Global Market Comments

April 8, 2021

Fiat Lux

Featured Trade:

(A NOTE ON OPTIONS CALLED AWAY),

(BAC)

Global Market Comments

April 8, 2021

Fiat Lux

Featured Trade:

(A NOTE ON OPTIONS CALLED AWAY),

(BAC)

I know all of this may sound confusing at first. But once you get the hang of it, this is the greatest way to make money since sliced bread.

I still have a record five positions left in my model trading portfolio, they are all deep in-the-money, and about to expire in six trading days. That opens up a set of risks unique to these positions.

I call it the “Screw up risk.”

As long as the markets maintain current levels, ALL of these positions will expire at their maximum profit values.

They include:

|

2X (TSLA) 4/$450-$500 call spread |

20.00% |

|

2X (TLT) 4/$142-$145 put spread |

20.00% |

|

(TLT) 4/$127-$130 call spread |

-10.00% |

With the April 16 options expirations upon us, there is a heightened probability that your short position in the options gets called away.

If it happens, there is only one thing to do: fall down on your knees and thank your lucky stars. You have just made the maximum possible profit for your position instantly.

Most of you have short option positions, although you may not realize it. For when you buy an in-the-money vertical option spread, it contains two elements: a long option and a short option.

The short options can get “assigned,” or “called away” at any time, as it is owned by a third party, the one you initially sold the put option to when you initiated the position.

You have to be careful here because the inexperienced can blow their newfound windfall if they take the wrong action, so here’s how to handle it correctly.

Let’s say you get an email from your broker telling you that your call options have been assigned away.

I’ll use the example of the Tesla (TSLA) call spread.

For what the broker had done in effect is allow you to get out of your call spread position at the maximum profit point the day before the April 16 expiration date. In other words, what you bought for $44.00 on March 19 is now worth $50.00, giving you a near-instant profit of 13.63%!

In the case of the Tesla (TSLA) April $450-%500 in-the-money vertical Bull Call spread all have to do is call your broker and instruct them to “exercise your long position in your (Tesla) April 16 $450 calls to close out your short position in the (Tesla) April 16 $500 calls.”

This is a perfectly hedged position, with both options having the same name and the same expiration date, so there is no risk. The name, number of shares, and number of contracts are all identical, so you have no exposure at all.

Calls are a right to buy shares at a fixed price before a fixed date, and one options contract is exercisable into 100 shares.

To say it another way, you bought Tesla at $450 and sold it at $500, paid $44.00 for the right to do so, so your profit is $6.00, or ($6.00 X 100 shares X 2 contracts) = $1,200. Not bad for a 20-day limited risk play.

Sounds like a good trade to me.

Short positions usually only get called away for dividend-paying stocks or interest-paying ETFs like the (TLT). There are strategies out here that try to capture dividends the day before they are payable. Exercising an option is one way to do that.

Weird stuff like this happens in the run-up to options expirations like we have coming.

A call owner may need to buy a long (TSLA) position after the close, and exercising his long (TSLA) $500 call is the only way to execute it.

Adequate shares may not be available in the market, or maybe a limit order didn’t get done by the market close.

There are thousands of algorithms out there which may arrive at some twisted logic that the puts need to be exercised.

Many require a rebalancing of hedges at the close every day which can be achieved through option exercises.

And yes, options even get exercised by accident. There are still a few humans left in this market to blow it by writing shoddy algorithms.

And here’s another possible outcome in this process.

Your broker will call you to notify you of an option called away, and then give you the wrong advice on what to do about it.

This generates tons of commissions for the broker but is a terrible thing for the trader to do from a risk point of view, such as generating a loss by the time everything is closed and netted out.

There may not even be an evil motive behind the bad advice. Brokers are not investing a lot in training staff these days. In fact, I think I’m the last one they really did train.

Avarice could have been an explanation here but I think stupidity and poor training and low wages are much more likely.

Brokers have so many ways to steal money legally that they don’t need to resort to the illegal kind.

This exercise process is now fully automated at most brokers but it never hurts to follow up with a phone call if you get an exercise notice. Mistakes do happen.

Some may also send you a link to a video of what to do about all this.

If any of you are the slightest bit worried or confused by all of this, come out of your position RIGHT NOW at a small profit! You should never be worried or confused about any position tying up YOUR money.

Professionals do these things all day long and exercises become second nature, just another cost of doing business.

If you do this long enough, eventually you get hit. I bet you don’t.

Global Market Comments

April 7, 2021

Fiat Lux

Featured Trade:

(GUIDE TO THE MAD HEDGE DAILY POSITION SHEET)

Global Market Comments

April 6, 2021

Fiat Lux

Featured Trade:

(THE IRS LETTER YOU SHOULD DREAD),

(PANW), (CSCO), (FEYE),

(CYBR), (CHKP), (HACK), (SNE)

(FB), (AAPL), (NFLX), (GOOGL), (MSFT), (TSLA), (VIX)

(TESTIMONIAL)

Thank you for all the good work and the exceptional work you do. Your webinars give us a wonderful understanding of what is happening in the markets and undergirds, enhances, and makes your recommendations so meaningful.

It opens up our understanding and confidence in trading. Also, all of your interesting pictures and your travels make me think I know you, which further increases my understanding of all you do and ties me into your work.

You are a gem.

Best Regards,

Bill

Seminole, Florida

Global Market Comments

April 5, 2021

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or A SUPERCHARGED ECONOMY IS SUPERCHARGING THE STOCK MARKET),

(SPX), (LRCX), (AMAT), (VIX), (BA), (LUV), (AKL), (TSLA), (DAL)

Stocks have risen at an annualized rate of 40% so far in 2021. If that sounds too good to be true, it is.

But then, we have the greatest economic and monetary stimulus of all time rolling out also.

Of the $10 trillion in government spending that has or is about to be approved, virtually none of it has been spent. There hasn’t been enough time. It turns out that it is quite hard to spend a trillion dollars. Corporate America and its investors are salivating.

The best guess is that the new spending will create five million jobs for the economy over eight years, taking the headline Unemployment Rate down to a full employment 3-4%. The clever thing about the proposal is that it is financed over 15 years, which takes advantage of the current century's low interest rates.

That is something many strategists have been begging the US Treasury to do for years. Take the free money while it is on offer.

There is something Rooseveltean about all this, with great plans and huge amounts of money, like 10% of GDP on the table. But then we did just come out of a Great Depression, with unemployment peaking at 25 million, the same as in 1933.

The package is so complex that it is unlikely to pass by summer. Until then, stocks will probably continue to rally on the prospect.

It makes my own forecast of a 30% gain in stocks and a Dow Average of 40,000 for 2021 look overly cautious, conservative, and feeble (click here). But then, you have to trade the market you have, not the one you want.

And here is the really fun part. After a grinding seven-month-long correction, technology stocks have suddenly returned from the dead. All the best names gained 10% or more in the previous four-day holiday-shortened week. Clearly, investors have itchy trigger fingers with tech stocks at these levels.

In the meantime, technology stock prices have fallen 20-50% while earnings have jumped by 20% to 40%. What was expensive became cheap. It was a setup that was begging to happen.

This is great news because technology stocks are the core to all non-indexed retirement funds.

The S&P 500 (SPX) blasted through 4,000, a new all-time high, off the back of one of the largest infrastructure spends in history. Job creation over the next eight years is estimated at 5 million. Corporate earnings will go through the roof. Tech is back from the dead. Leaders were semiconductor equipment makers like my old favorites, Applied Materials (AMAT) and Lam Research (LRCX). The Volatility Index (VIX) sees the $17 handle, hinting at much higher to come. The next leg up for the Roaring Twenties has begun!

Biden Infrastructure Bill Tops $2.3 Trillion. Of course, some of it isn’t infrastructure but other laudable programs that starved under the Trump administration, like spending on seniors (I’m all for that!). Still, spending is spending, and this will turbocharge the economy all the way out to say….2024. The impact on interest rates will be minimal as long as the Fed keeps overnight rates near zero, as they have promised to do for nearly three years. Making the power grid carbon-free by 2035 is a goal and would require a 50% increase in solar national installations. Infrastructure spending is always a win-win because the new tax revenues it generates always pay for it in the end.

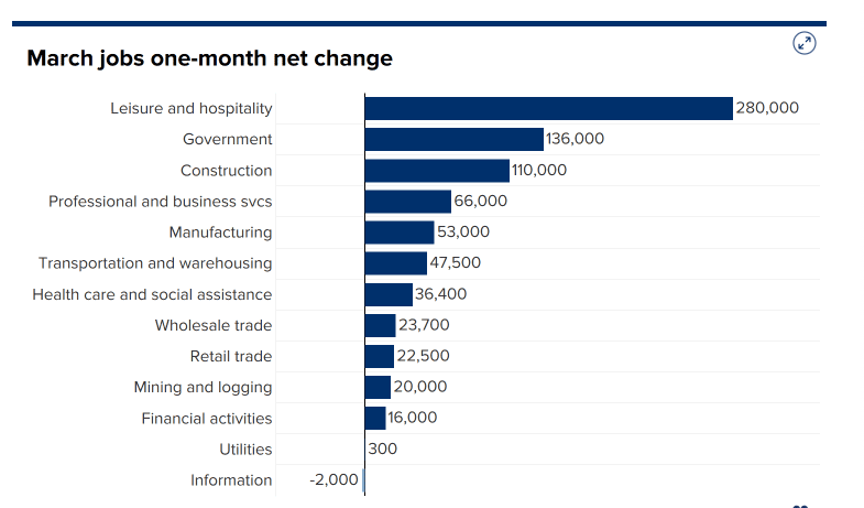

March Nonfarm Payroll Report exploded to the upside, adding a near record 917,000 jobs, and taking the headline Unemployment Rate down to 6.0%. Employers are front running Biden’s infrastructure plans, hiring essential workers while they are still available. Look for labor shortages by summer, especially in high paying tech. Leisure & Hospitality was the overwhelming leader at a staggering 280,000, followed by Government at 136,000 and Construction at 110,000.

Goldilocks lives on, with a 1.0% drop in Consumer Spending in February, keeping inflation close to zero. The Midwest big freeze is to blame. You can’t buy anything when there’s no gas for the car and no electricity once you get there, as what happened in Texas. The $1,400 stimulus checks have yet to hit much of the country, although I got mine. It couldn’t be a better environment for owning stocks. Keep buying everything on dips.

Consumer Confidence soared, up 19.3 points to 109 in February, according to the Conference Board. It’s the second-biggest move on record. A doubling of the value of your home AND your stock portfolio in a year is making people feel positively ebullient. Oh, and free money from the government is in the mail.

The Suez Canal reopened, allowing 10% of international trade to resume. A massive salvage effort that freed the 200,000 ton Ever Given. The ship will be grounded for weeks pending multiple inspections. Somebody’s insurance rates are about to rachet up. It all shows how fragile is the international trading system. Deliveries to Europe will still be disrupted for months. It puts a new spotlight on the Arctic route from Asia to Europe, which is 4,000 nm shorter.

Boeing (BA) won a massive order, some 100 planes from Southwest Air (LUV), practically the only airline to use the pandemic to expand. Boeing can fill the order almost immediately from 2020 cancelled orders for the $50 million 737 MAX. Keep buying both (BA), (LUV), and (AKL) on dips.

Tesla blows away Q1 deliveries, with a 184,400 print, or 47.5% high than the 2021 rate. That is without any of the new Biden EV subsidies yet to kick in. Lower priced Model 3 sedans and Model Y SUVs accounted for virtually all of the report. The Shanghai factory is kicking in as a major supplier to high Chinese demand. The one million target for 2021 is within easy reach. Traders saw this coming (including me) and ramped the stock up $100. Buy (TSLA) on dips. My long-term target is $10,000.

United Airlines hires 300 pilots to front-run expected exposure summer travel. CEO Scott Kirby says domestic vacation travel has almost completely recovered. Keep buying (LUV), (AKL), and (DAL) on dips.

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% to 120,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 120,000 here we come!

My Mad Hedge Global Trading Dispatch profit reached 0.38% gain during the first two days of April on the heels of a spectacular 20.60% profit in March.

I used the Monday low to double up my long in Tesla. After that, it was off to the races for all of tech. I caught a $100 move on the week.

My new large Tesla (TSLA) long expires in 9 trading days.

That leaves me with 50% cash and a barrel full of dry powder.

My 2021 year-to-date performance soared to 44.47%. The Dow Average is up 9.40% so far in 2021.

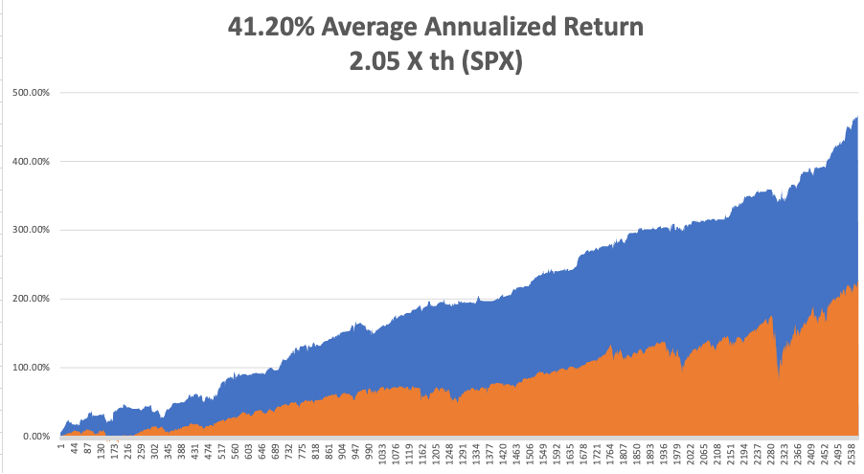

That brings my 11-year total return to 467.02%, some 2.08 times the S&P 500 (SPX) over the same period. My 11-year average annualized return now stands at an unbelievable 41.20%, the highest in the industry.

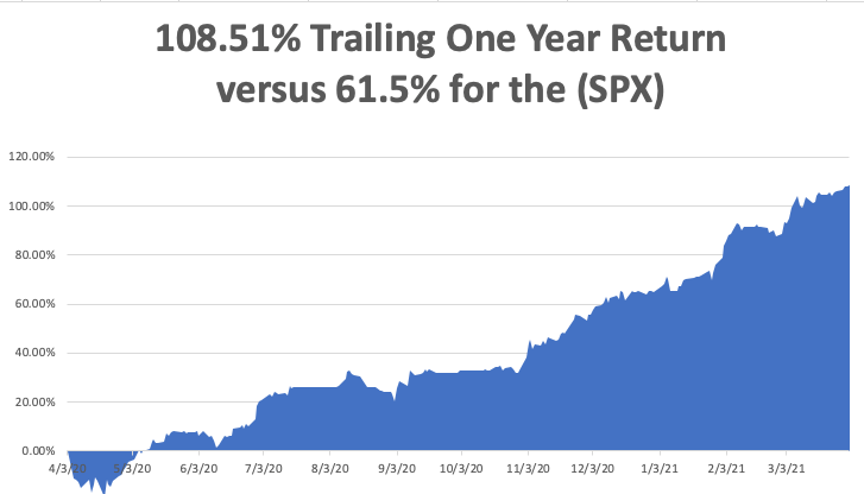

My trailing one-year return exploded to positively eye-popping 108.51%. I truly have to pinch myself when I see numbers like this. I bet many of you are making the biggest money of your long lives.

We need to keep an eye on the number of US Coronavirus cases at 30.6 million and deaths topping 555,000, which you can find here.

The coming week will be dull on the data front.

On Monday, April 5, at 10:00 AM, the ISM Non-Manufacturing Index for March is released.

On Tuesday, April 6, at 10:00 AM, US Consumer Inflation Expectations for March are published.

On Wednesday, April 7 at 2:00 PM, the minutes of the last Federal Open Market Committee Meeting are published.

On Thursday, April 8 at 8:30 AM, the Weekly Jobless Claims are printed.

On Friday, April 9 at 8:30 AM we get the Producer Price Index for March. At 2:00 PM, we learn the Baker-Hughes Rig Count.

As for me, I recently turned 69, so I used a nice day to climb up to the Lake Tahoe High Sierra rim at 9,000 feet, found a nice granite boulder sit on to keep dry, and tried to figure out what it was all about.

I’ve been very lucky.

I had a hell of a life that I wouldn’t trade for anything. I wouldn’t change a bit (well, maybe I would have bought more Apple shares at a split-adjusted 30 cents in 1998. I knew Steve was going to make it).

Since I’ve always loved what I did, journalist, trader, combat pilot, hedge fund manager, writer, I don’t think I have “worked” a day in my life.

I fought for things I believed in passionately and won, and kept on winning. It’s good to be on the right side of history.

I have loved and lost and loved again and lost again, and in the end outlived everyone, even my younger brother, who died of Covid-19 a year ago. The rule here is that it is always the other guy who dies. My legacy is five of the smartest kids you ever ran into. They’re great traders as well.

So I’ll call it a win.

I visited my orthopedic surgeon the other day to get a stem cell top-up for my knees and she asked how long I planned to keep coming back. I told her 30 years, and I meant it.

There’s nothing left for me to do but to make you all savvy in the markets and rich, something I leap out of bed every morning at 5:00 AM to accomplish.

Enjoy your weekend.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

April 2, 2021

Fiat Lux

Featured Trade:

(WHY CONSUMER STAPLES ARE PEAKING),

(XLP), (PG), (PEP), (PM), (WMT), (AMZN),

(WHY YOUR OTHER INVESTMENT NEWSLETTER IS SO DANGEROUS)

Everyone always needs toilet paper, right?

Wrong. At least stock investors don’t.

Once considered one the safest stock market sectors in which to hide out during bear markets and more recently pandemics, Consumer Staples no longer offer the hideout they once did.

Who needs a hideout anyway now that the Roaring Twenties are on and may make another decade to run.

Take a look at the Consumer Staples Select Sector SPDR ETF (XLP). It’s top five holdings include Proctor & Gamble (PG) (11.13%), Coca-Cola (KO) (10.07%), PepsiCo, Inc. (PEP) (8.7%), Philip Morris (7.80%) (PM), and Walmart (WMT).

Its only remaining attraction is that it has a 30-day SEC yield of 2.67%.

The (XLP) has recently been one of the best performing ETFs. However, costs are rising dramatically, and the bloom is coming off the rose.

In short, the industry is caught in a vice.

In the meantime, ferocious online competition from the likes of Amazon (AMZN) makes it impossible for consumer staples to pass costs on to consumers as they did in past economic cycles.

In fact, the prices for many consumer staples are falling thanks to the world’s most efficient distribution network. And if you are an Amazon Prime member, they will deliver it to your door for free. I just bought a pair of Head Kore 93 skis in Vermont, and they were delivered in two days.

It gets worse. The largest sector of the consumer staples market, the poor and working middle class are seeing the smallest wage gains, the worst layoffs, and the slowest pandemic recovery. Almost all pay increases are now taking place at the top of the wage ladder.

AI specialists and online marketing experts, yes, Safeway checkout clerks and fast food workers, no.

This also will get a lot worse as some 50% of all jobs will disappear over the next 20 years, mostly at the low end.

Blame technology. There is even a robot now that can assemble Ikea furniture. And there goes my side gig!

So, if your friend at the country club locker room tells you it’s time to load up on Consumer Staples because they are cheap, safe, and high-yielding, ignore him, delete his phone number from your contact list, and unfriend him on Facebook.

If anything, the sector is a great “sell short on rallies” candidate.

As I never tire of telling followers, never confuse “gone down a lot” with “cheap.”

Eventually, the sector will fall enough to where it offers value. But that point is not now. There has to be a bottom somewhere.

After all, everyone needs toilet paper, right? Or will a robot soon take over that function as well? They already have in Japan.

Global Market Comments

April 1, 2021

Fiat Lux

Featured Trade:

(MARCH 31 BIWEEKLY STRATEGY WEBINAR Q&A),

(FB), (ZM), ($INDU), (X), (NUE), (WPM), (GLD), (SLV), (KMI), (TLT), (TBT), (BA), (SQ), (PYPL), (JNP), (CP), (UNP), (TSLA), (GS), (GM), (F)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.

This site uses cookies. By continuing to browse the site, you are agreeing to our use of cookies.

OKLearn moreWe may request cookies to be set on your device. We use cookies to let us know when you visit our websites, how you interact with us, to enrich your user experience, and to customize your relationship with our website.

Click on the different category headings to find out more. You can also change some of your preferences. Note that blocking some types of cookies may impact your experience on our websites and the services we are able to offer.

These cookies are strictly necessary to provide you with services available through our website and to use some of its features.

Because these cookies are strictly necessary to deliver the website, refuseing them will have impact how our site functions. You always can block or delete cookies by changing your browser settings and force blocking all cookies on this website. But this will always prompt you to accept/refuse cookies when revisiting our site.

We fully respect if you want to refuse cookies but to avoid asking you again and again kindly allow us to store a cookie for that. You are free to opt out any time or opt in for other cookies to get a better experience. If you refuse cookies we will remove all set cookies in our domain.

We provide you with a list of stored cookies on your computer in our domain so you can check what we stored. Due to security reasons we are not able to show or modify cookies from other domains. You can check these in your browser security settings.

These cookies collect information that is used either in aggregate form to help us understand how our website is being used or how effective our marketing campaigns are, or to help us customize our website and application for you in order to enhance your experience.

If you do not want that we track your visist to our site you can disable tracking in your browser here:

We also use different external services like Google Webfonts, Google Maps, and external Video providers. Since these providers may collect personal data like your IP address we allow you to block them here. Please be aware that this might heavily reduce the functionality and appearance of our site. Changes will take effect once you reload the page.

Google Webfont Settings:

Google Map Settings:

Vimeo and Youtube video embeds: