When asked how he felt when visiting the Federal Reserve at the height of the financial crisis, Goldman Sachs CEO Lloyd Blankfein responded, "I'm getting out of a Mercedes to go to the Federal Reserve, not getting out of a Higgins Boat going to Omaha Beach."

To minimize risk to our staff while continuing to provide an excellent service to our customers, the Mad Hedge Fund Trader is going completely virtual. Of course, the fact that we are already a global virtual company makes this really easy.

All work will be done from home. Everyone has to lay in a two-month stockpile of food. If you have to leave the house, you must wear a 3M N-95 Respirator Mask (click here for the link). Make sure your Netflix account is paid up. Stay on good terms with your family. You are about to get to know them really well.

My bet is that most US companies will adopt the same policies in the coming weeks. The major Bay Area technology companies already have. The Internet was built to cope with a nuclear war. We got a biological one instead.

As long as the Internet and our key applications keep working, we should have no problem delivering our investment and trading advice several times a day as usual. Now, you have more time to read it. We have just suffered the most rapid bear market in market history with only modest trading losses. Making money from here should be like shooting fish in a barrel.

Again, thank you for supporting my research. Let’s make 2020 our best year ever!

Good Luck and Good Trading. And stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

March 13, 2020

Fiat Lux

Featured Trade:

(MARCH 11 BIWEEKLY STRATEGY WEBINAR Q&A),

(INDU), (SPX), (LVMH), (CCL), (WYNN), (AXP), (JPM), (MSFT), (AAPL), (NVDA)

Below please find subscribers’ Q&A for the Mad Hedge Fund Trader March 11 Global Strategy Webinar broadcast from Silicon Valley, CA with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming!

Q: What is the worst-case scenario for this bear market?

A: The average earnings loss for a recession is 13%. Last year, we earned $165 a share for the S&P 500. So, a recession would take us down to $143 a share. Multiply that by the 15.5X hundred-year average earnings multiple, where we are now, and that would take the (SPX) down to 2,200. However, if we get 100 million cases and 5 million deaths, as some scientists are predicting, we could get a 2008 repeat and a 50% crash in the (SPX) to 1,700. With the administration asleep at the switch, that is clearly a possibility. Nice knowing you all.

Q: Do you think we’re still setting up for another roaring 20s?

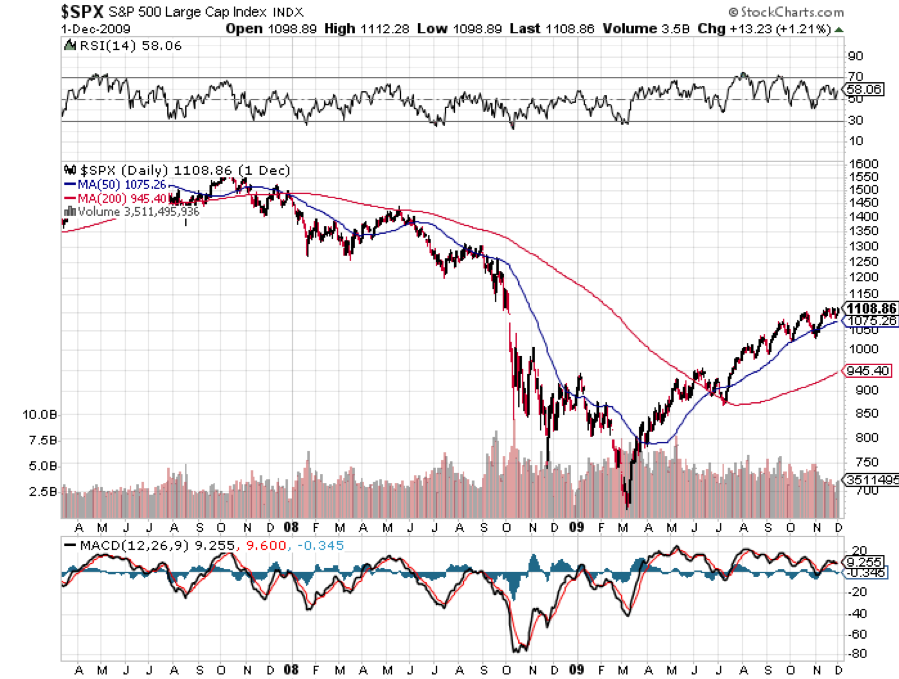

A: Yes, absolutely. We could not have a roaring 20s unless we got a major selloff and clearing out of old positions like we're getting now. That flushes out all the old capital and positions and paves the way for people to set up brand new positions at really bargain prices. If you missed the 2009 bottom, here's another chance.

Q: Will the fiscal stimulus help defeat the coronavirus?

A: No, viruses are immune to money. They don’t take PayPal or American Express (AXP). The president has been able to buy his way out of all his other problems until now; there’s no way to buy his way out of this one.

Q: Is JP Morgan’s (JPM) Jamie Dimon getting a heart attack related to the financial crisis?

A: Probably, yes. In a normal time, the pressure of a CEO in these big banks is enormous. All of a sudden half of your small customers are looking at bankruptcy—the pressure has to be immense. You've got customers screaming for short term loan facilities, you’ve got risk managers asking for margin extensions. And you certainly don't want to buy the banks here. I think this may be the final selloff with legacy banks, from which they never recover. The banks will disappear and come back online.

Q: What would you do with a $45,000-dollar portfolio right now? I don’t do options.

A: Look at my story on Ten Leaps to Buy at Market Bottom. Use those names—Microsoft (MSFT), Apple (AAPL), NVIDIA (NVDA), etc.—and just buy the stocks. Buy half now and a half in a month. This is a time to dollar cost average. And you’re looking at doubles at a minimum 3 years down the road—at the end of this year if you’re lucky. Once the virus burns out, it will only take a couple months to do that. Then it will be off to the races once again.

Q: Since the 2018 low was never tested, what do you think of 2400/2450?

A: I think that’s great. And you can get a half dozen different analyses that all come up with numbers around 2400, 2500, 2600. That’s where the final low will be—where you get a convergence of multiple support lines and opinions.

Q: Will buybacks come back or are they over for now?

A: They will come back once markets bottom. Companies aren’t stupid; they don’t like buying their own stocks at all-time highs, but they certainly will come in with major amounts of buying when they see their stocks down 20% or 30%. That's certainly what Apple is going to do.

Q: Will luxury retail shares get killed in the current market?

A: Yes, especially stocks like (LVMH), the old Louis Vuitton Moet Hennessey. They’re already down 37% this year. When it becomes clear that we are in an actual recession, these luxury names across the board will get completely abandoned. By the way, I worked with the son of the founder of this company when I was at Morgan Stanley. We called him “Bubbles.”

Q: Are there any similarities to 2008?

A: Yes; it’s worse because the market is dropping much faster than it ever has before. The 52% selloff in 2008 was spread out over the course of 18 months. Here, it’s taken only 14 trading days to see half of the damage done back then. It’s truly unbelievable.

Q: What do you think about gold (GLD)?

A: Even though gold is going up, gold miners (GDX) are doing terribly because they are stocks. They get tarred with the same brush blackening all other stocks. This is exactly what happened during the 2008-2009 crash. Fundamentals go out the window in these kinds of trading conditions, but they always come back.

Q: Is Europe in recession?

A: Absolutely, yes. I saw an interview with the Adidas CEO (ADDYY) this morning on TV and they said sales are off 90% on a month-on-month basis. Their stock is down 49% this year. You can bet that every other consumer company in Europe is suffering similar declines.

Q: What will real estate do in the next 3 months?

A: It's impossible to price real estate so finely because it's so illiquid. However, I expect it to hold up here because of super low interest rates, and then keep rising over the long term. We’re not going to get anything like the crashes we saw in 2008-2009 because all the excess leverage is not in the real estate market now, it’s in the stock market, where we are getting a much-deserved crash. If anything, I’d be buying rental properties here in low cost cities.

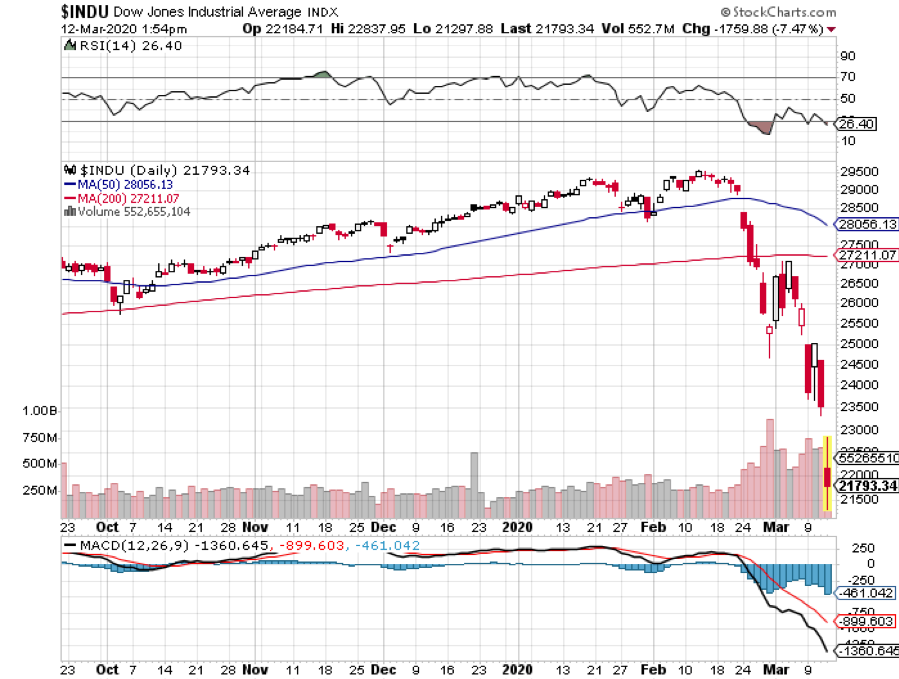

Q: What if the Dow Average (INDU) reaches the 300-day moving average?

A: It’s a nice theory, but technicals are meaningless in the face of panic selling. You don't want to get too fancy looking at these charts. When you have a billion shares to go at market, the 200 or 300 day moving average means nothing.

Good Luck and Good Trading. And stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

March 12, 2020

Fiat Lux

Featured Trade:

(SHORT SELLING SCHOOL 101)

(SH), (SDS), (PSQ), (DOG), (RWM), (SPXU), (AAPL),

(VIX), (VXX), (IPO), (MTUM), (SPHB), (HDGE)

Global Market Comments

March 11, 2020

Fiat Lux

Featured Trade:

(A NOTE ON ASSIGNED OPTIONS, OR OPTIONS CALLED AWAY),

(AAPL), (BA), (UAL), (CCL), (WYNN), (FB)

I almost got to take a shower today.

However, whenever I got close to the bathroom, I'd get an urgent call from a concierge member, Marine buddy, Morgan Stanley retiree, fraternity brother from 50 years ago, or one of my kids asking me which stocks to buy at the bottom.

It’s been that kind of market.

I refer them to the research piece I sent out last week, “Ten Long Term LEAPs to Buy at the Bottom” for a quick and dirty way to get into the best names in a hurry (click here for the link).

I have been doing the same, and as a result, I have one of the largest trading portfolios in recent memory. When the Volatility Index is above $50, it is almost impossible to lose money as long as you remember to buy the 1,000 dips and sell the 1,000 point rallies.

In the run-up to every options expiration, which is the third Friday of every month, there is a possibility that any short options positions you have may get assigned or called away.

If that happens, there is only one thing to do: fall down on your knees and thank your lucky stars. You have just made the maximum possible profit for your position instantly.

Most of you have short option positions, although you may not realize it. For when you buy an in-the-money vertical option spread, it contains two elements: a long option and a short option.

The short options can get “assigned,” or “called away” at any time, as it is owned by a third party, the one you initially sold the put option to when you initiated the position. Whenever you have sold short an option, you run an assignment risk.

You have to be careful here because the inexperienced can blow their newfound windfall if they take the wrong action, so here’s how to handle it correctly.

Let’s say you get an email from your broker saying that your call options have been assigned away. I’ll use the example of the Microsoft (MSFT) December 2019 $134-$137 in-the-money vertical BULL CALL spread.

For what the broker had done in effect is allow you to get out of your call spread position at the maximum profit point 8 days before the December 20 expiration date. In other words, what you bought for $4.50 last week is now with $5.00!

All have to do is call your broker and instruct them to exercise your long position in your (MSFT) December 134 calls to close out your short position in the (MSFT) December $137 calls.

This is a perfectly hedged position, with both options having the same expiration date, the same amount of contracts in the same stock, so there is no risk. The name, number of shares, and number of contracts are all identical, so you have no exposure at all.

Calls are a right to buy shares at a fixed price before a fixed date, and one options contract is exercisable into 100 shares.

To say it another way, you bought the (MSFT) at $134 and sold it at $137, paid $2.60 for the right to do so, so your profit is 40 cents, or ($0.40 X 100 shares X 38 contracts) = $1,520. Not bad for an 18-day limited risk play.

Sounds like a good trade to me.

Weird stuff like this happens in the run-up to options expirations like we have coming.

A call owner may need to buy a long (MSFT) position after the close, and exercising his long December $134 call is the only way to execute it.

Adequate shares may not be available in the market, or maybe a limit order didn’t get done by the market close.

There are thousands of algorithms out there which may arrive at some twisted logic that the puts need to be exercised.

Many require a rebalancing of hedges at the close every day which can be achieved through option exercises.

And yes, options even get exercised by accident. There are still a few humans left in this market to blow it by writing shoddy algorithms.

And here’s another possible outcome in this process.

Your broker will call you to notify you of an option called away, and then give you the wrong advice on what to do about it. They’ll tell you to take delivery of your long stock and then most additional margin to cover the risk.

Either that, or you can just sell your shares on the following Monday and take on a ton of risk over the weekend. This generates a ton of commission for the brokers but impoverishes you.

There may not even be and evil motive behind the bad advice. Brokers are not investing a lot in training staff these days. It doesn’t pay. In fact, I think I’m the last one they really did train.

Avarice could have been an explanation here but I think stupidity and poor training and low wages are much more likely.

Brokers have so many legal ways to steal money that they don’t need to resort to the illegal kind.

This exercise process is now fully automated at most brokers but it never hurts to follow up with a phone call if you get an exercise notice. Mistakes do happen.

Some may also send you a link to a video of what to do about all this.

If any of you are the slightest bit worried or confused by all of this, come out of your position RIGHT NOW at a small profit! You should never be worried or confused about any position tying up YOUR money.

Professionals do these things all day long and exercises become second nature, just another cost of doing business.

If you do this long enough, eventually you get hit. I bet you don’t.

Calling All Options

“At some point, all the money that has been parked in bonds and money market funds over the last five years will go into equities,” said Julian Emanuel of investment bank BTIG.

Global Market Comments

March 10, 2020

Fiat Lux

Featured Trade:

(RISK CONTROL FOR DUMMIES IN TODAY’S MARKET),

(SPY), (VIX), (VXX), (AAPL), (CCL), (UAL), (WYNN)

Today, we saw the largest point loss in market history, the first use of modern circuit breakers, and individual stocks down up to 40%. Ten-year US Treasury bond yields cratered to 0.39%. Virtually the entire energy and banking sectors vaporized.

What did I do? I did what I always do during major stock market crashes.

I took my Tesla out to get detailed. When I got home, I washed the dishes and did some laundry. And for good measure, I mowed the lawn, even though it is early March and it didn’t need it.

That’s because I was totally relaxed about how my portfolio would perform.

There is a method to my madness, although I understand that some new subscribers may need some convincing.

I always run hedged portfolio, with hedges within hedges within hedges, although many of you may not realize it. I run long calls and puts against short calls and puts, balance off “RISK ON” positions with “RISK OFF” ones, and always keep a sharp eye on multi-asset class exposures, options implied volatilities, and my own Mad Hedge Market Timing Index.

While all of this costs me some profits in rising markets, it provides a ton of protection in falling ones, especially the kind we are seeing now. So, while many hedge funds are blowing up and newsletters wiping out their readers, I am so relaxed that I could fall asleep at any minute.

Whenever I change my positions, the market makes a major move or reaches a key crossroads, I look to stress test my portfolio by inflicting various extreme scenarios upon it and analyzing the outcome.

This is second nature for most hedge fund managers. In fact, the larger ones will use top of the line mainframes powered by $100 million worth of in-house custom programming to produce a real-time snapshot of their thousands of positions in all imaginable scenarios at all times.

If you want to invest with these guys feel free to do so. They require a $10-$25 million initial slug of capital, a one-year lock-up, charge a fixed management fee of 2% and a performance bonus of 20% or more.

You have to show minimum liquid assets of $2 million and sign 50 pages of disclosure documents. If you have ever sued a previous manager, forget it. The door slams shut. And, oh yes, the best performing funds are closed and have a ten-year waiting list to get in. Unless you are a major pension fund, they don’t want to hear from you.

Individual investors are not so sophisticated, and it clearly shows in their performance, which usually mirrors the indexes less a large haircut. So, I am going to let you in on my own, vastly simplified, dumbed-down, seat of the pants, down and dirty style of risk management, scenario analysis, and stress testing that replicates 95% of the results of my vastly more expensive competitors.

There is no management fee, performance bonus, disclosure document, lock up, or upfront cash requirement. There’s just my token $3,000 a year subscription fee and that’s it. And I’m not choosy. I’ll take anyone whose credit card doesn’t get declined.

To make this even easier, you can perform your own analysis in the excel spreadsheet I post every day in the paid-up members section of Global Trading Dispatch. You can just download it and play around with it whenever you want, constructing your own best-case and worst-case scenarios. To make this easy, I have posted this spreadsheet on my website for you to download by clicking here. You have to be logged in to access and download the spreadsheet.

Since this is a “for dummies” explanation, I’ll keep this as simple as possible. No offense, we all started out as dummies, even me.

I’ll take Mad Hedge Model Trading Portfolio at the close of March 9, 2020, the date of a horrific 2,000 down day in the Dow Average. This was the day when margin clerks were running rampant, brokers were jumping out of windows, and talking heads were predicting the end of the world.

I projected my portfolio returns in three possible scenarios: (1) The market collapses an additional 5.3% by the March 20 option expiration, some 8 trading days away, (2) the S&P 500 (SPX) rises 10% by March 20, and (3) the S&P 500 trades in a narrow range and remains around the then-current level of $2,746.

Scenario 1 – The S&P 500 Falls Another 5.3% to the 2018 Low

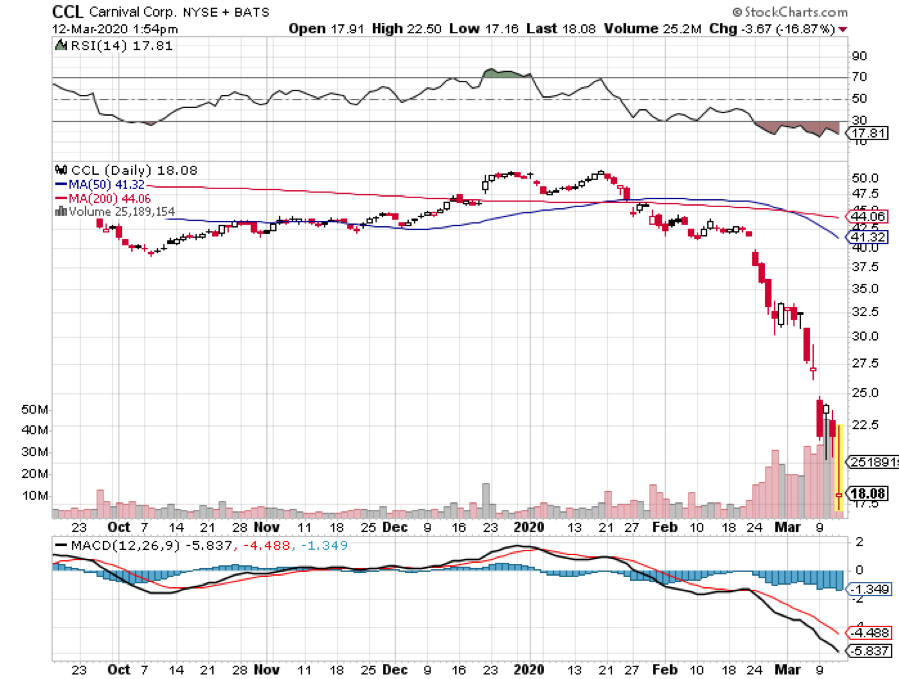

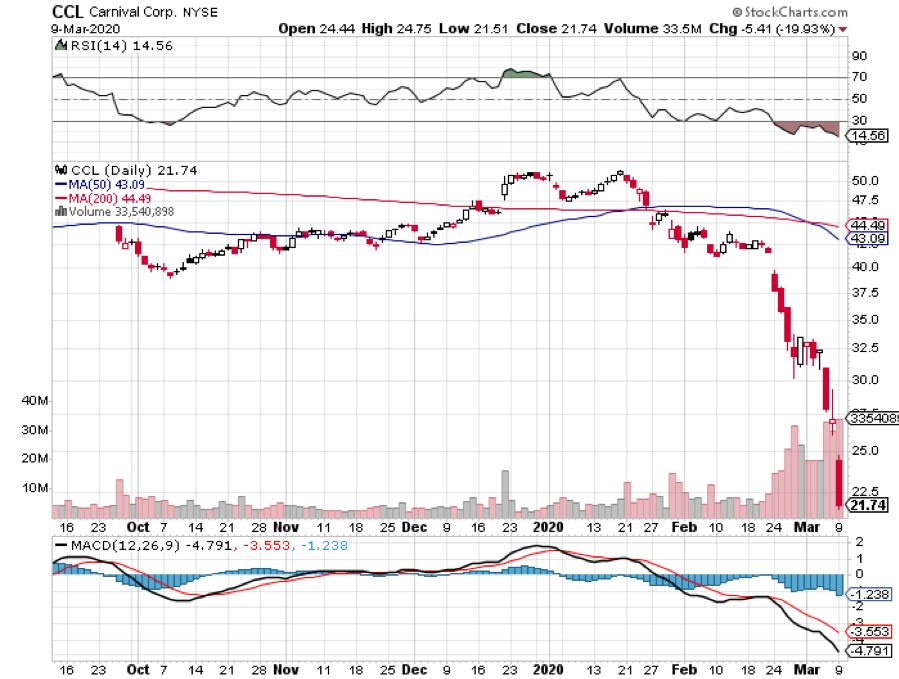

A 5.3% loss would take the (SPX) down to $2,600, to the 2018 low, and off an astonishing 800 points, or 23.5% down from the recent peak in a mere three weeks. In that situation the Volatility Index (VIX) would rise maybe to $60, the (VXX) would add another point, but all of our four short positions (AAPL), (UAL), (CCL), and (WYNN) would expire at maximum profit points.

In that case, March will end up down -3.58%, and my 2020 year-to-date performance would decline to -6.60%, a pittance really compared to a 23.5% plunge in the Dow Average. Most people would take that all day long. We live to buy another day. Better yet, we live to buy long term LEAPs at a three-year market low with my Mad Hedge Market Timing Index at only 3, a historic low.

Also, when the market eventually settles down, volatility will collapse, and the value of my (VXX) positions double.

Scenario 2 – S&P 500 rises 10%

The impact of a 10% rise in the market is easy to calculate. All my short positions expire at their maximum profit point because they are all so far in the money, some 20%-40%. It would be a monster home run. I would go back in the green on the (VXX) because of time decay. That would recover my March performance to +1.50% and my year-to-date to only -1.42%

Scenario 3 – S&P 500 Remains Unchanged

Again, we do great, given the circumstances. All the shorts expire at max profits and we see a smaller increase in the value of the (VXX). I’ll take that all day long, even though it cost me money. When running hedge funds, you are judged on how you manage your losses, not your gains, which are easy.

Keep in mind that these are only estimates, not guarantees, nor are they set in stone. Future levels of securities, like index ETFs, are easy to estimate. For other positions, it is more of an educated guess. This analysis is only as good as its assumptions. As we used to say in the computer world, garbage in equals garbage out.

Professionals who may want to take this out a few iterations can make further assumptions about market volatility, options implied volatility or the future course of interest rates. And let’s face it, politics is a major influence this year. Thanks Joe Biden for that one day 1,000 point rally to sell into, when I established most of my shorts and dumped a few longs.

Keep the number of positions small to keep your workload under control. Imagine being Goldman Sachs and doing this for several thousand positions a day across all asset classes.

Once you get the hang of this, you can start projecting the effect on your portfolio of all kinds of outlying events. What if a major world leader is assassinated? Piece of cake. How about another 9/11? No problem. Oil at $10 a barrel? That’s a gimme.

What if there is an American attack on Iranian nuclear facilities to distract us from the Coronavirus and stock market carnage? That might take you all two minutes to figure out. The Federal Reserve launches a surprise QE5 out of the blue? I think you already know the answer.

Now that you know how to make money in the options market, thanks to my Trade Alert service, I am going to teach you how to hang on to it.

There is no point in being clever and executing profitable trades only to lose your profits through some simple, careless mistakes.

The first goal of risk control is to preserve whatever capital you have. I tell people that I am too old to lose all my money and start over again as a junior trader at Morgan Stanley. Therefore, I am pretty careful when it comes to risk control.

The other goal of risk control is the art of managing your portfolio to make sure it is profitable no matter what happens in the marketplace. Ideally, you want to be a winner whether the market moves up, down, or sideways. I do this on a regular basis.

Remember, we are not trying to beat an index here. Our goal is to make absolute returns, or real dollars, at all times, no matter what the market does. You can’t eat relative performance, nor can you use it to pay your bills.

So the second goal of every portfolio manager is to make it bomb-proof. You never know when a flock of black swans is going to come out of nowhere or another geopolitical shock occurs causing the market crash.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.