In the investment business, you’re only as good as your last trade. If that is the case, that makes me a pretty worthless person in the wake of a record four stop-losses at the November 19 option expiration.

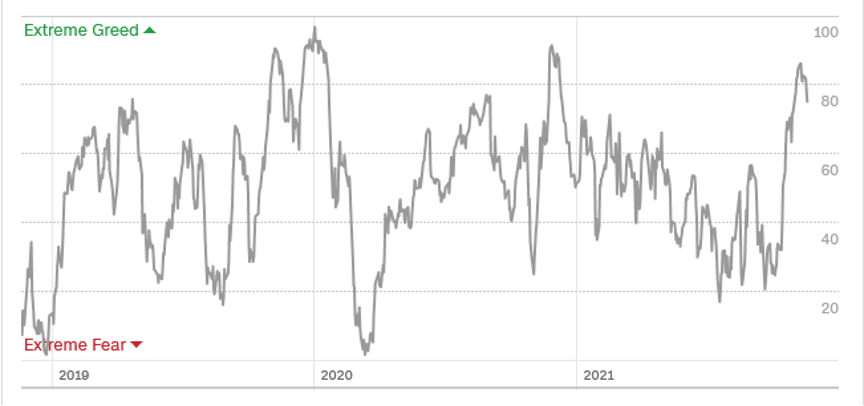

Days before, the market closed with all ten of our positions profitable. But the pandemic lockdown in Austria on Friday morning shattered those plans. Fears of a new Covid wave and another mini-recession send bonds soaring and interest rates crashing. That trashed financial stocks, where I had a heavy exposure.

If you work in the business long enough, you see a black swan on an options expiration day every five or ten years. This was our turn. As a result, we traded a double-digit gain for November for a moderate loss. That still leaves us with a heroic 80% gain for 2021 and 15 consecutive profitable months.

There is nothing to do but pick yourself up, dust yourself off, and go on to the next trade. I wouldn’t be surprised to see all of the Friday losses reversed in the coming weeks. Banks are still outrageously profitable and the cheapest sector in the market. If you have a six-month to one-year view, the action on Friday changed nothing.

You live by the sword, you die by the sword.

There was a lot going on Friday than just another Covid wave. November option expirations used to be a snore. But this year, brokerage firms have stampeded so many retail investors into the options markets where they make the most money that they have become major events.

Some 70% of all options trading now takes place in securities with less than two weeks to expiration. In the meantime, professional traders limit their personal accounts to long term LEAPS which are the subject of the Mad Hedge Concierge Service. Instead of rolling the dice for a 10% profit in a month, you get a very safe 100% return in a year.

Of course, while financials were getting wrecked, falling interest rates were acting as a steroid for tech stocks. (MSFT) and Google (GOOG) hit new highs for the year. Concierge members in my (ROM) LEAPS were rolling in clover.

The barbell strategy wins again!

Infrastructure Bill is signed on Monday, injecting another $1.2 trillion into the economy today. This assured the economy will keep booming through 2024. The bond market hates it, down $6.00 in three days. It adds another 3% to GDP over the next five years. Keep selling (TLT) on rallies.

Bitcoin Forks for the first some since 2017, making it much more competitive with Ethereum. It enables the lead crypto to use defi and third party apps. Miner Marathon (MARA) is raising a $500 million bond issue to buy Bitcoin. Keep buying (BITO) and (ETHE) on dips.

US Retail Sales roar, up 1.7% in October compared to 0.8% in September, far more than expected. Receipts for all items are rising. Higher wages are immediately translating into increased spending.

Builder Sentiment jumps, up 3 points to 83, according to the National Association of Homebuilders. A decade-long structural shortage of housing is a huge tailwind. Good luck hiring a contractor right now. The Midwest and the south are the leaders in demand.

Dollar hits 16-Month High, on the strength of yesterday’s red hot Retail Sales. It means higher interest rates soon, which is great for the buck. Currencies with the fastest rising interest rates are always the strongest.

NVIDIA kills it, with revenues up 50% YOY and earnings up 60%. It’s well on the way to becoming the next trillion-dollar company. It’s another Mad Hedge 20 bagger. Buy (NVDA) on dips.

Biden may try an SPR Release to cap gasoline prices. There are 741 barrels in the Strategic Petroleum Reserve, enough for 21 days of US consumption. It’s sitting there costing money, essentially a government subsidiary for the energy industry. Why have it if the US is now a net energy exporter? The concern has been enough to drop oil prices by 10%.

Rents for single-family homes are up 10.2% YOY, and will continue to rise. Miami has the highest rent inflation in the country, and the highest-priced homes are seeing the fastest increases.

Weekly Jobless Claims drop to new post-pandemic low, to 268,000, just fractionally. There are 2 million continuing claims. The great resignation continues.

John Deere strike ends, with some of the best terms for workers in 40 years. It cost the company $2.5 billion. They get an immediate 10% raise and $7,500 bonus, larger out-year raises, and big performance bonuses. There is a lot of making up for 30 years of no real wage growth going on here. It points a loaded gun at the head of the “transitory” argument for inflation. Buy (DE) on dips.

My Ten-Year View

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 240,000 here we come!

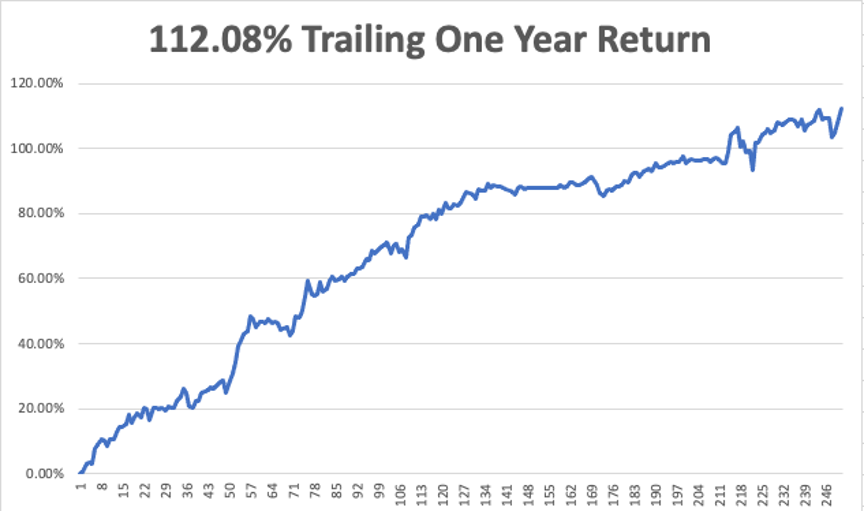

With the disastrous November options expiration, my November month-to-date performance plunged to -7.73%. My 2021 year-to-date performance took a haircut to 80.82%. The Dow Average is up 16.34% so far in 2021.

My entire portfolio expired on Friday, and I am 100% in cash. Of our ten positions, six made money and four lost. In addition, subscribers to the Mad Hedge Technology letter had another five winners, as tech stocks are still on a tear.

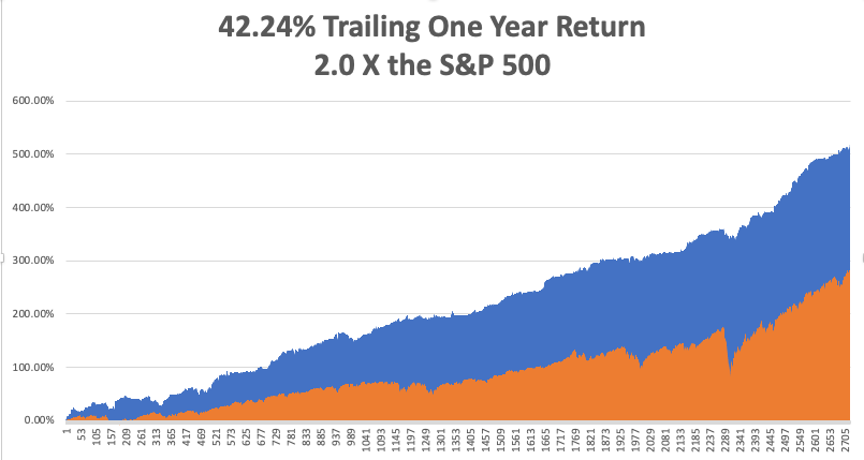

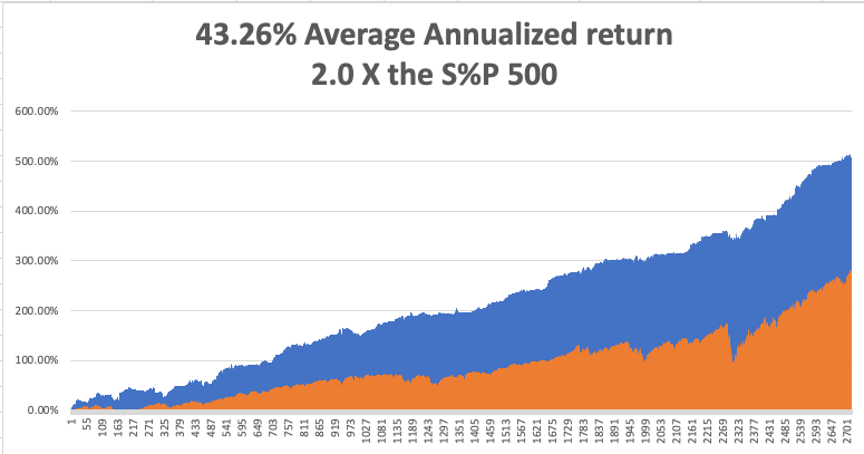

That brings my 12-year total return to 503.37%, some 2.00 times the S&P 500 (SPX) over the same period. My 12-year average annualized return has ratcheted up to 42.24%, easily the highest in the industry.

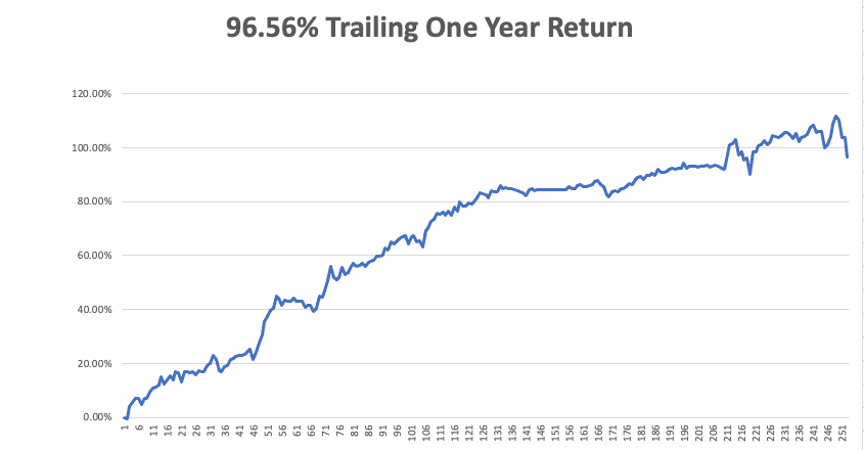

My trailing one-year return popped back to positively eye-popping 96.56%. I bet many of you are making the biggest money of your long lives.

We need to keep an eye on the number of US Coronavirus cases at 48 million and rising quickly and deaths topping 772,000, which you can find here at https://coronavirus.jhu.edu.

The coming week will be all about the inflation numbers.

On Monday, November 22 at 7:00 AM, Existing Homes Sales for October are released.

On Tuesday, November 23 at 6.45 AM, the Flash Manufacturing PMI is announced.

On Wednesday, November 24 at 5:30 AM, US Q3 GDP second estimate is published. At 7:00 AM we get New Home Sales for October. Minutes from the last Fed meeting are printed at 2:00 PM.

On Thursday, November 25 markets are closed for Thanksgiving Day.

On Friday, November 26 at 2:00 PM, the Baker Hughes Oil Rig Count are disclosed.

As for me, when I was shopping for a Norwegian Fiord cruise for next summer, each stop was familiar to me because a close friend had blown up bridges in every one of them.

During the 1970s at the height of the Cold War, my late wife Kyoko flew a monthly round trip from Moscow to Tokyo as a British Airways stewardess. As she was checking out of her Moscow hotel, someone rushed at her and threw a bundled typed manuscript that hit her in the chest.

Seconds later a half dozen KGB agents dog-piled on top of her. It turned out that a dissident was trying to get Kyoko to smuggle a banned book to the West and she was arrested as a co-conspirator and bundled away to Lubyanka Prison.

I learned of this when the senior KGB agent for Japan contacted me, who had attended my wedding the year before. He said he could get her released, but only if I turned over a top-secret CIA analysis of the Russian oil industry.

At a loss for what to do, I went to the US Embassy to meet with ambassador Mike Mansfield, who as The Economist correspondent in Tokyo I knew well. He said he couldn’t help me as Kyoko was a Japanese national, but he knew someone who could. Then in walked William Colby, head of the CIA.

Colby was a legend in intelligence circles. After leading the French resistance with the OSS, he was parachuted into Norway with orders to disable the railway system. Hiding in the mountains during the day, he led a team of Norwegian freedom fighters who laid waste to the entire rail system from Tromso all the way down to Oslo. He thus bottled up 300,000 German troops, preventing them from retreating home to defend themselves from an allied invasion.

During the Vietnam war, Colby became notorious for running the Phoenix assassination program.

I asked Colby what to do about the Soviet request. He replied, “give it to them.” Taken aback, I asked how. He replied, “I’ll give you a copy.” Mansfield was my witness so I could never be arrested for being a turncoat. Copy in hand, I turned it over to my KGB friend, and Kyoko was released the next day and put on the next flight out of the country. She never took a Moscow flight again.

I learned that the report predicted that the Russian oil industry, its largest source of foreign exchange, was on the verge of collapse. Only massive investment in modern western drilling technology could save it. This prompted Russia to sign deals with American oil service companies worth hundreds of millions of dollars.

Ten years later, I ran into Colby at a Washington event, and I reminded him of the incident. He confided in me “You know that report was completely fake, don’t you?” I was stunned. The goal was to drive the Soviet Union to the bargaining table to dial down the Cold War. I was the unwitting middleman. It worked. That was Bill, always playing the long game.

After Colby retired, he campaigned for nuclear disarmament and gun control. He died in a canoe accident in the lake near his Maryland home in 1996.

Stay Healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader