Global Market Comments

January 11, 2021

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or A WEEK FOR THE HISTORY BOOKS),

($INDU), (TSLA), (TBT), (TLT), (JPM), (WFC)

Global Market Comments

January 11, 2021

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or A WEEK FOR THE HISTORY BOOKS),

($INDU), (TSLA), (TBT), (TLT), (JPM), (WFC)

A man came at me with a crowbar last week.

I drove into Reno to buy some used backpacks for my Boy Scout troop and parked my Tesla in a nice residential neighborhood. Out of nowhere, a man ran down the street at me screaming profanities, crowbar in hand.

He shouted that I was from Antifa and that I had hired people to invade the Capitol Building to make President Trump look bad.

I reached into my car for my own crowbar. Then the local residents interceded, separating us. The man turned around and walked away, fuming.

“Who the heck was that?” I asked.

“He has mental issues,” said a neighbor. “We’ve had many problems with him before.”

Another said “He’s a Trump supporter. He saw your Tesla and thought you were a liberal.”

Wow! Looks like the nation has a very long way to heal.

Last year, the US defense budget amounted to $622 billion. When the greatest threat to congress in the nation’s history presented itself, it was antique chairs piled against the door that provided the best defense. Maybe we should ditch some big-ticket nuclear missiles and buy more chairs.

Of course, once the insurrection started on Wednesday, I was inundated with international calls from investors asking if they should pull all their money out of the US. I answered “NO” and that it was in fact time to double down. Those who did made a killing.

Ask any professional money manager what his reaction to a coup d’état in Washington would be, their response definitely would NOT be to run out and buy a ton of Tesla (TSLA). Yet, that was exactly the perfect thing to do, the stock soaring an astonishing $135, or 18% in two days. I have many followers who did exactly that and they made millions.

All I can say is that if a market gets hit with an insurrection, and exploding pandemic, and a crashing economy and only goes down 400 points and then bounces back the next day, you want to buy the hell out of it.

I’m talking about going on margin and taking a second mortgage on your home and pouring it into stocks. You might even consider going to a loan shark and borrowing at 18% because you can easily make double that in the right stocks.

After the Biden win and the Georgia sweep, there is now more rocket fuel pouring into the stock market than ever. Call it the “Biden blank check”. Estimates of new spending and subsidies about to hit the market now go up to $10 trillion. Let me list some of them:

*$2 trillion in enforced savings by locked up American consumers.

*Credit card balances have collapsed to multi-year lows, making available hundreds of billions in spending power.

*Trillions of Money market balances sitting on the sidelines yielding zero

*$908 billion stimulus package passed in the closing days of 2020

*A further $2 trillion stimulus package to pass shortly, including $2,000 checks for all 150 million US taxpayers.

*Add another $2 trillion infrastructure budget

*$1 trillion in student loan forgiveness for 10 million borrowers at $10,000 each

*Enormous subsidies for any alternative energy companies and Tesla cars

*The return of the deductibility of $1 trillion worth of state and local real estate taxes (known as (SALT)).

MUCH OF THIS CASH MOUNTAIN IS GOING STRAIGHT INTO THE STOCK MARKET!

It all sets up a stock market that has the potential to have “extreme” moves to the upside, according to my friend, Fundstrat’s Tom Lee.

All you need to retire early is someone to point you in the right direction, into the right sectors and the right stocks. Actually, I happen to know just the right person who can do that and that would be me!

Storming of the Capital shut down markets. After the initial crash, markets flatlined as the entire country dropped what they were doing and glued themselves to a TV, their jaws hanging open. The Dow dove 400 points, bonds and the US dollar stabilized, Tesla and oil took big hits, and gold and silver took off. The electoral college vote has been suspended, gunfights broke out on the house floor, and several explosive devices placed. Trump incited his followers to attack the capitol and they did exactly that. Washington DC is now subject to a 6:00 PM curfew for two weeks. Is this the beginning of the 2024 presidential election? It’s the worst day in Washington since the British burned it in 1814.

Democrats took Georgia, giving them Senate control and a blank check on spending for at least two years. Trump clearly blew the election for his party. My 3X short in bonds soared as the market crashed. Banks rocketed on a 10-basis point leap in interest rates. Infrastructure plays went ballistic. The US dollar faded. Add another couple of percentage points of US GDP growth for 2021.

Tesla Shorts posted biggest loss in history, setting on fire a staggering $38 billion in short positions. Many of these were financed by big oil looking to put Tesla out of business. The short interest in the stock has plunged from 37% to 5%. Did I mention that Tesla was the biggest Mad Hedge long of 2020? I’ve been buying it since it was a split-adjusted $3.30 a share in 2010 against a Friday close of $880, a gain of 290X. Elon Musk is now the richest man in the world and he’s only just getting started!

Tesla met its 500,000-unit 2020 target, far in excess of analyst forecasts. Q4 came in at a surprise 180,570 units. The firm’s 2021 target is 1.1 million units. The market Cap is about to touch $1 trillion, more than all of the global car industry combined. The Model 3 is doing the heavy lifting. Model Y production in Shanghai is about to ramp up and Berlin is to follow. If Tesla can mass-produce their solid-state batteries, they’ll attain a global monopoly in the car industry with 25 million units a year and a share price of $10,000.

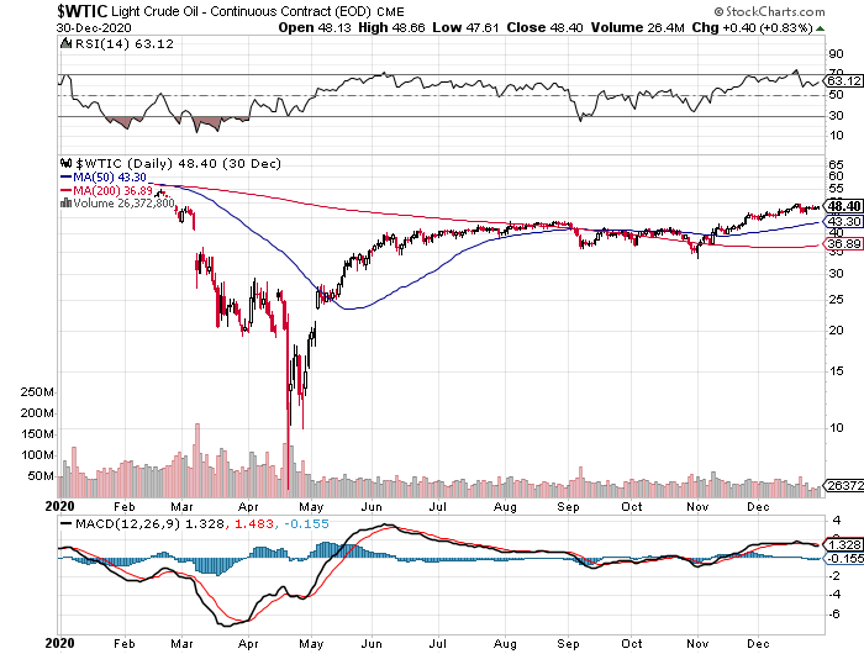

A Saudi surprise production cut, a million barrels a day, sent oil over $50. But with demand that weak, how long can the rally last? The market is entering short-selling territory. I bet you didn’t use much gas today commuting from your bedroom to your home office. Use the rally to unload what energy you have left. Sell the (XLE) on rallies.

Bitcoin topped $42,000, more than doubling in a month, and exceeded $1 trillion as an asset class. A Biden-run economy means more money creation which has to find a home. My friend’s pizza purchase for 8 Bitcoin a decade ago is now worth $320,000. I hope it was good!

The Nonfarm Payroll came in at a loss of 140,000, giving more credence to the Q1 double-dip scenario and far worse than expected. The headline Unemployment Rate came in unchanged at 6.7%, Leisure & Hospitality lost a mind-blowing 498,000 and an incredible 3.9 million since January. Private Education lost 63,000 and Government 45,000. Professional & Business Services gained 161,000. The real U-6 Unemployment Rate is a very high 11.6%.

The bond crash has only just begun, with the (TLT) down $8 on the week. The risk/reward is the worst of any financial asset anywhere. I am maintaining my triple short position. Massive government borrowing will be a death knell for fixed income investors.

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% to 120,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 120,000 here we come!

My Mad Hedge Global Trading Dispatch closed out a blockbuster 2020 with a blockbuster 10.20% in December, taking me up to an eye-popping 66.64% for the year. I’m up 81% since the March low. In 2021, I shot out of the gate with an immediate 5.93% profit for the first four trading days of the year.

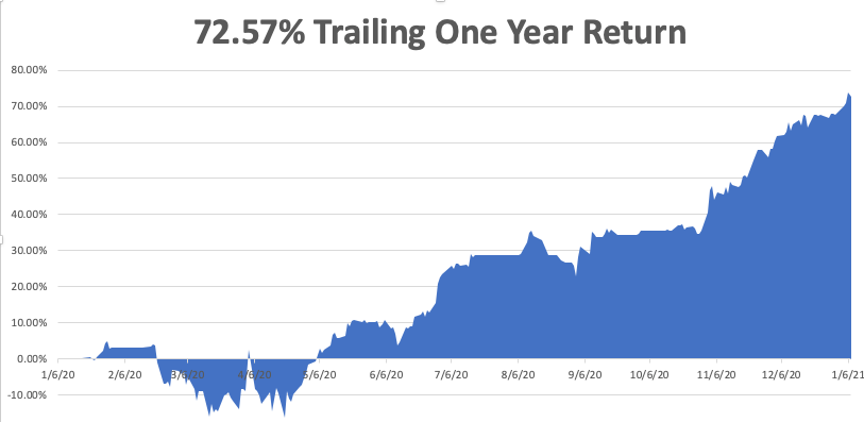

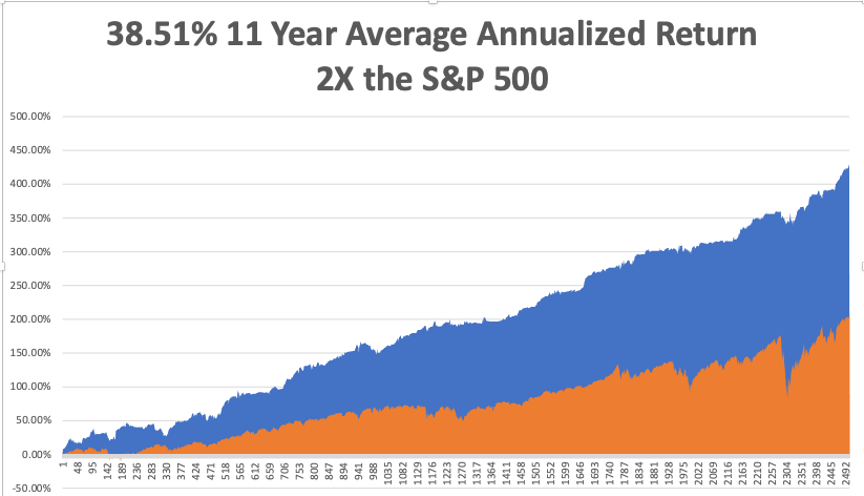

That brings my eleven-year total return to 428.48% double the S&P 500 over the same period. My 11-year average annualized return now stands at a nosebleed new high of 38.51%. My trailing one-year return exploded to 72.57%, the highest in the 13-year history of the Mad Hedge Fund Trader. We have earned 89% since the March low.

The coming week will be a slow one on the data front after last week's fireworks. We also need to keep an eye on the number of US Coronavirus cases at 22 million and deaths 370,000, which you can find here.

When the market starts to focus on this, we may have a problem.

On Monday, January 11 at 11:00 AM EST, US Inflation Expectations are released, which will increasingly become an area of interest.

On Tuesday, January 12 at 4:30 PM, API Crude Inventories are published.

On Wednesday, January 13 at 8:30 AM, the US Inflation Rate for December is announced.

On Thursday, January 14 at 8:30 AM, the Weekly Jobless Claims are published. We also get November Housing Starts.

On Friday, December 15 at 8:30 AM, December Retail Sales are printed. Q4 earnings seasons starts, with JP Morgan Chase (JPM) and Wells Fargo (WFC) reporting. At 2:00 PM we learn the Baker-Hughes Rig Count.

As for me, I’ll be taking my old Toyota Highlander down to the dealer in Reno. Squirrels moved into the engine and ate the wiring, knocking out the heater and the fan. All part of the cost of living in a mountain paradise. However, you have to share it with the critters.

I’ll also be investing in some pepper spray.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

“Getting rid of your great companies and adding to you bad companies is like cutting the flowers and watering the weeds,” said my former client and mentor, Magellan Fund’s Peter Lynch.

Global Market Comments

January 8, 2021

Fiat Lux

Featured Trade:

(JANUARY 6 BIWEEKLY STRATEGY WEBINAR Q&A),

(TSLA), (SQM), (GLD), (SLV), (GOLD), (WPM), (TLT), (FCX), (IBB), (XOM), (UPS), (FDX), (ZM), (DOCU), (VZ), (T), (RTX), (UT), (NOC),

(FXE), (FXY), (FXA), (UUP)

Below please find subscribers’ Q&A for the January 6 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Incline Village, NV.

Q: Any thoughts on lithium now that Tesla (TSLA) is doing so well?

A: Lithium stocks like Sociedad Qimica Y Minera (SQM) have been hot because of their Tesla connection. The added value in lithium mining is minimal. It basically depends on the amount of toxic waste you’re allowed to dump to maintain profit margins—nowhere close to added value compared to Tesla. However, in a bubble, you can't underestimate the possibility that money will pour into any sector massively at any time, and the entire electric car sector has just exploded. Many of these ETFs or SPACs have gone up 10 times, so who knows how far that will go. Long term I expect Tesla to wildly outperform any lithium play you can find for me. I’m working on a new research piece that raises my long-term target from $2,500 to $10,000, or 12.5X from here, Tesla becomes a Dow stock, and Elon Musk becomes the richest man in the world.

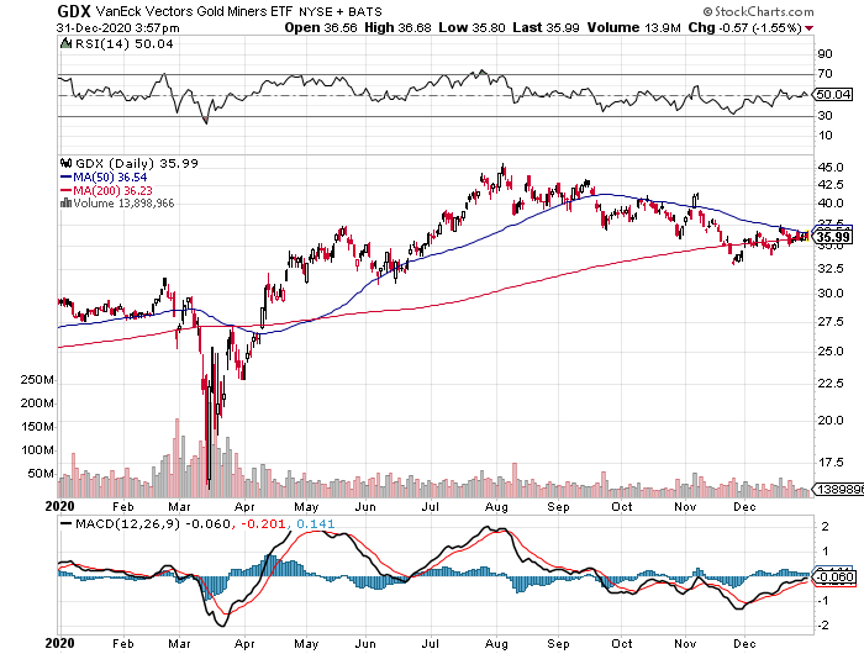

Q: Won’t rising interest rates hurt gold (GLD)? Or are inflation and a weak dollar more important?

A: You nailed it. As long as the rate rise is slow and doesn't get above 1.25% or 1.50% on the ten-year, gold will continue to rally for fears of inflation. Also, if you get Bitcoin topping out at any time, you will have huge amounts of money pour out of Bitcoin into the precious metals. We saw that happen for a day on Monday. So that is your play on precious metals. Silver (SLV) will do even better.

Q: What are your thoughts on TIPS (Treasury Inflation Protected Securities) as a hedge?

A: TIPS has been a huge disappointment over the years because the rate of rise in inflation has been so slow that the TIPS really didn’t give you much of a profit opportunity. The time to own TIPS is when you think that a very large increase in inflation is imminent. That is when TIPS really takes off like a rocket, which is probably a couple of years off.

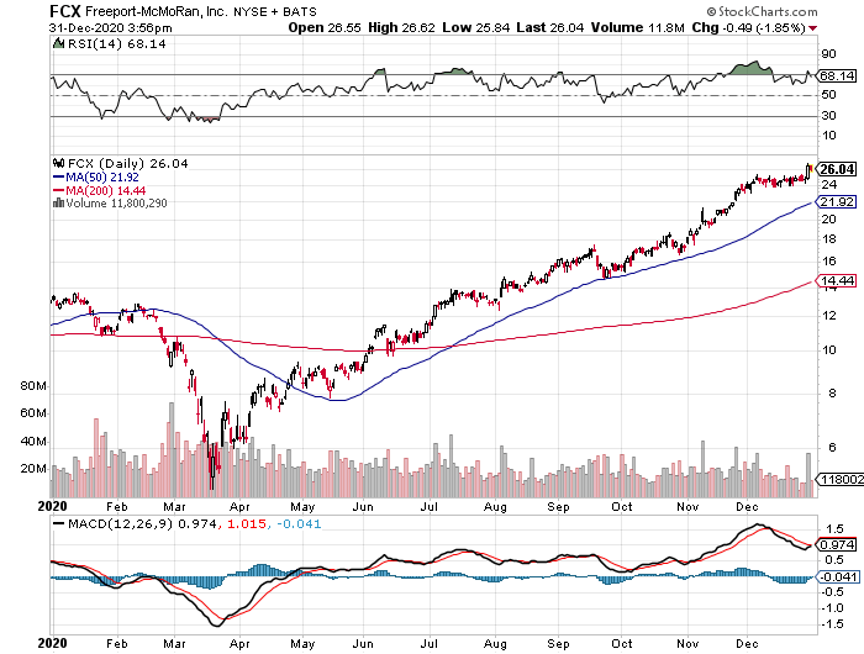

Q: Will Freeport McMoRan (FCX) continue to do well in this environment?

A: Absolutely, yes. We are in a secular decade-long commodity bull market. Any dip you get in Freeport you should buy. The last peak in the previous cycle ten years ago was $50, so there's another potential double in (FCX). I know people have been playing the LEAPS in the calendars since it was $4 a share in March and they have made absolute fortunes in the last 9 months.

Q: Is it a good time to take out a bear put debit spread in Tesla?

A: Actually, if you go way out of the money, something like a $1,000-$900 vertical bear put spread, with the 76% implied volatility in the options market one week out, you probably will make some pretty decent money. I bet you could get $1,500 from that. However, everyone who has gone to short Tesla has had their head handed to them. So, it's a high risk, high return trade. Good thought, and I will actually run the numbers on that. However, the last time I went short on Tesla, I got slaughtered.

Q: Any thoughts on why biotech (IBB) has been so volatile lately?

A: Fears about what the Biden government will do to regulate the healthcare and biotech industry is a negative; however, we’re entering a golden age for biotech invention and innovation which is extremely positive. I bet the positives outweigh the negatives in the long term.

Q: Oil is now over $50; is it a good time to buy Exxon Mobil (XOM)?

A: Absolutely not. It was a good time to buy when it was at $30 dollars and oil was at negative $37 in the futures market. Now is when you want to start thinking about shorting (XOM) because I think any rally in energy is short term in nature. If you’re a fast trader then you probably can make money going long and then short. But most of you aren't fast traders, you’re long-term investors, and I would avoid it. By the way, it’s actually now illegal for a large part of institutional America to touch energy stocks because of the ESG investing trend, and also because it’s the next American leather. It’s the next former Dow stock that’s about to completely disappear. I believe in the all-electric grid by 2030 and oil doesn't fit anywhere in that, unless they get into the windmill business or something.

Q: With Amazon buying 11 planes, should we be going short United Parcel Service (UPS) and FedEx (FDX)?

A: Absolutely not. The market is growing so fast as a result of an unprecedented economic recovery, it will grow enough to accommodate everyone. And we have already had huge performance in (UPS); we actually caught some of this in one of our trade alerts. So again, this is also a stay-at-home stock. These stocks benefited hugely when the entire US economy essentially went home to go to work.

Q: Should we keep our stay-at-home stocks like DocuSign (DOCU), Zoom (ZM), and UPS (UPS)?

A: They are way overdue for profit-taking and we will probably see some of that; but long term, staying at home is a permanent fixture of the US economy now. Up to 30% of the people who were sent to work at home are never coming back. They like it, and companies are cutting their salaries and increasing their profits. So, stay at home is overdone for the short term, but I think they’ll keep going long term. You do have Zoom up 10 times in a year from when we recommended it, it’s up 20 times from its bottom, DocuSign is up like 600%. So way overdone, in bubble-type territory for all of these things.

Q: Are telecom stocks like Verizon (VZ) and AT&T (T) safe here?

A: Actually they are; they will benefit from any increase in infrastructure spending. They do have the 5G trend as a massive tailwind, increasing the demand for their services. They’re moving into streaming, among other things, and they had very high dividends. AT&T has a monster 7% dividend, so if that's what you’re looking for, we’re kind of at the bottom of the range on (T), so I would get involved there.

Q: Should we sell all our defense stocks with the Biden administration capping the defense budget?

A: I probably would hold them for the long term—Biden won’t be president forever—but short term the action is just going to be elsewhere, and the stocks are already reflecting that. So, Raytheon (RTX), United Technologies (UT), and Northrop Grumman (NOC), all of those, you don’t really want to play here. Yes, they do have long term government contracts providing a guaranteed income stream, but the market is looking for more immediate profits, or profit growth like you have been getting in a lot of the domestic stocks. So, I expect a long sideways move in the defense sector for years. Time to become a pacifist.

Q: Is it safe to buy hotels like Marriott (MAR), Hyatt (H), and Hilton (HLT)?

A: Yes, unlike the airlines and cruise lines, which have massive amounts of debt, the hotels from a balance sheet point of view actually have come through this pretty well. I expect a decent recovery in the shares, probably a double. Remember you’re not going to see any return of business travel until at least 2022 or 2023, and that was the bread and butter for these big premium hotel chains. They will recover, but that will take a bit longer.

Q: How about online booking companies like Expedia (EXPE) and Booking Holdings Inc, owner of booking.com, Open Table, and Priceline (BKNG)?

A: Absolutely; these are all recovery stocks and being online companies, their overhead is minimal and easily adjustable. They essentially had to shut down when global travel stopped, but they don’t have massive debts like airlines and cruise lines. I actually have a research piece in the works telling you to buy the peripheral travel stocks like Expedia (EXPE), Booking Holdings (BKNG), Live Nation (LYV), Madison Square Garden (MSGE) and, indirectly, casinos (WYNN), (MGM) and Uber (UBER).

Q: What about Regeneron (REGN) long term?

A: They really need to invent a new drug to cure a new disease, or we have to cure COVID so all the non-COVID biotech stocks can get some attention. The problem for Regeneron is that when you cure a disease, you wipe out the market for that drug. That happened to Gilead Sciences (GILD) with hepatitis and it’s happening with Regeneron now with Remdesivir as the pandemic peaks out and goes away.

Q: What about Chinese stocks (FXI)?

A: Absolutely yes; I think China will outperform the US this year, especially now that the new Biden administration will no longer incite trade wars with China. And that is of course the biggest element of the emerging markets ETF (EEM).

Q: Will manufacturing jobs ever come back to the US?

A: Yes, when American workers are happy to work for $3/hour and dump unions, which is what they’re working for in China today. Better that America focuses on high added value creation like designing operating systems—new iPhones, computers, electric cars, and services like DocuSign, Zoom—new everything, and leave all the $3/hour work to the Chinese.

Q: What about long-term LEAPS?

A: The only thing I would do long term LEAPS in today would be gold (GOLD) and silver miners (WPM). They are just coming out of a 5-month correction and are looking to go to all-time highs.

Q: What about your long-term portfolio?

A: I should be doing my long-term portfolio update in 2 weeks, which is much deserved since we have had massive changes in the US economy and market since the last one 6 months ago.

Q: Do you have any suggestions for futures?

A: I suggest you go to your online broker and they will happily tell you how to do futures for free. We don’t do futures recommendations because only about 25% of our followers are in the futures market. What they do is take my trade alerts and use them for market timing in the futures market and these are the people who get 1,000% a year returns. Every year, we get several people who deliver those types of results.

Q: Will people go back to work in the office?

A: People mostly won’t go back to the office. The ones who do go back probably won't until the end of the summer, like August/September, when more than half the US population has the Covid-19 vaccination. By the way, getting a vaccine shot will become mandatory for working in an office, as it will in order to do anything going forward, including getting on any international flights.

Q: What is the best way to short the US dollar?

A: Buy the (FXE), the (FXY), the (FXA), or the (UUP) basket.

Q: Silver LEAP set up?

A: I would do something like a $32-$35 vertical bull call spread on options expiring in 2023, or as long as possible, and that increases the chance you’ll get a profit. You should be able to get a 500% profit on that LEAP if silver keeps going up.

Q: What about agricultural commodities?

A: Ah yes, I remember orange juice futures well, from Trading Places, where I also once made a killing myself. Something about frozen iguanas falling out of trees was the tip-off. We don’t cover the ags anymore, which I did for many years. They are basically going down 90% of the time because of the increasing profitability and efficiency of US farmers. Except for the rare weather disaster or an out of the blue crop disease, the ags are a loser’s game.

Q: Can we view these slides?

A: Yes, we load these up on the website within two hours. If you need help finding it just send an email or text to our ever loyal and faithful Filomena at support@madhedgefundtrader.com and she will direct you.

Q: Do you have concerns about Democrats regulating bitcoin?

A: Yes, I would say that is definitely a risk for Bitcoin. It is still a wild west right now and there are massive amounts of theft going on. It is a controlled market, with bitcoin miners able to increase the total number of points at any time on a whim.

Good Luck and Stay Healthy

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

“If you can’t convince an 8-year-old why you own this thing, you probably shouldn’t own it” said legendary value stock manager Peter Lynch.

Global Market Comments

January 7, 2021

Fiat Lux

Featured Trade:

(HOW TO HANDLE THE FRIDAY, JANUARY 15 OPTIONS EXPIRATION),

(TSLA), (TLT), (WPM), (GOLD)

Followers of the Mad Hedge Fund Trader Alert Service have the good fortune to own TEN deep in-the-money options positions, all of which are profitable. Six of these expire in six trading days on Friday, January 15, and I just want to explain to the newbies how to best maximize their profits.

These involve the following:

(TLT) 1/$164-$167 put spread

(TSLA) 1/$430-$460 call spread

(TSLA) 1/$570-$600 call spread

(WPM) 1/$39-$41 call spread

(GOLD) 1/$21-$23 call spread

(TSLA) 1/$830-$860 put spread

Provided that we don’t have a huge selloff in gold, silver, or Tesla, or monster rallies in bonds or Tesla, all six of these positions will expire at their maximum profit point.

So far, so good.

The storming of Capital hill on Wednesday worked to the benefit of every one of these positions. Gold and silver took off, bonds stabilized, and Tesla ceased its heroic rally.

I’ll do the math for you on our oldest and least liquid position, the Tesla January 15 $430-$460 call spread, which I initiated on December 10, 2020 and will definitely run into expiration. At the Wednesday high, it was an astonishing $315, or 68.47%, in-the-money.

This is the biggest one-month stock gain I have seen in one of my positions in the 13-year history of this service.

Your profit can be calculated as follows:

Profit: $30.00 expiration value - $25.00 cost = $5.00 net profit

(4 contracts X 100 contracts per option X $5.00 profit per options)

= $2,000 or 20% in 18 trading days.

Many of you have already emailed me asking what to do with these winning positions.

The answer is very simple. You take your left hand, grab your right wrist, pull it behind your neck, and pat yourself on the back for a job well done.

You don’t have to do anything.

Your broker (are they still called that?) will automatically use your long position to cover your short position, canceling out the total holdings.

The entire profit will be credited to your account on Monday morning January 18 and the margin freed up.

Some firms charge you a modest $10 or $15 fee for performing this service.

If you don’t see the cash show up in your account on Monday, get on the blower immediately and find it.

Although the expiration process is now supposed to be fully automated, occasionally machines do make mistakes. Better to sort out any confusion before losses ensue.

If you want to wimp out and close the position before the expiration, it may be expensive to do so. You can probably unload them pennies below their maximum expiration value.

Keep in mind that the liquidity in the options market understandably disappears, and the spreads substantially widen, when a security has only hours, or minutes until expiration on Friday January 15. So, if you plan to exit, do so well before the final expiration at the Friday market close.

This is known in the trade as the “expiration risk.”

If for some reason your short position in your spread gets “called away,” don’t worry. Just call your broker and instruct them to exercise your long option position to cover your short option position. That gets you out of your position a few days early at your maximum profit point.

If your broker tells you to sell your remaining long and cover your short separately in the market, don’t. That makes money for your broker, but not you. Do what I say, and then fire your broker and close your account because they are giving you terrible advice. I’ve seen this happen many times among my followers.

One way or the other, I’m sure you’ll do OK, as long as I am looking over your shoulder, as I will be, always. Think of me as your trading guardian angel.

I am going to hang back and wait for good entry points before jumping back in. It’s all about keeping that “Buy low, sell high” thing going.

I’m looking to cherry-pick my new positions going into the next month end.

Take your winnings and go out and buy yourself a well-earned dinner. Just make sure it’s take-out. I want you to stick around.

Well done, and on to the next trade

Global Market Comments

January 6, 2021

Fiat Lux

2021 Annual Asset Class Review

A Global Vision

FOR PAID SUBSCRIBERS ONLY

Featured Trades:

(SPX), (QQQ), (XLF), (XLE), (XLY),

(TLT), (TBT), (JNK), (PHB), (HYG), (PCY), (MUB), (HCP)

(FXE), (EUO), (FXC), (FXA), (YCS), (FXY), (CYB)

(BHP), (FCX), (VALE), (AMLP), (USO), (UNG),

(GLD), (GDX), (SLV), (ITB), (LEN), (KBH), (PHM)

I am once again writing this report from a first-class sleeping cabin on Amtrak’s legendary California Zephyr.

By day, I have two comfortable seats facing each other next to a panoramic window. At night, they fold into two bunk beds, a single and a double. There is a shower, but only Houdini could navigate it.

I am anything but Houdini, so I go downstairs to use the larger public hot showers. They are divine.

We are now pulling away from Chicago’s Union Station, leaving its hurried commuters, buskers, panhandlers, and majestic great halls behind. I love this building as a monument to American exceptionalism.

I am headed for Emeryville, California, just across the bay from San Francisco, some 2,121.6 miles away. That gives me only 56 hours to complete this report.

I tip my porter, Raymond, $100 in advance to make sure everything goes well during the long adventure and to keep me up-to-date with the onboard gossip.

The rolling and pitching of the car is causing my fingers to dance all over the keyboard. Microsoft’s Spellchecker can catch most of the mistakes, but not all of them.

As both broadband and cell phone coverage are unavailable along most of the route, I have to rely on frenzied Internet searches during stops at major stations along the way to Google obscure data points and download the latest charts.

You know those cool maps in the Verizon stores that show the vast coverage of their cell phone networks? They are complete BS.

Who knew that 95% of America is off the grid? That explains so much about our country today.

I have posted many of my better photos from the trip below, although there is only so much you can do from a moving train and an iPhone 12 Pro.

After making the rounds with strategists, portfolio managers, and hedge fund traders in the run-up to this trip, I can confirm that 2020 was one of the most challenging for careers lasting 30, 40, or 50 years.

This was the year that EVERYTHING crashed, then posted heroic recoveries. Comparisons with 2008, 1999, and 1929 were frequently made. It truly was a year of extremes.

My own 66.64% return for last year is the best in the 13-year history of the Mad Hedge Fund Trader, nearly ten times the Dow Average performance of 7.3%. Yet, even during the darkest days of the March bottom, when the Dow was down 40%, we were never down more than 12%.

That took my eleven-year average annualized return up to an eye-popping 38.18%.

If you think I spend too much time absorbing conspiracy theories from the Internet, let me give you a list of the challenges I see financial markets are facing in the coming year:

The Ten Key Variables for 2020

1) Will the Covid-19 vaccine work, or will new mutations render it useless?

2) When will the pandemic peak, at 500,000 or 1 million deaths?

3) Will there be a double dip recession in Q1, or will the economy keep powering on?

4) Will the Democrats get control of the Senate through the Georgia Senate races, paving the way for more government spending?

5) Will technology stocks continue to dominate, or will domestic recovery stocks take over for good?

6) How long will the commodities boom continue?

7) Is the US dollar dead for good or are we approaching a bottom?

8) How long can the Fed artificially support the bond market, or is a crash imminent?

9) Has international trade been permanently impaired or will it recover?

10) Is oil seeing a dead cat bounce or is this a sustainable recovery?

The Thumbnail Portfolio

Equities – buy dips

Bonds – sell rallies

Foreign Currencies – buy dips

Commodities – buy dips

Precious Metals – buy dips

Energy – stand aside

Real Estate – buy dips

1) The Economy – The Roaring Twenties is Here

With the worst economic whipsaw in American history taking place in 2020, one might be hesitant about making forecasts for 2021. However, I shall press onward.

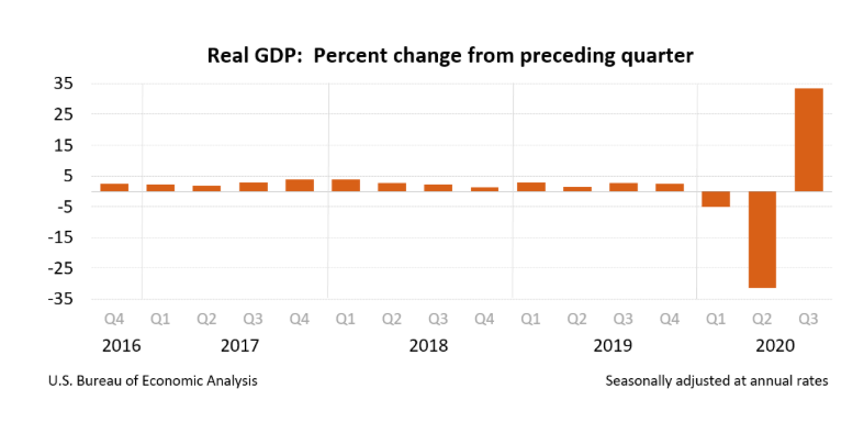

Last year saw a horrific 32.8% drawdown in Q2 GDP followed by an explosive 33.4% growth in Q3. It was the perfect “V” shaped recovery. However, we won’t see 2019 GDP levels until 2022, so there is plenty of growth to come, both nationally and on an individual company basis.

The reopening of the economy will bring us more double-digit growth after a Q1 slowdown mired by a peaking pandemic and delayed stimulus spending.

But it won’t be the same economy.

I figured out early that the pandemic was instantly moving us ten years into the future, placing a turbocharger on all existing trends. The economy is digitized at a rate that it has never seen before at the expense of mass closings of shopping malls and other old-line business models.

This will continue.

The online economy, working at home, and Zoom meetings are here to stay. You can’t get the genie back into the bottle. That has permanently increased the profitability of all the benefiting industries, while many others will never come back. As a result, the investment portfolio you should own in the future will look nothing like the one you had in the past. It’s not your father’s stock market.

It all sets out a base for an economic boom that could extend for another decade. Yes, Virginia, the Roaring Twenties are here. Better learn that Charleston!

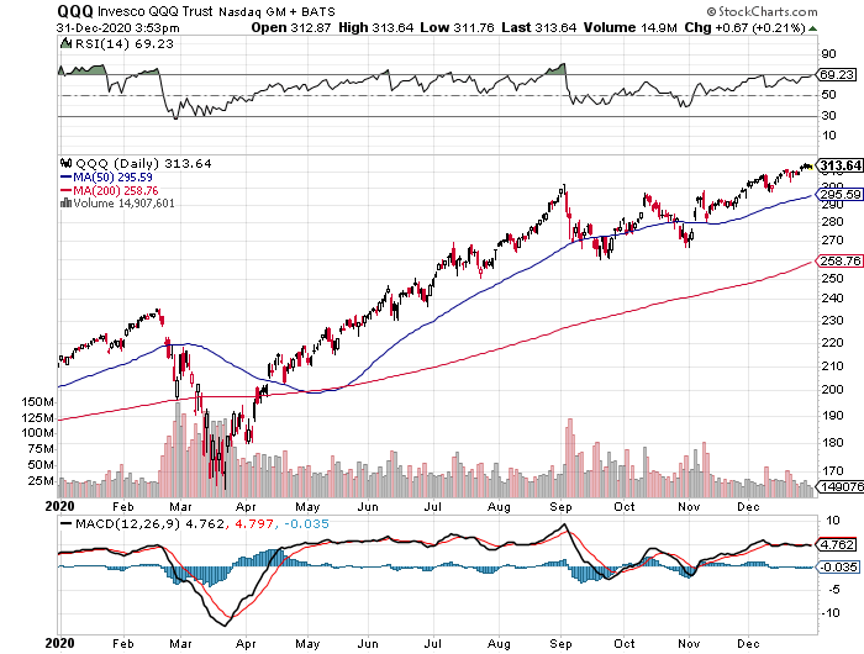

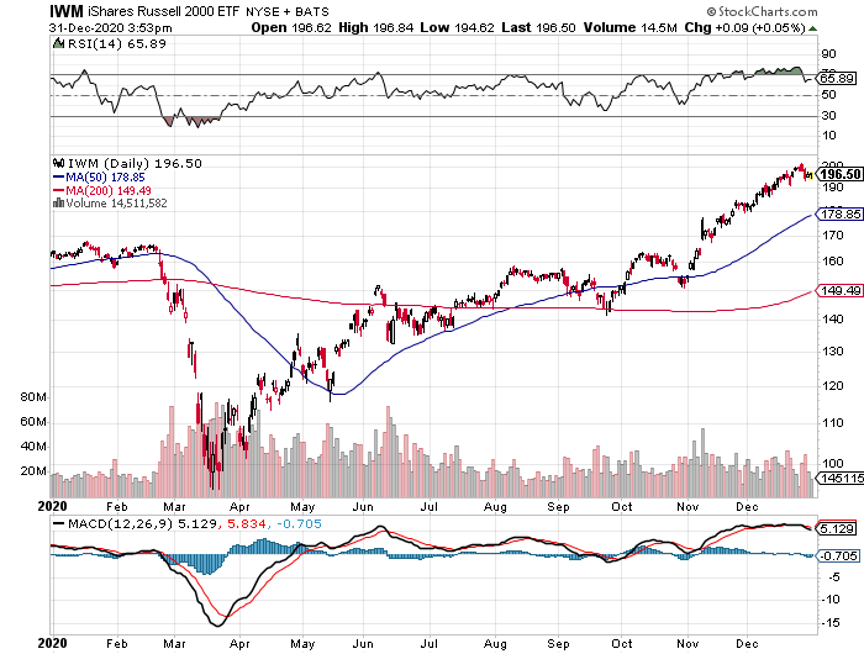

2) Equities (SPX), (QQQ), (IWM) (AAPL), (XLF), (BAC)

Stocks will finish much higher in 2021, and with much less volatility. I doubt we see pullbacks of more than 10%. The entire gain in stocks last year came from a massive expansion in earnings multiples. That could continue.

S&P 500 earnings per share will grow in 2021 from the current $180 per share to $200. If we increase the market earnings multiple from the current 18X to 22X, that brings us a combined gain in stock prices of 30%. That will take the (SPX) from a current $3,754 to $4,860. If that sounds high, remember that tech stocks reached 100X multiples in 2000. Many already have.

Why are earnings multiples headed to twenty-year highs? Because the pandemic has greatly increased the productivity of American companies, boosting their profitability and making them vastly more valuable.

Stocks also will rally from here because they are STILL receiving the greatest monetary stimulus in history, some $120 billion a month from the Fed alone, and this is a global trend. And Federal Reserve governor Jay Powell has promised NOT to raise interest rates from near zero for three years. Most of the excess cash is going into the stock market, either directly or indirectly.

Finally, the stock buybacks that drove the market from 2010 to 2019 but were frozen in 2020 will boisterously resume in 2021, exceeding $1 trillion a year.

And here’s the part you don’t want to hear. When QE ends a few years down the road and interest rates rise, the bull market in stocks will take a break. That’s when you get your cut churning 20% correction. I’ll give you the heads up right before that happens.

Technology stocks will continue their relentless rise, although less than at last year’s torrid pace. Love them or hate them, big tech accounts for 27% of stock market capitalization but 50% of US profits. It's why Willie Sutton robbed banks. That is where the money is.

However, in 2021, they will be joined by domestic recovery stocks, such as banks, online financials, constructions, commodities, delivery companies, hotels, airlines, and railroads. This, a barbell portfolio split between the two groups, will be the most effective strategy in 2021.

You can add on Biotech and Healthcare companies as a further diversification, which are entering a golden age of their own.

Passive index investing is over. This year, portfolio managers are going to have to earn their crust of bread through perfect market timing, sector selection, and individual name picking. Good luck with that. But then, that’s why you read this newsletter. I expect the blockbuster 2020 rally to continue into 2021. After that, I expect a correction. Piece of cake!

3) Bonds (TLT), (TBT), (JNK), (PHB), (HYG), (MUB), (LQD)

Amtrak needs to fill every seat in the dining car to get everyone fed on time, so you never know who you will share a table with for breakfast, lunch, and dinner.

There was the Vietnam Vet Phantom Jet Pilot who now refused to fly because he was treated so badly at airports. A young couple desperately eloping from Omaha could only afford seats as far as Salt Lake City. After they sat up all night, I paid for their breakfast.

A retired British couple was circumnavigating the entire US in a month on a “See America Pass.” Mennonites returning home by train because their religion forbade automobiles or airplanes.

The national debt ballooned to an eye-popping $28 trillion in 2020, a gain of an incredible $5 trillion and a post-World War II record. Yet, as long as global central banks are flooding the money supply with trillions of dollars in liquidity, bonds will not fall in value too dramatically. I’m expecting a slow grind down in prices and up in yields.

With a stable Fed, the best-case scenario is that the ten-year Treasury bond yield (TLT) will rise from 0.95% to 1.25% in 2021, and the worst case is they rise all the way up to 2.00%. That would take the price of the (TLT) down from $158 to $136. Remove any of that record liquidity from the system sooner than expected, and the bond market crashes, causing interest rates to soar and prices to crater.

It’s not impossible. We now have a democratic president and a republican Fed governor. Suffice it to say that all risks and surprises in the bond market are overwhelmingly to the downside.

What is different this year is that the US dollar is in free fall. That will dampen foreign demand for US debt, about half of the total.

Bond investors today get an unbelievably bad deal. If they hang on to the longer maturities, they will get back only 90 cents worth of purchasing power at maturity for every dollar they invest a decade down the road, at best.

A Visit to the 19th Century

4) Foreign Currencies (FXE), (EUO), (FXC), (FXA), (YCS), (FXY), (CYB)

Throughout human history, whenever a country’s borrowing exceeded its GDP, its currency collapsed. It happened to the Roman Empire, Bourbon France, Weimer Germany, post-colonial Great Britain, and now the US. Quite simply, whenever you print more of a currency, it becomes less valuable.

The national debt just exploded from $23 trillion to $28 trillion in 2020, and we are in store for $32 trillion in a year or 152% of the US GDP of $21 trillion. How many people have noticed?

Check out your charts and you’ll see that the US dollar started to depreciate while the Japanese yen and Euro started to gain, after we topped the 100% mark. This greenback weakness could continue for a decade.

There is even more trouble.

I have pounded away at you for years that interest rate differentials are far and away the biggest decider of the direction in currencies.

This year will prove that concept once again.

With American overnight rates now at 0.25% and ten-year Treasury bonds at 0.92%, the US has the highest interest rates of any major industrialized economy with the exception of China. This means that the US will be the last to raise interest rates from here.

Compounding the problem is that a weak dollar begets selling from foreign investors. The Chinese government, the world’s largest buyer of government bonds, have been boycotting US Treasuries for three years now. Maybe it’s something the president said? They are in a mood to do so anyway, as they see a chronically high US trade deficit as a burgeoning threat to the value of the greenback.

So, the dollar will continue weak against all major currencies, especially the Japanese yen (FXY), the Australian (FXA), and Euro (FXE).

This explains the recent success with points all weak dollar plays, including emerging markets (EEM), commodities (FCX), and precious metals (GLD).

You can take that to the bank!

5) Commodities (FCX), (VALE), (DBA)

The global synchronized economic recovery now in play can mean only one thing, and that is sustainably higher commodity prices.

Industrial commodities, like copper and iron ore, have just posted their best years in a decade, the red metal rising by an eye-popping 87% off of the March market bottom.

The heady days of the 2011 commodity bubble top are now in play. That is as investors are already front running that move, loading the boat with Freeport McMoRan (FCX), US Steel (X), and BHP Group (BHP).

Now that this sector is convinced of a permanently weak US dollar and higher inflation, it is taking off like a scalded chimp.

China will still demand prodigious amounts of imported commodities, but not as much as in the past. Much of the country has seen its infrastructure build out, and it is turning from a heavy industrial to a service-based economy, like the US. Miners are keeping a sharp eye on India as the next major commodity consumer.

The great thing about commodities is that it takes a decade to bring new supply online, unlike stocks and bonds, which can merely be created by an entry in an excel spreadsheet. As a result, they always run far higher than you can imagine.

6) Energy (DIG), (RIG), (USO), (DUG), (UNG), (USO), (XLE), (AMLP)

One of my best predictions of 2020 was that energy would be a complete disaster, and so it was. In fact, energy has been a horrific investment for the last 20 years. I never thought I’d see negative oil prices in the futures market, but we got them in April.

The industry invested trillions in infrastructure in a grand plan to export natural gas to China. Just as it was coming onstream, the president declared a trade war against China, its principal customer. Then the pandemic collapsed the global economy.

So, where does that leave us for 2021?

A lot of people have been piling into energy lately on the hope that happy days are here again.

I view carbon-based energy companies as the next generation of buggy whip makers. No matter how green the seven sisters talk, we are moving to an all-alternative energy economy over the next 20 years. That means you should sell energy NOW. Tesla (TSLA) shares rocketing from $3.30 to $600 in a decade tells you as much.

I believe what we are seeing is a lot of buying on technicals, on cheap prices, and of dogs of the Dow. No one is talking about an embedded structural oversupply of oil that will never be unwound.

Saudi Arabia said as much with the flotation of Saudi Aramco, which has a monopoly on oil production in the kingdom. After a three-year effort, they were only able to shift 1.5% of the company in a local stock exchange listing. It was one of the greatest accounting frauds in history. Only global index funds that HAD to buy shares picked it up. When Saudi Arabia wants to get out of the oil business, so should you.

OPEC Plus engineered a modest 500,000 production increase at their December Vienna meeting, and that has helped prices rise 10%. It is no more than a band-aid on a great gaping wound.

And now, ESG investing has banned new money from going into energy by most of the investment community. Like tobacco, that will leave a permanently cheap energy sector to a handful of niche players.

Use this as your last chance to get out at a decent price.

Our train has moved over to a siding to permit a freight train to pass, as it has priority on the Amtrak system.

Three Burlington Northern engines are heaving to pull over 100 black, spanking brand-new tank cars, each carrying 30,000 gallons of oil from the fracking fields in North Dakota.

There is another tank car train right behind it. No wonder Warren Buffett tap dances to work every day, as he owns the railroad.

We are also seeing relentless improvements on the energy conservation front with more electric vehicles, high mileage conventional cars, and newly efficient buildings. Electric cars are now 4% of US car sales and that could rise to 25% by 2025. Conventional Energy doesn’t fit anywhere in this industry.

In addition, the incoming administration is distinctly pro-environment and anti-energy and could deep six a 100-year accumulation of oil and gas subsidies in the next tax bill. The energy industry now carries far more political risk than the drug industry, once an unimaginable thought.

Any one of these inputs is miniscule on its own. But, add them all together, and you have a game-changer, a new paradigm.

We will never see $100/barrel crude again. The last peak in oil prices is the last one we ever see. The word is that leasing companies will stop offering five-year agreements in five years because cars with internal combustion engines will become worthless by then.

As a result, I think I will stand aside from the energy industry in 2021, and maybe, forever. You should too.

7) Precious Metals (GLD), (DGP), (SLV), (PPTL), (PALL)

The train has added extra engines at Denver, so now we may begin the long laboring climb up the Eastern slope of the Rocky Mountains.

On a steep curve, we pass along an antiquated freight train of hopper cars filled with large boulders.

The porter tells me this train is welded to the tracks to create a windbreak. Once, a gust howled out of the pass so swiftly that it blew a passenger train over on to its side.

In the snow-filled canyons, we sight a family of three moose, a huge herd of elk, and another group of wild mustangs. The engineer informs us that a rare bald eagle is flying along the left side of the train. It’s a good omen for the coming year.

We also see countless abandoned 19th century gold mines and the broken-down wooden trestles leading to them, relics of previous precious metals booms. So, it is timely here to speak about the future of precious metals.

Gold (GLD) brought in a respectable 21% return in 2020, its best performance in ten years. It’s not as much as many hot stocks, but better than a poke in the eye with a sharp stick.

As long as the world was clamoring for paper assets like stocks, gold was just another shiny rock. After all, who needs an insurance policy if you are going to live forever?

But the long-term bull case is still there. Gold is not dead; it is just resting.

If you forgot to buy gold at $35, $300, or $800, there is another entry point up here at $1,800 for those who, so far, have missed the gravy train.

To a certain extent, the belief that high interest rates are bad for gold is a myth. Wealth creation is a far bigger driver, and we have had plenty of that lately. Since the March bottom, stock has gained some $12.6 trillion in value, a meteoric 70% gain. To see what I mean, take a look at a gold chart for the 1970s when interest rates were going through the roof.

Remember, this is the asset class that takes the escalator up and the elevator down, and sometimes the window.

If the institutional world devotes just 5% of their assets to a weighting in gold, and an emerging market central bank bidding war for gold reserves continues, it has to fly to at least $2,300, the inflation-adjusted all-time high, or more.

This is why emerging market central banks step in as large buyers every time we probe lower prices. China and India emerged as major buyers of gold in the final quarters of 2020.

They were joined by Russia, which was looking for non-dollar investments to dodge US economic and banking sanctions.

That means it’s just a matter of time before gold breaks out to a new all-time high, above $2,080 an ounce. ETF players can look at the 1X (GLD) or the 2X leveraged gold (DGP).

I would also be using the next bout of weakness to pick up the high beta, more volatile precious metal, silver (SLV), which I think could rise from the present $18 and hit $50 once more, and eventually $100. Next year will see the production of one million electric cars and 500,000 solar panels and all of them require some amount of silver.

The turbocharger for gold will hit sometime in 2021 with the return of inflation. Hello stagflation, it’s been a long time.

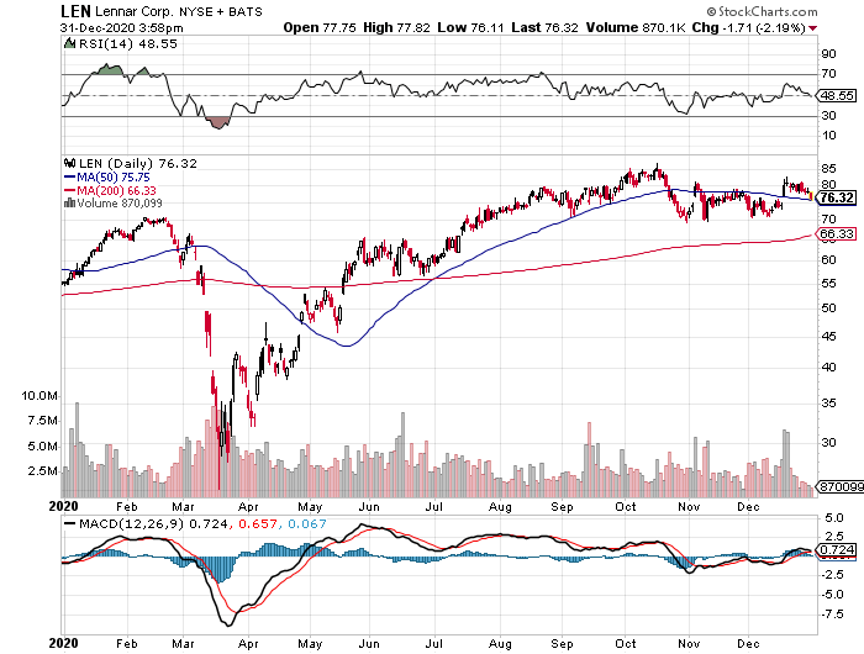

8) Real Estate (ITB), (LEN)

The majestic snow-covered Rocky Mountains are behind me. There is now a paucity of scenery, with the endless ocean of sagebrush and salt flats of Northern Nevada outside my window, so there is nothing else to do but write.

My apologies in advance to readers in Wells, Elko, Battle Mountain, and Winnemucca, Nevada.

It is a route long traversed by roving banks of Indians, itinerant fur traders, the Pony Express, my own immigrant forebearers in wagon trains, the transcontinental railroad, the Lincoln Highway, and finally US Interstate 80, which was built for the 1960 Winter Olympics at Squaw Valley.

Passing by shantytowns and the forlorn communities of the high desert, I am prompted to comment on the state of the US real estate market.

There is no doubt a long-term bull market in real estate is underway.

The good news is that we will not see a 2008 repeat when home values cratered by 50%-70%. There is just not enough leverage in the system yet to do any real damage. That has gone elsewhere, like in exchange traded funds, leveraged ETFs, Bitcoin, and SPACs. You can thank Dodd/Frank for that, which imposed capital rules so strict that it is now almost impossible for banks to commit suicide.

You are not going to see any serious damage in a market where there is a generational structural shortage of supply, as with housing.

We are probably ten years into an 18-year run at the next peak in 2028.

There are only three numbers you need to know in the housing market for the next 20 years: there are 80 million baby boomers, 65 million Generation Xer’s who follow them, and 86 million in the generation after that, the Millennials.

The boomers have been unloading dwellings to the Gen Xer’s since prices peaked in 2007. But there is not enough of the latter, and three decades of falling real incomes mean that they only earn a fraction of what their parents made. That’s what caused the financial crisis.

If they have prospered, banks won’t lend to them. Brokers used to say that their market was all about “location, location, location.” Now it is “financing, financing, financing.” Imminent deregulation is about to deep six that problem.

There is a happy ending to this story.

Millennials now aged 25-40 are already starting to kick in as the dominant buyers in the market. They are transitioning from 30% to 70% of all new buyers of homes.

The Great Millennial Migration to the suburbs has just begun. So has the migration from the coast to the American heartland. Personally, I like Reno, Nevada.

As a result, the price of single-family homes should rocket tenfold during the 2020s, as they did during the 1970s and the 1990s when similar demographic forces were at play.

This will happen in the context of a coming labor shortfall, soaring wages, and rising standards of living.

Rising rents are accelerating this trend. Renters now pay 35% of their gross income, compared to only 18% for owners, and less, when multiple deductions and tax subsidies are taken into account.

Remember, too, that the US will not have built any new houses in large numbers in 12 years. The 50% of small homebuilders that went under during the crash aren’t building new homes today.

We are still operating at only a half of the peak rate. Thanks to the Great Recession, the construction of five million new homes has gone missing in action.

That makes a home purchase now particularly attractive for the long term, to live in, and not to speculate with.

You will boast to your grandchildren how little you paid for your house, as my grandparents once did to me ($3,000 for a four-bedroom brownstone in Brooklyn in 1922), or I do to my kids ($180,000 for a two-bedroom in Upper East Side Manhattan high rise with a great view of the Empire State Building in 1983).

That means the major homebuilders like Lenar (LEN), Pulte Homes (PHM), and KB Homes (KBH) are a buy on the dip.

Quite honestly, of all the asset classes mentioned in this report, purchasing your abode is probably the single best investment you can make now.

If you borrow at a 2.8% 30-year fixed rate, and the long-term inflation rate is 3%, then, over time, you will get your house for free.

How hard is that to figure out?

9) Postscript

We have pulled into the station at Truckee in the midst of a howling blizzard.

My loyal staff has made the ten-mile trek from my beachfront estate at Incline Village to welcome me to California with a couple of hot breakfast burritos and a chilled bottle of Dom Perignon Champagne, which has been resting in a nearby snowbank. I am thankfully spared from taking my last meal with Amtrak.

After that, it was over legendary Donner Pass, and then all downhill from the Sierras, across the Central Valley, and into the Sacramento River Delta.

Well, that’s all for now. We’ve just passed what left of the Pacific mothball fleet moored near the Benicia Bridge (2,000 ships down to six in 50 years). The pressure increase caused by a 7,200-foot descent from Donner Pass has crushed my plastic water bottle. Nice science experiment!

The Golden Gate Bridge and the soaring spire of Salesforce Tower are just around the next bend across San Francisco Bay.

A storm has blown through, leaving the air crystal clear and the bay as flat as glass. It is time for me to unplug my Macbook Pro and iPhone 12 Pro, pick up my various adapters, and pack up.

We arrive in Emeryville 45 minutes early. With any luck, I can squeeze in a ten-mile night hike up Grizzly Peak and still get home in time to watch the ball drop in New York’s Times Square.

I reach the ridge just in time to catch a spectacular pastel sunset over the Pacific Ocean. The omens are there. It is going to be another good year.

I’ll shoot you a Trade Alert whenever I see a window open at a sweet spot on any of the dozens of trades described above.

Good luck and good trading in 2021!

John Thomas

The Mad Hedge Fund Trader

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.