First of all, I want to confirm absolutely and without any doubt that I did not write the anonymous and controversial New York Times op-ed entitled “I Am Part of the Resistance Inside the Trump Administration.” It wasn’t me.

During the 1970s I tried to write for the Grey Lady about the Chinese Cultural Revolution, the threat to the U.S. posed by the Japanese auto industry, and the coming appreciation of the Japanese yen. But they would have none of it.

That’s because they only ran copy from their own full-time journalists and didn’t accept work from freelancers. The Wall Street Journal, Barron’s, The Economist, no problem. The New York Times, no way Jose.

Anyway, anyone with any knowledge of military aviation knows who wrote it. Yes, it’s that obvious.

I was driving over the Oakland Bay Bridge on my way to San Francisco the other day and what I saw stunned me.

This time of year, you usually see 18 enormous Chinese container ships waiting to offload their cargo at the Port of Oakland in the run-up to the Christmas shopping season. This time I saw only 10.

Either the Chinese are sending their toys, electronics, and apparel to other U.S. ports, or they are not sending them at all. If it’s the latter it means that U.S. consumer demand is about to fall off a cliff, driven away by the high prices demanded by the new 25% import duties.

I called around to see if this was just a local problem. In fact, U.S. port landings are down 10% year on year, and off by a dramatic 25% in the hardest hit ports such as New Orleans, a major agricultural exporter.

If this is true, the consequences for U.S. investors are dire.

Let me give you one of my secret trading insights borne of a half century of stock market research. Real world observations front run official government data releases by three to six months. This is why I spend so much time in the field kicking tires, chatting up store managers, and flying over auto landing docks. If this is true, you could see early signs of a recession by early 2019.

The August Nonfarm Payroll Report came in at 201,000 on Friday, with the headline Unemployment Rate unchanged at 3.9%. June and July were revised down by 50,000 jobs.

The real news here is that Average Hourly Earnings popped to 2.9%, the biggest gain in nine years, proving that inflation is edging its way closer.

Health Care added 33,000 jobs, Construction 23,000, and Transportation up 20,000. Manufacturing lost 3,000 jobs, a victim of the trade wars, while Retail lost 5,000.

The U-6 broader “discouraged worker” unemployment fell to 7.4%, a new decade low. Certainly, the job market is firing on all cylinders.

The news gave us a nice little gap down in our short position in the bond market, taking the 10-year U.S. Treasury yield up to 2.95%, a one month high.

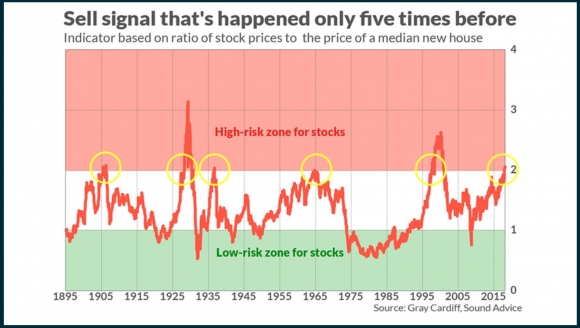

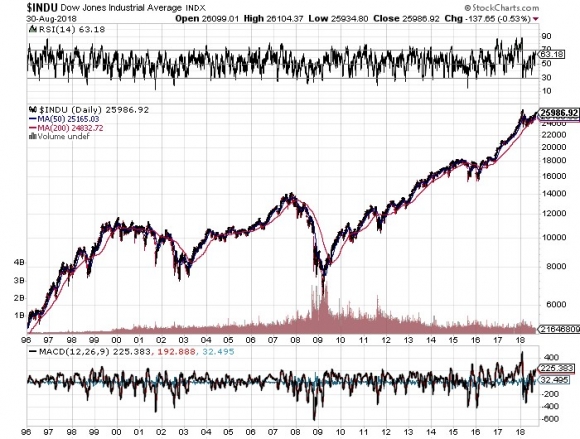

Still, you have to wonder why the stock market behaved so poorly after the release of such a healthy number. Was it “buy the rumor, sell the news,” the September effect, or the end of the 8 ½-year bull market? Obviously, I came out of my long (VXX) position too soon.

All doubts were removed when the president delivered a sucker punch to stocks by announcing new tariffs on a further $267 billion in Chinese imports. This is on top of the duties that applied to $200 billion of imports on Monday. The trade war steps up another notch. Now ALL Chinese imports are subject to punitive U.S. duties.

Amazon (AMZN) finally topped $1 trillion in market capitalization, delivering for my followers a ten-bagger on a recommendation I made several years ago.

Nike (NKE) delivered the ad campaign of the century, led by former San Francisco 49ers quarterback Colin Kaepernick. Just think of all the new demand created in the market by all those burning shoes.

The State of California passed a bill to stick the utility PG&E (PCG) with the bill for last year’s big fires. The company will pass it on to rate payers. Thank goodness I went all solar three years ago!

With the Mad Hedge Market Timing Index diving from 78 to 52 we definitely got some topping action in the market, and our short positions paid off handsomely. Both of my remaining positions are making money, my longs in Microsoft (MSFT) and my short in the U.S. Treasury bond market (TLT).

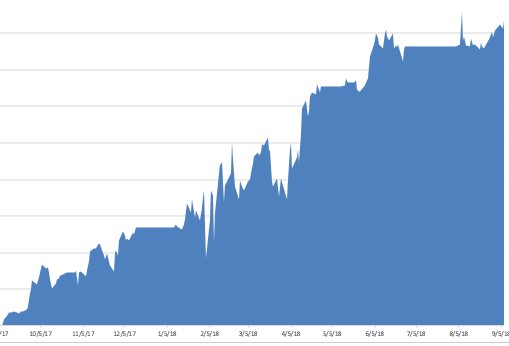

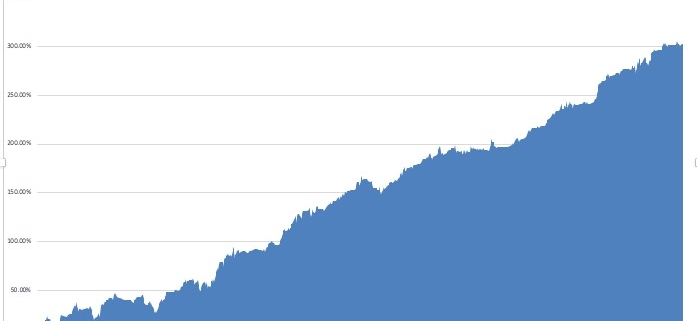

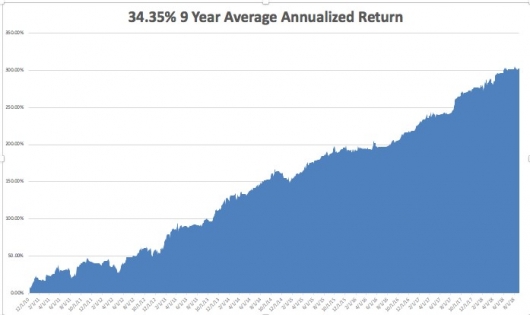

We are off to the races in September, giving us a robust return of 1.37%. My 2018 year-to-date performance has clawed its way back up to 28.39% and my nine-year return appreciated to 304.86%. The Averaged Annualized Return stands at 34.51%. The more narrowly focused Mad Hedge Technology Fund Trade Alert performance is annualizing now at an impressive 29.59%.

This coming week only has one important data release, the Fed Beige Book on Wednesday afternoon.

On Monday, September 10, at 3:00 PM, July Consumer Credit is out and should be at an all-time high as people max out their credit cards at the top of an economic cycle.

On Tuesday, September 11, at 6:00 AM, the NFIB Small Business Optimism Index is released at 6:00 AM.

On Wednesday, September 12, at 2:00 PM, the Federal Reserve discloses its Beige Book, which includes the data from the 12 Fed districts the Federal Open Market Committee at its September 19-20 meeting.

Thursday, September 13 leads with the Weekly Jobless Claims at 8:30 AM EST, which saw an amazing fall of 10,000 last week to 203,000.

On Friday, September 14, at 9:15 AM, we learn August Industrial Production. The Baker Hughes Rig Count is announced at 1:00 PM EST.

As for me,

Good luck and good trading.

41.79% Trailing One Year Return