Global Market Comments

December 30, 2021

Fiat Lux

Featured Trade:

(DINNER WITH DAVID POGUE),

(TSLA)

Global Market Comments

December 30, 2021

Fiat Lux

Featured Trade:

(DINNER WITH DAVID POGUE),

(TSLA)

Global Market Comments

December 29, 2021

Fiat Lux

Featured Trade:

(MY OLD PAL, LEONARDO FIBONACCI),

(TESTIMONIAL)

Global Market Comments

December 28, 2021

Fiat Lux

Featured Trade:

(A COW-BASED ECONOMICS LESSON)

Global Market Comments

December 27, 2021

Fiat Lux

Featured Trade:

(A COW-BASED ECONOMICS LESSON)

“Amazon isn’t happening to the book business. The future is happening to the book business,” said Amazon founder Jeff Bezos.

Global Market Comments

December 24, 2021

Fiat Lux

Featured Trade:

(TRADING THE NEW APPLE IN 2022),

(AAPL),

(TESTIMONIAL)

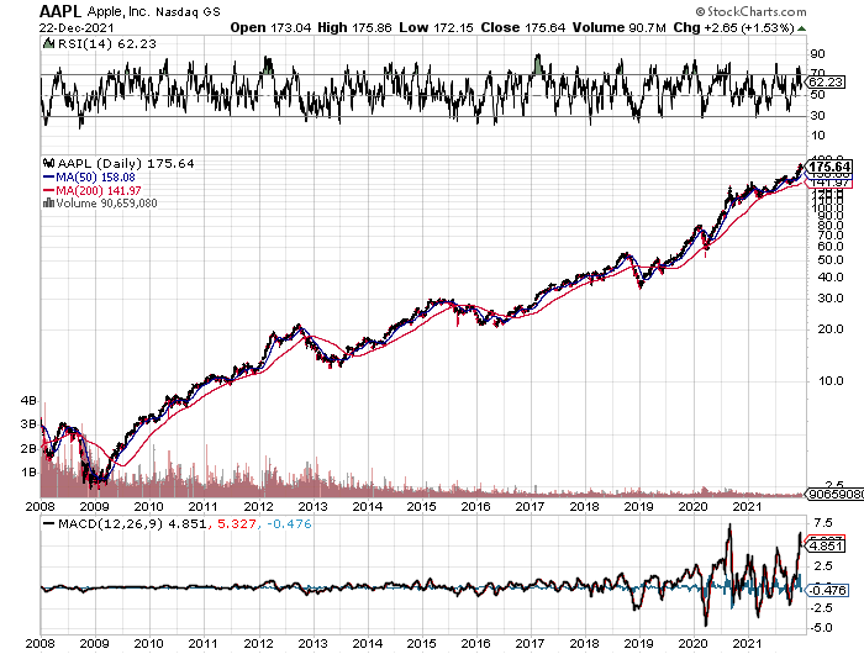

Not a day goes by when someone doesn’t ask me about what to do about Apple (AAPL).

After all, it is the world's largest publicly-traded company at a $2.1 trillion market capitalization. It is the planet’s most widely owned stock. Almost everyone uses their products in some form or another.

It buys back more of its own stock than any other company on the planet. Oh yes, it is also one of Warren Buffet’s favorite picks and one of his biggest holdings.

So, the widespread adulation is totally understandable.

Apple is a company with which I have a very long relationship. During the early 1980s, I was ordered by Morgan Stanley to take Steve Jobs around to the big New York Institutional Investors to pitch a secondary share offering for the sole reason that I was one of three people who worked for the firm who was then from California.

They thought one West Coast hippy would easily get along with another. Boy, were they wrong, me in my three-piece navy blue pinstripe suit and Steve in his battered Levi’s. It was the worst day of my life.

Steve was not a guy who palled around with anyone. He especially hated investment bankers, like me.

I last got into Apple with my personal account when the company only had four weeks of cash flow remaining and was on the verge of bankruptcy. I got in at $7, which on a split-adjusted basis today is 25 cents. I still have them. In fact, my cost basis in Apple is less than the 88 cents annual dividend now.

Today, some 200 Apple employees subscribe to the Diary of a Mad Hedge Fund Trader looking to diversify their substantial holdings. Many own Apple stock with an adjusted cost basis of under $5. Suffice it to say, they all drive really nice Priuses.

So I get a lot of information about the firm far above and beyond the normal effluent of the media and stock analysts. That’s why Apple has become a favorite target of my Trade Alerts over the years.

And here is the great irony: Nobody would touch the stock with a ten-foot pole at the end of 2018. Since then, Apple has rallied 274%, creating more market cap in a year than any company in history.

Here’s why. Apple was all about the iPhone which then accounted for 75% of its total earnings. The TV, the watch, the car, iPods, the iMac, and Apple Pay were all a waste of time and consumed far more coverage than they are collectively worth.

The good news is that iPhone sales are subject to a fairly predictable cycle. Apple launches a major new iPhone every other fall. The share price peaks shortly after that. The odd years see minor upgrades, not generational changes.

Just like you see a big pullback in the tide before a tsunami hits, iPhone sales are flattening out between major upgrades. This is because consumers start delaying purchases in expectation of the introduction of the new iPhone, more power, gadgets, and gizmos.

So during those in-between years, the stock performance was disappointing. 2018 certainly followed this script with Apple down a horrific 30.13% at the lows. Maybe it’s a coincidence, but the previous generation in Apple shares in 2015 brought a decline of, you guessed it, exactly 29.33%.

But Apple is a much bigger company this time around, and well-established cycles tend to bring in diminishing returns. It’s like watching the declining peaks of a bouncing rubber ball.

This is not your father’s Apple anymore. Services like iTunes and the new Apple+ streaming service are accounting for an even larger share of the company’s profits. And guess what? Services companies command much higher multiples than boring old hardware ones. It’s the old questions of linear versus exponential growth.

Here’s the next new play. Autonomous driving looks to be a huge business for Apple, possibly a $1 trillion a year business. After all, Tesla is already charging $8,000 for the upgrade and it only works on freeways. My bet is that they sell autonomous consoles to legacy Ford (F) and General Motors (GM).

An easing of trade relations with China under a new Biden administration will bring a new spring to Apple’s step, where sales have recently been in free fall. Their new membership lease program promises to deliver a faster upgrade cycle that will allow higher premium prices for their products. That will bring larger profits.

A decade ago, I ran into a local school teacher who, after 30 years of slaving away with your brats, was unable to retire because, with only $100,000 saved, she was too poor to do so. All her money went to expensive California rent and to Blue Cross since her district had no health insurance plan.

I told her to place her entire life savings into Apple. Her financial advisor told her she was nuts. Her friends told her she was crazy. Her mother said she should disown me.

Where is that school teacher today? She just bought a $3 million beachfront home on Hawaii’s Kona Coast. She sold her Apple shares for $7.3 million. I know because I just received a nice Christmas card from her attached to a two-pound box of See’s candy, my favorite.

Who said teaching didn’t pay!

It all adds up to keeping Apple as a core to any long-term portfolio.

Just thought you’d like to know.

I Heard They are Diversifying

Global Market Comments

December 22, 2021

Fiat Lux

Featured Trade:

(THE EIGHT WORST TRADES IN HISTORY),

(TESTIMONIAL)

Global Market Comments

December 21, 2021

Fiat Lux

Featured Trade:

(A CHRISTMAS STORY),

(THE U-HAUL INDICATOR)

Global Market Comments

December 20, 2021

Fiat Lux

Featured Trade:

(I’M TAKING OFF FOR THE YEAR)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.