“Only the mediocre are always at their best,” said the late American comedian Jonathan Winters.

“Only the mediocre are always at their best,” said the late American comedian Jonathan Winters.

Global Market Comments

October 1, 2018

Fiat Lux

Featured Trade:

(THE MARKET OUTLOOK FOR THE WEEK AHEAD,

or DON’T NOMINATE ME!),

(AMZN), (NVDA), (AAPL), (MSFT), (GLD), (ABX), (GOLD),

(JOIN US AT THE MAD HEDGE LAKE TAHOE, NEVADA,

CONFERENCE, OCTOBER 26-27, 2018)

I have a request for all of you readers. Please do not nominate me for justice of the Supreme Court.

I have no doubt that I could handle the legal load. A $17 copy of Litigation for Dummies from Amazon would take care of that.

I just don’t think I could get through the approval process. There isn’t a room on Capitol Hill big enough to house all the people who have issues with my high school background.

In 1968, I ran away from home, hitchhiked across the Sahara Desert, was captured by the Russian Army when they invaded Czechoslovakia, and had my front teeth knocked out by a flying cobblestone during a riot in Paris. I pray what went on in Sweden never sees the light of day.

So, I’m afraid you’ll have to look elsewhere to fill a seat in the highest court in the land. Good luck with that.

The most conspicuous market action of the week took place when several broker upgrades of major technology stocks. Amazon (AMZN) was targeted for $2,525, NVIDIA (NVDA) was valued at $400, and JP Morgan, always late to the game (it’s the second mouse that gets the cheese), predicted Apple (AAPL) would hit a lofty $270.

That would make Steve Jobs’ creation worth an eye-popping $1.3 trillion.

The Mad Hedge Market Timing Index dove down to a two-month low at 46. That was enough to prompt me to jump back into the market with a few cautious longs in Amazon and Microsoft (MSFT). The fourth quarter is now upon us and the chase for performance is on. Big, safe tech stocks could well rally well into 2019.

Facebook (FB) announced a major security breach affecting 50 million accounts and the shares tanked by $5. That prompted some to recommend a name change to “Faceplant.”

The economic data is definitely moving from universally strong to mixed, with auto and home sales falling off a cliff. Those are big chunks of the economy that are missing in action. If you’re looking for another reason to lose sleep, oil prices hit a four-year high, topping $80 in Europe.

The trade wars are taking specific bites out of sections of the economy, helping some and damaging others. Expect to pay a lot more for Christmas, and farmers are going to end up with a handful of rotten soybeans in their stockings.

Barrick Gold (ABX) took over Randgold (GOLD) to create the world’s largest gold company. Such activity usually marks long-term bottoms, which has me looking at call spreads in the barbarous relic once again.

With inflation just over the horizon and commodities in general coming out of a six-year bear market, that may not be such a bad idea. Copper (FCX) saw its biggest up day in two years.

The midterms are mercifully only 29 trading days away, and their removal opens the way for a major rally in stocks. It makes no difference who wins. The mere elimination of the uncertainty is worth at least 10% in stock appreciation over the next year.

At this point, the most likely outcome is a gridlocked Congress, with the Republicans holding only two of California’s 52 House seats. And stock markets absolutely LOVE a gridlocked Congress.

Also helping is that company share buybacks are booming, hitting $189 billion in Q2, up 60% YOY, the most in history. At this rate the stock market will completely disappear in 20 years.

On Wednesday, we got our long-expected 25 basis-point interest rate rise from the Federal Reserve. Three more Fed rate hikes are promised in 2019, after a coming December hike, which will take overnight rates up to 3.00% to 3.25%. Wealth is about to transfer from borrowers to savers in a major way.

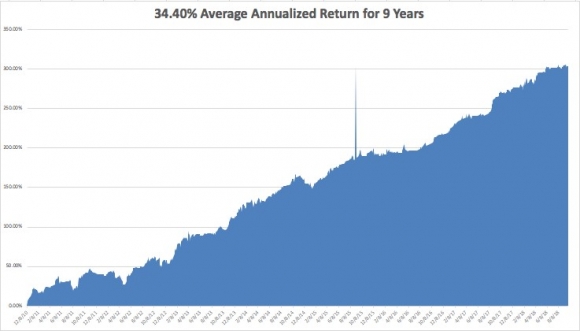

The performance of the Mad Hedge Fund Trader Alert Service eked out a 0.81% return in the final days of September. My 2018 year-to-date performance has retreated to 27.82%, and my trailing one-year return stands at 35.84%.

My nine-year return appreciated to 304.29%. The average annualized return stands at 34.40%. I hope you all feel like you’re getting your money’s worth.

This coming week will bring the jobspalooza on the data front.

On Monday, October 1, at 9:45 AM, we learn the August PMI Manufacturing Survey.

On Tuesday, October 2, nothing of note takes place.

On Wednesday October 3 at 8:15 AM, the first of the big three jobs numbers is out with the ADP Employment Report of private sector hiring. At 10:00 AM, the August PMI Services is published.

Thursday, October 4 leads with the Weekly Jobless Claims at 8:30 AM EST, which rose 13,000 last week to 214,000. At 10:00 AM, September Factory Orders is released.

On Friday, October 5, at 8:30 AM, we learn the September Nonfarm Payroll Report. The Baker Hughes Rig Count is announced at 1:00 PM EST.

As for me, it’s fire season now, and that can only mean one thing: 1,000 goats have appeared in my front yard.

The country hires them every year to eat the wild grass on the hillside leading up to my house. Five days later there is no grass left, but a mountain of goat poop and a much lesser chance that a wildfire will burn down my house.

Ah, the pleasures of owning a home in California!

Good luck and good trading.

Tickets for the Mad Hedge Lake Tahoe Conference are selling briskly. If you want to obtain a ticket that includes a dinner with John Thomas and Arthur Henry you better get your order in soon.

The conference date has been set for Friday and Saturday, October 26-27.

Come learn from the greatest trading minds in the markets for a day of discussion about making money in the current challenging conditions.

How soon will the next bear market start and the recession that inevitably follows?

How will you guarantee your retirement in these tumultuous times?

What will destroy the economy first, rising interest rates or a trade war?

Who will tell you what to buy at the next market bottom?

John Thomas is a 50-year market veteran and is the CEO and publisher of the Diary of a Mad Hedge Fund Trader. John will give you a laser-like focus on the best-performing asset classes, sectors, and individual companies of the coming months, years, and decades. John covers stocks, options, and ETFs. He delivers your one-stop global view.

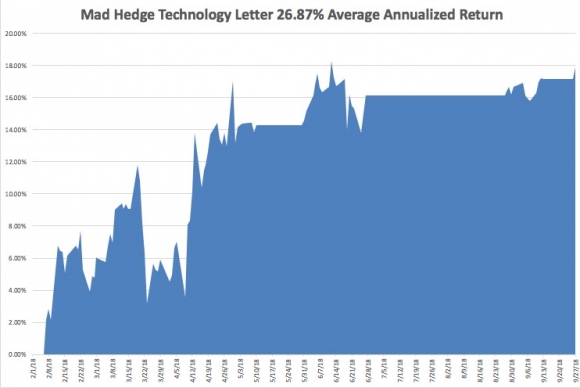

Arthur Henry is the author of the Mad Hedge Technology Letter. He is a seasoned technology analyst and speaks four Asian languages fluently. He will provide insights into the most important investment sector of our generation.

The event will be held at a five-star resort and casino on the pristine shores of Lake Tahoe in Incline Village, NV, the precise location of which will be emailed to you with your ticket purchase combination.

It will include a full breakfast on arrival, a sit-down lunch, coffee break. The wine served will be from the best Napa Valley vineyards.

Come rub shoulders with some of the savviest individual investors in the business, trade investment ideas, and learn the secrets of the trading masters.

Ticket Prices

Copper Ticket - $599: Saturday conference all day on October 27, with buffet breakfast, lunch, and coffee break, with no accommodations provided

Silver Ticket - $1,299: Two nights of double occupancy accommodation for October 26 & 27, Saturday conference all day with buffet breakfast, lunch and coffee break

Gold Ticket - $1,499: Two nights of double occupancy accommodation for October 26 & 27, Saturday conference all day with buffet breakfast, lunch, and coffee break, and an October 26, 7:00 PM Friday night VIP Dinner with John Thomas

Platinum Ticket - $1,499: Two nights of double occupancy accommodation for October 26 & 27, Saturday conference all day with buffet breakfast, lunch, and coffee break, and an October 27, 7:00 PM Saturday night VIP Dinner with John Thomas

Diamond Ticket - $1,799: Two nights of double occupancy accommodation for October 26 & 27, Saturday conference all day with buffet breakfast, lunch, and coffee break, an October 26, 7:00 PM Friday night VIP Dinner with John Thomas, AND an October 27, 7:00 PM Saturday night VIP Dinner with John Thomas

Schedule of Events

Friday, October 26, 7:00 PM

7:00 PM - Exclusive dinner with John Thomas and Arthur Henry for 12 in a private room at a five-star hotel for gold and diamond ticket holders only

Saturday, October 27, 8:00 AM

8:00 AM - Breakfast for all guests

9:00 AM - Speaker 1: Arthur Henry - Mad Hedge Technology Letter editor Arthur Henry gives the 30,000-foot view on investing in technology stocks

10:00 AM - Speaker 2: Brad Barnes of Entruity Wealth on "An Introduction to Dynamic Risk Management for Individuals"

11:00 AM - Speaker 3: John Thomas - An all-asset class global view for the year ahead

12:00 PM - Lunch

1:30 PM - Speaker 4: Arthur Henry - Mad Hedge Technology Letter editor on the five best technology stocks to buy today

2:30 PM - Speaker 5: John Triantafelow of Renaissance Wealth Management

3:30 PM - Speaker 6: John Thomas

4:30-6:00 PM - Closing: Cocktail reception and open group discussions

7:00 PM - Exclusive dinner with John Thomas for 12 in a private room at a five-star hotel for Platinum or Diamond ticket holders only

To purchase tickets, click: CONFERENCE.

Global Market Comments

September 28, 2018

Fiat Lux

Featured Trade:

(WHAT WILL TRIGGER THE NEXT BEAR MARKET?)

(JPM), (SNE), (TLT), (ELD), (AMZN),

(WEDNESDAY, OCTOBER 17, 2018, HOUSTON

GLOBAL STRATEGY LUNCHEON)

To paraphrase Leo Tolstoy in Anna Karenina, all bull markets are alike; each bear market takes place for its own particular reasons.

Now that the wreckage of the past financial crises is firmly in our rearview mirror, it is time for us to start pondering the causes of the next one. I’ll give you a hint: It will all boil down to excessive debt…again.

Global quantitative easing has been going on for a decade now, keeping interest rates far too low for too long. The unintended consequences will be legion, and the day of atonement may be a lot closer than you think.

The 1991 bear market was prompted by the Savings & Loan Crisis, where too many unsophisticated financial institutions in a newly unregulated world dreadfully mismatched asset and liabilities.

Every time I drive by a former Home Savings and Loan branch, with its unmistakable quilt decorations and accents, I remember those frightful days. Back then, when I looked at buying a home in San Francisco, the seller burst into tears when the price I offered would have generated a negative equity bill due for him.

The 2000 Dotcom crash can easily be explained by the monstrous amounts of debt provided to stock speculators. The 2008 crash was produced by massive, unregulated, and largely unknown lending to the housing sector through complex derivatives that virtually no one understood, especially the buyers.

So, here we are in 2018 nearly a decade out of the last crisis. Potential disasters are lurking everywhere under the surface while blinder constrained investors blithely power ahead. Once they metastasize, they rapidly feed into each other, creating a domino effect. They always do.

Emerging Market Debt

Lacking domestic capital markets with any real depth, companies in emerging economies prefer to borrow in U.S. dollars. When the dollar is weak that’s great because it means liabilities on the balance sheet shrink when brought back into the home currency. When the greenback is strong, the opposite happens. Dollar debt can grow so large that it can wipe out a company’s total equity.

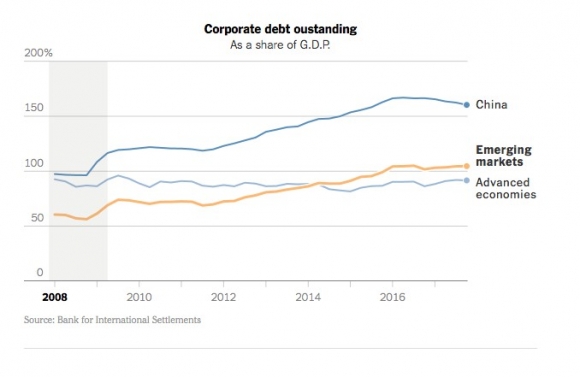

This is already happening in a major way in Turkey, where the lira has plunged 50% in the past year, effectively doubling their debt. And once it starts, a global contagion kicks in as all emerging companies become suspect. This is not a small problem. Emerging market debt has rocketed from 55% to 105% of GDP since 2008.

The Rise of Junk Borrowers

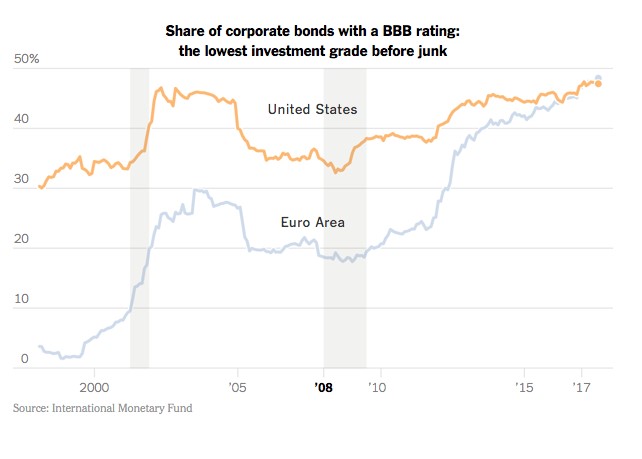

In recent years there has been a massive expansion in borrowing by marginal credits. This is taking place because fixed income investors are willing to accept a large increase in the amount of risk for only a small marginal rise in interest rates.

There is now $1.4 trillion in low grade BBB bonds outstanding, with one-third of this one downgrade away from junk. There has also been a dramatic rise in “covenant lite” issuance, which minimizes the rights of bond holders in the event of default. When the next round of trouble arrives, you can expect this market to shut down completely, as it did in 2008.

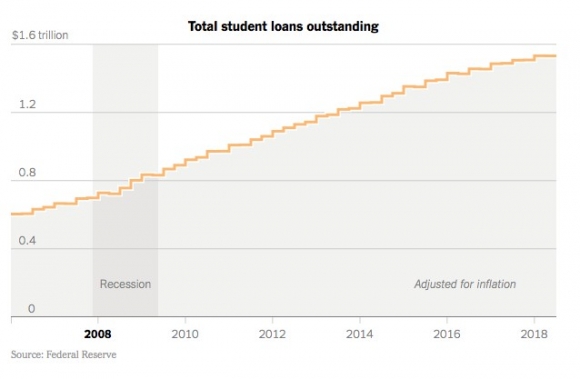

Student Loans

These have been the sharpest rising form of borrowing over the past decade, doubling to $1.5 trillion. Some 10% are now in default. This acts as a major drag on the economy as heavily indebted students don’t borrow, buy homes or cars, or really participate in the economy in any way, banned by lowly FICO scores. This is why millennials in general have been slow to enter the housing market for the first time.

Shadow Banking

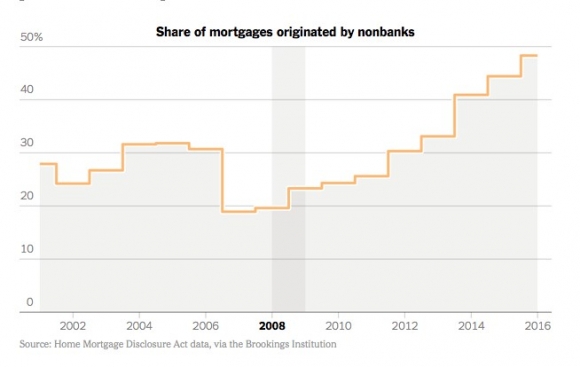

Would you like to know today’s equivalent of subprime the lending that took the financial system down in 2008? That would be shadow banking, or off the books, unreported lending by hedge funds, private equity funds, and mortgage companies. Again, this is all in pursuit of high interest rates in a low interest rate world.

Yes, liars’ loans are back, just not to the extent we saw 10 years ago…yet. I’m waiting for my cleaning lady to get offered a great refi package again, just as she was in the run-up to the last crisis. How many of these loans are out there? No one has any idea, especially the Fed. As a result, nearly 50% of all mortgage lending is now from unregulated nonbank sources.

The Outlier

Remember when Sony (SNE) was almost put out of business by a hack attack from North Korea? What if they had done this to JP Morgan (JPM)? That would have created a chain reaction of defaults throughout the financial system that would have been impossible to stop. When this happened in 2008, it took the Fed three months to reopen markets such as commercial paper. If big bankers need a reason to lie awake at night, this is it.

I’m not saying that markets can’t go higher before they go lower. In fact, I dove back into Amazon (AMZN) only this morning.

However, as an Australian farmer told me on my last trip down under, “Be careful when you cross the field, mate. Deadly snakes abound.” Add up all the above and it will turn into a giant headache for investors everywhere.

Come join me for lunch at the Mad Hedge Fund Trader’s Global Strategy Luncheon, which I will be conducting in Houston, Texas, on Wednesday, October 17, 2018.

A three-course lunch will be followed by a wide-ranging discussion and an extended question-and-answer period.

I’ll be giving you my up-to-date view on stocks, bonds, foreign currencies, commodities, energy, precious metals, and real estate. And to keep you in suspense, I’ll be tossing a few surprises out there, too.

Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $228.

I’ll be arriving an hour early and leaving late in case anyone wants to have a one-on-one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at a private downtown Houston club that will be emailed with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research.

To purchase tickets, please click here.

Global Market Comments

September 27, 2018

Fiat Lux

Featured Trade:

(HOW TO GAIN AN ADVANTAGE WITH PARALLEL TRADING),

(GM), (F), (TM), (NSANY), (DDAIF), BMW (BMWYY), (VWAPY),

(PALL), (GS), (RSX), (EZA), (CAT), (CMI), (KMTUY),

(KODK), (SLV), (AAPL),

(TUESDAY, OCTOBER 16, 2018, MIAMI, FL,

GLOBAL STRATEGY LUNCHEON)

Come join me for lunch for the Mad Hedge Fund Trader’s Global Strategy luncheon, which I will be conducting in Miami, Florida, on Tuesday, October 16, 2018.

A three-course lunch will be followed by an extended question-and-answer period.

I’ll be giving you my up-to-date view on stocks, bonds, foreign currencies, commodities, energy, precious metals, and real estate.

And to keep you in suspense, I’ll be tossing a few surprises out there, too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $248.

I’ll be arriving at 11:30 AM and leaving late in case anyone wants to have a one-on-one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at a restaurant at a major downtown hotel.

I look forward to meeting you, and thank you for supporting my research.

To purchase tickets, click here.

Global Market Comments

September 26, 2018

Fiat Lux

SPECIAL CAR ISSUE

Featured Trade:

(SAY GOODBYE TO THAT GAS GUZZLER),

(GM), (F), (TSLA), (GOOGL), (AAPL)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.