“Amazon isn’t happening to the book business. The future is happening to the book business,” said Amazon founder Jeff Bezos.

“Amazon isn’t happening to the book business. The future is happening to the book business,” said Amazon founder Jeff Bezos.

Global Market Comments

December 24, 2021

Fiat Lux

Featured Trade:

(TRADING THE NEW APPLE IN 2022),

(AAPL),

(TESTIMONIAL)

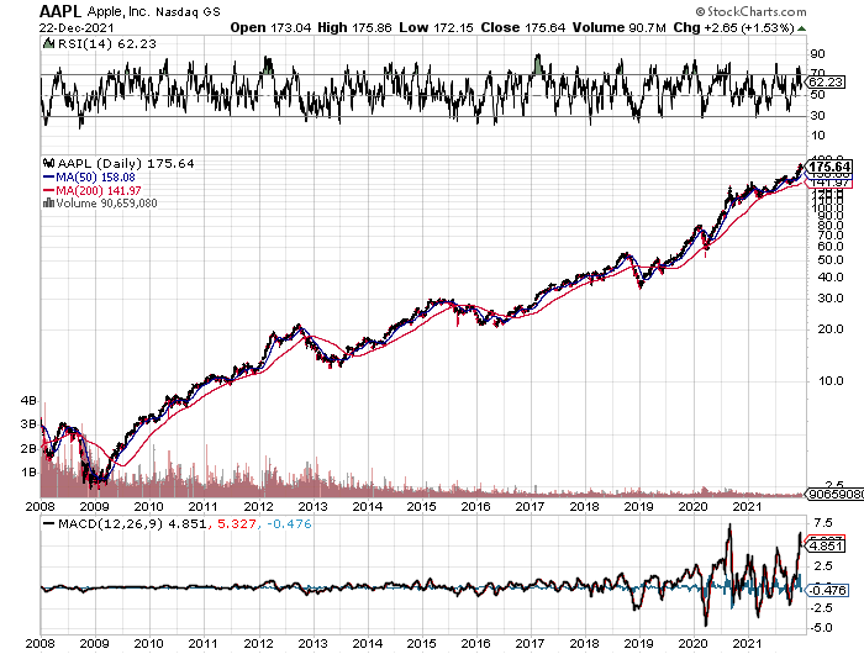

Not a day goes by when someone doesn’t ask me about what to do about Apple (AAPL).

After all, it is the world's largest publicly-traded company at a $2.1 trillion market capitalization. It is the planet’s most widely owned stock. Almost everyone uses their products in some form or another.

It buys back more of its own stock than any other company on the planet. Oh yes, it is also one of Warren Buffet’s favorite picks and one of his biggest holdings.

So, the widespread adulation is totally understandable.

Apple is a company with which I have a very long relationship. During the early 1980s, I was ordered by Morgan Stanley to take Steve Jobs around to the big New York Institutional Investors to pitch a secondary share offering for the sole reason that I was one of three people who worked for the firm who was then from California.

They thought one West Coast hippy would easily get along with another. Boy, were they wrong, me in my three-piece navy blue pinstripe suit and Steve in his battered Levi’s. It was the worst day of my life.

Steve was not a guy who palled around with anyone. He especially hated investment bankers, like me.

I last got into Apple with my personal account when the company only had four weeks of cash flow remaining and was on the verge of bankruptcy. I got in at $7, which on a split-adjusted basis today is 25 cents. I still have them. In fact, my cost basis in Apple is less than the 88 cents annual dividend now.

Today, some 200 Apple employees subscribe to the Diary of a Mad Hedge Fund Trader looking to diversify their substantial holdings. Many own Apple stock with an adjusted cost basis of under $5. Suffice it to say, they all drive really nice Priuses.

So I get a lot of information about the firm far above and beyond the normal effluent of the media and stock analysts. That’s why Apple has become a favorite target of my Trade Alerts over the years.

And here is the great irony: Nobody would touch the stock with a ten-foot pole at the end of 2018. Since then, Apple has rallied 274%, creating more market cap in a year than any company in history.

Here’s why. Apple was all about the iPhone which then accounted for 75% of its total earnings. The TV, the watch, the car, iPods, the iMac, and Apple Pay were all a waste of time and consumed far more coverage than they are collectively worth.

The good news is that iPhone sales are subject to a fairly predictable cycle. Apple launches a major new iPhone every other fall. The share price peaks shortly after that. The odd years see minor upgrades, not generational changes.

Just like you see a big pullback in the tide before a tsunami hits, iPhone sales are flattening out between major upgrades. This is because consumers start delaying purchases in expectation of the introduction of the new iPhone, more power, gadgets, and gizmos.

So during those in-between years, the stock performance was disappointing. 2018 certainly followed this script with Apple down a horrific 30.13% at the lows. Maybe it’s a coincidence, but the previous generation in Apple shares in 2015 brought a decline of, you guessed it, exactly 29.33%.

But Apple is a much bigger company this time around, and well-established cycles tend to bring in diminishing returns. It’s like watching the declining peaks of a bouncing rubber ball.

This is not your father’s Apple anymore. Services like iTunes and the new Apple+ streaming service are accounting for an even larger share of the company’s profits. And guess what? Services companies command much higher multiples than boring old hardware ones. It’s the old questions of linear versus exponential growth.

Here’s the next new play. Autonomous driving looks to be a huge business for Apple, possibly a $1 trillion a year business. After all, Tesla is already charging $8,000 for the upgrade and it only works on freeways. My bet is that they sell autonomous consoles to legacy Ford (F) and General Motors (GM).

An easing of trade relations with China under a new Biden administration will bring a new spring to Apple’s step, where sales have recently been in free fall. Their new membership lease program promises to deliver a faster upgrade cycle that will allow higher premium prices for their products. That will bring larger profits.

A decade ago, I ran into a local school teacher who, after 30 years of slaving away with your brats, was unable to retire because, with only $100,000 saved, she was too poor to do so. All her money went to expensive California rent and to Blue Cross since her district had no health insurance plan.

I told her to place her entire life savings into Apple. Her financial advisor told her she was nuts. Her friends told her she was crazy. Her mother said she should disown me.

Where is that school teacher today? She just bought a $3 million beachfront home on Hawaii’s Kona Coast. She sold her Apple shares for $7.3 million. I know because I just received a nice Christmas card from her attached to a two-pound box of See’s candy, my favorite.

Who said teaching didn’t pay!

It all adds up to keeping Apple as a core to any long-term portfolio.

Just thought you’d like to know.

I Heard They are Diversifying

Global Market Comments

December 22, 2021

Fiat Lux

Featured Trade:

(THE EIGHT WORST TRADES IN HISTORY),

(TESTIMONIAL)

Global Market Comments

December 21, 2021

Fiat Lux

Featured Trade:

(A CHRISTMAS STORY),

(THE U-HAUL INDICATOR)

Global Market Comments

December 20, 2021

Fiat Lux

Featured Trade:

(I’M TAKING OFF FOR THE YEAR)

I need a vacation.

I have been working nonstop for two years and desperately need a break.

You can tear up your rolodex card for me, unfriend me on Facebook, designate my email address as SPAM, and block my Twitter account. It won’t do you any good.

If I don’t take some time off, I am going to start raving MAD!

Over the last two years, I have worked the hardest in my entire life.

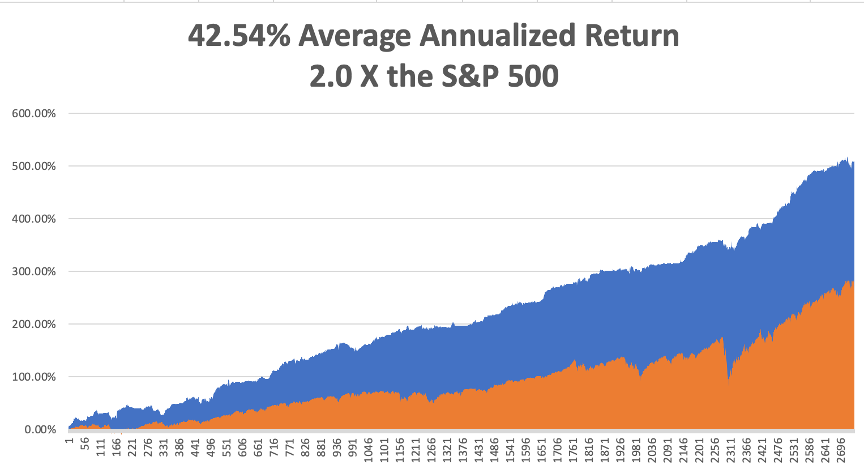

During said two years, I have brought in a total return of 157.13%, versus 18% for the Dow Average, far and away the best of my life and almost certainly yours as well. If you got half of my performance, you beat virtually everyone else in the industry. In other words, I under-promised and over-delivered in spades.

If you wonder why I do this, it's really very simple. Read my inbox and you would burst into tears.

Every day, I learn tales of mortgages paid off, student loans dealt with, college educations financed, and early retirements launched. I am improving lives by the thousands. That’s far better than any hedge fund bonus could offer me, although I wouldn’t mind owning the Golden State Warriors.

At this late stage in my life, the most valuable thing is to be needed and listened to. If that means becoming a cult leader, that’s fine with me. After all, the last guy to try this route got crucified.

This was one of those once-in-a-century years, like 1968, when absolutely everything happened. To say we had challenges would be putting it mildly.

I had to become a chief medical officer, advising staff on four countries and five US states which vaccine to get and how to get it. Not a single person got sick. Then the US staff all applied for PPP loans and got them.

When the Philippine staff began starving because of severe government lockdown orders, I went to Costco, bought a 50-pound bag of rice, and sent it to Manila by Federal Express. It worked.

When horrific uncontrollable wildfires broke out in California, I flew spotter planes for Cal Fire, holding the stick with one hand and a pair of binoculars with the other, looking for trouble and radioing in coordinates and directing aerial tankers. Nobody can fly wildfires like I can.

I lost access to my Lake Tahoe house when the big fire hit right in the middle of a remodel. All the contractors disappeared chasing much higher paying insurance work. At least we now have a 20-mile wide fire break to the southwest of the house. And I have not been to my Zermatt chalet in 2 ½ years because of the Swiss quarantine.

I have high hopes for next summer.

Thankfully, there were no new wars this year, so the Marine Corps didn’t come calling, except for their annual toy donations. I’ll take toys over more combat flight time any day.

So, I will spend the next two weeks reading the deep research, speaking with old hedge fund buddies, and trying to come up with a game plan for 2022. One thing is certain: we are going to have to work twice as hard to make half the profits with double the volatility. Discipline will be key.

Instead of sending out urgent trade alerts, emergency news flashes, and more research than you can read, I’ll be playing Monopoly and Risk, practicing my banjo, a catching up on some classic films.

I already have one trade on: I’ll watch Elf if the kids watch Gary Cooper’s 1949 Task Force, the history of naval aviation (semper fi).

In the meantime, I’ll be running some of my favorite research pieces from the past over the next two weeks. I won’t be sending out Hot Tips at all.

Sixteen feet of snow is expected at Tahoe by New Year. Boy, do we need it.

So, everyone have some great holidays, spend your trading profits, and get well-rested. We have some serious work to do in January.

Merry Christmas and Happy New Year.

John Thomas

CEO and Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

December 17, 2021

Fiat Lux

Featured Trade:

(DECEMBER 15 BIWEEKLY STRATEGY WEBINAR Q&A),

(FCX), (FCI), (TLT), (TBT), (BITO), (AAPL), (AMZN), (T), (TSLA), (BABA), (BLOK), (MSTR), (COIN)

Below please find subscribers’ Q&A for the December 15 Mad Hedge Fund Trader Global Strategy Webinar broadcast from the safety of Silicon Valley.

Q: With interest rates going up, would it make sense to short heavily indebted companies as a class?

A: Yes it does; those would be old-line industrials and auto companies with very heavy debts. Technology companies essentially have no debt unless they’re startups. So yeah, that’s a good idea; unless of course inflation is peaking right now, which it may be if you solve these supply chain problems, and it becomes evident that retailers overordered to beat the supply chain problems and now have a ton of excess inventory they can’t meet—then the inflation plays will crash. So, not a low-risk environment right now. No matter where you look, you’re screwed if you do, you’re screwed if you don't. So that is an issue to keep in mind.

Q: What do you think of Freeport McMoRan (FCX) short-term?

A: Short term, (FCX) only sees the Chinese (FXI) real estate crisis, which is getting worse before it gets better and could bring a complete halt to all known construction in China. The government is forcing the real estate companies there to run at losses in order to bring the bottom part of their society into the middle class with houses in third and fourth-tier cities. Long term, as annual electric car production goes from a million cars a year to 25 million cars a year and each car needs 200 lbs. of copper, we have to triple world production practically overnight to accommodate that. That can’t happen, therefore that means much higher prices. If you’re willing to take some pain, picking up freeport McMoRan in the low $30s has to be the trade of the century.

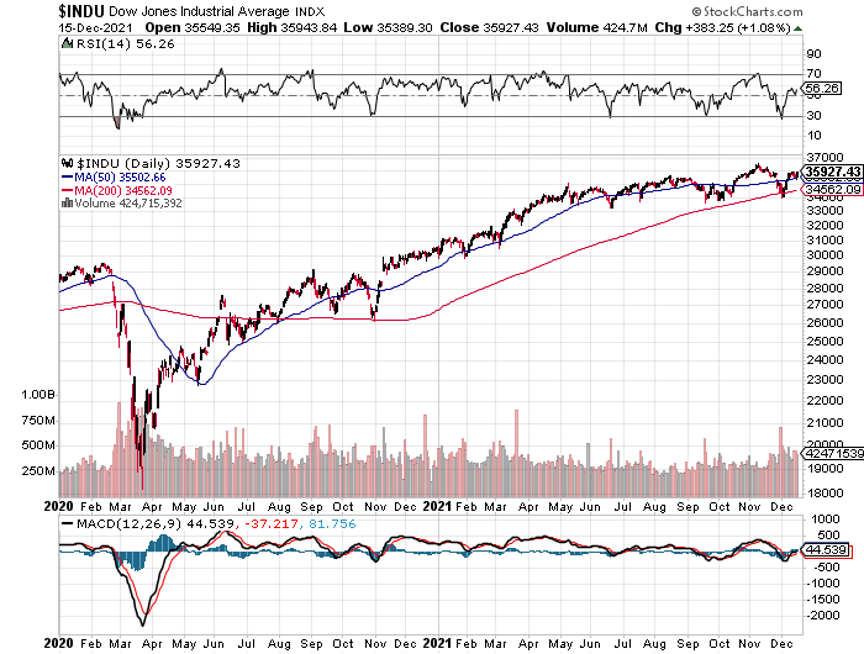

Q: Do you see a Christmas rally or a bigger correction?

A: Rally first. Once we get the Fed out of the way today, we could get our Christmas rally resumed and go to new highs by the end of the year. But, January is starting to look a little bit scary with all the unknowns going forward and massive long positions. January could be okay as hedge funds put positions back on in tech that they’re dumping right now. If they don’t show up…Houston, we might have a problem.

Q: Thoughts on the iShares 20 Plus Year Treasury Bond ETF (TLT) Dec 2022 $150-$155 vertical bear put spread?

A: Since I'm in low-risk mode, I would go up $5 or $10 points and not be greedy. Not being greedy is going to be one of the principal themes of 2022 therefore I’m recommending that people do the $160-$165 or even the $165-$170, which still gives you a 30% return in a year, and I think next year this will be seen as a fabulous return.

Q: What about the $100,000 target for Bitcoin (BITO) by the end of the year?

A: That’s off the table thanks to the Fed tightening and Omicron triggering a massive “RISK OFF” and flight to safety move. Non-yielding instruments tend not to do well during periods of rising interest rates, so gold along with crypto is getting crushed.

Q: What will happen in the case of a black swan event in early 2022, like Russia invading Ukraine?

A: Market impact for that would be a bad couple of days, a buying opportunity, and then you’d want to pile into stocks. Every geopolitical event that’s happened in the last 20 years has been a buying opportunity for stocks. Of course, I would feel bad for the Ukrainians, but it’s kind of like Florida seceding from the US, then the US invading Florida to take it back, and the rest of the world not really caring. Plus, it doesn’t help that their heavily nationalist post-coup government has some fascist tendencies. However, we could get global economic sanctions against Russia like an import/export embargo, which would hurt them and destroy their economy.

Q: Will the European natural gas shortage continue?

A: Yes because the Europeans are at the mercy of the Russians, who have all the gas and none of the economy. Therefore, they can export as much or as little as they want, depending on how much political control they’re trying to exert in Europe.

Q: Apple Inc. (AAPL) price target?

A: Well, my price target for next year was $200; we could hit that by the end of the year if we get a rally after the Fed meeting.

Q: 33% of the population is in collection status with personal debt, credit cards, etc—is that a harbinger of a 2008 crash?

A: No, it is a harbinger of excess liquidity, interest rates being too low, and lenders being too lax. However, we aren’t at the level where it could wipe out the entire economy like with defaulting on a third of all housing market debt in 2008.

Q: What should I do with my call spreads for Amazon.com, Inc. (AMZN)?

A: Well, November would have been a great sell. Down here, I’d be inclined to hold onto the spreads you have, looking for a yearend rally and a new year rally. But remember, with all these short-dated plays risk is rising, so keep that in mind.

Q: What do you think of AT&T Inc (T)?

A: The whole sector has just been treated horrifically; I don’t want to try to catch a falling knife here even though AT&T pays a 10% dividend.

Q: What about quad witching day?

A: Expect a battle by big hedge funds trying to push single stocks options just above or below strike prices. It’s totally unpredictable because of the rise of front-month trading, which is now 80% of all options trading with the participation of algorithms.

Q: Is the Alibaba Group Holding Limited (BABA) $230-$250 LEAP in June 2023 worth keeping?

A: I would say yes, I think the Chinese will come to their senses by then, and all the Chinese tech plays will double, but there’s no guarantee. That is still a high-risk trade.

Q: Does the US have an opportunity to export petroleum products?

A: The answer is yes, we are already a net energy exporter thanks to fracking. But, it is a multi-year infrastructure build-out to add foreign export destinations like Europe, which hasn’t bought our petroleum since WWII. Right now, almost all of our exports are going to Asia. No easy fixes here.

Q: Is Tesla Inc (TSLA) a buy at 935 down 300 in change?

A: Not yet; 45% seems to be the magic number for Tesla correction. We had one this year. And Elon Musk hasn’t quit selling yet, although I suspect he’ll end his selling by the end of the year because he’ll have met all his tax obligations for the year. He has to sell these options before they expire and are rendered useless. So that is what’s happening with Tesla, Elon Musk selling. And can you blame him? He almost worked himself to death making that company, time to spend some money and have a good time, like me.

Q: What if your Chinese company gets delisted?

A: Try to get out before it is delisted. Otherwise, the domicile moves to Hong Kong and you’ll have to sell equivalent shares there. I don’t know what the details of that are going to be, but the Chinese companies are trying to force companies to delist from the US and list in Hong Kong so they have complete control over what's going on. Also, I never liked these New York listings anyway because the disclosures were terrible, with Cayman Island PO Boxes and so on…

Q: Is the ProShares UltraShort 20+ Year Treasury (TBT) a good long-term position to hold?

A: It is to an extent—only if you expect any big moves up in interest rates, which I kind of am. This is because the cost of carry for (TBT) is quite high; you have to pay double the 10-year US Treasury rates, which is double 1.45% or about 2.90%, and then another management fee of 1%, so you have kind of a 4% a year headwind on that because of cost. Remember, if you’re short a bond, you’re short a coupon; if you’re double short a bond you’re short twice the coupon and you have to pay that and they take it out of the share price. But, if you’re expecting bonds to go down more than 4%, you’ll cover that and then some and I think bonds could drop 10-20% this year.

Q: What’s the difference between GBTC and BITO?

A: Nothing, both are Bitcoin plays that are tracking reasonably well. I prefer to go with the miners—the Bitcoin providers, that’s a selling-shovels-to-the-gold-miners play. They tend to have more volatility than the underlying Bitcoin, so that’s why I’m in (BLOK) and (MSTR) when I’m in it.

Q: What’s the best way to buy Crypto?

A: If you really want to buy Crypto directly, the really easy way is to go through one of the top crypto brokerage houses, and we’ve recommended several of those. Coinbase (COIN) is the one I’m in. It literally takes you five minutes to set up an account and you can instantly buy Bitcoin linked to your bank account.

Q: What are the fees like for Coinbase?

A: The fees at (COIN) are exorbitant only if you’re buying $10 worth of Bitcoin. If you’re buying like $1 million worth, they’re much, much smaller. But I recommend you start at $10 and work your way up as I did, and sooner or later you’ll be buying million-dollar chunks of Bitcoin which then double in three months, which happened to me this year.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last ten years are there in all their glory.

Good Luck and Stay Healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

December 15, 2021

Fiat Lux

Featured Trade:

(TESTIMONIAL)

(LONG TERM ECONOMIC EFFECTS OF THE CORONAVIRUS),

(ZM), (LOGM), (AMZN), (PYPL), (SQ), CNK), (AMC),

(IMAX), (CCL), (RCL), (NCLH), (CVS), (RAD), (WMT)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.