There is nothing quite like selling short sovereign bonds and then seeing the country in question go into default.

That was a big trade during the 1970's and 1980's, when after two oil shocks the credit worthiness of emerging nations went into a tailspin. I think I made three round trips on Brazil alone.

However, this time the sovereign in question is the United States of America. The government shut down that ensued on Friday triggers a de facto default on all its IOU's.

As a result, US Government bond prices have sold off sharply, taking yields on the ten-year Treasury bond from 2.44% to 2.64%, a four-year high.

The charts on bond prices couldn't look uglier, with many important long-term trend lines shattered. The double top is bleakly staring you in the face.

If you happen to be a coupon cutter not to worry. The Treasury has enough cash in the pipeline to keep up interest payments for at least a month.

And there is a silver lining behind the giant black clouds roiling over Washington. If you are being audited by the IRS this week the meeting is cancelled. Agents won't show if there's no money to pay them.

Such is trading and investing in the modern age, which seems to change by the day. Governments were never really all that reliable anyway; here today, gone tomorrow.

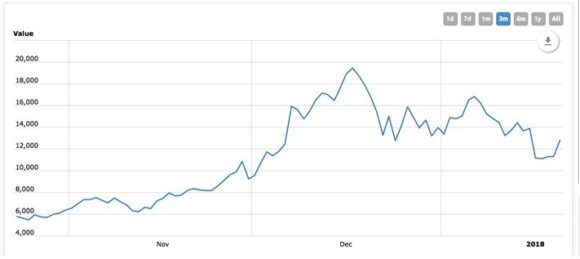

One of my 2018 forecasts has already played out. A Bitcoin crash would lead to a major rally in gold. That is exactly what has happened, with the crypto currency down an amazing 55% from its December high.

The barbarous relic popped smartly, some 8.54%. Is this the beginning of its long-awaited run to the old high at $1,928? We shall see.

After a slow start, no doubt the after effects of the Chicago winter, it's off to the races again with the Mad Hedge Fund Trader's Trade Alert Service.

At the Friday close we were up 3.1% so far in 2018, and boast a trailing 12 month profit of 58.68%, thanks to longs in Apple (AAPL) and Facebook (FB) and a short in Treasury bonds (TLT).

It hasn't been an easy market to get into. You essentially had to close your eyes and BUY. I sold into a brief short covering rally in bonds because they were so obviously falling apart.

I picked up the first of my long's during the 300 point dump triggered by the Steve Bannon subpoena. So far, I'm batting 100% in 2018.

This week will be all about housing data, which we already know are hotter than hot. Then there's the all-important Q4 GDP data on Friday. You'll have to count on individual company earnings reports as the wellspring of any volatility.

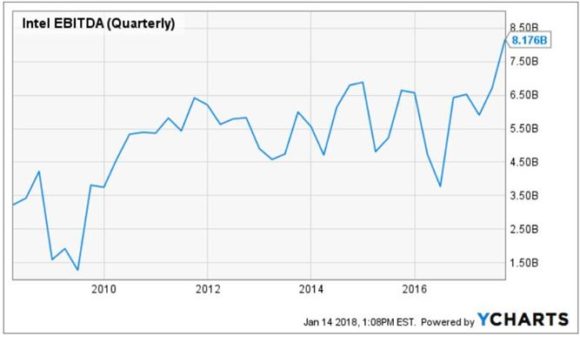

We are now into Q4 earnings season so those should be the dominant data points of the coming weeks.

On Monday, January 22, at 8:30 AM, the week kicks off with the December Chicago Fed National Activity Index, a leading indicator of inflation. Haliburton (HAL) announces Q4 earnings.

On Tuesday, January 23 at 10:00 AM EST the December Richmond Fed Manufacturing Index, a read on southern business activity. Johnson & Johnson (JNJ) announces earnings.

On Wednesday, January 24, at 10:00 AM EST, we obtain December Existing Home Sales. Ford Motors (F) announces earnings.

Thursday, January 25 leads with the 8:30 EST release of the Weekly Jobless Claims. At 10:00 AM December New Homes Sales are announced. The weekly EIA Petroleum Status Report is out at 11:00 AM EST. Celgene (CELG) announces earnings.

On Friday, January 26 at 8:30 AM we learn the first read on Q4 GDP, which should be very positive. Honeywell International (HON) announces earnings.

Then at 1:00 PM, we receive the Baker-Hughes Rig Count, which has started going ballistic.

As for me, I shall be flat on my back trying to recover from the flu. Yes, I am writing this letter in bed with a 103-degree fever watching the WWII movie Fury (my dad was a tanker).

Some 30 years of flu shots didn't do me any good this time, and 74 people in California have already died from this epidemic. However, as poorly as I may feel, the work schedule continues unabated. No rest for the wicked!

How about that (TLT) short!! It turns out that imminent government default on their bond obligations makes bond prices fold like a wet taco.