Global Market Comments

March 21, 2019

Fiat Lux

Featured Trade:

(DIVING BACK INTO THE MOUSE HOUSE),

(DIS),

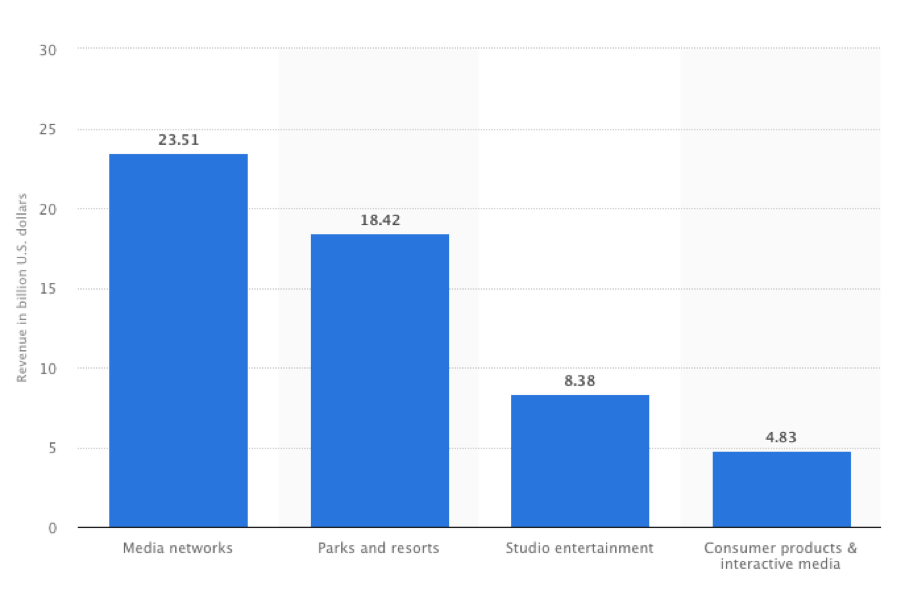

Walt Disney (DIS) shares have just suffered a 6% dive on the news they will buy the assets of 20th Century Fox in one of the largest entertainment takeovers in history. The new combined mega-company will dominate Hollywood and content production in general.

In fact, the new acquisition will enable the company to go from strength, enabling it to become the most powerful media company in well….the universe, to borrow from one of its many franchises.

This gives us a rare entry point to get into. Disney is just about to launch its own streaming service which will allow them to take a generous share of the Netflix and Amazon businesses.

Disney is spending a staggering $12 billion on new content this year. The parks are all packed to the gills. They already launch so many blockbuster movies that they have to be rationed awards at the Oscars.

It really is a company that is firing on all cylinders, as long as its erstwhile CEO Bob Iger doesn’t run for president in 2020.

I am therefore buying the Walt Disney Corp (DIS).

I’ll never forget the first time I met Walt Disney. There he was smiling at the entrance on opening day of the first Disneyland in Anaheim, Calif., in 1955 on Main Street, shaking the hand of every visitor as they came in. My dad sold the company truck trailers and managed to score free tickets for the family.

At 100 degrees on that eventful day, it was so hot that the asphalt streets melted. Most of the drinking rooms and bathrooms didn’t work. And ticket counterfeiters made sure that 100,000 jammed the relatively small park. But we loved it anyway. The bandleader handed me his baton and I was allowed to direct the musicians in the most ill-tempoed fashion possible.

After Disney took a vacation to my home away from home in Zermatt, Switzerland, he decided to build a roller-coaster based on bobsleds running down the Matterhorn on a 1:100 scale. In those days, each ride required its own ticket, and the Matterhorn needed an “E-ticket,” the most expensive. It was the first tubular steel roller coaster ever built.

Walt Disney shares have been on anything but a roller-coaster ride for the past four years. In fact, they have absolutely gone nowhere.

The main reason has been the drain on the company presented by the sports cable channel ESPN. Once the most valuable cable franchise, the company is now suffering on multiple fronts, including the acceleration of cord-cutting, the demise of traditional cable, the move to online streaming, and the demographic abandonment of traditional sports such as football.

However, ESPN’s contribution to Walt Disney earnings is now so small that it is no longer a factor.

In the meantime, a lot has gone right with Walt Disney. The parks are going gangbusters. With two teenage girls in tow, I have hit three in the past two years (Anaheim, Orlando, Paris).

The movie franchise is going from strength to strength. Pixar has Frozen 2 and Toy Story 4 in the pipeline. Look for Lucasfilm to bring out a new trilogy of Star Wars films, even though Solo: A Star Wars Story was a dud. Its online strategy is one of the best in the business. And it’s just a matter of time before they hit us with another princess. How many is it now? Nine?

It is about to expand its presence in media networks with the acquisition of 21st Century Fox (FOX) assets, already its largest source of earnings. It will join the ABC Television Group, the Disney Channel, and the aforementioned ESPN.

It has notified Netflix (NFLX) that it may no longer show Disney films, so it can offer them for sale on its own streaming service. Walt Disney is about to become one of a handful of giant media companies with a near monopoly.

What do you buy in an expensive market? Cheap stuff, especially quality laggards. Walt Disney totally fits the bill.

As for old Walt Disney himself, he died of lung cancer in 1966, just when he was in the planning stages for the Orlando Disney World. All that chain smoking finally got to him. He used to start out every TV show with a non-filter Luck Strike in his hand.

My own grandfather died the same way from the same brand, the one who fought in the trenches of WWI where Euro Disney sits today. It is a small world after all.

Despite that grandfatherly appearance on the Wonderful World of Color weekly TV show, friends tell me he was a complete bastard to work for.

Global Market Comments

March 20, 2019

Fiat Lux

Featured Trade:

(WHO THE GRAND NICARAGUA CANAL HAS WORRIED),

(SCAM OF THE MONTH)

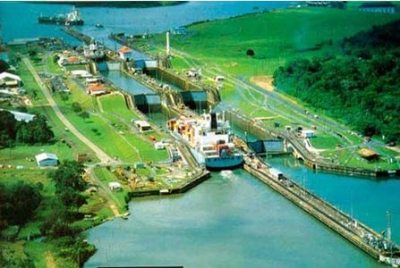

Multinationals, Global development economists, and armchair military strategists are all watching with great interest China’s plans to build a Grand Nicaragua Canal.

The government in Managua inked a deal with a Hong Kong-based consortium in 2013 led by telecommunications magnate Wang Jing and broke ground on a minor access road on December 22. But that is a very long way from the mega project getting built.

The project is nothing if not ambitious. The 172-mile canal will connect the town of Brito on the Pacific coast with Punta Gorda on the Caribbean traversing Lake Nicaragua for 65 miles and crossing a minor mountain range.

The new passage has many merits. Much wider and deeper than the Panama Canal, it will be able to accommodate the new ultra “Triple E” super container ships now under construction in China and South Korea.

These behemoths, which are as large as the Empire State Building flipped on its side, carry a staggering 18,000 containers and are nearly four times larger than the standard “Panamax” ship, which can only hold 5,000 containers.

The Nicaraguan route would knock days off the 18-day trip from Los Angeles to New York, substantially dropping shipping costs, and stimulating international trade.

More important, it would give direct access from China to the US Gulf ports, enabling them to bypass troublesome strike-prone ports on the US West Coast. A prolonged strike brought traffic there to a virtual standstill in early 2015.

The aging Panama Canal, now over 100 years old, its infrastructure is getting rather long in the tooth, dating back to the era of Teddy Roosevelt, and still won’t be able to handle the new Triple Es.

Prices to transit Panama have also been rising and is now a major income earner for the country. Further expansion is mooted, if the China traffic can justify it.

The project is certainly being welcomed in Nicaragua, the second poorest country in the western hemisphere, just above destitute Haiti, and not far behind impoverished Cuba. Some 15% of the population earns less than $1.25 a day, and many don’t even own shoes.

The infrastructure of every description is sorely lacking, with paved roads scarce and cities subject to power brownouts or outright failure. A functioning cellular network is but a distant dream in most of the country.

The project is expected to cost $50 billion, but overruns could take the final price tag much higher. This compares to Nicaragua’s miniscule $11 billion GDP. The 2020 completion deadline is therefore considered fanciful. The project will create 50,000 jobs during the five years the canal is under construction.

The final boost to economic growth could produce as many as 200,000 jobs in a country with a population of 6 million and beset with chronic unemployment. If the project goes ahead, it will spark an unprecedented economic boom.

This isn’t the first time that a canal across Nicaragua has been contemplated. German and French companies drew up plans during the 19th century but fell victim to malaria, yellow fever, dysentery, and bankruptcy.

Roosevelt considered the country for his canal but passed over worries about erupting volcanoes, which Nicaragua prominently displayed on its postage stamps. In the end, smaller and weaker Panama was easier to take over by force via an imagined coup d’ etat.

The Grand Nicaragua Canal is not without its own challenges. Actual plans are somewhat murky, and the organizing Chinese group is clouded in secrecy.

Only $200 million has actually been raised from private investors. Transparency has been completely lacking. The prime organizer, a Chinese telecommunications tycoon, has no prior experience with a project of this size.

Some 100,000 peasants will have to be displaced whose legal title to the land they occupy is tenuous at best. Demonstrations against the Sandinista government of Daniel Ortega in the capital, Managua, have become commonplace. Workers have even refused to transport machinery to the project.

More than 1 million acres of virgin jungle and wetlands will have to be destroyed to make way for the canal, appalling environmentalists. Nicaragua is much more prone to hurricanes than Panama. Indeed, in 1998, Hurricane Mitch flattened the country and killed 3,800.

Having Chinese ships, notorious for dumping sewage and waste oil in foreign ports, crossing Nicaragua’s principal source of drinking water is adding further concerns.

US railroads will also be impacted by the canal which have prospered mightily by picking up Chinese imports on the west coast and moving them inland. American transportation infrastructure will have to convert from a predominantly East-West axis to more of a North-South one.

That is a big deal.

But Union Pacific’s CEO John Koraleski isn’t worried, citing this as the source of only 1% of their revenues. They, too, would be happy to be rid of the pesky unions there. For more depth here, please click “Will the Oil Bust Kill the Railroads”.

Chinese construction of the canal has piqued the interest of military observers around the world. It would give the Middle Kingdom’s naval vessels direct and rapid access to the Atlantic Ocean for the first time in history.

China has already refurbished a used Russian aircraft carrier, and work is underway on a second carrier it purchased from France. Could the Grand Nicaragua Canal ultimately pose a military threat to the US east coast?

It doesn’t help that relations between Washington and Managua have never been cordial. In fact, Ronald Reagan financed right-wing death squads there for nearly a decade against none other than president Ortega himself (remember Iran-Contra?).

I have watched many of these gigantic projects take shape over the years. The 31-mile underwater Eurotunnel connecting England and France wiped out all of its original investors, and the initial cost doubled to $15 billion before it was done.

I covered France for Morgan Stanley in those days, and my institutional clients used to wear me out with a torrent of complaints about how much money they lost on the channel tunnel. But then, the French will complain about anything.

Still, it is a nice ride today, but it took 20 years to complete. And that was with an entire continent behind it with unlimited budgets.

Like the California bullet train, these megaprojects look great on paper and attract many avid followers, but are very difficult to pull off.

I’ll believe it when I see it.

A New "Triple E"

"Risk is measurable. Uncertainty is not" said Sandra Navidi, CEO of Beyond Global, and international macro economic consultancy

Global Market Comments

March 19, 2019

Fiat Lux

Featured Trade:

(TURBULENCE AT BOEING), (BA),

(AN AFTERNOON WITH BOONE PICKENS)

You would think that with all the bad news out, Boeing shares would finally hit bottom.

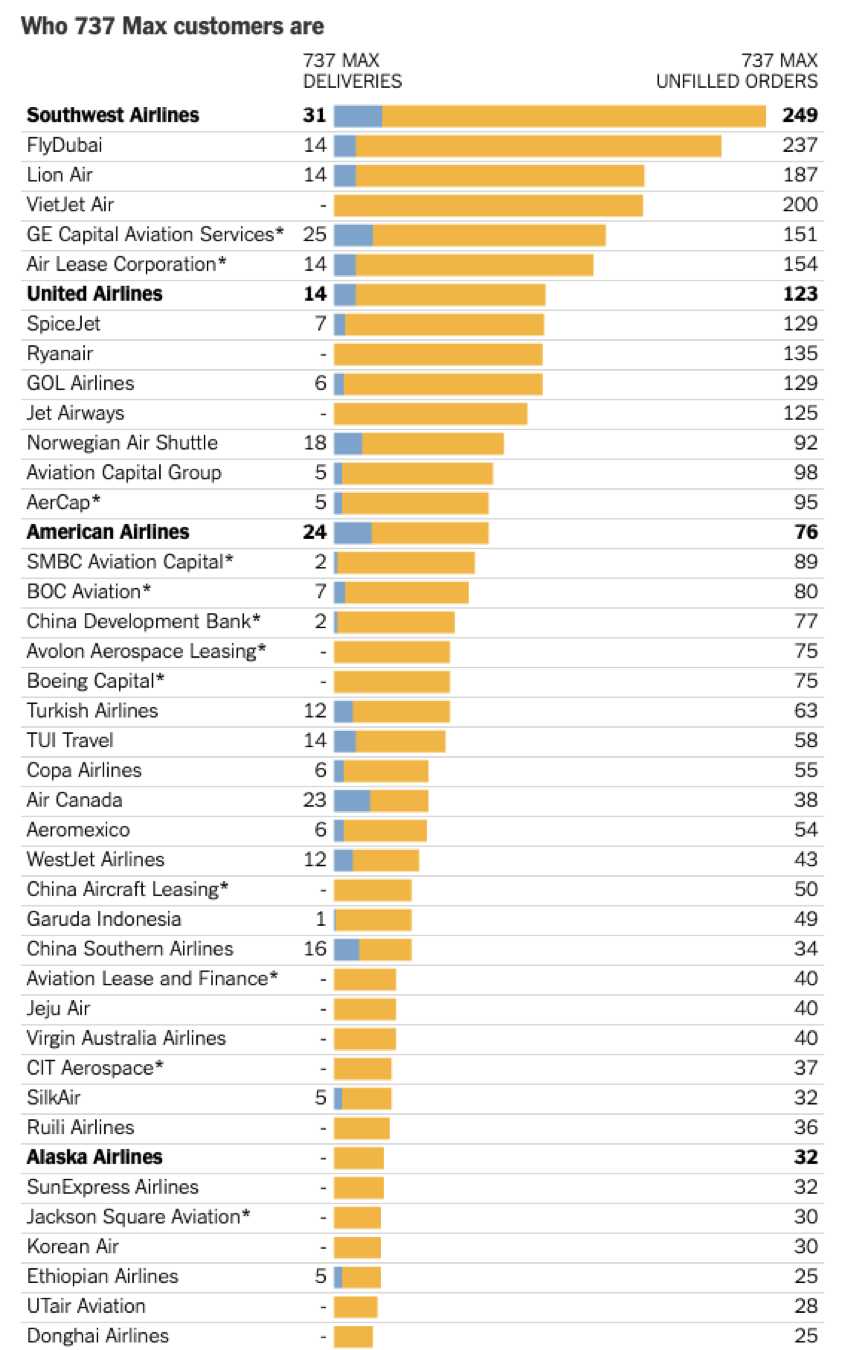

All Boeing 737 Max 8 planes have been grounded. The 58 new $100 million planes a month scheduled for delivery have been suspended. That means one of the largest companies in the United States is banned from selling far and away its most important product.

Wrong!

This morning we learned that Federal prosecutors are investigating Boeing as to whether it was criminally negligent in obtaining the troubled aircraft’s original FAA certification. Subpoenas for emails and documentation have been issued, and a general ruckus created.

This was a guaranteed outcome. You want deregulation? This is what you get. You cut budgets? This is also what you get. I highly doubt that Boeing will be found criminally culpable for the two crashes. This is all an outcome from the US government’s withdrawal from oversite of the private sector.

The truth is that the technological and cost advantages of the Boeing 737 Max are so enormous that airlines have little choice but to stand behinf them. That explains why Boeing has a ten-year, 4,636 plane order book for the plane. Boeing has to fix this problem or there will be NO aircraft industry.

This is why Southwest Airlines (LUV) has ordered 249 of the cutting edge planes, followed by 123 for United (UAL) and 76 for American (AAL).

Having been a commercial pilot for most of my life, and once owning a European air charter company I have some insights into this issue.

These two crashes are not a software problem, which can be fixed in days. It is a pilot training issue. And I have been subjected to this training myself hundreds of times until I can do it blindfolded and in my sleep. Whenever you have a runaway autopilot problem, you PULL THE DAMN CIRCUIT BREAKER!

However, if you are poorly trained, as are many emerging airline pilots, and can’t remember which of the 100 circuit breakers you need to pull with a runaway autopilot then the plane will crash. The harsh truth here is that MOST modern-day pilots can’t hand fly a plane without an autopilot.

I am therefore willing to bet that Boeing shares are near or at a medium-term bottom, now $75 off its high from only weeks ago.

Boeing Aircraft (BA) is one of the great icons of American manufacturing, and also one of the country’s largest exporters. I was given a private, sneak preview of the new Dreamliner at the Everett plant days before the official launch with the public, and I can tell you that this engineering marvel is a quantitative leap forward in technology. No surprise that the company has amassed one of the greatest back order books in history.

I can also tell you that my family has a very long history with Boeing (BA). During WWII, my dad got down on his knees and kissed the runway when the B-17 bomber in which he served as tail gunner (two probables) made it back despite the many holes. It was only after the war that he learned that the job had one of the highest fatality rates in the services.

Some 40 years later, I got down on my knees and kissed the runway when a tired and rickety Boeing 707 held together with spit and bailing wire which was first delivered as Dwight Eisenhower’s Air Force One in 1955, flew me and the rest of Reagan’s White House Press Corp to Tokyo in 1983 and made it there in one piece.

I even tried to buy my own personal B-17 bomber in the nineties for a nonprofit air show I was planning but was outbid by the late Paul Allen on behalf of his new aviation museum. Note to self: never try to outbid a co-founder of Microsoft on anything.

So it is with the greatest difficulty that I examine this company in the cold hard light of a stock analyst. There is nothing fundamentally wrong with the company. But its major customers around the world are suffering from some unprecedented stress.

US airlines are getting hammered by the rising cost of fuel. Delta even resorted to the unprecedented move of buying its own refinery to assure fuel supplies. Europe, where Boeing competes fiercely against its arch enemy, Airbus, is clearly in recession. Government-owned airlines there are in ferocious cost-cutting mode.

China, another one of Boeing’s largest customers, is also slowing down, thanks to the trade war. As for Japan, the economy there is going from bad to worse. All Nippon Airways was awarded the first Dreamliner for delivery because it is such a large customer. It is just a matter of time before this harsh reality starts to put a dent in the company’s impressive earnings growth.

This is not for the weak of heart.

They Build Those Boeings to Last

“The VIX right here is unsustainably low. I think China has more of a downside surprise. Analyst expectations for earnings are overly aggressive. There are just a few too many things that can go wrong out there,” said Vadim Zlotnikov, chief market strategist at Alliance Bernstein.

Global Market Comments

March 18, 2019

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, OR A STIFF DOSE OF HUMILITY),

(FCX), (AAPL), (IWM), (SPY), (BA), (FXI), (FXB)

Sometimes markets have to give you a solid dose of humility, blindside you with a sucker punch, and slap you across the face with a wet kipper. Last week was definitely one of those weeks for me.

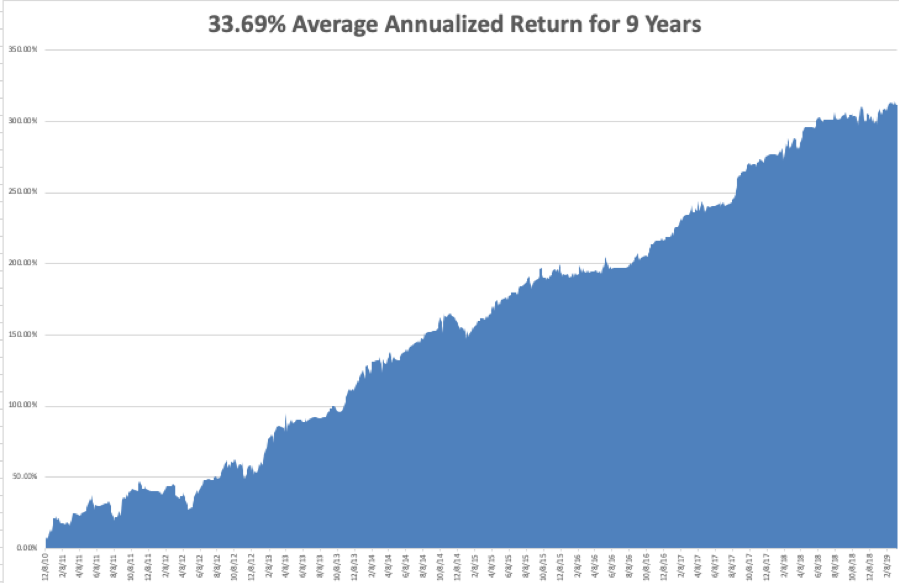

It was only just a matter of time before this happened. We posted new record gains for the first ten weeks of 2019. It was just a matter of time before the reality check kicked in.

I believed that we have seen the sharpest rally in stocks since the 2009 bottom, we were overdue for a respite. That respite came and only lasted a week. It has been an especially frustrating week for those few of us who watch economic data because it has been unremittingly awful while stocks rose daily.

There were really no reasons for shares to rise that week. There were also no reasons to sell, other than a dozen or so complete disasters that are looming just over the horizon. Still, to quote an old friend of mine, “Markets can remain irrational longer than you can remain liquid.”

The bull market reached ten years old last week, and if you read this letter you caught every dollar of the move up since then, plus some. But how much longer will it last? The technicals say it’s already in its death throes.

China trade negotiations (FXI) endlessly continued as they have for a year, but now the Chinese have thrown up a roadblock. They want everything in writing. In the wake of the North Korean disaster, can you blame them? This will weigh heavily on stocks until it's done.

Another day, another Brexit vote failed again. The pound (FXB) is doing the Watusi. Avoid all UK plays until the issue is decided.

The share buyback blackout started on Friday for many companies which are not allowed to repurchase their own shares up to 30 days ahead of the Q1 earnings reports. If you take the largest buyers of shares out of the market, what is left? Look to play the short side for the market.

Boeing (BA) hit bottom as the US became the last country to ban the 737 Max 8. Imagine being 35,000 feet in the air and you find out your plane is grounded for safety reasons, as 6,000 people did last week. Buy more (BA) on the dip. The next move is from $360 to $450.

Weekly Jobless Claims jumped, by 6,000 to a seasonally adjusted 229,000. Notice claims aren’t falling anymore. Another sign the tax cut stimulus is shrinking? Or that there is no one left to hire with any skills whatsoever?

Tesla (TSLA) released its Model Y SUV, but the cheaper $39,000 version won’t be available until 2021 and the stock dove. We are approaching the make or break level for the stock, the bottom of a two-year range. Get ready to buy on the meltdown. This is a ten bagger in a decade. Buy (TSLA).

The Mad Hedge Fund Trader lost ground last week. The tenth rally in 11 weeks made my short positions lose money faster than my long positions could make it back.

The Mad Hedge Technology Letter was stopped pit of a short position in Apple (AAPL) for a small loss a heartbreaking three days before its options expiration.

February came in at a hot +4.16% for the Mad Hedge Fund Trader. March started negative, down -2.18%.

My 2019 year to date return retreated to +11.46%, a new all-time high and boosting my trailing one-year return back up to +23.72%.

My nine-year return pared back to +311.60%. The average annualized return appreciated to +33.69%.

I am now 60% in cash, 20% long Freeport McMoRan (GLD), 10% short the S&P 500, and 10% short the Russell 2000. My short bond position (TLT) expired at its maximum profit point of $1,140.

As for the Mad Hedge Technology Letter, it covered its short in Apple (AAPL) for a small loss.

Q4 earnings reports are pretty much done, so the coming week will be pretty boring on the data front after last week's fireworks.

On Monday, March 18, at 10:00 AM EST, the March Homebuilders Index is out.

On Tuesday, March 19, 8:30 AM EST, February Housing Starts is published.

On Wednesday, March 20 is the first official day of Spring, at last!

Thursday, March 21 at 8:30 AM EST, the Weekly Jobless Claims are announced. At 10:00 AM, we get a new number for Leading Economic Indicators.

On Friday, March 22 we get a delayed number for Existing Home Sales.

The Baker-Hughes Rig Count follows at 1:00 PM.

As for me, it’s fundraising time here in the San Francisco Bay Area for local schools and gala balls are now a weekly event. I, who have pursued a lifelong pursuit of low prices and great deals, ended up paying $1,000 for a homemade coffee cake, $7,000 for tickets to the Golden State Warriors, and $10,000 for the best table in the house. Hey, what’s the value of money if you can’t spend it? You can’t take it with you.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.