I often review the portfolios of new concierge subscribers looking for fundamental flaws in their investment approach and it is not unusual for me to find some real disasters.

The Armageddon scenario was quite popular a decade ago. You know, the philosophy that said that the Dow ($INDU) was plunging to 3,000, the US government would default on its debt (TLT), and gold (GLD) was rocketing to $50,000 an ounce?

Those who stuck with the deeply flawed analysis that led to those flawed conclusions saw their retirement funds turn to ashes.

Traditional value investors also fell into a trap. By focusing only on stocks with bargain basement earnings multiples, low price to book values, and high visible cash flows, they shut themselves out of technology stocks, far and away the fastest-growing sector of the economy.

If they are lucky, they picked up shares in Apple a few years ago when the earnings multiple was still down at ten. But even the Giant of Cupertino hasn’t been that cheap for years.

And here is the problem. Tech stocks defy analysis because traditional valuation measures don’t apply to them.

Let’s start with the easiest metric of all, that of sales. How do you measure the value of sales when a company gives away most of its services for free?

Take Google (GOOG) for example. I bet you all use it. How many of you have actually paid money to Google to use their search function? I would venture none.

What would you pay Google for search if you had to? What is it worth to you to have an instant global search function? Probably at least $100 a year. I would pay $10,000 as I use it all day long. With 92.05% of the global search market comprising 2 billion users, that means $200 billion a year of potential Google revenues are invisible.

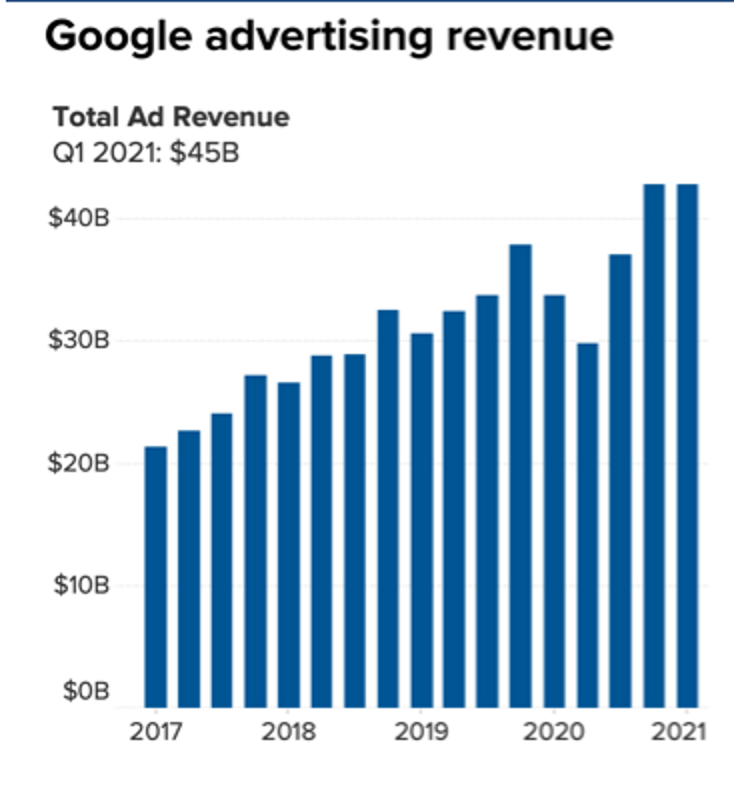

Yes, the company makes a chunk of this back by charging advertisers access to these search users, generating some $55.31 Billion in revenues and $17.93 billion in net income in the most recent quarter.

But much of the increased value of this company is passed on to shareholders not through rising profits or dividend payments but through an ever-rising share price. If you’re looking for dividends, Google doesn’t exist. It is also very convenient that unrealized capital gains are tax-free until the shares are sold, which may be never.

I’ll tell you another valuation measure that investors have completely missed, that of community. The most successful companies don’t have just customers who buy stuff, they have a community of members who actively participate in a common vision, which is then monetized. There are countless communities out there now making fortunes, you just have to know how to spot them.

Facebook (FB) has created the largest community of people who are willing to share personal information. This permits the creation of affinity groups centered around specific interests, from your local kids’ school activities to municipality emergency alerts, to your preferred political party.

This creates a gigantic network effect that increases the value of Facebook. Each person who joins (FB) makes it worth more, raising the value of the shares, even though they haven’t paid it a penny. Again, it’s advertisers who are footing your tab.

Tesla (TSLA) has one million customers willing to lend it $400 billion for free in the form of deposits on future car purchases because they also share in the vision of a carbon-free economy. When you add together the costs of initial purchase, fuel, and maintenance savings, a new Tesla Model 3 is now cheaper than a conventional gasoline-powered car over its entire life.

REI, a privately held company, actively cultivates buyers of outdoor equipment, teaches them how to use it, then organizes trips. It will then pursue you to the ends of the earth with seasonal discount sales. Whole Foods (WFC), now owned by Amazon (AMZN), does the same in the healthy eating field.

If you spend a lot of your free time in these two stores, as I do, The United States is composed entirely of healthy, athletic, good-looking, and long-lived, intelligent people.

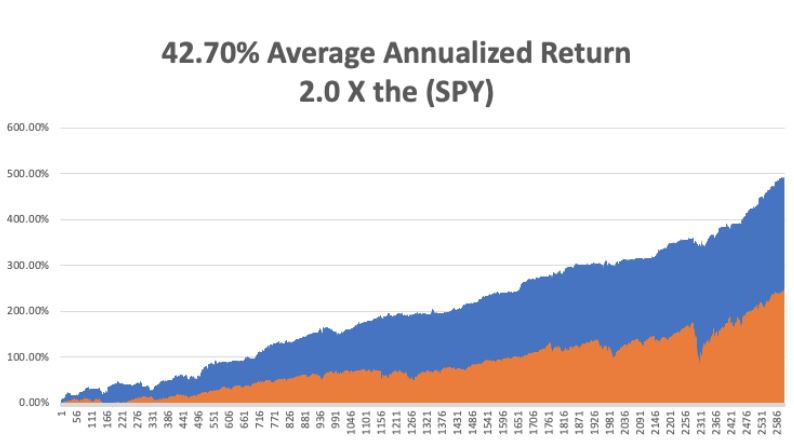

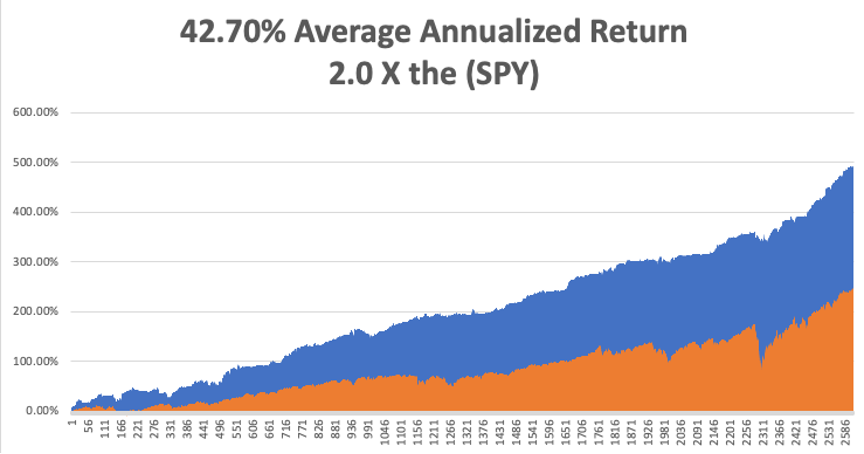

There is another company you know well that has grown mightily thanks to the community effect. That would be the Diary of a Mad Hedge Fund Trader, one of the fastest-growing online financial services firms of the past decade. What is the value of our community? To give you a hint, the price of my Global Trading Dispatch has soared from $29 a month to $3,000 a year.

We have succeeded not because we are good at selling newsletters, but because we have built a global community of like-minded investors with a common shared vision around the world, that of making money through astute trading and investment.

We produce daily research services covering global financial markets, like Global Trading Dispatch, the Mad Hedge Technology Letter, and the Mad Hedge Biotech & Healthcare Letter. We teach you how to monetize this information with our books like Stocks to Buy for the Coming Roaring Twenties and the Mad Hedge Options Training Course.

We then urge you to action with our Trade Alerts. If you want more hands-on support, you can upgrade to the Concierge Service. You can also meet me in person to discuss your personal portfolios and my Global Strategy Luncheons.

The luncheons are great because long-term Mad Hedge veterans trade notes on how best to use the service and inform me on where to make improvements. It’s a blast.

The letter is self-correcting. When we make a mistake, readers let us know in 60 seconds and we can shoot out a correction immediately. The services evolve on a daily basis.

It all comes together to enable customers to make up to 20% to 100% a year on their retirement funds. And guess what? The more money they make, the more products and services they buy from me. This is why I have so many followers who have been with me for a decade or more. And some of my best ideas come from my own subscribers.

So, if you missed technology now what should you do about it? Recognize what the new game is and get involved. Microsoft (MSFT) with the fastest-growing cloud business offers good value here. Amazon looks like it will eventually hit my $5,000 target. You want to be buying graphics card and AI company NVIDIA (NVDA) on every 10% dip. It’s going to $1,000.

You can buy the breakouts now to get involved or patiently wait until the 10% selloff that usually follows blowout quarterly earnings.

My guess is that tech stocks still have to double in value before their market capitalization of 26% matches their 50% share of US profits. And the technologies are ever hyper-accelerating. That leaves a lot of upside even for the new entrants.