You can pretty much write off trading for the next two weeks.

The election has been decided. It’s going to be a scandal a day in the media, but everyone has already made up their minds. All attention will be devoted to politics at the expense of trading, investment, and research. In the end, the president will lose by more than 15 million votes. All that is left but the imprimatur of the Electoral College.

Yet the Democrats are not declaring victory, with the memory of the 2016 debacle too fresh, when overconfidence and complacency ruled.

The few who are trading are jockeying around to position for the 2021 market. That means keeping big tech and adding to positions in domestic recovery and industrial stocks, like banks, couriers, railroads, and drug companies.

Tech will keep rising because of the catapult into the future provided by the pandemic yet to be reflected by share prices. Domestic industrials will see a recovery that is normal when coming out of a tradition recession, or Great Depression.

But they are doing so hesitantly, with little conviction.

After all, there are national elections in two weeks.

As for me, I have limited myself to the cautious two positions, one long in Visa (V) and one short in the S&P 500 (SPY), both of which are making money.

So, it is a good time to do your research, build your short lists of stocks to buy, and gird your loins. The main event begins after November 3.

Markets jumped on stimulus hopes. Investors don’t really care if stimulus happens before or after a Biden win. They’re buying now. And Biden will almost certainly double up spending later in the year. No dips for latecomers. The post-election market melt-up has begun and new highs beckon. Fears of election disruption have vaporized.

Markets just entered the strongest six months of the year. It’s the inverse of sell in May and go away. October to May portfolios have yielded 64% annually for the past 20 years, while May to October investments yield exactly 4%. It traces back to America’s agricultural cycle of a century ago. Take every tailwind you can find.

The IMF predicted negative 4.4% growth for 2020, the worst since the Great Depression. Believe it or not, this is an upgrade from more dismal numbers. By comparison, the 2008-09 Great Recession brought only a 0.1% drawdown. If the US passes another stimulus package, it will recover its 2019 GDP in 2021 instead of 2022.

The new 5G iPhone is out! After a year of speculation, we get a better screen, improved camera, and magnetic charging for $999. The stock dumped on a classic “buy the rumor, sell the news.” Also out is a new mini iPhone for $699. Your neighborhood won’t have 5G for a year. Buy Apple (AAPL) on dips.

The US PC market saw best quarter in a decade, with millions of new home offices joining the fray. Some 71.4 million computers were shipped in Q3, up 3.6% YOY. Think enormous demand for new chips. Buy (AMD), (MU), and (NVDA) on dips.

Used car prices are soaring, jumping the most since 1969, and lifted the Consumer Price Index by 0.2% in September. It’s the fourth straight month of increasing inflation.

Ships are backed up in Los Angeles waiting to unload. America’s import boom and soaring trade deficit with China leaves no available dock space on the west coast. It’s another sign of a recovering economy.

US Producer Prices pop in September bringing the first YOY gain since March. They were up 0.4% following a 0.3% gain in August. Another sign of a recovering economy.

Weekly Jobless Claims ballooned to 898,000, now that California is reporting again. Not what you want to see going into an election. A slowing economy and spreading virus don’t help either. Some 25.5 million Americans are out of work.

When we come out the other side of this, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 120,000 here we come!

My Global Trading Dispatch hit a new all-time high last week by staying 100% in cash. I was just as grateful for having no positions on the up 600-point days as I was on the down 600-point days. Safe to say that I will be an increasingly more aggressive buyer on ever smaller dips and a seller on bigger rallies. October has now reached to a welcome 1.61% profit.

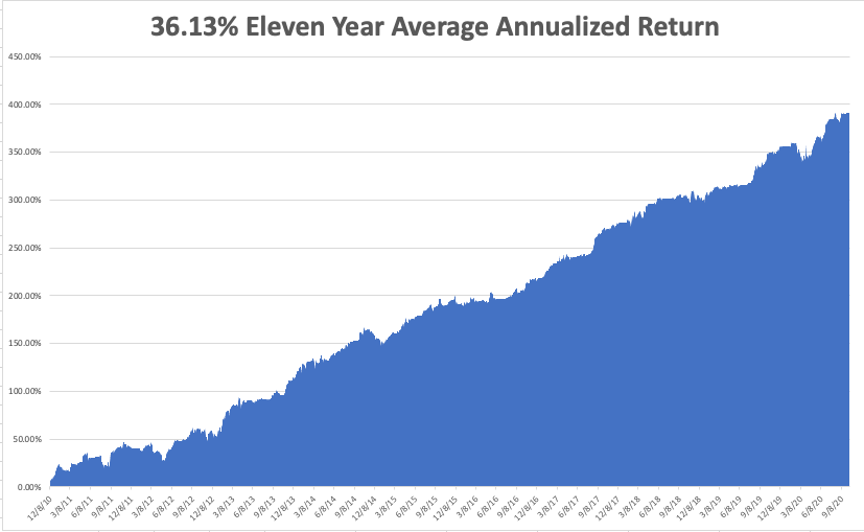

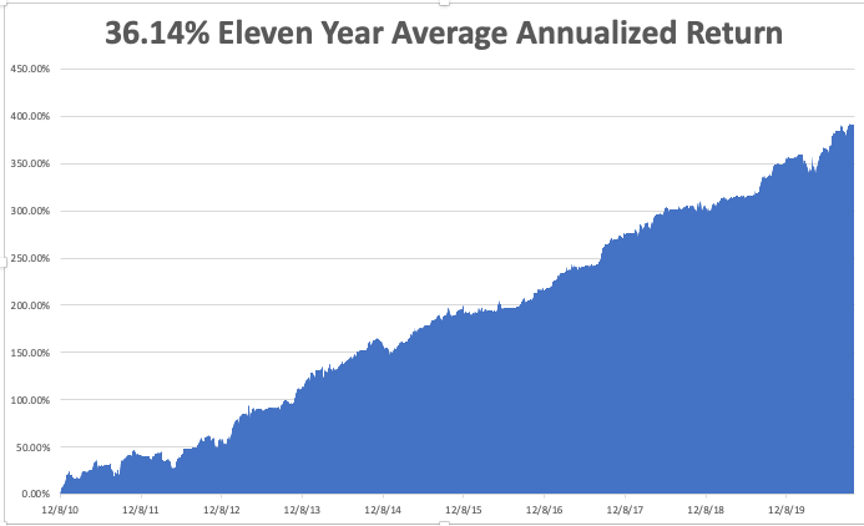

That keeps our 2020 year-to-date performance at a blistering +36.11%, versus a gain of 0.3% for the Dow Average. That takes my eleven-year average annualized performance back to +36.13%. My 11-year total return stood at a new all-time high at +392.02%. My trailing one-year return appreciated to +42.67%.

The coming week will be a dull one on the data front. The only numbers that really count for the market are the number of US Coronavirus cases and deaths, now at 219,679, which you can find here.

On Monday, October 19 at 8:30 AM EST, the IMF/World Bank virtual annual meeting starts, so we can expect Fed speakers every day. (IBM) reports earnings.

On Tuesday, October 20 at 8:30 AM EST, Housing Starts for September are announced. Netflix (NFLX) reports earnings.

On Wednesday, October 21 at 10:30 AM EST, the EIA Cushing Crude Oil Stocks are out. At 2:00 PM EST, the Fed Beige Book is published, a transcript of the Federal Open Market Committee meeting from six weeks ago. Tesla (TSLA) reports earnings.

change.

On Thursday, October 22 at 8:30 AM EST, the Weekly Jobless Claims are announced. At 10:00 AM EST Existing Home Sales for September are out. AT&T (T) reports.

On Friday, October 23, at 2:00 PM, we learn the Baker-Hughes Rig Count. American Express (AXP) reports earnings.

As for me, I saw a curious thing driving back from Lake Tahoe this weekend. Usually, I see a never-ending parade of out of state license plates moving to the Golden State.

This time, I saw telephone poles coming in by the truckloads, hundreds of them. These are to replace the many burned down in the horrific wildfires that incinerated an area the size of Connecticut. Apparently, California has run out of telephone poles.

Is there a public stock for a company that sells telephone poles?

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader