Global Market Comments

June 17, 2019

Fiat Lux

Featured Trade:

(THE MARKET OUTLOOK FOR THE WEEK AHEAD, or THE SCARY THING ABOUT THE MARKETS)

(SPY), (TLT), (GLD), (TSLA)

Global Market Comments

June 17, 2019

Fiat Lux

Featured Trade:

(THE MARKET OUTLOOK FOR THE WEEK AHEAD, or THE SCARY THING ABOUT THE MARKETS)

(SPY), (TLT), (GLD), (TSLA)

There’s one big scary thing about the markets right now. As I mentioned last week, the major indexes are sitting on a precipice of a right shoulder of a ‘Head and Shoulders” top.

Traders are expecting a trade war settlement and a Fed interest rate cut in July. While the economy in no way needs a rate cut, stock markets desperately do. In fact, they need another dose of steroids just to remain level. It reminds me of a certain recent California governor (I’ll be back).

If we get them, markets will grind up a few percentage points to a new all-time high. If we don’t, the top is in, possibly for this entire economic cycle, and a 25% swan dive is in the cards.

It's what traders call “Asymmetric risk.” If we get the bull case, you make sofa change. If we don’t, you lose dollars. It’s what I call picking up pennies in front of a steamroller. But in the 11th year of a bull market, that’s all you get. The truly disturbing part of this is that this setup is happening with valuation close to a historic high at a 17.5X price earnings multiple.

We’ll get a better read on Wednesday at 2:00 PM EST when the Fed announces its decision on interest rates. The post meeting statement will be more crucial than usual. What’s in a word, Shakespeare might have asked? If the Fed drops the word “Patient”, then a July interest rate cut is a sure thing. The algos reading the release at the speed of light will be the first to know.

It was initially off to the races last Monday when the one-week trade war with Mexico came to an end and some immigration issues were settled.

The tariffs are off, even though the Mexicans say the terms were already agreed to months ago.

There is no big ag buy either. The economy is still sliding into a recession, and the bond market has already discounted three of the next five quarter point rate cuts.

US exports are in free fall, with Long Beach, America’s busiest port, seeing seven straight months of declines in shipping volumes. They were off 19.5% in May alone. Recession indicator no. 199.

Buy bonds (TLT), gold (GLD), and short the US dollar (UUP), says my old friend, hedge fund legend Paul Tudor Jones. He is certainly reading the writing on the wall. The legendary trading billionaire believes that plunging interest rate cuts are going to dominate the scenery for the rest of 2019.

Tanker attacks sent oil soaring. After 50 years of waiting, it finally happened, torpedo attacks against two tankers in the Straits of Hormuz bound for China. Oil rocketed 4%, then gave up the rally, and stocks are amazingly up on the day.

Go figure. A decade ago, this would have been a down 1,000-point day for stocks and Texas tea would have soared to $100. Clearly, tensions in the Middle East are ratcheting up, but with the US now the swing oil producer, why bother?

With US oil production climbing to 17 million barrels a day by 2024, up from 5 million b/d in 2005, the Middle East can blow itself up and nobody cares. The US by then will have created an entire Saudi Arabia’s worth of new oil production over a 20-year period. US troops there are defending China’s oil supply, not ours.

The US budget deficit soared by 38.7% YOY, to $739 billion. It’s the fastest growth in government borrowing since WWII. Much of today’s economic growth in on credit and this can only end in tears. Enjoy the good times while they last.

Major semiconductor maker Broadcom (AVGO) disappointed hugely on earnings, tanking the market, and the stock plunged a heartbreaking 12%. The trade war gets the entire blame. It turns out that Broadcom’s biggest customer is the ill-fated Huawei whose CFO is now sitting in a Canadian jail awaiting extradition to the US. Other semiconductor stocks especially got slammed. The canary in the coal mine just died.

China’s industrial production hit a 17 year low, and yes, it’s because of the trade war, trade war, trade war. When your biggest customers come down with the Asian flu, you at the very least catch a severe cold. Start shopping for Robitussin.

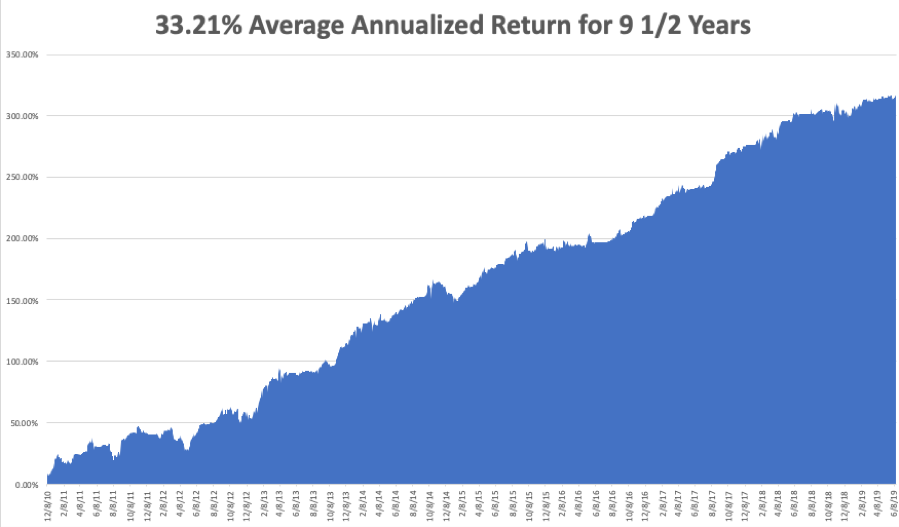

Global Trading Dispatch closed the week up 15.38% year-to-date and is down by -0.34% so far in June. That’s show business. You work your guts out trying to understand this market and it turns out to be for free. Or worse yet, you get a bill without an amount due. This is something that regular salary earners don’t understand.

My nine and a half year profit appreciated to +315.52%, pennies short of a new all-time high. I think I’ll be flatlining at a high for a while to create a base from which I can jump to new highs. The average annualized return ticked up to +33.21%. With the trade war with China raging, I am now 100% in cash with Global Trading Dispatch and 100% cash in the Mad Hedge Tech Letter.

My twin bets on Tesla (TSLA) worked out very nicely and I took profits on both. It was an option play whereby I expected that (TSLA) shares would not fall below $150 or rise above $240 by the June 21 option expiration.

Several followers have seen good success using every Tesla dip below $200 to go naked short August $100 or $125 Tesla puts in small quantities for a decent amount of change.

The long view here is to wait for some kind of summer meltdown and then go long into a year-end rally as 2020 election-related turbochargers start to hit the market.

The coming week will be all about waiting for the Fed to jump. We also get some important updates on housing data.

On Monday, June 17 at 8:30 AM EST the Empire State Manufacturing Index is out.

On Tuesday, June 18, 8:30 AM EST, the May Housing Starts are released.

On Wednesday, June 19 at 2:00 PM EST, the Federal Reserve decision on interest rates is announced. Vital is whether the word “Patient” remains in their statement.

On Thursday, June 20 at 8:30 AM, the Weekly Jobless Claims are printed. We also get the Philadelphia Fed Manufacturing Index.

On Friday, June 21 at 10:00 AM, we learn May Existing Home Sales. The Baker Hughes Rig Count follows at 2:00 PM.

As for me, by the time you read this, I will be winging my way somewhere over the Pacific Ocean. It’s a 14-hour flight from California to New Zealand, and the plane carries two crews.

It’s a genuine four movie flight. I’ll take off on Sunday and don’t arrive until Tuesday because I’ll be crossing the International Dateline. When I arrive, I’ll feel like death warmed over. It’s all in the name of research and finding that next great trading idea.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

June 14, 2019

Fiat Lux

Featured Trade:

(WEDNESDAY JUNE 26 BRISBANE, AUSTRALIA STRATEGY LUNCHEON)

(MAY 29 BIWEEKLY STRATEGY WEBINAR Q&A),

(TSLA), (BYND), (AMZN), (GOOG), (AAPL), (CRM), (UT), (RTN), (DIS), (TLT), (HAL), (BABA), (BIDU), (SLV), (EEM)

Come join me for lunch at the Mad Hedge Fund Trader’s Global Strategy Luncheon which I will be conducting in Brisbane, Australia on Wednesday, June 26, 2019 at 1:15 PM.

An excellent meal will be followed by a wide-ranging discussion and a question-and-answer period. I’ll be giving you my up to date view on stocks, bonds, currencies, commodities, precious metals, energy, and real estate.

I also hope to provide some insight into America’s opaque and confusing political system. And to keep you in suspense, I’ll be throwing a few surprises out there too.

Tickets are available for $234.

The lunch will be held at an exclusive hotel in downtown Brisbane, the location of which will be emailed with your purchase confirmation.

I look forward to meeting you and thank you for supporting my research. To purchase tickets for this luncheon, please click here.

Below please find subscribers’ Q&A for the Mad Hedge Fund Trader June 12 Global Strategy Webinar with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming!

Q: Do you think Tesla (TSLA) will survive?

A: Not only do I think it will survive, but it’ll go up 10 times from the current level. That’s why we urged people to buy the stock at $180. Tesla is so far ahead of the competition, it is incredible. They will sell 400,000 cars this year. The number two electric car competitor will sell only 25,000. They have a ten-year head start in the technology and they are increasing that lead every day. Battery costs will drop another 90% over the next decade eventually making these cars incredibly cheap. Increase sales by ten times and double profit margins and eventually, you get to a $1 trillion company.

Q: Beyond Meat (BYND)—the veggie burger stock—just crashed 25% after JP Morgan downgraded the stock. Are you a buyer here?

A: Absolutely not; veggie burgers are not my area of expertise. Although there will be a large long-term market here potentially worth $140 billion, short term, the profits in no way justify the current stock price which exists only for lack of anything else going on in the market. You don’t get rich buying stocks at 37 times company sales.

Q: Are you worried about antitrust fears destroying the Tech stocks?

A: No, it really comes down to a choice: would you rather American or Chinese companies dominate technology? If we break up all our big tech companies, the only large ones left will be Chinese. It’s in the national interest to keep these companies going. If you did break up any of the FANGS, you’d be creating a ton of value. Amazon (AMZN) is probably worth double if it were broken up into four different pieces. Amazon Web Services alone, their cloud business, will probably be worth $1 trillion as a stand-alone company in five years. The same is true with Apple (AAPL) or Google (GOOG). So, that’s not a big threat overhanging the market.

Q: Is it time to buy Salesforce (CRM)?

A: Yes, you want to be picking up any cloud company you can on any kind of sizeable selloff, and although this isn’t a sizeable selloff, Salesforce is the dominant player in cloud plays; you just want to keep buying this all day long. We get back into it every chance we can.

Q: Do you think the proposed merger of United Technologies (UT) and Raytheon (RTN) will lower the business quality of United Tech’s aerospace business?

A: No, these are almost perfectly complementary companies. One is strong in aerospace while the other is weak, and vice versa with defense. You mesh the two together, you get big economies of scale. The resulting layoffs from the merger will show an increase in overall profitability.

Q: I had the Disney (DIS) shares put to me at $114 a share; would you buy these?

A: Disney stock is going to go up ahead of the summer blockbuster season, so the puts are going to expire being worthless. Sell the puts you have and then go short even more to make back your money. Go naked short a small non-leveraged amount Disney $114 puts, and that should bring in a nice return in an otherwise dead market. Make sure you wait for another selloff in the market to do that.

Q: What role does global warming play in your bullish hypothesis for the 2020s?

A: If people start to actually address global warming, it will be hugely positive for the global economy. It would demand the creation of a plethora of industries around the world, such as solar and other alternative energy industries. When I originally made my “Golden Age” forecast years ago, it was based on the demographics, not global warming; but now that you mention it, any kind of increase in government spending is positive for the global economy, even if it’s borrowed. Spending to avert global warming could be the turbocharger.

Q: Why not go long in the United States Treasury Bond Fund (TLT) into the Fed interest rate cuts?

A: I would, but only on a larger pullback. The problem is that at a 2.06% ten-year Treasury yield, three of the next five quarter-point cuts are already priced into the market. Ideally, if you can get down to $126 in the (TLT), that would be a sweet spot. I have a feeling we’re not going to pull back that far—if you can pull back five points from the recent high at $133, that would be a good point at which to be long in the (TLT).

Q: Extreme weather is driving energy demand to its highest peak since 2010...is there a play here in some energy companies that I’m missing?

A: No, if we’re going into recession and there’s a global supply glut of oil, you don’t want to be anywhere near the energy space whatsoever; and the charts we just went through—Halliburton (HAL) and so on—amply demonstrate that fact. The only play here in oil is on the short side. When US production is in the process of ramping up from 5 million (2005) to $12.3 million (now), to 17 million barrels a day (by 2024) you don’t want to have any exposure to the price of oil whatsoever.

Q: What about China’s FANGS—Alibaba (BABA) and Baidu (BIDU). What do you think of them?

A: I wanted to start buying these on extreme selloff days in anticipation of a trade deal that happens sometime next year. You actually did get rallies without a deal in these things showing that they have finally bottomed down. So yes, I want to be a player in the Chinese FANGS in expectation of a trade deal in the future sometime, but not soon.

Q: Silver (SLV) seems weaker than gold. What’s your view on this?

A: Silver is always the high beta play. It usually moves 1.5-2.5 times faster than gold, so not only do you get bigger rallies in silver, you get bigger selloffs also. The industrial case for silver basically disappeared when we went to digital cameras twenty years ago.

Q: Does this extended trade war mean the end for emerging markets (EEM)?

A: Yes, for the time being. Emerging markets are one of the biggest victims of trade wars. They are more dependent on trade than any of the major economies, so as long as we have a trade war that’s getting worse, we want to avoid emerging markets like the plague.

Q: We just got a huge rebound in the market out of dovish Fed comments. Is this delivering the way for a more dovish message for the rest of the year?

A: Yes, the market is discounting five interest rate cuts through next year; so far, the Fed has delivered none of them. If they delayed that cutting strategy at all, even for a month, it could lead to a 10% selloff in the stock market very quickly and that in and of itself will bring more Fed interest rate cuts. So, it is sort of a self-fulfilling prophecy. The bottom line is that we’re looking at an ultra-low interest rate world for the foreseeable future.

Good Luck and Good Trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

June 13, 2019

Fiat Lux

Featured Trade:

(TUESDAY, JUNE 25 SYDNEY, AUSTRALIA STRATEGY LUNCHEON)

(CYBERSECURITY IS ONLY JUST GETTING STARTED),

(PANW), (HACK), (FEYE), (CSCO), (FTNT), (JNPR), (CIBR)

Come join me for lunch at the Mad Hedge Fund Trader’s Global Strategy Update, which I will be conducting in Sydney, Australia at 1:15 PM on Tuesday, June 25, 2019.

An excellent meal will be followed by a wide-ranging discussion and an extended question-and-answer period.

I’ll be giving you my up to date view on stocks, bonds, currencies, commodities, precious metals, energy, and real estate.

And to keep you in suspense, I’ll be throwing a few surprises out there too.

Tickets are available for $233.

The lunch will be held at an exclusive downtown hotel the details of which will be emailed with your purchase confirmation.

I look forward to meeting you and thank you for supporting my research.

To purchase tickets for this luncheon, please click here.

Global Market Comments

June 12, 2019

Fiat Lux

Featured Trade:

(MONDAY, JUNE 24 MELBOURNE, AUSTRALIA STRATEGY LUNCHEON)

(AMGEN’S BIG LUNG CANCER BREAKTHROUGH),

(AMGN), (GSK), (MRTX)

Come join me for lunch at the Mad Hedge Fund Trader’s Global Strategy Update which I will be conducting in Melbourne, Australia on Monday, June 24, 2019 at 1:15 PM.

An excellent meal will be followed by a wide-ranging discussion and an extended question-and-answer period.

I’ll be giving you my up to date view on stocks, bonds, currencies commodities, precious metals, energy, and real estate.

I also hope to provide some insight into America’s opaque and confusing political system. And to keep you in suspense, I’ll be throwing a few surprises out there too.

Tickets are available for $232.

I’ll be arriving at 1:00 and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at a downtown five-star hotel, the details of which will be emailed with your purchase confirmation.

I look forward to meeting you and thank you for supporting my research.

To purchase tickets for this luncheon, please click here.

I recently heard that some of my hedge fund friends were loading up on Amgen (AMGN) and now I know why. It’s a company I know well because my UCLA biochemistry professor was its first chairman.

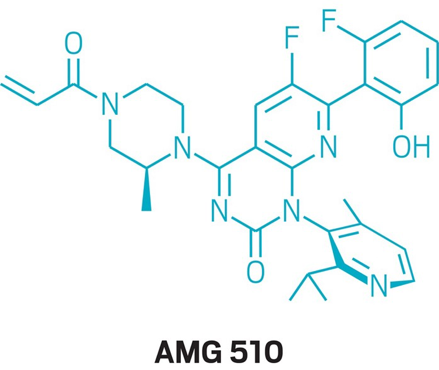

Amgen has accomplished a major medical breakthrough. The company has revealed that its experimental drug, AMG 510, exhibited the ability to significantly shrink the size of tumors by 50%. The results were obtained from early-stage trials performed on advanced lung cancer patients.

In a nutshell, AMG 510 could become the first-ever approved treatment that can target a mutated gene called KRAS which is one of the most common mutations involved in non-small cell lung cancer (NSCLC). The American Cancer Society identified NSCLC as the leading cause of cancer death, accounting for a stunning 85% of lung cancers.

For decades, researchers have been searching for ways to address KRAS mutations, with the sought-after solution dubbed as the "the great white whale of drug discovery." With the first proof-of-concept presented a mere six years ago, the rapid development of Amgen’s new drug has impressed researchers in the field.

Simply put, this drug will be a game changer for particular types of cancer. Subsequently, its success would mean massive profits for Amgen shareholders.

The announcement of AMG 510’s promising results saw a jump in Amgen shares of 6.1% delivering a new two-year high. While this product remains in its initial phase, the fact that this cancer drug addresses a vital unmet need in oncology makes it a prime candidate in becoming the next blockbuster drug for Amgen.

Aside from lung cancer, this drug is also aimed at providing treatment for colorectal cancer and nearly uncurable pancreatic cancer (of which Steve Jobs died). To date, AMG 510 sales are estimated to initially reach more than $1 billion a year and peak at $2 billion.

With the extremely massive market for this particular drug, it comes as no surprise that Amgen is not alone in the race.

So far, two more biopharma companies are looking to develop similar medications: GlaxoSmithKline Plc (GSK) and Mirati Therapeutics (MRTX). While the former has yet to reveal the covalent inhibitor drug it’s currently developing, reports indicate that Mirati’s work involves a drug called MRTX849. Aside from these, no other information has been released by the two companies.

While these are encouraging results vis-à-vis its oncology department, how is Amgen doing so far this year with the rest of its business?

Based on its earnings report in the first quarter of 2019, Amgen recorded $5.6 billion in total revenues. This matches the amount the company reported during the same quarter in 2018. Despite the promising projects in its pipeline, Amgen’s product sales saw a 1% dip globally.

However, its new products showed double-digit increases in the first quarter. Osteoporosis and hypercalcemia drug Prolia reported a 20% increase while cardiovascular medication Repatha also showed a 15% revenue jump during the first quarter. Even the revenues for relapsed multiple myeloma treatment Kyprolis showed a 10% rise in this period.

As for its earnings per share (EPS), Amgen is coming in at $12.53. This indicates an EPS growth of 14.8% this year, which could lead to a projected 5.25% EPS growth for 2020.

Meanwhile, Amgen’s positive outlook particularly with AMG 510 as an additional blockbuster drug in its portfolio prompted the company to adjust its earnings expectations for this year. In terms of its expected revenue, Amgen raised it from $21.8 billion to $22.9 billion range to $22 billion to $22.9 billion.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.