If you are a believer in the FANGS (FB), (AAPL), (AMZN), (MSFT), (NFLX), with NVIDIA (NVDA) as an add-on, last week was definitely your week.

They rose every day, ending the week with a melt-up of epic proportions. After eight months in the penalty box, tech came back with a vengeance and is now two months into their comeback tour.

The icing on the cake was Facebook’s big win in the antitrust suit from the FTC. That suitably deep-sixes the issue not just for (FB) but all of big tech, possibly for years. The five stocks above now account for a hefty 22% of the S&P 500 (SPY).

The question now on everyone’s mind is what’s next for tech? 25%? 30% 50%? The answer is all of the above, but you have to give it some time, like years.

We are now in an overbought market where big tech has become the cheapest sector. In addition, the global chip shortage promises to get worse before it gets better, with some products seeing a 10X increase in a single generation.

Companies that can’t get the chips they want are resigning products around the chips they can get on the fly.

This has created enormous spillover demand for marginal suppliers like Advanced Micro Devices (AMD) and Micron Technology (MU). It has also accelerated the evolution of technology.

Companies that already have decade-long supply chains already set up, like Tesla, now have a big advantage. That’s why (TSLA) has managed a healthy 27% gain in six weeks.

The severity of the chip shortage is wildly estimated if you look at future design plans of the biggest industries. A tech rally lasting months, if not years, was a totally natural progression.

I’ll tell you who else is dropping the ball. Analysts and strategists are consistently underestimating the strength of the economic recovery and the torrid growth of earnings. They are lagging by about six months. That is why 80% of announcements have delivered upside surprises.

There are more surprises to come.

When markets peaked in April, an eye-popping 92% of shares were above their 50-day moving average. Now, we are only at 52%. That suggests we have another month of excitement before we get another short-term correction.

June Nonfarm Payroll Report comes in hot, up 850,000, an eye-popping 150,000 better than expected. The headline Unemployment Rate moved up slightly to 5.9%. Accommodation gained 269,000, and Food Services & Drinking Places were up 194,000. It was a true Goldilocks number for the stock market, but not the million some had hoped for. My 30% forecast for the Dow Average is looking good.

The Infrastructure Bill extends the hot economy well into 2023 and longer. Analysts better start upgrading now, who have been badly lagging behind the recovery. Tech stocks saw this six weeks ago and began their torrid rally. Buy everything on dips and stick with the barbell strategy to catch all of the rotations.

Rents will continue to go through the roof. Good thing you don’t live in Boise, ID, which is seeing the fastest rent increases in the county at 39% YOY. Of course, having the Micron Technology (MU) HQ there is a major push. Don’t expect any respite. With home prices soaring, rents will get dragged up as prospective buyers are priced out of the market.

Weekly Jobless Claims moderate further, 364,000 Americans filed new claims for unemployment benefits last week - lowest since pandemic. Still elevated from a typical pre-pandemic week when we would see about 210,000 claims.

Softbank’s capital flooding into Crypto, with Japan's SoftBank Group Corp has invested $200 million in Mercado Bitcoin, one of the largest cryptocurrency exchanges in Latin America signaling the start of the first phase of big institutional money hoping to take advantage of the digital currency craze.

Goldman Sachs is the top financial pick according to JP Morgan Chase. All cylinders are firing and we’ve just come off a fabulous 15% dip. A move to more sustainable revenue streams, like wealth management, is the reason, which Morgan Stanley did decades ago under my watch. I’m looking for $450 on dips. Buy (GS) on dips.

Morgan Stanley doubles its dividend, now that it has passed the Fed stress test and the tethers are off. It also announced a share buyback of $12 billion over the next year which may be increased. Buy (MS) on dips.

S&P Case Shiller National Home Price Index for April hits new high, up 14.6%, the biggest increase in 30 years. Phoenix leads at +22.3%, followed by San Diego at +21.6% and Seattle at +20.2%. The numbers run from incredible to unbelievable.

CRISPR Therapeutics goes through the roof, up 12% at the highs, on successful drug trials by Intellia Therapeutics (NTLA) and Regeneron (REGN). The Mad Hedge Biotech Letter core holding provided the gene-editing technology behind the 45% gain in (NTLA) today. It enabled the 85% elimination of a rare inherited fatal liver disease, transthyretin amyloidosis. Say that fast three times. Buy (CRSP) on dips. With Editas, there are only three small companies that have a monopoly here.

Facebook wins antitrust action, a federal judge dismissing an FTC action against the company. The move set the entire tech sector on fire. It looks like all of NASDAQ is going to much higher highs. I bet you had a great day. The court found that (FB) did not enjoy a monopoly which might have forced them to sell off Instagram and WhatsApp.

My Ten-Year View

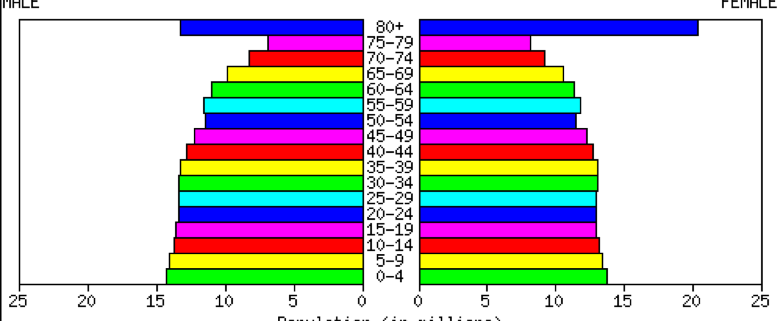

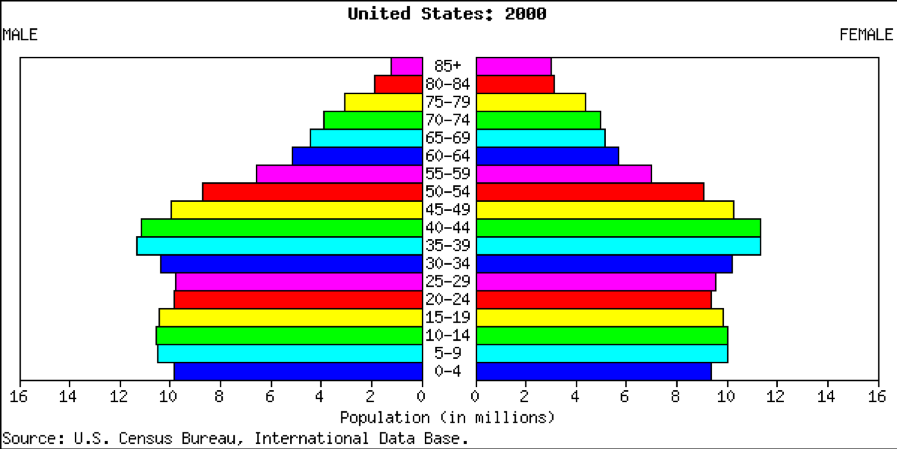

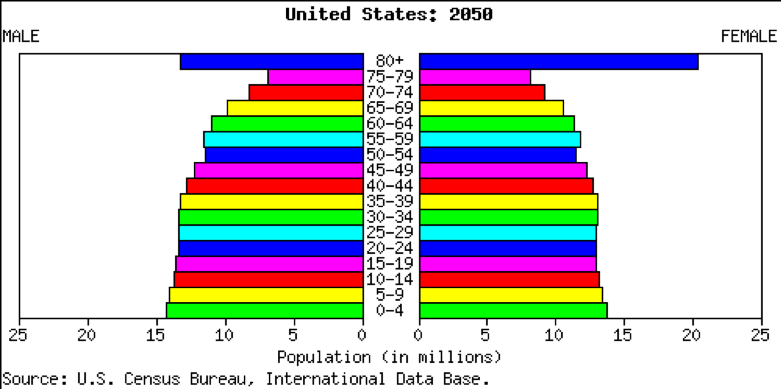

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% to 120,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 120,000 here we come!

My Mad Hedge Global Trading Dispatch profit reached 0.71% gain so far in June on the heels of a spectacular 8.13% profit in May. That leaves me 100% in cash.

My 2021 year-to-date performance appreciated to 68.60%. The Dow Average is up 13.7% so far in 2021.

I spent the week sitting in 100% cash, waiting for a better entry point on the long side. Up this much this year, there is no reason to reach for the marginal trade, then maybe instead of the certainty. I’ll leave that for the Millennials.

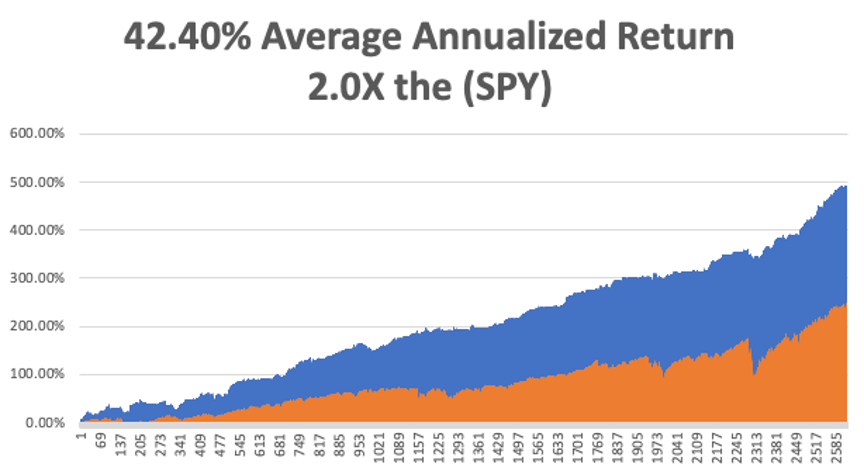

That brings my 11-year total return to 491.15%, some 2.00 times the S&P 500 (SPX) over the same period. My 11-year average annualized return now stands at an unbelievable 42.40%, easily the highest in the industry.

My trailing one-year return exploded to positively eye-popping 112.59%. I truly have to pinch myself when I see numbers like this. I bet many of you are making the biggest money of your long lives.

We need to keep an eye on the number of US Coronavirus cases at 33.7 million and deaths topping 606,000, which you can find here.

The coming week will be a weak one on the data front.

On Monday, July 5, markets are closed for the US Independence Day celebration.

On Tuesday, July 6 at 10:00 AM, the ISM Non-Manufacturing Index for June is released.

On Wednesday, July 7 at 10:00 AM, the Federal Open Market Committee Meeting from the last meeting are published.

On Thursday, July 8 at 8:30 AM, the Weekly Jobless Claims are published.

On Friday, July 9 at 2:00 PM, we learn the Baker-Hughes Rig Count.

As for me, with all the hiking I have been doing during the pandemic, I have been listening to a lot of WWII audio books lately. That reminds me of an old friendship I had with Toshiro Mifune, then the most movie famous star in Japan.

Mifune was drafted into the Japanese army during WWII where he served as an aerial reconnaissance photographer. After the war, that led him to work as a cameraman at Toho Productions, then the largest movie company in Japan.

A friend submitted his photo with an application for a casting call without his knowledge, and Toshiro, a good-looking guy, was one of 48 picked out of 4,000. He then met the legendary director, Akia Kurosawa, and the two launched the golden age of Japanese cinema in the late 1940s.

In just a couple of years, they produced blockbuster classic films like the Seven Samurai, Rashomon, and Throne of Blood, all of which are now required viewing by every American film school, and where Mifune demonstrated his impressive skills with a sword he picked up in the army.

I met Toshiro late in his career when he was cast as Admiral Isoroku Yamamoto for the 1976 Universal movie Midway. The problem was that Mifune couldn’t speak a word of English. I was brought in to bring Toshiro up to par in a crash course held at his west Tokyo mansion every afternoon seven days a week. We became good friends.

After a heroic effort, Mifune’s English was still awful, so the producers brought in a voice actor to dub Mifune’s part in Midway. That was Paul Frees, who provided the voice for the Disneyland’s Haunted House and Pirates of the Caribbean rides, as well as the cartoon Boris Badenov. His voice is still attached to those rides today, and I recognize it every time I take the kids.

Midway was a huge success and Mifune’s next big role was to play Commander Mitamura in Stephen Spielberg’s 1941. He followed that up with a role as Toranaga in James Clavell’s 1980 miniseries, Shogun, another old friend. (Clavell is a story for another day). My tutoring skills came back into demand once again, with better results.

Mifune died in 1997 at 77 and I miss him still.

Stay healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader