“The most dangerous word in the English language is “cheap”” said a hedge fund manager friend of mine.

Global Market Comments

August 26, 2021

Fiat Lux

Featured Trade:

(GOOGLE’S MAJOR BREAKTHROUGH IN QUANTUM COMPUTING),

(GOOGL), (IBM)

Global Market Comments

August 25, 2021

Fiat Lux

Featured Trade:

(PLEASE USE MY FREE DATABASE SEARCH)

Global Market Comments

August 24, 2021

Fiat Lux

Featured Trade:

(A REFRESHER COURSE AT SHORT SELLING SCHOOL),

(SH), (SDS), (PSQ), (DOG), (RWM), (SPXU), (AAPL), (TSLA),

(VIX), (VXX), (IPO), (MTUM), (SPHB), (HDGE)

Global Market Comments

August 23, 2021

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or DOING SKUNK DUTY)

Gophers have lately been eating my rose bushes. So I bought some special humane catch and release traps imported from France. Using peanut butter and almonds as bait, what did I catch the first night?

A skunk.

Guess who has skunk removal duty in this family? That would be me.

The Federal Reserve has some skunk duty of its own in the near future. For the time to take the punch bowl away is rapidly approaching.

A majority of Fed presidents now believe that continuing $40 billion a month worth of mortgage bond purchases while there are nationwide bidding wars going on in the housing market is nuts. So a taper is coming most likely in September if we get another hot jobs report.

The last time the Fed tapered, way back in 2013, the stock market dropped 5%. Remember the “taper tantrum”? It then realized the error of its ways and resumed stimulus. So, the worst we can expect is a 5% correction in the fall. And by the way, the market technicals have been screaming for a correction.

It will just be another buying opportunity. The wall of money is still getting higher, even with a Fed pullback. US corporate profits are likely to soar from $1.9 trillion in 2020 to over $10 trillion in 2021. More than $1 trillion of this is being poured straight back into share buybacks by the healthiest companies.

So the first round of taper, some $480 billion annualized, pales by comparison to the enormous profits and wealth being created right now.

And the Fed isn’t about to end QE, just tone it down. There isn’t a hint of actually withdrawing liquidity from the system, just slowing the rate of increase. It’s why there is active discussion of reappointing Jay Powell for a second term as Fed governor, the greatest QE king of all time. That alone would be worth a thousand-point rally in the Dow.

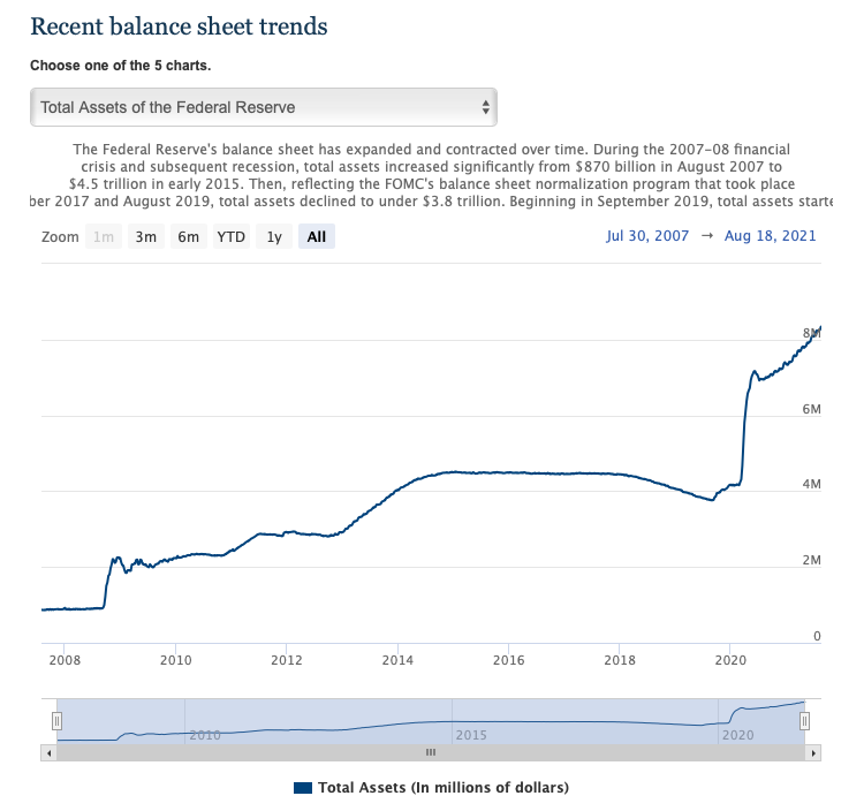

It is truly amazing how much liquidity has entered the system since the Great Recession. Since 2008, the Fed balance sheet has exploded from $400 billion to $8.9 trillion. It has created this staggering amount of money while keeping interest rates near zero.

During this time, the Dow has risen 59X from 600 to 35,500. All of the new money created is still in the system. The only thing it can buy is stocks, homes, and commodities.

And the best is yet to come!

It’s looking like the delta variant will cost the US about 3% in GDP growth this year. But that growth isn’t lost, just deferred into 2022. That keeps the party rolling on, with or without a punch bowl.

Fed Minutes show a Taper is in the Works, almost certainly cutting monthly bond purchases before yearend, but the delta variant is stretching it out. The (TLT) was rallied on the news and interest rates dropped. Short term rates to remain glued to zero. Asset inflation continues.

Equity Mutual Funds see third week of inflows, some $2.67 billion. Blockbuster Q2 earnings were a major driver where 73% of firms beat forecasts. Q3 looks just as good. Financial sector funds saw the greatest gain, one of the few places where investors can still find value.

Bitcoin market recovers $2 trillion value, with the weekend rally to $48,142, a three-month high. The break above the 200-day moving average is proving big.

Delta continues to take its toll, with new cases topping 130,000, half the January 20 peak, and deaths at 1,500. When it peaks in a few weeks, it will present one of the best buying opportunities of the year for stocks. The “end of delta” rally is coming. The US should top the 625,000 fatalities we saw during the 1919 Spanish Flu in the coming week.

Share Buy Back companies are beating the market. Shrinking the float has always been a big winner for the share prices and the senior management who are paid in stock options. This year, they have the money to do so with massive earnings increases. Goldman Sachs (GS) has put together a portfolio of the biggest buy-back companies and it is handily outperforming the index. What is the number one holding by a large market? Apple (AAPL), which has $250 billion in cash.

Homebuilder Sentiment dives, down 5 points to 75, as high prices cure high prices. Anything above 50 is still positive, but this is the lowest reading since last year. Materials and labor shortages are still a big problem. Nobody can get windows.

July Retail Sales disappoints, down 1.1%, delivering a 300-point hit for stocks. Tech is leading the downturn and Bitcoin took a hit. Clearly, delta is inciting a new “stay at home” movement, at least for the short term.

Housing Starts hit three -month low, down 7% in July to 1.53 million units. Materials and labor shortages are the issue.

Robinhood reports a Q2 loss of $2.16 a share, or $502 million. Revenues came in at $565 million, up over 131%, making it the fastest-growing broker on Wall Street. Shares were down small on the news. Some 60% of account owners are trading in crypto. Buy (HOOD) on dips.

My Ten-Year View

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 240,000 here we come!

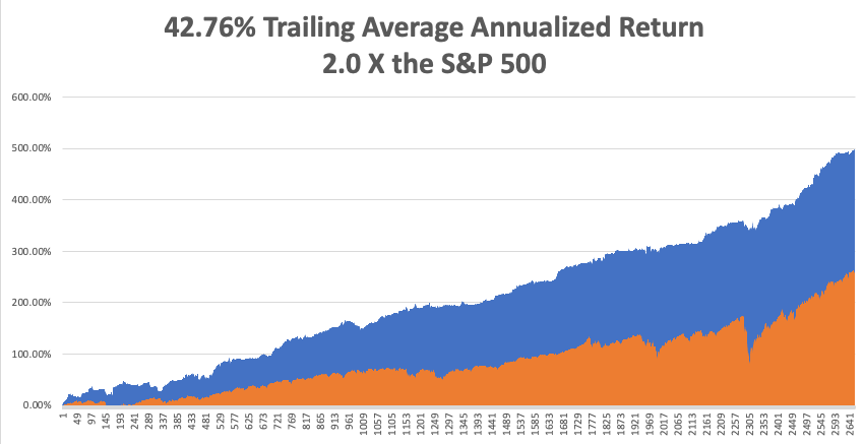

My Mad Hedge Global Trading Dispatch saw a modest +6.05% in August. My 2021 year-to-date performance appreciated to 75.26%. The Dow Average was up 14.77% so far in 2021.

This was an options expiration week, running five positions in (TLT), (JPM), (GS), and (V) into max profit. I stopped out of a long in (HOOD) close to cost.

That leaves me 80% in cash at 20% in short (TLT) and long (SPY). I’m keeping positions small as long as we are at extreme overbought conditions.

That brings my 12-year total return to 497.81%, some 2.00 times the S&P 500 (SPX) over the same period. My 12-year average annualized return now stands at an unbelievable 42.76%, easily the highest in the industry.

My trailing one-year return popped back to positively eye-popping 113.21%. I truly have to pinch myself when I see numbers like this. I bet many of you are making the biggest money of your long lives.

We need to keep an eye on the number of US Coronavirus cases at 37 million and rising quickly and deaths topping 628,000, which you can find

The coming week will bring our monthly blockbuster jobs reports on the data front.

On Monday, August 23 at 11:00 AM, the Existing Home Sales for July are out. Palo Alto Networks (PANW) reports.

On Tuesday, August 24, at 11:00 AM, New Home Sales for July are published. Toll Brothers (TOL) reports.

On Wednesday, August 25 at 8:30 AM, the July Durable Goods get printed. Snowflake (SNOW) reports.

On Thursday, August 26 at 8:30 AM, Weekly Jobless Claims are announced. We also get the second estimate of US Q2 GDP. Dell Computers (DELL) reports.

On Friday, August 27 at 8:30 AM US Personal Income & Spending are disclosed. At 2:00 PM, the Baker Hughes Oil Rig Count are disclosed.

And how did I deal with my captive skunk? I gingerly approached the cage with a large garbage bag and threw it over. Then I wrapped the entire cage up and threw it in the back of the car (not the Tesla). I then drove down the mountain, pulled over to the side of the road, opened the gate to the trap, and ran like hell. One angry skunk took off up the hill.

As for me, while in New York a few years ago waiting to board Cunard’s Queen Mary II to sail for Southampton, England, I decided to check out the Bay Ridge address near the Verrazano Bridge where my father grew up.

At the outbreak of WWI, my Italian-born grandfather volunteered for the army as a ploy to gain US citizenship. He was mustard gassed and was completely blinded for two years, living in a veteran’s hospital, a relic from the Civil War.

In 1923, 5% of his vision came back in one eye, so US citizenship in hand, he used his veteran’s benefits to buy a home on 76th street in Bay Ridge, then a middle-class Italian neighborhood.

I took a limo over to Brooklyn and knocked on the front door. I told the driver to keep the engine running.

The owner was expecting a plumber, so he let me right in, despite the fact that I was wearing my pre-boarding attire of a Brioni double-breasted blue blazer and Gucci shoes. I told him about my family history with the property, but I could see from the expression on his face that he didn’t believe a single word.

Then I told him about the relatives moving into the basement during the Great Depression. Grandpa never bought a stock in his life and thought the stock market was a Ponzi scheme. After the 1929 crash, several relatives lost their homes and moved into grandpa’s basement as a last resort.

He immediately offered me a tour of the house. He told me that he had just purchased the home and had extensively remodeled it. When they tore out the basement balls, he discovered that the insulation was composed of crumpled-up Brooklyn newspapers from the 1930s, so he knew I was telling the truth.

When the Japanese attacked Pearl Harbor on December 7, 1941, dad went straight down to Times Square and volunteered for the US Marine Corps. He was given a few days to settle his affairs and then the family didn’t see him for four years.

Before he left, dad wrapped up the engine parts of a 1928 Ford Model A with old newspapers which he had bought from a junkyard and was rebuilding. There they sat in cardboard boxes until 1945.

At the end of my tour, I was shown the brick garage where those cardboard boxes sat. Grandpa received a telegram indicating the day dad would return from San Francisco by train. He warned everyone not to cry. The second dad stepped into the house, some 40 pounds lighter, it was grandpa himself who started bawling.

I told the owner that grandpa would be glad that the house was still in Italian hands. Could I inquire what he had paid for the house that sold in 1923 for $3,000? He said he bought it as a broken-down fixer-upper for a mere $1.5 million and had put another $300,000 in it.

As I passed under the Verrazano Bridge on the Queen Mary II later that day in the two-floor Owner’s Suite, I contemplated how much smarter grandpa became the older I got.

I hope the same is true with my kids.

Grandpa in 1966

76th Street in 1930

1928 Ford Model A

Queen Mary II Sailing Under the Verrazano Bridge Past Bay Ridge

Global Market Comments

August 20, 2021

Fiat Lux

Featured Trade:

(WHY SPACS ARE A SCAM)

(PSTH), (SPAK)

Global Market Comments

August 19, 2021

Fiat Lux

Featured Trade:

(MY NEWLY UPDATED LONG-TERM PORTFOLIO),

(PFE), (BMY), (AMGN), (CRSP), (FB), (PYPL), (GOOGL), (AAPL), (AMZN), (SQ), (JPM), (BAC), (MS), (GS), (BABA), (EEM), (FXA), (FCX), (GLD), (SLV), (TLT)

I am really happy with the performance of the Mad Hedge Long Term Portfolio since the last update on February 2, 2021. In fact, not only did we nail the best sectors to go heavily overweight, we also completely dodged the bullets in the worst-performing ones.

For new subscribers, the Mad Hedge Long Term Portfolio is a “buy and forget” portfolio of stocks and ETFs. If trading is not your thing and you don’t want to remain glued to a screen all day, these are the investments you can make. Then don’t touch them until you start drawing down your retirement funds at age 72.

For some of you, that is not for another 50 years. For others, it was yesterday.

There is only one thing you need to do now and that is to rebalance. Buy or sell what you need to reweight every position to its appropriate 5% or 10% weighting. Rebalancing is one of the only free lunches out there and always adds performance over time. You should follow the rules assiduously.

Despite the seismic changes that have taken place in the global economy over the past nine months, I only need to make minor changes to the portfolio, which I have highlighted in red on the spreadsheet.

To download the entire new portfolio in an excel spreadsheet, please go to www.madhedgefundtrader.com, log in, go “My Account”, then “Global Trading Dispatch”, the click on the “Long Term Portfolio” button, then “Download.”

Changes

Biotech

Pfizer (PFE) has nearly doubled in six months, while Crisper Therapeutics (CRSP) has almost halved. Since the pandemic, which Pfizer made fortunes on, is peaking and we are still at the dawn of the CRISPR gene editing revolution, the natural switch here is to take profits in (PFE) and double up on (CRSP).

Technology

I am maintaining my 20% in technology which are all close to all-time highs. I believe that Apple (AAPL), (Amazon (AMZN), Google (GOOGL), and Square (SQ) have a double or more over the next three years, so I am keeping all of them.

Banks

I am also keeping my weighting in banks at 20%. Interest rates are imminently going to rise, with a Fed taper just over the horizon, setting up a perfect storm in favor of bank earnings. Loan default rates are falling. Banks are overcapitalized, thanks to Dodd-Frank. And because of the trillions in government stimulus loans they are disbursing, they are now the most subsidized sector of the economy. So, keep Morgan Stanley (MS), Goldman Sachs (GS), JP Morgan (JPM), and Bank of America, which will profit enormously from a continuing bull market in stocks. They are also a key part of my” barbell” portfolio.

International

China has been a disaster this year, with Alibaba (BABA) dropping by half, while emerging markets (EEM) have gone nowhere. I am keeping my positions because it makes no sense to sell down here. There is a limit to how much the Middle Kingdom will destroy its technology crown jewels. Emerging markets are a call option on a global synchronized recovery which will take place next year.

Bonds

Along the same vein, I am keeping 10% of my portfolio in a short position in the United States Treasury Bond Fund (TLT) as I think bonds are about to go to hell in a handbasket. I rant on this sector on an almost daily basis so go read Global Trading Dispatch. Eventually, massive over-issuance of bonds by the US government will destroy this entire sector.

Foreign Exchange

I am also keeping my foreign currency exposure unchanged, maintaining a double long in the Australian dollar (FXA). Eventually, the US dollar will become toast and could be your next decade-long trade. The Aussie will be the best performing currency against the US dollar.

Australia will be a leveraged beneficiary of the synchronized global economic recovery through strong commodity prices which have already started to rise, and the post-pandemic return of Chinese tourism and investment. I argue that the Aussie will eventually make it to parity with the US dollar, or 1:1.

Precious Metals

As for precious metals, I’m keeping my 0% holding in gold (GLD). From here, it is having trouble keeping up with other alternative assets, like Bitcoin, and there are better fish to fry.

I am keeping a 5% weighting in the higher beta and more volatile iShares Silver Trust (SLV), which has far wider industrial uses in solar panels and electric vehicles. The arithmetic is simple. EV production will rocket from 700,000 in 2020 to 25 million in 2030 and each one needs two ounces of silver.

Energy

As for energy, I will keep my weighting at zero. Never confuse “gone down a lot” with “cheap”. I think the bankruptcies have only just started and will stretch on for a decade. Thanks to hyper-accelerating technology, the adoption of electric cars, and less movement overall in the new economy, energy is about to become free. You are looking at the next buggy whip industry.

The Economy

My ten-year assumption for the US and the global economy remains the same. I’m looking at 3%-5% a year growth for the next decade after this year’s superheated 7% performance.

When we come out the other side of this, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 700% or more from 35,000 to 240,000 in the coming decade. The American coming out the other side of the pandemic will be far more efficient, productive, and profitable than the old.

You won’t believe what’s coming your way!

I hope you find this useful and I’ll be sending out another update in six months so you can rebalance once again. If I forget, please remind me.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

August 18, 2021

Fiat Lux

Featured Trade:

(HANGING WITH LEONARDO)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.