLT)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.