Global Market Comments

April 15, 2025

Fiat Lux

Featured Trade:

(HOW TO HANDLE THE THURSDAY, APRIL 17 OPTIONS EXPIRATION)

Followers of the Mad Hedge Fund Trader alert service have the good fortune to own FIVE in-the-money options positions that expire on Thursday, April 17, and I just want to explain to the newbies how to best maximize their profits.

These involve the:

Risk On

(COST) 4/$840-$850 call spread 10.00%

(TSLA) 4/$160/$170 put spread 10.00%

(NFLX) 4/$800-$810 call spread 10.00%

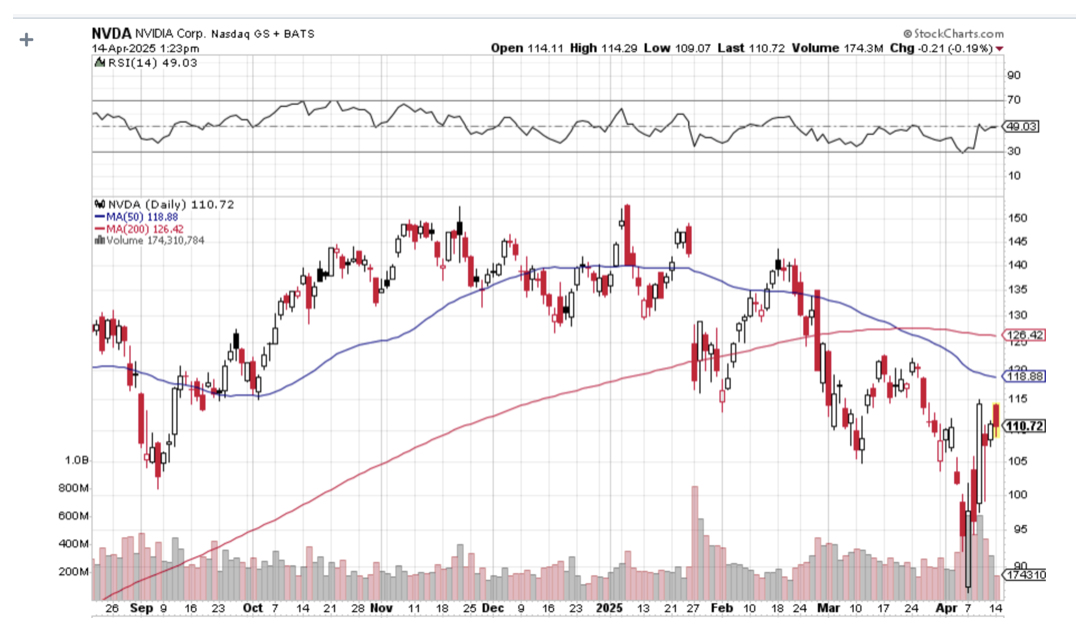

(NVDA) 4/$70-$75 call spread 10.00%

Risk Off

(MSTR) 4/$340-$350 put spread -10.00%

Provided that we don’t have a monster move in the market in three trading days, these positions should expire at their maximum profit points.

So far, so good.

I’ll take the example of the (NVDA) 4/$70-$75 call spread.

Your profit can be calculated as follows:

Profit: $5.00 expiration value - $4.50 cost = $0.50 net profit

(25 contracts X 100 contracts per option X $0.50 profit per option)

= $1,250 or 11.11% in 9 trading days.

Many of you have already emailed me asking what to do with these winning positions.

The answer is very simple. You take your left hand, grab your right wrist, pull it behind your neck, and pat yourself on the back for a job well done.

You don’t have to do anything.

Your broker (are they still called that?) will automatically use your long position to cover your short position, canceling out the total holdings.

The entire profit will be credited to your account on Monday morning, April 21, and the margin freed up.

Some firms charge you a modest $10 or $15 fee for performing this service.

If you don’t see the cash show up in your account on Monday, get on the blower immediately and find it.

Although the expiration process is now supposed to be fully automated, occasionally, machines do make mistakes. Better to sort out any confusion before losses ensue.

If you want to wimp out and close the position before the expiration, it may be expensive to do so. You can probably unload those pennies below their maximum expiration value.

Keep in mind that the liquidity in the options market understandably disappears and the spreads substantially widen when a security has only hours or minutes until expiration on Thursday. So, if you plan to exit, do so well before the final expiration at the Thursday market close.

This is known in the trade as the “expiration risk.”

One way or the other, I’m sure you’ll do OK, as long as I am looking over your shoulder, as I will always. Think of me as your trading guardian angel.

I am going to hang back and wait for good entry points before jumping back in. It’s all about keeping that “Buy low, sell high” thing going.

I’m looking to cherry-pick my new positions going into the next quarter's end.

Take your winnings and go out and buy yourself a well-earned dinner.

Well done, and on to the next trade.

You Can’t Do Enough Research

Global Market Comments

April 14, 2025

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD or REARRANGING THE DECKCHAIRS ON THE TITANIC),

(SPY), (GLD), (NFLX), (NVDA), (TLT), (MSTR), (SVXY), ($VIX)

(AMZN), (AAPL), (GOOGL), (PANW), (NFLX), (CORN), (WEAT), (SOYB)

Back in 1987, I flew my Cessna 340 twin from London to Rome to visit Morgan Stanley’s high-end Italian clients. Held over by meetings, I got a late start, and I didn’t get as far as the French Champagne country until midnight. Right then, at 20,000 feet, the gyroscope suddenly blew up with a great resounding “thwacking sound.”

I instantly lost all instruments and lights, but still had a radio. I commenced a very wide spiral dive in the pitch-black darkness. Paris control started yelling at me because I was deviating from my approved flight plan. I started to pass out from vertigo.

Then I did what all Marines and Eagle Scouts are taught to do in this situation.

I improvised.

I pulled a flashlight and canteen out of my cockpit side pocket. By steering to the water level, I was able to use it as an artificial horizon level and straighten out the plane. Then I used the Girl Scout compass I always kept around my neck and plotted a rough course to Paris. Then I got on the radio.

“Mayday, Mayday, Mayday, N3919G complete instruments failure, request emergency landing at nearest airfield.” The air went dead for 30 seconds.

Then I heard “N3919G, cleared for approach Charles de Gaulle, steer 240 degrees and change over to 118.15.” As I made my final approach, the Eiffel Tower sparkled off my starboard wingtip. I could see the entire Charles de Gaulle fire department (Sapeurs Pompiers in French), blinking their blue lights. When I hit the runway, they chased me all the way until I stopped.

Then a captain elaborately dressed in firefighting gear stepped out of his fire engine cabin and asked, “Are you alright?”

The experience reminds me of the government’s current economic policies. They are attempting to rebuild the engines of a plane while flying at 20,000 feet in the dark with no tools or instruments. Except there are 340 million passengers this time, not just one.

Will we pull out of the dive before we crash?

Back in January and February, my biggest concern about the markets was complacency. It is safe to say now that this concern has completely vanished, not just by me but everyone.

I have been looking for parallels to the current crisis, and there are few to choose from. Stocks, bonds, oil, commodities, and the US dollar are all crashing at the same time. S&P 500 multiples (SPY) have been marked down from 22X to 18X in a mere two months, and 16X or 14X beckon. The NASDAQ multiple has collapsed from 31 to 21. Small caps (IWM) were hit the hardest, falling to 2016 levels.

It was the action in the bond market that was most concerning, which was hit by massive waves of selling from both foreign investors and hedge funds facing margin calls. Liquidity has disappeared and the Treasury was ill-equipped to deal with this because DOGE just fired 10,000 of their people.

Most don’t realize that US bonds are the lifeblood of the global financial market. When they drop 10% in a week, as they just did, ripples become tidal waves. Suddenly, banks are undercapitalized, central banks and companies have to mark down reserves, and margin calls run rampant.

A national debt of $36 trillion, which was happily ignored for 25 years, instantly becomes a crisis. Is US debt headed for junk status? Will Trump impose capital controls to stem the outflows? You might call these questions fanciful or born of conspiracy theories, but I was woken up every morning last week from European banks asking exactly this. When they start asking in the debt markets, you have a problem.

All earnings reports coming out now can be torn up and thrown out the window. That’s because they reflect profits from an ancient economy in the distant past that no longer exists, like January-March 2025.

Back then, it was about a growing globalized economy spinning off ever-increasing profits and higher multiples and share prices. Now it’s about a shrinking global economy at war with itself, declining profits everywhere justifying lower multiples and share prices.

Last year, S&P 500 earnings came in at $240. Two months ago, the consensus forecast for 2025 was $270. Now it’s moving towards $230.

The average price earnings multiple is now back up to 20X. The 120-year average is 14X. American exceptionalism picked up another 8 multiple points after WWII. If we give all that back and the multiple returns to 14X that gets the (SPX) down to $3,220, or off 47.5% from the February high.

Confidence levels are collapsing at 50-year lows. We’re rearranging the deckchairs on the Titanic while we’re headed straight for a giant iceberg, and it's dark and darn cold outside. We are not getting a reversion to the mean in stock markets; we are getting a reversion far beyond the mean. Markets won’t bottom until all the worst-case scenarios out there are fully discounted.

The shock to the global financial system is of the same magnitude as when Nixon took the US off the gold standard in 1972. That’s why gold is rocketing now as then. The US dollar then lost half its value.

This is the first bear market created by government policies since 1930, back when the Smoot-Hawley Tariff Act started the last major trade war. When the current policies end, the bear market will end and not before then. We are now within days, if not hours, to the complete collapse of the global financial system. The global economic pie is rapidly shrinking, and everyone is fighting over the scraps that are left.

Trillions of dollars of capital from corporate America have been stranded abroad in the wrong countries because Trump convinced them to move there eight years ago, like Vietnam. Millions of small businesses unable to eat the tariffs or pass them on to consumers will go out of business.

With no policy changes from Washington expected any time soon, it’s likely that we will eventually exhaust selling and enter an “L” shaped bottom. That has stocks bottoming out and then moving sideways in a range for a long time. You can forget about any immediate sharp “V” type recovery that takes us back to the all-time highs we saw in February.

So you should use any rally in the stock market to sell short calls against the long equity positions you want to keep. If you want to be more proactive than that, I have some clever ideas for you.

We now know that Trump is willing to resort to gaming the market by talking it up whenever the S&P 500 hits 5,000. That’s because he is taking immense heat from Americans who have lost 20%-30% of their retirement funds in two months.

You can use the next plunge to 5,000 in the (SPX) to buy the best quality technology names like (AMZN), (AAPL), (GOOGL), (PANW), and (NFLX), which likely won’t go to new lows on the next crash and will rocket on any trade war success.

There are other fish to fry.

Let’s say that a tweet hits that the trade war is progressing or is about to end. What are China’s biggest US imports? Corn (CORN), wheat (WEAT), or soybeans (SOYB), which all have actively traded ETFs just above four-year lows. They will take off like a scalded cat on any good news.

The next time the Volatility Index ($VIX) takes a run at $60, buy the Proshares Short Vix Short Term Futures ETN (SVXY), an exchange-traded fund that sells short futures in the ($VIX). You can buy shares in it like any ETF. There is no expiration date. It hit a low of $32.90 on Thursday, but traded as high as $40 the week before, and $50 in December.

By the way, icebergs don’t enter the Atlantic shipping lanes anymore. Global warming has melted them before they do. The few that do drift south are tagged with transmitters that show up on ship radars. So if you’re planning a trip to Europe this summer on the Queen Mary II, you don’t need to worry about suffering the fate of Leonardo DiCaprio.

The Financial Crisis Trade is Still On, with 10-year US Treasury bonds hitting 4.6% yields, the US dollar plunging to 3-year lows, and gold at an all-time high. Foreign investors are abandoning the US at an unprecedented pace. It turns out that confidence in the US was worth a lot more than we thought. You don’t know what you have until you lose it.

Trump Cracks, Caves, and Does a U-Turn, announcing a 90-day delay in trade tariffs forced by the imminent collapse of global financial markets. The 10% tariffs remain. Inflation is still on track to skyrocket. A Fed interest rate cut is now on the table for June to head off a recession. What is the long-term trend now? It’s anyone’s guess. But Christmas shopping is certainly going to be a lot more expensive this year.

China Imposes 125% Retaliatory Tariffs, and Europe is yet to come. China’s biggest US imports are all agricultural, and many commodities hit multi-year lows on Friday, delivering a knockout blow to US farmers just as the planting season begins. Shiploads of American grain may be left to rot in the ports as Chinese importers refuse delivery due to the dramatic price increase. Also announced were antitrust investigations of US tech companies and export restrictions on rare earths needed for tech products. It’s 1930 all over again.

Chinese Tariffs Raised to 145%, in a US retaliation to the retaliation. Markets tanked again. Most of the goods and parts cannot be obtained elsewhere. Recession fears are now going mainstream, it’s not just me.

Unemployment rises to 4.2%, a multi-year high, says the March Nonfarm Payroll Report. Nonfarm payrolls in March increased to 228,000 for the month, up from the revised 117,000 in February. Health care was the leading growth area, consistent with prior months. The industry added 54,000 jobs, almost exactly in line with its 12-month average.

Federal Reserve’s Powell Says Inflation to Rise, as a result of the larger-than-expected tariffs. But don’t expect any interest rate cuts until yearend when the Fed has the benefit of 20/20 hindsight on inflation.

Volatility Hits 16-Year High at 60, in overnight Asia trading. The ($VIX) peaked at 95 during the Financial Crisis in 2009. ($VIX) may not have peaked yet.

Oil Crashes, down an amazing $13, or 18% in a week, from $72 to $59. High dividend-paying (XOM) has collapsed by 18%. It is the sharpest fall in Texas tea prices since the 1991 Gulf War. Recession fears are running rampant, and no one wants to pay for storage until a recovery, which may be years off. Sell all energy rallies.

JP Morgan Raises Recession Risk to 79%, while credit investors remain sanguine even as funding stress threatens to build. The small-cap focused Russell 2000, which has been battered in the recent selloff, is now pricing in a 79% chance of an economic downturn, according to JPMorgan’s dashboard of market-based recession indicators. Other asset classes are also sounding alarms.

Q1 Gold Inflows Hit Three-Year High, according to the World Gold Council. Gold ETFs saw an inflow of 226.5 metric tonnes worth $21.1 billion in the first quarter, the largest amount since the first quarter of 2022, when global markets were grappling with the immediate consequences of Russia's invasion of Ukraine. This raised their total holdings by 3% to 3,445.3 tonnes by the end of March, the largest since May 2023. Their record was 3,915 tonnes in October 2020.

Canadian Visitors Fall 32%, in line with other forecasts of a collapse in international travel. That is why Delta Air Lines (DAL) crashed by 50% in three months. Conditions will get worse before they can get better. A weak dollar has caused the price of my Europe trip this summer to rise by 20%.

Consumer Confidence is in Free Fall. Friday brought a fresh signal that consumers were queasy even before Wednesday’s policy shift. US consumer sentiment tumbled to the second-lowest level on record in a University of Michigan survey, as inflation expectations soared to multi-decades highs. That result was based on interviews from March 25 through April 8, before the change in tack on tariffs.

Delta Pulls Guidance, citing the trade war’s impact on sales. The stock is down 50% in three months. No guidance from any company is possible or credible, as Q1 earnings took place in an ancient, more business-friendly world.

April is now up by -1.13% so far due to the explosion in implied volatilities in our hedged positions. A lot of the Friday options prices made no sense and may reflect broker efforts to increase margin requirements. That takes us to a year-to-date profit of +14.96% so far in 2025. My trailing one-year return stands at a spectacular +75.65%. That takes my average annualized return to +50.28% and my performance since inception to +765.85%, a new all-time high.

It has been another wild week in the market. I was forced out of longs in (GLD) and (TLT) thanks to panic-inspired out-of-the-blue freefall. I managed to hang on to my longs in (COST), (NVDA), and (NFLX) because they were so far in the money. I used a 25% rally in the leveraged long Bitcoin play (MSTR) to add a short. I also used a run by the Volatility Index ($VIX) to $54 to add the Proshares Short VIX Short Term Futures ETN (SVXY). Unusual times call for unusual trades.

Some 63 of my 70 round trips, or 90%, were profitable in 2023. Some 74 of 94 trades have been profitable in 2024, and several of those losses were really break-even. That is a success rate of +78.72%.

Try beating that anywhere.

My Ten-Year View – A Reassessment

We have to substantially downsize our expectations of equity returns in view of the election outcome. My new American Golden Age, or the next Roaring Twenties is now looking at multiple gale-force headwinds. The economy will completely stop decarbonizing. Technology innovation will slow. Trade wars will exact a high price. Inflation will return. The Dow Average will rise by 600% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old. My Dow 240,000 target has been pushed back to 2035.

On Monday, April 14, at 8:30 AM EST, the Consumer Inflation Expectations are announced.

On Tuesday, April 15, at 8:30 AM, the New York Empire State Manufacturing Index is released.

On Wednesday, April 16, at 1:00 PM, the Retail Sales are published.

On Thursday, April 17, at 8:30 AM, the Weekly Jobless Claims are disclosed. We also get Housing Starts and Building Permits.

On Friday, April 18, markets are closed for Good Friday.

As for me, in 1987, to celebrate obtaining my British commercial pilot’s license, I decided to fly a tiny single-engine Grumman Tiger from London to Malta and back.

It turned out to be a one-way trip.

Flying over the many French medieval castles was divine. Flying the length of the Italian coast at 500 feet was fabulous, except for the engine failure over the American air base at Naples.

But I was a US citizen, wore a New York Yankees baseball cap, and seemed an alright guy, so the Air Force fixed me up for free and sent me on my way. Fortunately, I spotted the heavy cable connecting Sicily with the mainland well in advance.

I had trouble finding Malta and was running low on fuel. So I tuned into a local radio station and homed in on that.

It was on the way home that the trouble started.

I stopped by Palermo in Sicily to see where my grandfather came from and to search for the caves where my great-grandmother lived during the waning days of WWII. Little did I know that Palermo had the worst windshear airport in Europe.

My next leg home took me over 200 miles of the Mediterranean to Sardinia.

I got about 50 feet into the air when a 70-knot gust of wind flipped me on my side perpendicular to the runway and aimed me right at an Alitalia passenger jet with 100 passengers awaiting takeoff. I managed to level the plane right before I hit the ground.

I heard the British pilot of the Alitalia jet say on the air, “Well, that was interesting.”

Fire engines flashing lights descended upon me, but I was fine, sitting in my cockpit, admiring the tree that had suddenly sprouted through my port wing.

Then the Carabinieri arrested me for endangering the lives of 100 tourists. Two days later, the Ente Nazionale per l’Aviazione Civile held a hearing and found me innocent, as the windshear could not be foreseen. I think they really liked my hat, as most probably had distant relatives in New York City.

As for the plane, the wreckage was sent back to England by insurance syndicate Lloyds of London, where it was disassembled. Inside the starboard wing tank, they found a rag that the American mechanics in Naples had left by accident.

If I had continued my flight, the rag would have settled over my fuel intake valve, cut off my gas supply, and I would have crashed into the sea and disappeared forever. Ironically, it would have been close to where French author Antoine de St.-Exupery (The Little Prince) crashed his Lockheed P-38 Lightning in 1944.

In the end, the crash only cost me a disk in my back, which I had removed in London and led to my funny walk.

Sometimes, it is better to be lucky than smart.

Antoine de St.-Exupery on the Old 50 Franc Note

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

“A government big enough to give you everything you want is strong enough to take everything you have,” said Thomas Jefferson, the second US president and the man on the $2 and $10 bill.

Global Market Comments

April 11, 2025

Fiat Lux

SPECIAL VOLATILITY ISSUE

Featured Trade:

(TESTIMONIAL)

(MAKING VOLATILITY YOUR FRIEND),

(VIX), (VXX), (XIV),

(THE ABC’s OF THE VIX),

(VIX), (VXX), (SVXY)

I am one of those cheapskates who buy Christmas ornaments by the bucket load from Costco in January for ten cents on the dollar because my 11-month theoretical return on capital comes close to 1,000%.

I also like buying flood insurance in the middle of the summer drought, when the forecast in California is for endless days of sunshine. That is what we had at the end of July when the (VIX) was plumbing the depths of $12.

Get this one right, and the profits you can realize are spectacular.

It gets better.

If the bottom in volatility exactly coincides with the peak in the stock market that it measures, volatility could be headed back up to the 30% handle, and maybe more.

I double dare you to look at the charts below and tell me this isn’t happening.

Watch carefully for other confirming trends to affirm this trade is unfolding. Those would include a strong dollar, and a weak Japanese yen, Euro, and rising fixed-income instruments of any kind.

Notice that every one of these is happening this week!

Reversion to the mean, anyone?

You may know of this from the many clueless talking heads, beginners, and newbies who call (VIX) the “Fear Index”.

For those of you who have a PhD in higher mathematics from MIT, the (VIX) is simply a weighted blend of prices for a range of option contracts on the S&P 500 index (SPX).

The formula uses a kernel-smoothed estimator that takes as inputs the current market prices for all out-of-the-money calls and puts for the front-month and second-month expirations.

The (VIX) is the square root of the par variance swap rate for a 30-day term initiated today. To get into the pricing of the individual options, please go look up your handy dandy and ever-useful Black-Scholes equation.

You will recall that this is the equation that derives from the Brownian motion of heat transference in metals. Got all that?

For the rest of you who do not possess a PhD in higher mathematics from MIT, and maybe scored a 450 on your math SAT test, or who don’t know what an SAT test is, this is what you need to know.

When the market goes up, the (VIX goes down. When the market goes down, the (VIX) goes up. Period. End of story. Class dismissed.

The (VIX) is expressed in terms of the annualized monthly movement in the S&P 500 (SPX) which, with the (VIX) today at $10, is at $72.54.

So for example, a (VIX) of $10 means that the market expects the index to move 2.89%, or $72.54 S&P 500 points, over the next 30 days.

You get this by calculating $10/3.46 = 2.89%, where the square root of 12 months is 3.46.

The volatility index doesn’t really care which way the stock index moves. If the S&P 500 moves more than the projected 2.89% in ANY direction, you make a profit on your long (VIX) positions.

I am going into this detail because I always get a million questions whenever I raise this subject with volatility-deprived investors.

It gets better.

Futures contracts began trading on the (VIX) in 2004, and options on the futures since 2006.

Since then, these instruments have provided a vital means through which hedge funds control risk in their portfolios, thus providing the “hedge” in hedge fund.

Global Market Comments

April 9, 2025

Fiat Lux

Featured Trade:

(TECH SHARES RECOVER ON MACRO NEWS)

(FXI), ($COMPQ)

Global Market Comments

April 8, 2025

Fiat Lux

Featured Trade:

(A REFRESHER COURSE AT SHORT SELLING SCHOOL),

(SH), (SDS), (PSQ), (DOG), (RWM), (SPXU), (AAPL), (TSLA),

(VIX), (VXX), (IPO), (MTUM), (SPHB), (HDGE)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.