Global Market Comments

August 2, 2021

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or TAKING A BREAK)

(AAPL), (AMZN), (FB), (MSFT), (TSLA), (JPM), (TLT), (SPY)

Global Market Comments

August 2, 2021

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or TAKING A BREAK)

(AAPL), (AMZN), (FB), (MSFT), (TSLA), (JPM), (TLT), (SPY)

When things can’t be better, they really can’t get any better, and there is no upside left.

As I expected, big tech companies announced earnings for the ages, the top four totaling a staggering $56.6 billion in profits in Q2, or $226.4 billion annualized. That compares to total US Q1 profits of $2.347 trillion. Then their stocks fell apart, with Amazon leading the charge to the downside.

To say tech earnings were impressive would be a vast understatement, with Apple (AAPL) coming in at $21.7 billion, Amazon (AMZN) at $7.8 billion, Facebook (FB) at $10.4 billion, and Microsoft (MSFT) at $16.7 billion.

However, since we are in the “What have you done for me lately” business, what do we have to look forward in August?

Covid cases are soaring nationally tripling off the 15,000 a day lows of a month ago. The delta variant is twice as contagious and twice as fatal as earlier ones. Mask mandates are back in the big cities, pushing back economic growth and a jobs recovery out into 2022. The least vaccinated stated are seeing hospital systems overwhelmed once again. School reopenings are now an unknown, and if they do, it will be with masks.

I sent my kids to a Boy Scout camp this week. On the second day, two unvaccinated staff members tested positive for delta and the county immediately shut the place down, sending home 500 disappointed scouts and parents. Dreams of long sought merit badges went up in smoke. The same thing is happening across the entire economy.

The next three months are historically the worst performing of the year, generating an average 0.03% over the last 100 years. Inflation reports are going to remain high for the rest of the year. The Fed has a new reason to keep interest rates a zero for longer, bad for banks, brokers, commodities, and industrials.

Oh, and the next round of spectacular tech earnings are three months away.

There is another factor in play. Investors have made the most money in their lives over the last 16 months, including me. The temptation to take the money and run is strong and irresistible. Traders have visions of Ferraris dancing in their eyes. This alone would bring on an overdue 5%-10% pull back.

So what is the smart thing to do here? Sell all your short-term positions but keep all your long-term positions and LEAPS. The market isn’t going down enough to justify the round-trip expenses and capital gains taxes.

If you have new cash flows keep it in money market funds. People will be shocked by the speed and viciousness of the coming selloff. But when it occurs, the best buying opportunity in a year will be on its knees begging for your attention.

It may feel cataclysmic, another Armageddon, and like the end of the world, but it won’t be. After all, we have seen no less than 36 10% corrections in my lifetime. The investors who hung in made the most money every single time.

I’ll tell you when we hit bottom with a raft of new LEAPS recommendations, provided I can get them out fast enough.

The Fed stands pat, keeping overnight rates at 0%-0.25%. The delta variant has pushed the taper off three months, but Jay Powell gave the barest of hints that it is the next step to take. We have 9 million unemployed and 9 million job openings but there is a massive skills gap, with jobless waitresses and retails in over supply and coders and artificial intelligence specialist sought after. It’s all the result of 40 years of under investment in our education system.

US Q2 GDP comes in at 6.5%, one of the strongest in economic history, but less than forecasts that were as high as 10%. Supply chain restraints we the main explanation for the shortfall. All that does is push growth into 2022, when people CAN get parts and labor. In the meantime, personal consumption soared by 11.8%, the hottest report since 1952, proving the demand is there.

Covid Cases triple from recent lows to 43,700 a day. Blame the delta variant, which originated in India, and now accounts for 86% of new cases. Twice as contiguous, with a greater fatality rate and more long-term effect, delta is prompting the return of mask mandates in several cities. Only the unvaccinated are affected. This could be the trigger for the next correction.

Smart phones will deliver the next big chip shortage, even if the chip shortage for cars abates. The bad news? There are 22 times more phones produced each year than cars, 1.4 billion versus only 64 million in 2020. Out of the frying pan and into the fire.

S&P Case Shiller smashes all records, up 17% YOY for national home prices. Phoenix (25.9%), San Diego (24.7%), and Seattle (23.4%) lead. These numbers are past “extraordinary.” Expect it to continue.

New Homes Sales plunge to 676,000, down 6.6% on a signed contract basis, but prices are up 6%. Inventories are up from 5 months to a still low 6.5 months. Shortages of land, labor, and materials are still the big issue.

Pending Home Sales drop 1.9% in June on a signed contract bases. High prices are curing high prices, with the Case-Shiller National Home Price Index up 17% YOY. The south and west posted the biggest declines. Single family homes have dropped for three months in a row to a one year low.

China meltdown continues, with the Beijing government apparently withdrawing from western capital markets. It’s all about showing the world who is in charge and punishing the billionaires by destroying their stocks. They are wiping out $1 trillion in equity per day and don’t care if you get hit as well. Cathy Wood’s Ark Innovation ETF (ARKK) is dumping everything they have. Avoid China at all cost.

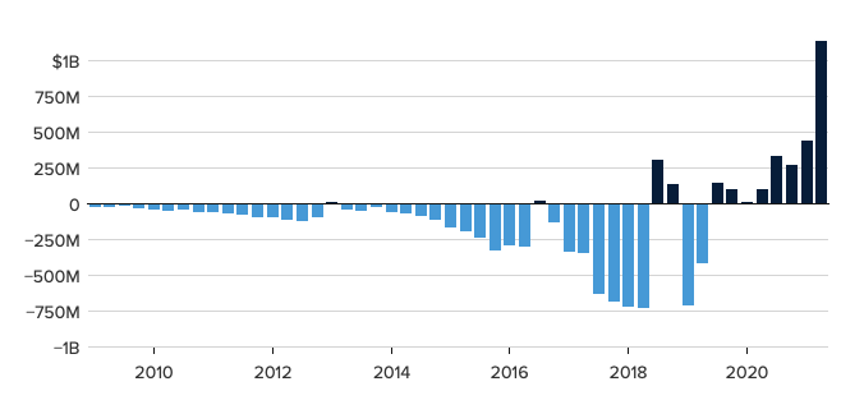

Tesla announces first $1 billion profit in Q2, despite losing $23 million in Bitcoin. That is 10X the year ago report. They could have made a lot more if they had more chip supplies. The energy business brought in a rapidly growing $800 million in revenues. The Austin and Berlin Gigafactory’s are coming online at the end of the year, allowing them to scale globally. The Cybertruck is on hold and production of Powerwall’s cut back until they can get more chip supplies, creating extreme shortages. Buy (TSLA) on dips. There’s a 10X from here.

Tesla claims No.2 auto sales spot in Europe in June, just behind Volkswagen’s Golf, and beathing Daimler Benz, Audi, Fiat, and Renault. The company shipped 25,697 Model 3’s, which is perfect for the continent’s tight spaces, short distances, and green preferences. Big government subsidies to switch from internal combustion engines helped too.

Tesla Profits

Bitcoin tops $40,000 in a massive short covering rally. Tesla may start taking the crypto currency as payment for new vehicles and Amazon (AMZN) may get into the game as well. While China is studying way to make a digital yuan (CYB) and Europe a digital Euro (FXE), the US congress sees such a move as pointless.

Robinhood IPO (HOOD) Bombs, trading down as much as 12% from its $38.00 IPO price. That leaves it with a still impressive $29 billion market capitalization, a fifth the size of Morgan Stanley. What happens when individuals get their allocations? No “diamond hands” here. It looks like a “BUY” after it drops by half opportunity, just like Tesla after its IPO. The facilitator of meme stock frenzies has best ever year is behind it, or until we get another pandemic. The company has already paid $127 million in fines and almost went under in January. Avoid (HOOD) for now.

My Ten Year View

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 240,000 here we come!

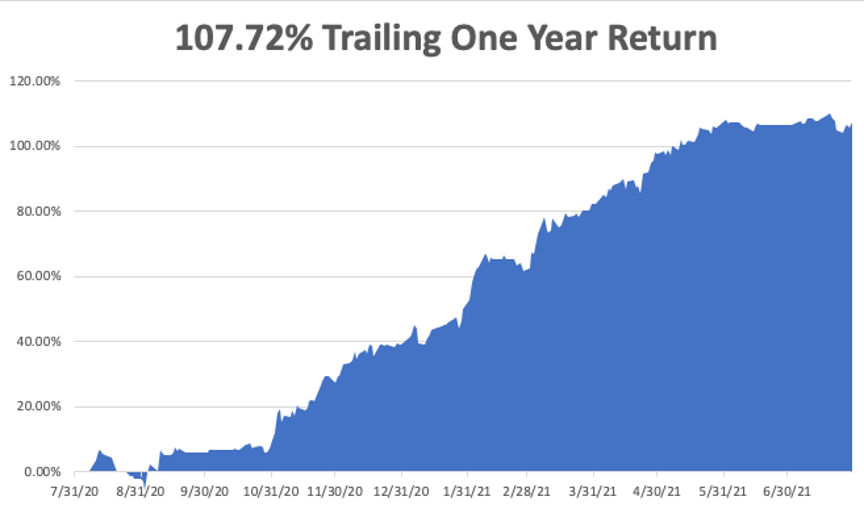

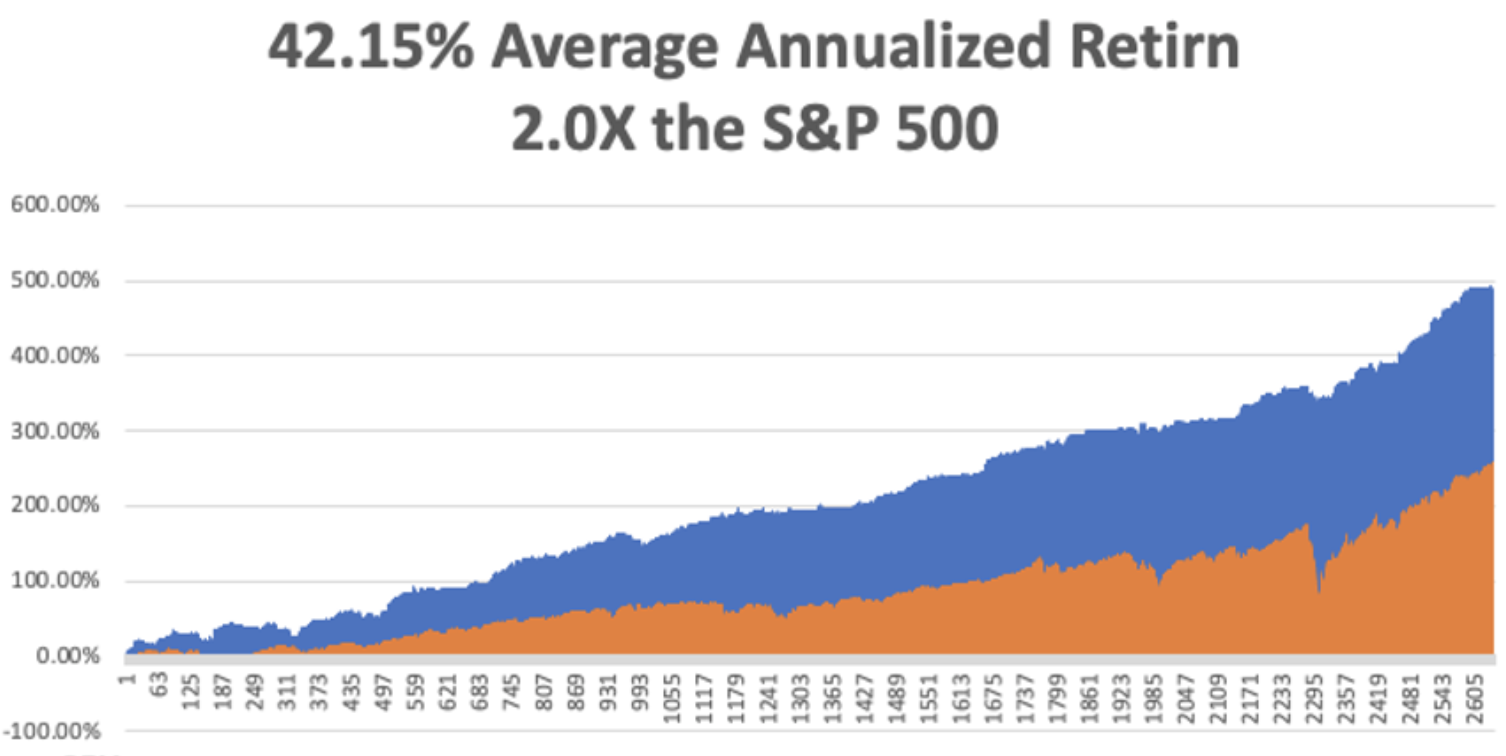

My Mad Hedge Global Trading Dispatch saw a modest +0.61% in July. My 2021 year-to-date performance appreciated to 69.21%. The Dow Average was up 14.16% so far in 2021.

I stuck with my four positions, a long in (JPM) and a short in the (TLT) and a double short in the (SPY). I bled all the way until Friday, when big hits to tech stocks took the (SPY) down and edging me up to a positive return for July. That leaves me 60% in cash. I’m keeping positions small as long as we are at extreme overbought conditions.

That brings my 11-year total return to 491.76%, some 2.00 times the S&P 500 (SPX) over the same period. My 12-year average annualized return now stands at an unbelievable 12.15%, easily the highest in the industry.

My trailing one-year return retreated to positively eye-popping 107.72%. I truly have to pinch myself when I see numbers like this. I bet many of you are making the biggest money of your long lives.

We need to keep an eye on the number of US Corona virus cases at 34.9 million and rising quickly and deaths topping 613,000, which you can find here.

The coming week will bring our monthly blockbuster jobs reports on the data front.

On Monday, August 2 at 7:00 AM, the Manufacturing PMI for July is published. NXP Semiconductor (NXP) reports.

On Tuesday, August 3, at 7:30 AM, Factory Orders for June are released. Amgen (AMGN), Eli Lily (LLY), and Alibaba (BABA) report.

On Wednesday, August 4 at 5:30 AM, the ADP Private Employment Report is published. Uber (UBER) and General Motors (GM) report.

On Thursday, August 5 at 8:30 AM, Weekly Jobless Claims are announced. Square (SQ) reports.

On Friday, August 6 at 8:30 AM, we get the Nonfarm Payroll Report for July. Berkshire Hathaway (BRKB) reports.

As for me, I am reminded of my own summer of 1967, back when I was 15, which may be the subject of a future book and movie.

My family summer vacation that year was on the slopes of Mount Rainier in Washington state. Since it was raining every day, the other kids wanted to go home early. So my parents left me and my younger brother in the hands of Mount Everest veteran Jim Whitaker to summit the 14,411 peak (click here for his story). The deal was for us to hitch hike back to Los Angeles when we got off the mountain.

In those days, it wasn’t such an unreasonable plan. The Vietnam war was on, and a lot of soldiers were thumbing their way to report to duty. My parents figured that since I was an Eagle Scout, I could take care of myself.

When we got off the mountain, I looked at the map and saw there was this fascinating country called “Canada” just to the north. So, it was off to Vancouver. Once there, I learned there was a world’s fair going on in Montreal some 2,843 away, so we hit the TransCanada Highway going east.

We ran out of money in Alberta, so we took jobs as ranch hands. There we learned the joys of running down lost cattle on horseback, working all day at a buzz saw, inseminating cows, and eating steak three times a day. I made friends with the cowboys by reading them their mail, which they were unable to do. There were lots of bills due, child support owed, and alimony demands.

In Saskatchewan, the roads ran out of cars, so we hopped a freight train in Manitoba, narrowly missing getting mugged in the rail yard. We camped out in a box car occupied by other rough sorts for three days. There’s nothing like opening the doors and watching the scenery go by with no billboards ad, the wind blowing through your hair!

When the engineer spotted us on a curve, he stopped the train and invited us to up the engine. There, we slept on the floor, and he even let us take turns driving! That’s how we made it to Ontario, the most mosquito-infested place on the face of the earth.

Our last ride into Montreal offered to let us stay in his boat house as long as we wanted so there we stayed. Thank you, WWII RAF bomber pilot Group Captain John Chenier!

Broke again, we landed jobs at a hamburger stand at Expo 67 in front of the imposing Russian pavilion. The pay was $1 an hour and all we could eat. At the end of the month, Madame Desjardin couldn’t balance her inventory, so she asked how many burgers I was eating a day. I answer 20, and my brother answered 21. “Well, there’s my inventory problem” she replied.

And then there was Suzanne Baribeau, the love of my life. I wonder whatever happened to her?

I had to allow two weeks to hitch hike home in time for school. When we crossed the border at Niagara Falls, we were arrested as draft dodgers as we were too young to have driver’s licenses. It took a long conversation between US Immigration and my dad to convince them we weren’t.

We developed a system where my parents could keep track of us. Long distance calls were then enormously expensive. So, I called home collect and when my dad answered he asked what city the call was coming from. When the operator gave him the answer, he said he would not accept the call. I remember lots of surprised operators. But the calls were free, and dad always knew where we were.

We had to divert around Detroit to avoid the race riots there. We got robbed in North Dakota, where we were in the only car for 50 miles. We made it as far has Seattle with only three days left until school started.

Finally, my parents had a nervous breakdown. They bought us our first air tickets ever to get back to LA, then quite an investment.

I haven’t stopped traveling since, my tally now topping all 50 states and 135 countries.

And I learned an amazing thing about the United States. Almost everyone in the country is honest, kind, and generous. Virtually every night, our last ride of the day took us home and provided us with an extra bedroom or a garage to sleep in. The next morning, they fed us a big breakfast and dropped us off at a good spot to catch the next ride.

It was the adventure of a lifetime and am a better man for it.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Summit of Mt. Rainier 1967

McKinnon Ranch Bassano Alberta 1967

American Pavilion Expo 67

Hamburger Stand at Expo 67

Picking Cherries in Michigan 1967

“There are no great men, only great challenges that ordinary men are forced by circumstances to meet,” said WWII Admiral “Bull Halsey.

Global Market Comments

July 30, 2021

Fiat Lux

Featured Trade:

(JULY 28 BIWEEKLY STRATEGY WEBINAR Q&A),

(SPY), (CRSP), (TLT), (TBT), (BABA), (BIDU), (FXI), (RAD), (TSLA), (NASD), (NKLA), (NIO), (INTC), (MU), (NVDA), (AMD), (TSM), (VXX), (XVZ), (SVXY), (FCX), (ROM), (SPG)

July 28 Biweekly Strategy Webinar Q&A

Below please find subscribers’ Q&A for the July 28 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Lake Tahoe, NV.

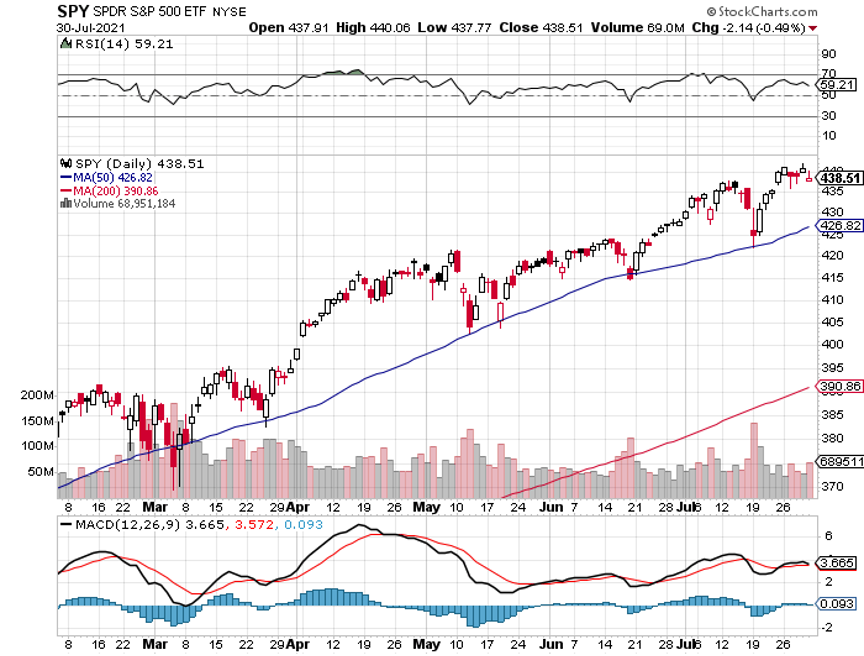

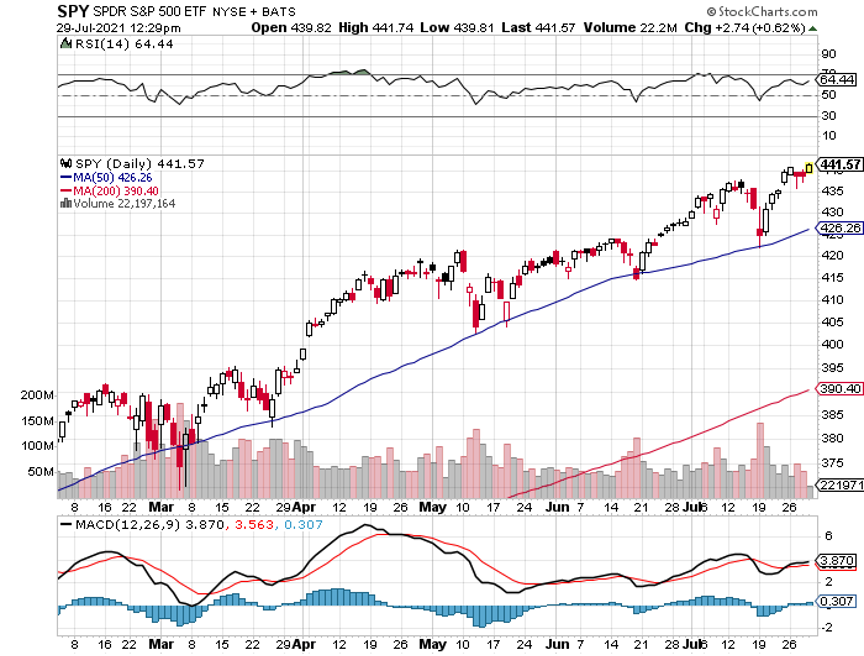

Q: What is your plan with the (SPY) $443-$448 and the $445/450 vertical bear put spreads?

A: I’m going to keep those until we hit the lower strike price on either one and then I’ll just stop out. If the market doesn’t go down in August, then we are going straight up for the rest of the year as the earnings power of big tech is now so overwhelming. Sorry, that’s my discipline and I’m sticking to it. Usually, what happens 90% of the time when we go through the strike, and then go back down again by expiration for a max profit. But the only way to guarantee that you'll keep your losses small is by stopping out of these things quickly. That’s easy to do when you know that 95% of the time the next trade alert you’ll get is a winner.

Q: Are you still expecting a 5% correction?

A: I am. I think once we get all these great earnings reports out of the way this week, we’re going to be in for a beating. I just don't see stocks going straight up all the way through August, so that’s another reason why I'm hanging on to my short positions in the S&P 500 (SPY).

Q: What’s the best way to play CRISPR Therapeutics (CRSP) right now?

A: That is with the $125-$130 vertical bull call spread LEAPS with any maturity in 2022. We had a run in (CRSP) from $100 up to $170 and I didn’t take the damn profit! And now we’ve gone all the way back down to $118 again. Welcome to the biotech space. You always take the ballistic moves. Someday I should read my own research and find out why I should be doing this. For those who missed (CRSP) the last time, we are one proprietary drug announcement, one joint venture announcement, or one more miracle cure away from another run to $170. So that will probably happen in the next year, you get the $125-$130 call spread, and you will double your money easily on that.

Q: I’m down 40% on the United States Treasury Bond Fund (TLT) January $130-$135 vertical bear put spread LEAPS. What would you do?

A: Number one, if you have any more cash I would double up. Number two, I would wait, because I would think that starting from the Fall, the Fed will start to taper; even if they do it just a little bit, that means we have a new trend, the end of the free lunch is upon us, and the (TLT) will drop from $150 down to $132 where it was in March so fast it will make your head spin. I'm hanging onto my own short position in (TLT). If you are new to the (TLT) space and you want some free money, put on the January 2020 $150-$155 vertical bear put spread now will generate about a 75% return by the January 21, 2022 options expiration. I just didn't figure on a 6.5% GDP growth rate generating a 1.1% bond yield, but that’s what we have. I'm sorry, it’s just not in the playbook. Historically, bonds yield exactly what the nominal GDP growth rate is; that means bonds should be yielding 6.50% now, instead of 1.1%. They will yield 6.5% in the future, but not right now. And that's the great thing about LEAPS—you have a whole year or 6 months for your thesis to play out and become right, so hang on to those bond shorts.

Q: Do you have any ideas about the target for Facebook (FB) by the end of the year?

A: I would say up about 20% from current levels. Not only from Facebook but all the other big tech FANGS too. Analysts are wildly underestimating the growth of these companies in the new post-pandemic world.

Q: Do you think the worst of the pandemic will be over by September?

A: Yes, we will be back on a downtrend by September at the latest and that will trigger the next leg up in the bull market. Delta with its great infectious and fatality rates is panicking people into getting shots. The US government is about to require vaccinations for all federal employees and that will get another 5 million vaccinated. Americans have the freedom to do whatever they want but they don’t have the freedom to kill their neighbors with fatal infections.

Q: What should I do with my China (BABA), (BIDU), (FXI) position? Should I be doubling down?

A: Not yet, and there’s no point in selling your positions now because you’ve already taken a big hit, and all the big names are down 50% from the February high. I wouldn't double down yet because you don’t know what's happening in China, nobody does, not even the Chinese. This is their way of addressing the concentration of the wealth in the top 1% as has happened here in the US as well. They’re targeting all the billionaire stocks and crushing them by restricting overseas flotations and so on, so it ends when it ends, and when that happens all the China stocks will double; but I have absolutely no idea when that's going to happen. That being said, I have been getting phone calls from hedge funds who aren’t in China asking if it's time to get in, so that's always an interesting precursor.

Q: What happened to the flu?

A: It got wiped out by all the Covid measures we took; all the mask-wearing, social distancing, all that stuff also eliminates transmission of flu viruses. Viruses are viruses, they’re all transmitted the same way, and we saw this in the Rite Aid (RAD) earnings and the 55% drop in its stock, which were down enormously because their sales of flu medicines went to zero, and that was a big part of their business. I didn’t get the flu last year either because I didn’t get Covid; I was extremely vigilant on defensive measures in the pandemic, all of which worked.

Q: Why would the Fed taper or do much of anything when Powell wants to be reappointed in February 2022?

A: I don’t think he is going to get reappointed when his four-year term is up in early 2022. His policies have been excellent, but never underestimate the desire of a president to have his own man in the office. I think Powell will go his way after doing an outstanding job, and they will appoint another hyper dove to the position when his job is up.

Q: What are your thoughts on the Chinese electric auto company Nio competing here in the U.S.?

A: They will never compete here in the U.S. China has actually been making electric cars longer than Tesla (TSLA) has but has never been able to get the quality up to U.S. standards. Look what happened to Nikola (NKLA) who’s founder was just indicted. Avoid (NIO) and all the other alternative startup electric car companies—they will never catch up with Tesla, and you will lose all your money. Can I be any clearer than that?

Q: You recently raised the ten-year price target up for the Dow Average from 120,000 to 240,000. What is Nasdaq's target 10 years out?

A: I would say they’re even higher. I think Nasdaq (NASD) could go up 10X in 10 years, from 14,000 to 140,000 because they are accounting for 50% of all earnings in the U.S. now, and that will increase going forward, so the stocks have to go ballistic.

Q: What do you think of Intel (INTC)?

A: I don’t like it. They had a huge rally when they fired their old CEO and brought in a new one. There was a lot of talk on reforming and restructuring the company and the stock rallied. Since then, the market has started insisting on performance which hasn’t happened yet so the stock gave up its gains. When it does happen, you’ll get a rally in the stock, not until then, and that could be years off. So I'd much rather own the companies that have wiped out Intel: (MU), (NVDA), (AMD), and (TSM).

Q: When you do recommend buying the Volatility Index (VIX), do you recommend buying the (VIX) or the (VXX)?

A: You can only buy the VIX in the futures market or through ETFs and ETNs, like the (VXX), the (XVZ), and the (SVXY), or options on these. I would be very careful in buying that because time decay is an absolute killer in that security, and that's why all the professionals only play it from the short side. That's also why these spikes in prices literally last only hours because you have professionals hammering (VIX). Somebody told me once that 50% of all the professional traders in the CME make their living shorting the (VIX) and the (VXX). So, if you think you’re better than the professionals, go for it. My guess is that you’re not and there are much better ways to make money like buying 6-to-12-month LEAPS on big tech stocks.

Q: Can the Delta variant get a bigger pullback?

A: Yes. I expect one in August, about 5%. But if Delta gets worse, the selloff gets worse. You saw what it did last year, down 40% in the (SPY) in only two months, so yes, it all depends on the Delta virus. I'm not really worrying about Delta, it's the next one, Epsilon or Lambda, which could be the real killer. That's when the fatality rate goes from 2% to 50%, and if you think I'm crazy, that's exactly what happened in 1919. Go read The Great Influenza book by John Barry that came out 20 years ago, which instantly became a best seller last year for some reason.

Q: Does the Matterhorn have enough flat space on the top to stand on it?

A: Actually, there is a 6’x6’ sort of level rock to stand on top of the Matterhorn. If you slip, it’s a 5000’ fall straight down on any side, and on a good weather day in the summer, there are 200 people climbing the Matterhorn. There's sometimes a one-hour line just to take your turn to get to the top to take your pictures, and then get down again to make space for the next person. So that's what it's like climbing the Matterhorn, it's kind of like climbing Mount Everest, but I still like to do it every year just to make sure I can do it, and one year I hope to win the prize for the oldest climber of the year to climb the Matterhorn. Every year this German guy beats me; he’s two years older than me.

Q: When will Freeport McMoRan (FCX) start going up? I have the 2023 LEAPS

A: Good thing you have the two-year LEAPS because that gives you two years for inflation to show its ugly face once again. You just have to be patient with these. I think we’ll get a rally in the Fall along with all the other interest rate plays like banks, industrials, money management companies, and so on. (FCX) will certainly participate in that. In the meantime, if we get all the way down to $30 in Freeport McMoRan, I would double up your position.

Q: Why is oil (USO) not a buy? Oil is the ultimate inflation hedge.

A: Yes, unless all of the cars in the United States become electric in the next 15 years, which they will, wiping out half of all demand from the largest oil consumer. The United States consumes about 20 million barrels of oil a day, half of that is for cars, and if you take that out of the demand picture you dump 10 million barrels a day on the market and oil goes back to negative numbers like we saw last year. Never do counter-trend trades unless you’re a professional in from of a screen 24 hours a day.

Q: Should I take profits on my ProShares Ultra Technology ETF (ROM) November $90-$95 vertical bull spread and then enter a new spread when tech sells off?

A: Absolutely! When you have that much leverage and you get these price spikes, you sell! The leverage on this position is 2X on the ETF and 10X on the options for a total of 20X! Well done, nice trade and nice profit, go out and buy yourself a new Tesla and wait for the next dip in tech, which may have already started, and which could power on for the rest of August.

Q: What’s the next move for REITs?

A: REITs came off of historic lows last year; a lot of people thought they were going to go bankrupt, and for companies like (SPG) it was a close-run thing. I would be inclined to take profits on REITs here. The next thing to happen is for interest rates to go up and REITs don’t do that great in a rising rate environment.

Q: When is the off-season in Incline Village?

A: It’s the Spring and the Fall, in between ski season and the summer season. That means there are four months a year here, May/June and September/October, where I’m the only one here and the parking lots are empty. There is no one on the trails, the weather is perfect, the leaves are changing colors, and the roads aren’t crowded, so that is the time to be here. It’s a mob scene in the winter and a worse mob scene in the summer!

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last ten years are there in all their glory.

Good Luck and Stay Healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

July 29, 2021

Fiat Lux

Featured Trade:

(TESTIMONIAL),

(HOW TO GAIN AN ADVANTAGE WITH PARALLEL TRADING),

(GM), (F), (TM), (NSANY), (DDAIF), BMW (BMWYY), (VWAPY),

(PALL), (GS), (RSX), (EZA), (CAT), (CMI), (KMTUY),

(KODK), (SLV), (AAPL)

Hi John,

You are a wonderful example for men to follow. Energetic, roping a steer? Climbing a mountain with a 40lb backpack for 10 miles? Incredible.

But the big one is your humble willingness to help us little guys who need your help. You take the jitters out of trading for us. And I for one am looking forward to great trading results. You have opened my eyes to the marvelous benefits of Vertical Bull Call Spread trades. Thank you for all you do!

Because of all the great pictures of you from all over the globe and at all ages, it makes me feel that I know you. Thank you for going the extra mile in keeping us informed of what you are doing and where you are going. That is truly great in an age when people do not get too much of an opportunity to personally meet in person to get to know each other.

Best regards,

Bill

Seminole, Florida

Global Market Comments

July 28, 2021

Fiat Lux

Featured Trade:

(COFFEE WITH RAY KURZWEIL)

(GOOG)

Global Market Comments

July 27, 2021

Fiat Lux

Featured Trade:

(HOW TO RELIABLY PICK A WINNING OPTIONS TRADE)

Global Market Comments

July 26, 2021

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or GETTING INTO STUDIO 54),

(AAPL), (AMZN), (TSLA), (GOOGL), (FB), (NVDA), (TLT)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.