Followers of the Mad Hedge Technology Letter have the good fortune to own three deep in-the-money options position that expires on Friday, August 16, and I just want to explain to the newbies how to best maximize their profits.

This involves the:

the Salesforce (CRM) August 2019 $125-$130 in-the-money vertical BULL CALL spread at $4.50 which will expire at $5.00

the Macy's (M) August 2019 $23-$25 in-the-money vertical BEAR PUT spread at $1.74 which will expire at $2.00

the Facebook (FB) August 2019 $167.50-$172.50 in-the-money vertical BULL CALL spread at $4.50 which will expire at $5.00

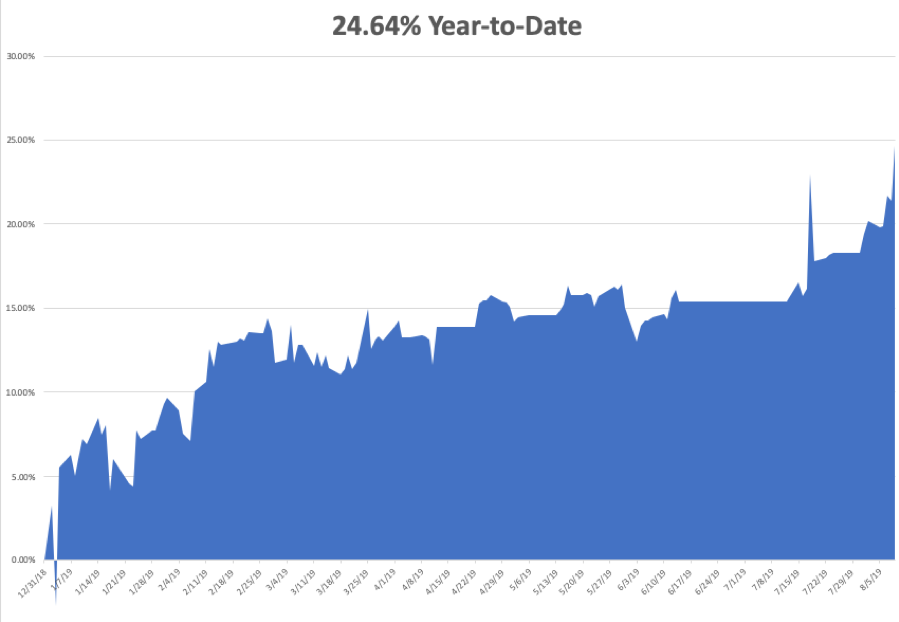

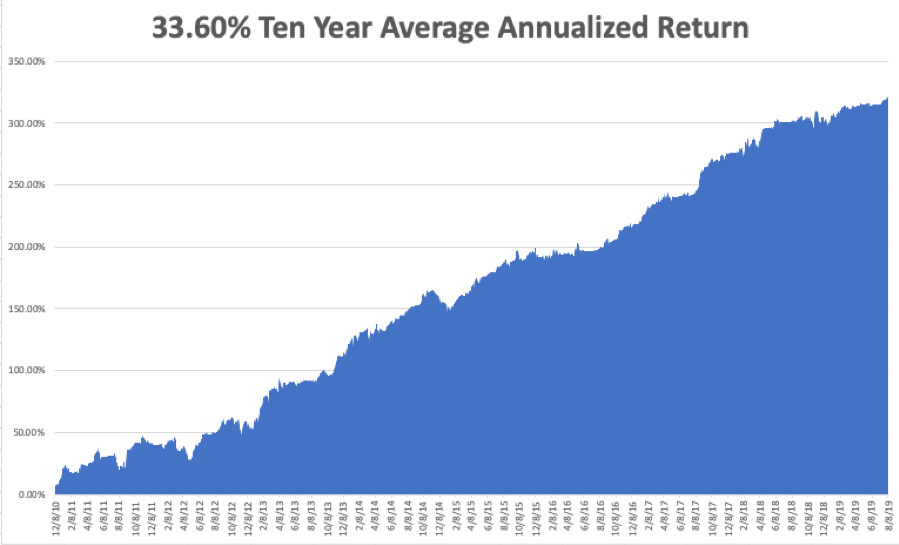

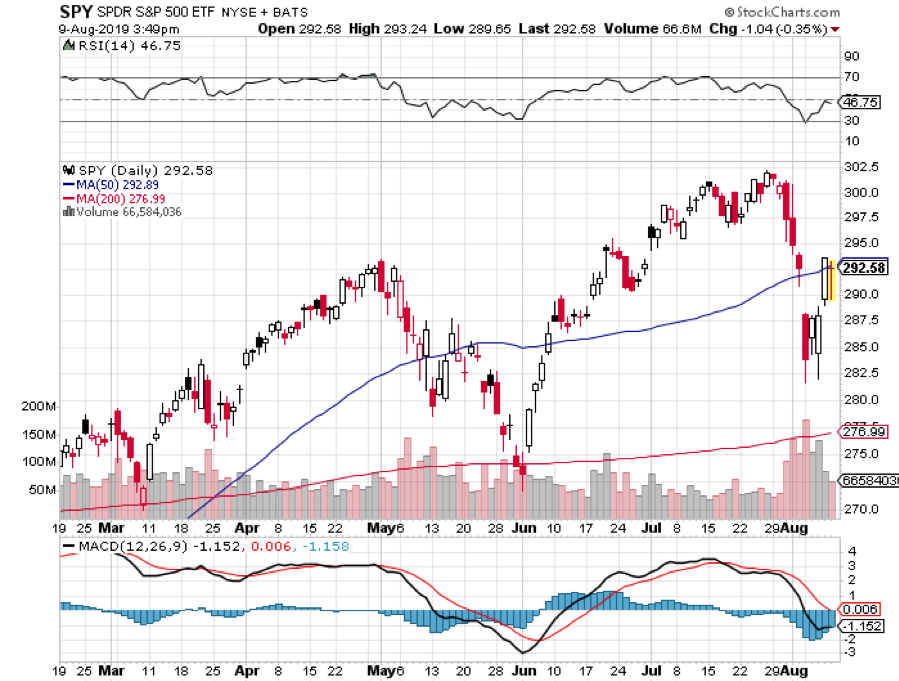

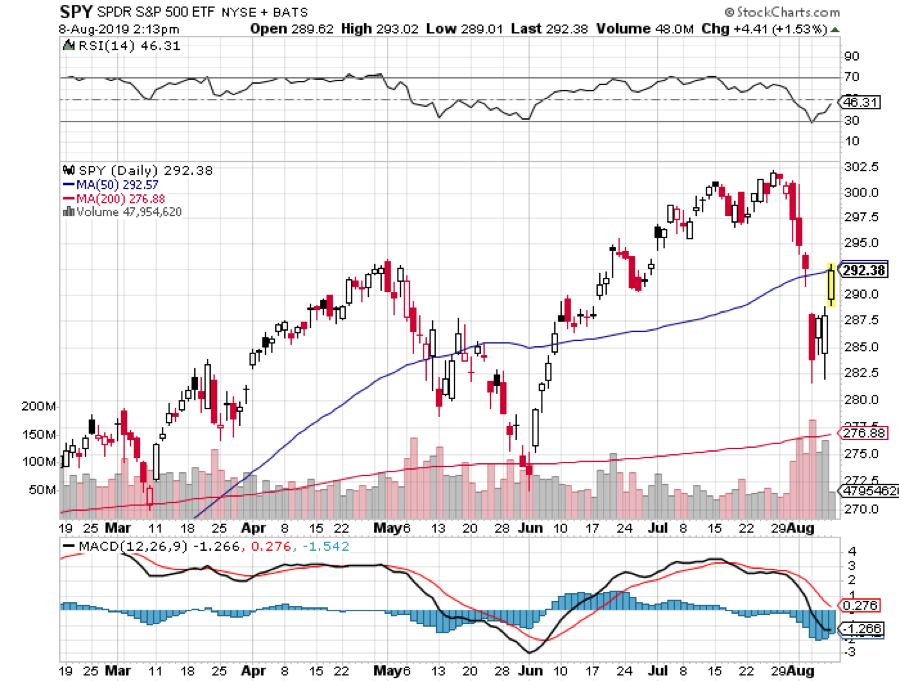

The total profit on all three positions will increase the value of our $100,000 model trading portfolio by 3.68%, or $3,680. This position only became possible due to the extreme volatility (VIX) seen in the market in recent weeks.

Provided that we don’t have a monster “RISK OFF” move in the market this week (more failure of the China trade talks? War with Iran? A massacre in Hong Kong?) which causes stocks to collapse and volatility to rocket, these positions should expire at its maximum profit points. So far, so good.

I’ll do the math for you on the Salesforce (CRM) position. Your profit can be calculated as follows:

Profit: $5.00 expiration value - $4.50 cost = $0.50 net profit

(22 contracts X 100 shares per option X $0.50 net profit)

= $1,100 or 11.11% in 7 trading days.

One of the reasons that I run these positions into expiration is that with volatility high, and therefore the implied volatility on the options, we get paid much more to run these into expiration than we have in the past.

Many of you have already emailed me asking what to do with these winning positions.

The answer is very simple. You take your left hand, grab your right wrist, pull it behind your neck, and pat yourself on the back for a job well done.

You don’t have to do anything.

Your broker (are they still called that?) will automatically use your long position to cover your short position, canceling out the total holdings.

The entire profit will be credited to your account on Monday morning August 19 and the margin freed up.

Some firms charge you a modest $10 or $15 fee for performing this service.

If you don’t see the cash show up in your account on Monday, get on the blower immediately and find it.

Although the expiration process is now supposed to be fully automated, mistakes occasionally do occur. Better to sort out any confusion before losses ensue.

If you want to wimp out and close the position before the expiration, it may be expensive to do so. You can probably unload them pennies below their maximum expiration value.

Keep in mind that the liquidity in the options market disappears, and the spreads substantially widen when a security has only hours or minutes until expiration on Friday. So, if you plan to exit, do so well before the final expiration at the Friday market close.

This is known in the trade as the “expiration risk.”

One way or the other, I’m sure you’ll do OK as long as I am looking over your shoulder, as I will be, always. Think of me as your trading guardian angel.

I am going to hang back and wait for good entry points before jumping back in. It’s all about keeping that “Buy low, sell high” thing going.

I’m looking to cherry-pick my new positions going into the next quarter end.

Take your winnings and go out and buy yourself a well-earned dinner. Or use it to put a down payment on a long cruise.

Well done, and on to the next trade.