?Most people my age spend their week planning their haircut.? said Oracle of Omaha, Warren Buffet, on why he won?t retire.

?Most people my age spend their week planning their haircut.? said Oracle of Omaha, Warren Buffet, on why he won?t retire.

Global Market Comments

November 7, 2016

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK OF NOVEMBER 7TH),

(XIV), (VIX), (VXX),

(EUROPEAN STYLE HOMELAND SECURITY),

(TESTIMONIAL)

VelocityShares Daily Inverse VIX ST ETN (XIV)

VOLATILITY S&P 500 (^VIX)

iPath S&P 500 VIX ST Futures ETN (VXX)

For the first time this decade, I did not care a whit about the monthly Nonfarm Payroll report.

Not an iota, a scintilla, a modicum, or even a speck.

That?s because no matter high or low the number came it, it would be vastly overshadowed by tomorrow?s election.

Nationwide voting is not the 800-pound gorilla in the room. It is the 800-ton gorilla in the room.

Like everyone else in the country, I feel like I have been the subject of a vicious child support battle between warring parents.

I just want it over.

The big question about the Federal Reserve is not about its possible move to raise interest rates in December. It?s whether our central bank will exist at all in the New Year!

Will Janet Yellen be demoted to washing Tesla windshields on street corners in Berkeley?

As it turned out, the Employment Situation Report could not have been more boring, missing the consensus by a mere 12,000.

The October Nonfarm Payroll Report came in at 161,000, versus a consensus expectation of 173,000.

The headline unemployment rate fell to 4.9%, a decade low.

The hourly earnings jumped an eye popping 0.40%, bringing the year-on-year gain to 2.8%, the largest increase since June, 2009.

Are these the early seeds of inflation? One can only hope.

The back month revisions were big, with September bumped up by 9,000, and July goosed also by 9,000.

Professional and business services led by 43,000 jobs, health care with 31,000, and government, mostly at the local level, at 19,000.

Hurricane Matthew seemed to have caused a drag on the numbers coming from the Southeast.

Another shocker was the U-6 long-term structural unemployment rate, which plunged to 9.5%, another ten year low.

Traders will certainly have their hands full this week.

The polls close at 8:00 PM, and network projections of the winners of the obvious states should be out a few minutes later.

However, it?s the battleground states that count, and the early results will be misleading.

Clinton?s support in the cities is overwhelming which will report first. Trumps voters are largely rural, and results will come in slowly.

So don?t be fooled by reports of an early Clinton landslide win. Trump will make up the gap as the night wears on, but not enough to win in the Electoral College.

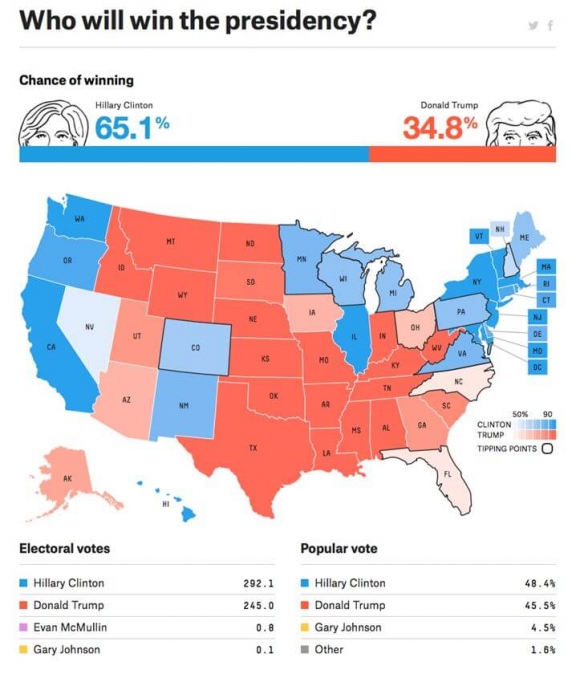

Nate Silver?s FiveThirtyEight has the best long-term record of predicting election outcomes using mathematical models (click here for his site at? http://fivethirtyeight.com/?ex_cid=2016-forecast . As of Friday, he had Hillary winning by at least 58 electoral votes (see map below).

I think the margin will be much wider, as the polls are missing millions of Hispanics who have never voted before.

This will give Hillary the majority of the battleground states, especially Florida, North Carolina, Georgia, Colorado, Virginia, Arizona, and Nevada, where I voted, and was presented with a ballot in Spanish.

Evan McMullin, a practicing Mormon, could take Utah, depriving Trump of a further 6 electoral votes.

That?s why I dipped my toe in the water by adding a modest 5% position in the Velocity Shares Daily Inverse VIX Short Term ETN (XIV) at the close on Friday, a bet that the Volatility Index (VIX) goes down.

Once the markets get a whiff of a Clinton win, it is going to be really hard to sell the Volatility Index (VIX) fast enough. Time to put my money where my mouth is. If the (VIX) rises on Monday, I?ll double up.

This renders all economic data releases for the coming week essentially meaningless. But I?ll go through the motions anyway.

Monday, November 7th at 8:30 AM EST, we get the Gallup Consumer Spending Report.

On Tuesday, November 8th at 6:00 AM EST we get a new update on the NFIB Small Business Optimism Index.

On Wednesday, November 9th at 7:00 AM EST, the MBA Mortgage Applications are published.

Thursday, November 10th we learn the Weekly Jobless Claims at 8:30 AM.

On Friday, November 11th at 10:00 AM EST we get the October Consumer Sentiment, and 1:00 PM delivers us the Baker Hughes Rig Count.

I hope everyone gets out there and votes. This time, it really IS the most important election in history.

This is your last chance to register for tonight?s strategy webinar on how to most profitably trade tomorrow?s presidential election.

This could be the most decisive move you make this year on increasing your wealth and assuring a comfortable retirement.

We are limited to only 500 participants, so it?s first come, first served.

Let trading veterans, John Thomas and Matthew Buckley, guide you about how to respond to every potential election outcome, including the unbelievable ones, or no outcome at all.

Join them for a FREE LIVE one-time-only webinar on Monday, November 7th at 9:00 PM EST. A chat box will be available for you to type in your questions.??

This may be the last chance you get to preserve your wealth before the election results are posted less than 24 hours later.

Get the 50,000-foot view you need from two experienced combat pilots.

Please click Trading the Election to register for this FREE webinar.

I look forward to working with you.

John Thomas

The Mad Hedge Fund Trader

We are right down to the wire for what has become one of the most contentious and narrow presidential elections in recent memory.

Your net worth is about to get a big boost or take a painful hit.

To generate the most positive outcome for your personal portfolio, listen to two of the most seasoned pros in the market.

Veteran traders, John Thomas and Matthew Buckley, will guide you on how to respond to every potential election outcome, including the unbelievable ones, or no outcome at all.

Join them for a FREE LIVE one-time-only webinar on Monday, November 7th at 9:00 PM EST. A chat box will be available for you to type in your questions.?

This may be the last chance you get to preserve your wealth before the election results are posted less than 24 hours later.

Get the 50,000-foot view you need from two experienced combat pilots.

Please click Trading the Election to register for this FREE webinar.

I look forward to working with you.

John Thomas

The Mad Hedge Fund Trader

The biggest risk event of the decade is now upon us.

By Wednesday morning, we should know the outcome of the presidential election.

Will markets take off for the moon?

Or will we witness the Great Crash of 2016?

Get this one right, and you will make a fortune. Blow it, and you could get wiped out.

John Thomas and Matthew Buckley have 70 years of trading experience between them.

They are among the few trading veterans who can tell you, with any precision, how to trade every potential election outcome, including the unthinkable ones.

Join John and Matt for a FREE no holds barred discussion about how to trade the election to maximize your profits while controlling your risk.

The webinar will be broadcast one time only on Monday, November 7th at 9:00 PM EST. A chat box will be available for you to type in your questions.

Please click Trading the Election to register for this FREE webinar.

I look forward to working with you.

John Thomas

The Mad Hedge Fund Trader

Global Market Comments

November 4, 2016

Fiat Lux

Featured Trade:

(NOVEMBER 9th GLOBAL STRATEGY WEBINAR),

(REVOLUTIONARY NEW DISCOVERY CONVERTS CO2 INTO ALCOHOL),

(CORN), (KOL),

(WHY WATER WILL SOON BE WORTH MORE THAN OIL),

(CGW), (PHO), (FIW), (VEOEY), (TTEK), (PNR)

Teucrium Corn ETF (CORN)

VanEck Vectors Coal ETF (KOL)

Guggenheim S&P Global Water ETF (CGW)

PowerShares Water Resources ETF (PHO)

First Trust ISE Water ETF (FIW)

Veolia Environnement S.A. (VEOEY)

Tetra Tech, Inc. (TTEK)

Pentair plc (PNR)

The Internet has recently been abuzz about a revolutionary new discovery that converts carbon dioxide (CO2) into ethanol.

Readers often refer me to new, incredible, and earth-shattering technologies which often turn out to be nothing more than investment scams. The cold fusion boom of the 1990s comes to mind.

As a reformed and non-practicing biochemist, I decided to check this one out.

What I discovered blew my mind.

Scientists at the US Department of Energy?s Oak Ridge National Laboratory literally stumbled across a process that could become a game changer for the entire energy industry.

Carbon dioxide is passed over a carbon and copper catalyst, energized with a jolt of electricity, and ethanol comes out the other end. How nice is that!

Ethanol (CH3CH2OH) is the kind of alcohol we drink, and is found in beer, wine, and spirits. It is not to be confused with methanol (CH3OH), known as rubbing alcohol which is lethal if drunk in quantity.

Ethanol boils at 78.4 degrees centigrade, compared to 64.7 degrees for methanol, which is how home distillers and moonshiners keep from killing themselves.

Oak Ridge National Laboratory is no slouch when it comes to energy research.

Built in Tennessee in a huge rush during 1942, it used to be one of the most secretive research institutions in the world.

Its original mission was to produce highly enriched uranium for the first atomic bomb, known as the Manhattan Project. Many of my college professors worked there during WWII.

In recent years, it has broadened its mandate to include materials science, artificial intelligence, systems biology, and national security. It possesses the Titan, one of the world?s most powerful super computers.

Since President Obama came into office, it has received an infusion of cash to explore new forms of alternative energy.

To visit their website, click https://www.ornl.gov .

The key to their method is how the copper is arranged. First, the researchers create a scaffold made from carbon and nitrogen. The surface is covered in tiny spikes, each about 50 nanometers high.

The researchers then deposit copper particles onto the surface which acts as a catalyst for the reaction.

When electricity is run through the material, the reactions are concentrated?at the very tips of the spikes, providing the energy required?for carbon dioxide dissolved in water to break apart and reform as ethanol.

The?reaction achieved an efficiency of 63 percent, using a power supply of just 1.2 volts at room temperature.

Of course, the process is still years away from scalability and mass production.

But the fact that this process can take place at room temperature and requires only small power inputs means it could become economically viable.

The long-term possibilities of this new technology would be momentous.

Previous carbon capture and conversion plans were wildly expensive. Carbon dioxide is one of the most stable molecules in the universe. Until now, breaking it apart required huge amounts of energy.

That is why the end products of all combustion are CO2 and H2O. There is nowhere else for a chemical reaction to go without help.

It would cost more than $1 trillion just to convert America?s existing coal fired power plants (to read more, click The Price Tag for Clean Coal).

This new technology could capture the carbon dioxide emitted by power plants, convert it into ethanol, and then burn the ethanol, all in a closed system. Nothing would reach the atmosphere.

Solar cells could be used to produce the ethanol during the day, which is then burned at night.

Ethanol could also be used to power cars. In most states about 10% of the gasoline you purchase at the pump is comprised of ethanol.

The new process could extend a lifeline to the beleaguered coal industry (KOL) which has been in free fall for years.

Many of the biggest firms, like Peabody Energy, Arch Coal, Alpha Natural Resources, and Walter Energy, have gone bankrupt.? It is unlikely that another coaled fired power plant will ever be built in the US again.

About 70% of America?s coal output is now exported to China, much of it in rail cars rumbling past my home late at night.

Coal's problems have become so severe that the plight of unemployed coal miners has become an issue in the presidential election.

The big loser from this technological breakthrough (there is ALWAYS a big loser) is a farmer in the Midwest who grows corn (CORN).

About 40% of the total US corn production is now used to make ethanol for fuel, an activity heavily subsidized by the government (for more on that sensitive topic, please read The Great Ethanol Boondoggle).

If the carbon dioxide conversion process goes mainstream, which could happen sooner than you think, it could trigger a collapse in corn prices, by half or more.

Maybe that is what the price of corn has been trying to tell us. For a host of reasons, it has been one of the world?s worst performing asset classes for the past four years, down some 67%.

Mind you, converting carbon dioxide to ethanol is no panacea. Burning ethanol puts plenty of CO2 into the atmosphere as well, just not as much as gasoline. It is an improvement, but not a solution.

Sometimes, markets can sniff these things out sooner than we mere mortals can. And I can tell you that my nose, in particular, is finely attuned to the scent of alcohol.

Should Jack Daniels be worried?

To read more, click ?High-Selectivity Electrochemical Conversion of CO2 to Ethanol?

If you think that an energy shortage was bad, it will pale in comparison to the next water crisis. So investment in fresh water infrastructure is going to be a great recurring long-term investment theme.

One theory about the endless wars in the Middle East since 1918 is that they have really been over water rights.

Although Earth is often referred to as the water planet, only 2.5% is fresh, and three quarters of that is locked up in ice at the North and South poles.

In places like China, with a quarter of the world?s population, up to 90% of the fresh water is already polluted, some irretrievably so.

Some 18% of the world population lacks access to potable water, and demand is expected to rise by 40% in the next 20 years.

Aquifers in the US, which took nature millennia to create, are approaching exhaustion, especially in California?s Central Valley.

While membrane osmosis technologies exist to convert seawater into fresh, they use ten times more energy than current treatment processes, a real problem if you don't have any, and will easily double the end cost of water to consumers.?

While it may take 16 pounds of grain to produce a pound of beef,?it takes a staggering 2,416 gallons of water?to do the same. Beef exports are really a way of shipping water abroad in highly concentrated form.

The UN says that $11 billion a year is needed for water infrastructure investment and $15 billion of the 2008 US stimulus package was similarly spent.

It says a lot that when I went to the University of California at Berkeley's School of Engineering to research this piece, most of the experts in the field had already been retained by major hedge funds!

At the top of the shopping list to participate here would be the Guggenheim S&P Global Water Index ETF (CGW).

You can also check out the PowerShares Water Resources Portfolio (PHO), the First Trust ISE Water Index Fund (FIW), or the individual stocks Veolia Environment (VEOEY), Tetra-Tech (TTEK) and Pentair (PNR).

Bonus Question:? Which country has the world?s greatest water resources? Siberia, which could become a major exporter of H2O to China in the decades to come.

The New Liquid Gold?

The New Liquid Gold?Global Market Comments

November 2, 2016

Fiat Lux

Featured Trade:

(WHY I?M GOING INTO CASH),

(SPY), (IWM), (TLT), (USO), (GLD),

(SHOPPING FOR A NEW BROKER)

SPDR S&P 500 ETF (SPY)

iShares Russell 2000 (IWM)

iShares 20+ Year Treasury Bond (TLT)

United States Oil (USO)

SPDR Gold Shares (GLD)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.